Recently, the Reserve Bank of India (RBI) allowed the opening of rupee accounts outside India.

Crucial Insights on RBI’s Announcement

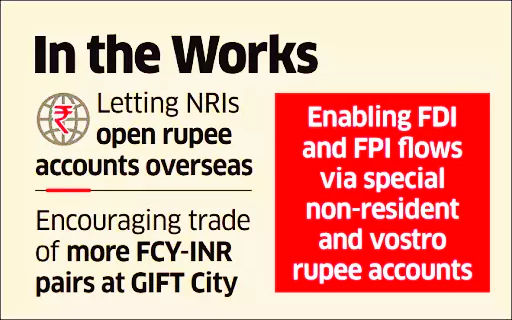

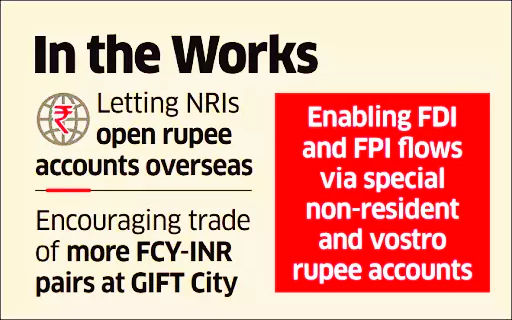

- Liberalization of the External Commercial Borrowing (ECB) Framework & Regulations: The RBI said, the Strategic Action Plan for 2024-25 has been finalized which includes the liberalization of the external commercial borrowing (ECB) framework.

- The RBI plans to liberalize regulations related to Indian Rupee (INR) accounts for non-residents and allow them to open rupee accounts outside India.

- Rationalization of Guidelines & Regulations: In its Annual Report, the RBI said that rationalization of various guidelines will be a priority, with an emphasis on continuous synchronization of the Foreign Exchange Management Act (FEMA) operating framework with the evolving macroeconomic environment.

Enroll now for UPSC Online Course

External Commercial Borrowings or ECB

These are loans raised by eligible resident entities from recognised non-resident entities and should conform to parameters, such as minimum maturity, permitted and non-permitted end-uses, maximum all-in-cost ceiling, etc.

Persons Resident Outside India (PROIs)

If a person leaves India for the purpose of employment, business or for any other purpose that indicates his intention to stay outside India for an uncertain period; then he/she becomes a person resident outside India from the day he/she leaves India for such purpose.

GIFT (Gujarat International Finance Tec-City) City

- About: It consists of a multi-service Special Economic Zone (SEZ), which houses India’s first International Financial Services Centre (IFSC) and an exclusive Domestic Tariff Area (DTA).

- GIFT City is envisaged as an integrated hub for financial and technology services not just for India but for the world.

- Location: Gandhinagar, Gujarat

|

-

- The RBI said rationalizing regulations to promote the internationalization of the Indian Rupee was undertaken to enable the settlement of bilateral trade in local currencies.

- Internationalization of the Indian Rupee with Regulatory Changes: The RBI will permit persons resident outside India (PROIs) to open rupee accounts outside India as part of the 2024-25 agenda for internationalizing the domestic currency.

- The RBI is intensifying efforts to internationalize the Indian Rupee (INR) by making regulatory changes for non-residents and enhancing the appeal of GIFT City as an international financial center.

Check Out UPSC NCERT Textbooks From PW Store

About Internationalization of Indian Rupee

Internationalization of Indian Rupee is a process that involves increasing the use of the rupee in cross-border transactions. These are all transactions between residents in India and non-residents.

- Key Process Involved: : It involves promoting the rupee for import and export trade and then other current account transactions, followed by its use in capital account transactions.

Significance and Requirement:

Significance and Requirement:-

- Need for Economic Progress: The Internationalisation of the rupee is essential for India’s economic growth.

- Necessary Steps:

- Requires opening up of the currency settlement

- A strong swap and forex market.

- Require full convertibility of the currency on the capital account and

- Cross-border transfer of funds without any restrictions.

- Historical Context:

- 1950s: In 1959, the Centre allowed the RBI to issue special notes only for the Gulf region.

- The Indian rupee was the legal tender in the Gulf countries, including Kuwait, Bahrain, Qatar and UAE, till the early 1970s. The currency had the same value as the Indian rupee and was known as the Gulf rupee or external rupee.

- Moreover, Indians could also take the Indian rupee notes when they went on the Haj pilgrimage and exchange them freely for Saudi riyals.

- Later, the Centre introduced special notes for the pilgrimage with the word “HAJ” inscribed on it. These were called “Haj notes”.

- The Indian currency, however, was devalued in 1966. This led to several countries in the Gulf withdrawing the use of the Gulf rupee. Gradually, by the early 1970s, all the countries stopped using the Gulf rupee as their currency.

- 1994: India accepted the Articles of Agreement of the IMF, making the Indian Rupee fully convertible on the current account.

- India also enabled external commercial borrowings in Rupees (like masala bonds, which are rupee-denominated bonds issued by Indian entities outside India).

Advantages of Internationalization of the Indian Rupee

- Mitigates Currency Risk: The use of the rupee in cross-border transactions mitigates currency risk for Indian businesses.

- Protection from currency volatility not only reduces the cost of doing business, it also enables better growth of business, improving the chances for Indian businesses to grow globally.

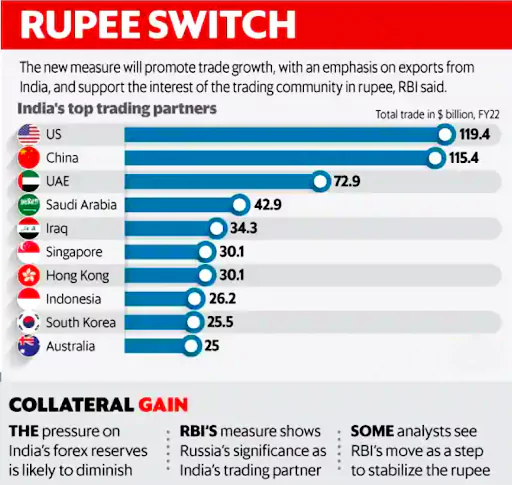

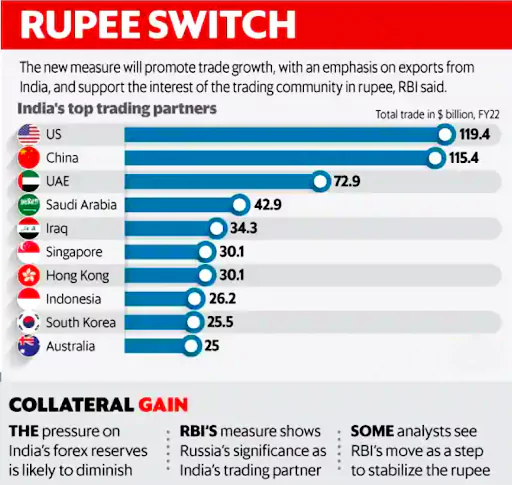

- Reduce dependency on Foreign Currency: Internationalization of the rupee reduces the need for holding foreign exchange reserves. Reducing dependence on foreign currency will make India less vulnerable to external shocks.

- As per RBI data, presently, India’s foreign exchange reserves are at a record high of $642.63 billion.

- Enhancement of India’s Global Stature: As the use of the rupee becomes significant, the bargaining power of Indian businesses would improve, adding weight to the Indian economy and enhancing India’s global stature and respect.

- Enhanced Competitiveness: It can enhance India’s competitiveness in global markets by allowing the Rupee to reflect India’s economic fundamentals and reducing the need for the RBI to intervene in currency markets.

- Diversification of Reserves: Internationalization of the rupee can diversify India’s foreign exchange reserves away from a concentration in US dollars, reducing the risks associated with holding a single currency.

Check Out UPSC CSE Books From PW Store

Challenges of Internationalization of Indian Rupee

- Trade Deficit: To internationalize any currency as a safe asset, the size of the economy is of primary importance. Whilst the Indian economy fulfills this criteria, India’s imports are larger than its exports and suffers from the disadvantage of a trade deficit.

- China’s efforts to make its currency, Renminbi internationally acceptable, has met with only limited success though, post the Ukraine war, as some settlements with Russia in Renminbi are taking place.

- Impact on Import Costs: If the internationalization of the Rupee leads to increased demand for the currency in global markets, it might strengthen the Rupee against other currencies.

- A stronger Rupee could potentially reduce the cost of imports from countries like China and Russia, potentially impacting trade balances.

- Tight Control by the Central Government: The RBI exercises a very tight control over India’s Capital account. To internationalize the rupee, the free flow of capital is desired.

- Even though the value of the Rupee is determined in the open market, RBI’s open market operations help maintain its stability.

- Convertibility Concern: Although Rupee-based trade is being encouraged by the government and the RBI, there is no move to permit full convertibility as it may lead to the flight of capital with attendant exchange risks.

- Full capital Account Convertibility is not permitted in India. It is driven by past fears of capital flight (outflow of capital from India due to monetary policies/lack of growth) and exchange rate volatility, given significant current and capital account deficits.

- The rupee is fully convertible in the current account, but partially in the capital account.

- Triffin Dilemma or Monetary Policy Dilemma: It is a conflict that arises when a country needs to supply enough of its currency to meet global demand while also maintaining its domestic monetary policies.

- Balancing these conflicting objectives can be challenging in the process of internationalizing the Rupee because actions taken to meet global demand may have unintended consequences for India’s economy such as inflation or unstable financial conditions.

Exchange Rate Volatility: Internationalization of the Rupee can create risks for businesses and investors that operate in multiple currencies, leading to uncertainty and higher transaction costs, especially in the initial stages.

Exchange Rate Volatility: Internationalization of the Rupee can create risks for businesses and investors that operate in multiple currencies, leading to uncertainty and higher transaction costs, especially in the initial stages. -

- Fluctuations can impact trade and investments, affecting economic stability.

- Lack of International Demand: The daily average share for the rupee in the global foreign exchange market is about 1.6%, while India’s share of global goods trade is about 2%.

- As per Parliamentary Standing Committee, there were few takers for the Indian Rupee.

- During FY 2022-23, no crude oil imports by oil Public Sector Undertakings (PSUs) were settled in Indian Rupee.

- While efforts have been made to trade with around 18 countries in Rupees, transactions have remained limited.

- Impact of Demonetization: The demonetization of 2016, along with the withdrawal of the Rupees 2,000 note has affected confidence in the rupee, particularly in neighboring countries like Bhutan and Nepal.

Enroll now for UPSC Online Classes

India’s Initiatives Towards Internationalization of Indian Rupee

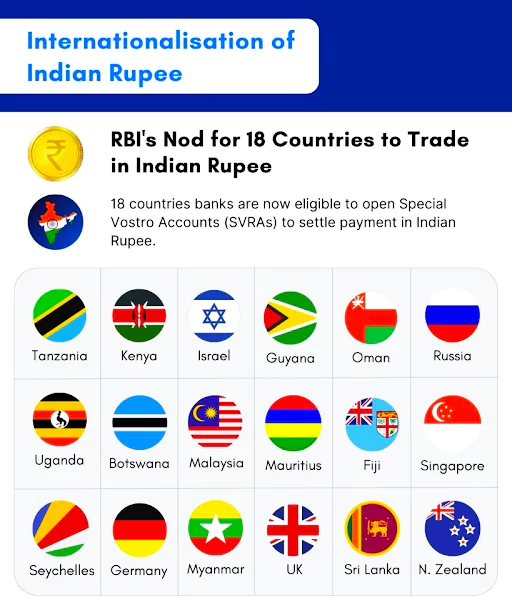

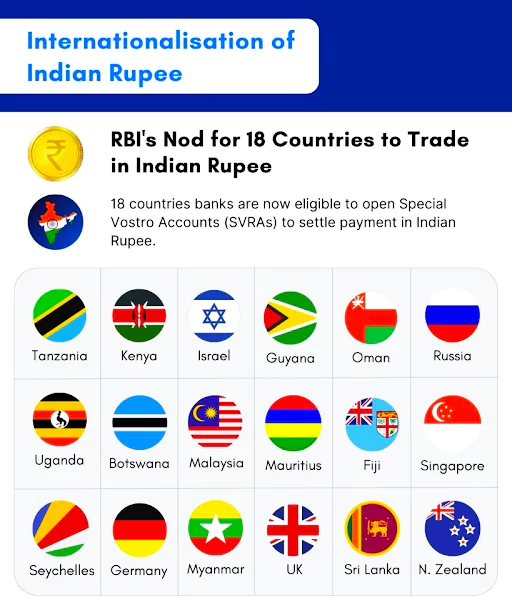

- Special Rupee Vostro Accounts (SRVAs): With the objective of promoting bilateral trade in local currencies, the RBI in July 2022, had permitted banks to open and maintain Special Rupee Vostro Accounts (SRVAs) for partner banks from other countries.

A Vostro Account:

- It is an account that a domestic bank holds for a foreign bank in the domestic bank’s currency, i.e., rupee.

- Domestic banks use it to provide international banking services to their clients who have global banking needs.

|

-

- The RBI has taken steps to make the rupee more acceptable in global trade by allowing 20 banks, operating in India, to open 92 SRVAs with partner banks from 22 countries to promote bilateral trade in a local currency.

- Recommendations of the Inter-Departmental Group (IDG): The efforts to internationalize rupee have gained momentum after an RBI-appointed working group, in July 2023, recommended various measures to accelerate the pace of internationalization of local currency.

- The inter-departmental group (IDG) said that non-residents should be allowed to open rupee accounts as the ability to open accounts outside the country of the currency is a foundational element of the internationalization of a currency.

Agreements on Unified Payments Interface (UPI): The government has also signed agreements with seven countries to make UPI, allowing Indian citizens to transact in local currency.

Agreements on Unified Payments Interface (UPI): The government has also signed agreements with seven countries to make UPI, allowing Indian citizens to transact in local currency.-

- Following its launch in Sri Lanka and Mauritius, UPI payments are accepted in France, UAE, Singapore, Bhutan, and Nepal.

- RBI in collaboration with the Government of India and National Payments Corporation of India (NPCI) is reaching out to jurisdictions to increase the global outreach of the UPI system to facilitate cross-border transactions, including remittances.

- Developments in the GIFT City: Gujarat International Finance Tec-City (GIFT City), Gandhinagar was set up as India’s first International Financial Service Centre (IFSC) with a vision to bring to the Indian shores, those financial services/markets and transactions, relating to India, that are currently done outside India.

- GIFT IFSC has the potential to develop as a competitor to international financial centers for Rupee products and also provides an opportunity for Indian entities to raise foreign capital through masala bonds and list the same on the exchanges in the IFSC.

- Asian Clearing Union (ACU): It is a regional payment arrangement that facilitates the settlement of trade transactions among its member countries on a multilateral basis.

- It was established in 1974 by 10 central banks of Asia. The ACU currently has 13 member countries, including India.

- In March 2023, the RBI put in place the mechanism for rupee trade settlement with as many as 18 countries.

- Banks from these countries have been allowed to open SVRAs for settling payments in the Rupees.

- Promotion of Rupee-denominated Bonds: The government has allowed Indian companies to issue rupee-denominated bonds in international markets that helped to increase the demand for the rupee.

- RBI enabled external commercial borrowings in Rupees (especially Masala Bonds).

- Currency Swap Agreements: The RBI has signed currency swap agreements with several countries, which allow for the exchange of rupee and foreign currency between the central banks of the two countries.

- The RBI launched the South Asian Association for Regional Cooperation (SAARC) Swap Framework to strengthen regional financial and economic cooperation and to provide to SAARC countries a backstop line of funding to meet any balance of payments and liquidity crises.

- The swap drawals can be made in US dollar, euro or Indian rupee. The framework provides certain concessions for swap drawals in Indian rupee.

- India currently has a Bilateral Swap Agreement with Japan for an amount up to USD 75 billion.

- Bilateral Trade Agreements: The Indian government has signed several bilateral trade agreements with other countries to facilitate greater cross-border trade and investment and increased the use of the rupee in international transactions.

- Recently India made its first-ever payment, in rupees, to the UAE to buy crude oil. This was seen as a significant boost for India, which has had to rely on buying 80% of its crude oil imports internationally in dollars.

- Under the Indo-Iran Agreement, the Indian Rupee vostro accounts of Iranian banks are credited 100% in Rupees by Indian importers

- In 2022, Sri Lanka also made Rupee a designated foreign currency.

Check Out Previous Years Papers From PW Store

Way Forward

- Adopt a Collaborative Approach: There is a need for careful planning and coordination between policymakers, market participants and regulators to ensure a smooth and successful transition towards the internationalization of the Rupee.

- More Freely Convertible Rupees: With a goal of full convertibility by 2060, there is a need for more financial investments that move freely between India and abroad.

- It would allow foreign investors to easily buy and sell the rupee, enhancing its liquidity and making it more attractive.

- While the acceptance of the Rupee as a global currency is gaining, its internationalization will still require cautious steps.

- Work upon Recommendations of Tarapore Committee: Recommendations of Tarapore Committee should be followed to achieve the aim of Internationalisation of the Indian Rupee.

- More Currency Swap Agreements: Currency Swaps and Local Currency Settlement provides currency diversification that stabilizes the local currency and provides a natural hedge for the business community to protect against currency risk exposure.

- A natural hedge is the reduction in risk that can arise from an institution’s normal operating procedures.

- Ensure Currency Management Stability: It is required to avoid sudden or drastic changes such as devaluation or demonetisation that can impact investors’ confidence.

- Easing Regulatory Hurdles: There is a need to ease the Foreign Exchange Management Act, 1999; revisiting regulatory guidelines to remove hurdles in the current Financial Action Task Force (FATF) and Prevention of Money Laundering Act (PMLA) provisions.

- Also, procedural and documentation roadblocks faced by foreign portfolio investors need to be reviewed. These roadblocks not only add to transaction and compliance costs but also affect the overall ease of doing business in India.

Tarapore Committee

- The RBI established the Committee on Capital Account Convertibility (CAC) or Tarapore Committee to propose a roadmap for full convertibility of the rupee on the capital account.

- In May 1997, the committee submitted its report.

Recommendations of Tarapore Committee

- Need to take actions for strong fiscal management such as reducing fiscal deficits lower than 3.5%, reducing gross banking non-performing assets to less than 5%, etc.

- The Liberalised Scheme for Personal Remittance would facilitate easier transactions for individuals dealing with foreign exchange.

- Removal of Restrictive Clauses for Employee Stock Options would allow smoother transactions and operations concerning stock options.

- Changing the name and reorienting the department responsible for handling the implementation of the FEMA, 1999, from the Exchange Control Department to the Foreign Exchange Department, emphasizing a leaner and more strategic task force approach.

- Enabling foreign investors and Indian trade partners to have more investment options in rupees, enabling its international use.

|

- Continuous Linked Settlement (CLS): Considering the growth in the Indian economy and the increase in trade, it is desirable and required to include Rupees as a direct settlement currency in CLS.

- CLS is a global system for the settlement of foreign currency transactions.

- Cross-border Payment Infrastructure: To achieve the objective of internationalization of Rupee, there is a need for a robust Rupee-denominated payment mechanism for cross-border transactions and providing timely inter-bank transfers and settlement.

- This ensures a seamless flow of cross-border transactions in local currencies and may also reduce dependence on international payment systems based on the SWIFT messaging system.

- Creation of an Indian Clearing System: An Indian Clearing System will bring greater efficiency in the settlement in domestic currencies.

- Part of Special Drawing Rights (SDR) Basket: Inclusion of Rupee in the International Monetary Fund’s (IMF) SDR basket will help in attaining the objective of internationalization of Rupees.

Enroll now for UPSC Online Course

![]() 3 Jun 2024

3 Jun 2024

Significance and Requirement:

Significance and Requirement: Exchange Rate Volatility: Internationalization of the Rupee can create risks for businesses and investors that operate in multiple currencies, leading to uncertainty and higher transaction costs, especially in the initial stages.

Exchange Rate Volatility: Internationalization of the Rupee can create risks for businesses and investors that operate in multiple currencies, leading to uncertainty and higher transaction costs, especially in the initial stages.  Agreements on Unified Payments Interface (UPI): The government has also signed agreements with seven countries to make UPI, allowing Indian citizens to transact in local currency.

Agreements on Unified Payments Interface (UPI): The government has also signed agreements with seven countries to make UPI, allowing Indian citizens to transact in local currency.