SEBI released a consultation paper proposing a framework to facilitate investments by domestic mutual funds (MFs) in their overseas counterparts and unit trusts with exposure to Indian securities.

Can domestic mutual funds invest in their overseas counterparts?

- Ambiguity: The existing framework does not explicitly permit domestic Mutual Funds to invest in overseas MF/UTs with exposure to Indian securities.

- Feeder Funds: Indian mutual funds diversify their portfolios by launching ‘feeder funds’ which invest in overseas instruments such as (units of) MF, UTs, ETFs and/or index funds.

- Purpose: To diversify and ease the path to make global investments.

Enroll now for UPSC Online Course

SEBI’s Proposal

- Upper limit: Overseas instruments being considered must not have an exposure of more than 20% of their net assets in Indian securities.

- To strike a balance between facilitating investments in overseas funds with exposure to India and preventing excessive exposure

- Breach of Cap: If the 20% cap is breached, the Indian mutual fund scheme which is investing in the overseas fund would slip into a 6-month observance period which will be utilized by the overseas fund to rebalance its portfolio.

- The domestic mutual fund cannot undertake any fresh investment in the overseas MF/UT, during this period. Further investment in the overseas instrument would be allowed only when the exposure drops below the limit.

- Investment Vehicle: SEBI’s proposal has sought that Indian mutual funds ensure contributions of all investors of the overseas MF/UT is pooled into a single investment vehicle and not a parallel instrument alongside the main instrument with varying exposure.

- Indian mutual funds must also ensure that all investors of the overseas instrument are receiving gains proportionate to their contribution and in no order of preference.

- Overseas Instrument Management: The overseas instrument needs to be managed by an “officially appointed, independent investment manager or fund manager” who is actively involved in making all investment decisions for the fund.

- SEBI says that these investments should be made autonomously by the manager without any influence from the investors or undisclosed parties.

- Transparency: SEBI seeks public disclosures of the portfolios of such overseas MF/UTs periodically for the sake of transparency.

- SEBI has warned against the existence of any advisory agreement (business agreement) between the Indian mutual fund and the overseas MF/UT.

- This is to prevent conflict of interest and avoid any undue advantage.

- Condition for Liquidation: The Indian mutual fund must liquidate its investment in the overseas instrument within 6 months, if the portfolio is not rebalanced within the observation period of 6 months.

- It would be debarred to accept any fresh subscriptions to the scheme, launch any new scheme or levy any exit load (the fee for redeeming the mutual fund before a specific date) on its investors exiting the scheme

Advantages

- Diversification: Investments in international markets provide diversification opportunities to Indian investors, by providing investment opportunities in sectors or industries that may not be available in the Indian listed market space.

- It will be an useful avenue for diversifying investor portfolios as well as generating significant risk adjusted returns

- It will enable investors to take desired exposure in overseas securities

Check Out UPSC NCERT Textbooks From PW Store

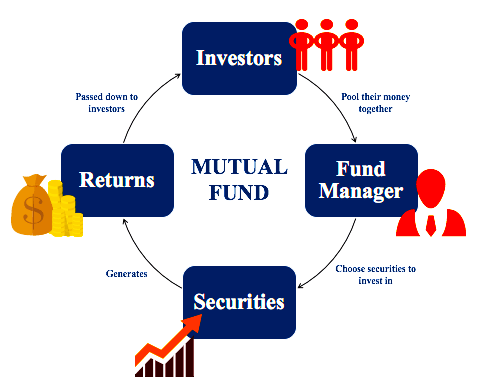

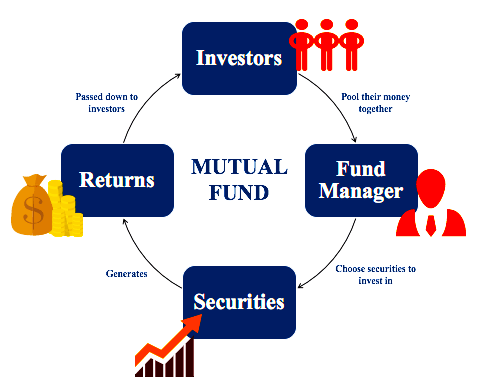

Mutual Funds

- About: A mutual fund is a pool of money managed by a professional Fund Manager.

- Trust: It acts like a trust collecting money from a number of investors who share a common investment objective and invests the same in equities, bonds, money market instruments and/or other securities.

- Income distribution:The income / gains generated from this collective investment is distributed proportionately amongst the investors after deducting applicable expenses and levies, by calculating a scheme’s Net Asset Value

- Systematic Investment Plan (SIP): It is an investment plan where one can invest a fixed amount in a mutual fund scheme periodically, at fixed intervals, instead of making a lump-sum investment being offered by Mutual Funds.

- The SIP is similar to a recurring deposit where you deposit a small /fixed amount every month.

- Status in India:

- Unique mutual fund investors in the country had grown from 1 crore in 2014 to 4 crore in 2024.

- As per the data, from the Association of Mutual Funds in India (AMFi), asset under management (AUM) of the Indian MF industry has grown six-fold in a decade from ₹9.45 trillion as on April 30, 2014, to ₹57.26 trillion in 2024.

|

![]() 3 Jun 2024

3 Jun 2024