India’s economic growth, driven by the services sector, has coincided with a decline in traditional labor-intensive industries like apparel and footwear, affecting millions of low-skilled workers.

Current Trend of Employment in India

- Stagnation in Manufacturing: The stagnation in manufacturing, which continues to remain at around 14% and well short of the targeted 25%. This has exacerbated the divide between high-skilled and low-skilled jobs.

- Growth in IT Sector: The IT sector has seen job creation and increased income for skilled professionals, particularly with the rise of Global Capability Centres (GCCs) by multinational companies in India.

- Manufacturing Weaknesses: India’s manufacturing sector has fallen behind competitors like Bangladesh in textiles, Thailand in machinery, and Vietnam in electronics, leading to a decline in low-skilled job creation.

- Need for Diversified Job Creation: Economists emphasize that India, with a population of 1.4 billion, cannot rely solely on the services sector for job creation. Contributions from all sectors are needed to generate sufficient employment.

- Job Creation Targets: According to the Economic Survey 2023-24, India needs to create nearly 7.85 million non-farm jobs annually to accommodate the growing workforce.

- Rising Unemployment: The Centre for Monitoring Indian Economy reported a surge in the national unemployment rate, from 7% to 9% in June 2024.

Enroll now for UPSC Online Course

Significance of Low Skilled and Manufacturing Jobs in India

- Employment Generation: Low-skilled, labor-intensive manufacturing jobs are essential for providing large-scale employment, particularly for workers transitioning from agriculture.

- With 46% of India’s workforce engaged in low-productivity agriculture, manufacturing offers an avenue for absorbing this labor into more productive sectors.

- Economic Growth: The manufacturing sector, contributing around 15-16% of India’s GDP and employing approximately 27 million workers, is crucial for sustained economic development. It drives growth by boosting exports and enhancing competitiveness in global markets.

- Inclusive Development: Unlike IT services that primarily benefit urban areas and the educated class, manufacturing can create jobs across regions and social strata. This helps reduce regional inequalities and promotes more balanced, inclusive growth

- Export Competitiveness: Low-skilled manufacturing is key to improving India’s global trade position. By focusing on export-driven industries like textiles, leather, and electronics, India can capture a larger share of global markets, especially under the China+1 strategy.

- Industrial Resilience: Countries like South Korea and Vietnam have shown that low-skilled, labor-intensive manufacturing can drive rapid economic development.

Reasons for Rising Gap between Low and High-skilled jobs

- Decline in Labour Intensive Jobs:

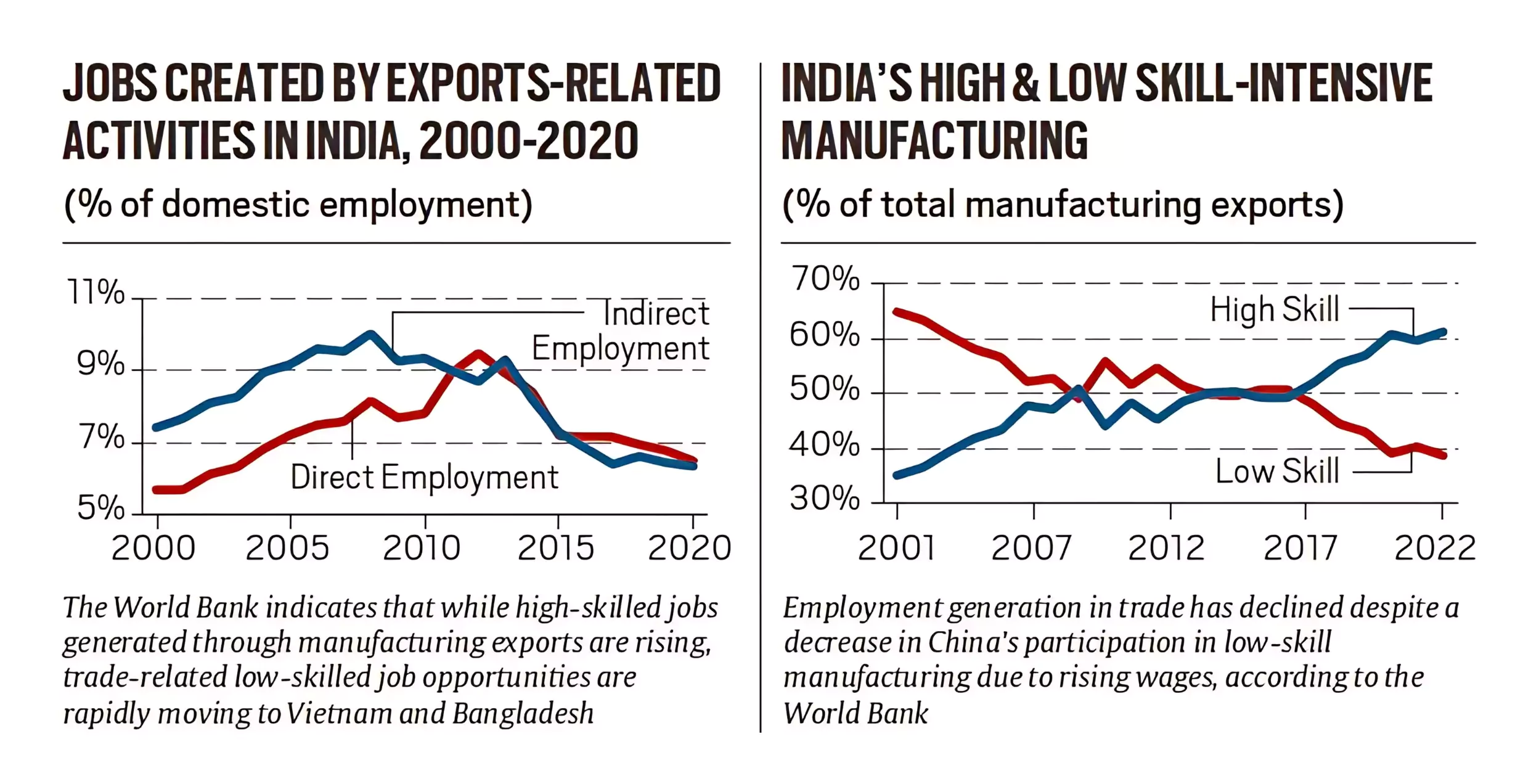

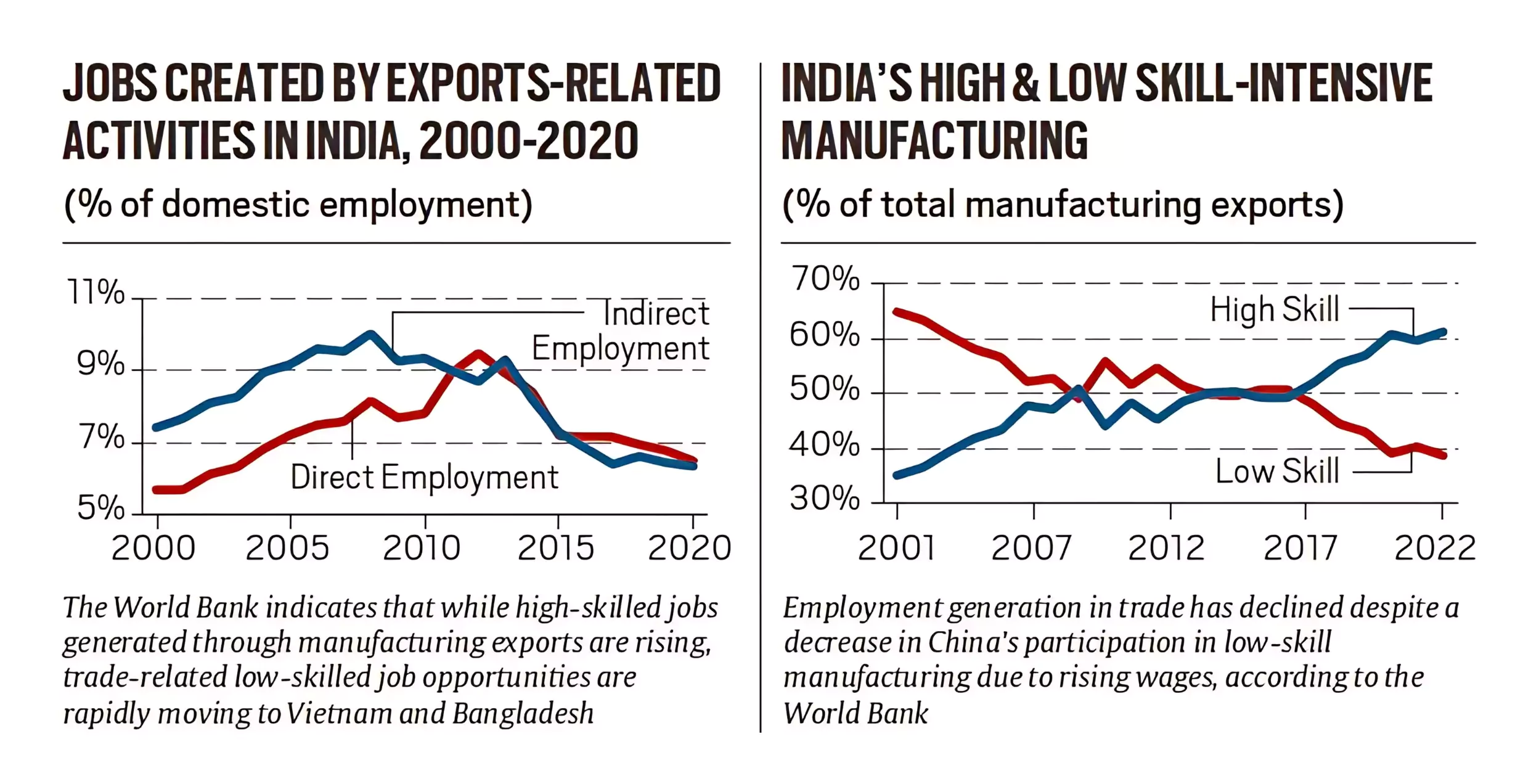

- Shift in Export Composition: India’s export basket has increasingly shifted towards services and high-skill manufacturing, sectors that are less capable of absorbing large portions of the low-skilled workforce. This shift has reduced the job creation potential of trade.

- Decline in Export-Related Employment: Export-related jobs have declined from 9.5% in 2012 to 6.5% in 2020, indicating a reduction in jobs linked to India’s goods exports, which are largely labor-intensive.

- Lagging Goods Exports: India’s goods exports only account for 1.8% of the global market, in contrast to its robust services exports (4.3% of the global market), leading to fewer jobs in labor-intensive manufacturing sectors like textiles and apparel.

- Missed Opportunity from China’s Exit: Despite China’s exit from low-skill manufacturing between 2015 and 2022, India failed to capitalize on this opportunity.

- Countries like Bangladesh and Vietnam have instead reaped the benefits of China’s reduced market share in sectors like apparel, leather, and textiles.

- Widening Skills Gap: There is a growing skills gap in India’s labor force, particularly in sectors that could benefit from labor-intensive jobs. This gap remains unaddressed despite government initiatives aimed at boosting the manufacturing sector.

- Shift Towards High-Skilled Employment

- Rise of Global Capability Centres (GCCs): Multinational companies are increasingly establishing GCCs in India for advanced functions like data analytics, software development, and supply chain management.

- This shift towards high-skilled jobs in IT and away from traditional labor-intensive sectors has contributed to fewer jobs for low-skilled workers.

- Slowdown in Labor-Intensive Manufacturing: Traditional labor-intensive sectors like textiles, apparel, and consumer goods have seen a slowdown, as multinational companies focus on advanced, high-skill roles.

- Evolution of IT Services: The transition from business process outsourcing (BPO) to IT services and now to advanced GCCs has led to a structural shift in employment, focusing more on skilled IT engineers and less on low-skilled manufacturing jobs.

- Reduced Hiring in IT Sector: Despite the growth of GCCs, the IT services sector has recently witnessed a significant reduction in hiring, with major companies like TCS, Infosys, and Wipro collectively cutting over 61,000 jobs in 2024 compared to 2023, further limiting opportunities for job growth in both skilled and semi-skilled roles.

Check Out UPSC CSE Books From PW Store

| Global Value Chains (GVCs) involve the division of production processes across multiple countries, allowing each to specialize in specific tasks. This boosts efficiency, productivity, and access to new markets. |

- Declining Participation in Global Value Chains

- Low Participation in Global Value Chains (GVCs): Around 70% of global trade involves GVCs, but India’s declining integration in these chains has reduced its ability to generate sufficient trade-related jobs, particularly in labor-intensive sectors.

- Decreasing Trade as a Share of GDP: Despite rapid economic growth, India’s trade in goods and services as a percentage of GDP has decreased over the past five years, limiting the potential for job creation through exports.

- Challenges in Export Performance: Indian exporters connected to GVCs show stronger performance, but many face obstacles like difficulties in procuring raw materials and high transport costs, reducing competitiveness in labor-intensive sectors.

- Rising Tariffs: India’s average tariffs increased to 18.1% in 2022, up from 13% in 2014, making Indian exports less competitive compared to countries like Vietnam, Thailand, and Mexico, further reducing job growth in sectors that depend on global trade.

- High Tariffs on Essential Input Materials

- High Import Tariffs: Elevated import tariffs on intermediate inputs have increased production costs, making Indian products less competitive in global markets, thereby reducing labor-intensive job creation.

- Reversal of Tariff Reductions: India has reversed the tariff reductions initiated in the early 1990s, with the average Most Favored Nation tariff rising to 18.1% in 2022, compared to 13.4% in 2016.

- This has made Indian goods more expensive compared to other countries, limiting growth in labor-intensive sectors.

- Global Trade Barriers: Tariff and non-tariff barriers are increasingly hindering India’s global trade participation, further reducing opportunities in industries that depend on cost-efficient imports for production.

- Limited Impact of Recent Tariff Reductions: Although the FY25 Union Budget introduced tariff cuts on several items, these reductions are not widespread enough to significantly lower production costs across labor-intensive industries.

Enroll now for UPSC Online Classes

Way Forward

- Balanced Sectoral Growth: Focus on reviving the manufacturing sector, especially labor-intensive industries like textiles and footwear, while maintaining growth in the services sector.

- Boost Manufacturing: India must prioritize manufacturing sector growth, especially in labor-intensive industries like textiles, apparel, and footwear, which have historically provided jobs for millions of low-skilled workers.

- Initiatives such as PM MITRA Parks and industrial smart cities should be effectively implemented to create world-class infrastructure and generate more employment.

- Government Schemes to Boost Manufacturing:

- Make in India

- Production-Linked Incentive (PLI) Scheme

- National Manufacturing Policy (NMP)

- Atma Nirbhar Bharat

- Strengthen Global Value Chain (GVC) Participation: India needs to enhance its participation in Global Value Chains (GVCs) by reducing tariffs and simplifying trade procedures.

- This will boost export competitiveness, particularly in labor-intensive sectors, and increase job creation through trade

- Tariff Reforms: Continue reducing tariffs across sectors, especially on input materials, to enhance manufacturing competitiveness and reduce production costs.

- Foster Export Growth: Encourage diversification in the export basket by supporting both high-skill manufacturing and traditional sectors like textiles and leather, aiming for balanced job generation.

- Leverage GCCs for Job Creation: While Global Capability Centres (GCCs) have created high-skilled jobs, India should explore ways to align the growth of GCCs with local manufacturing needs. This can ensure that they contribute to broader job creation, including low-skilled employment

- Policy Simplification: Implement fundamental changes to simplify trade procedures and make India more competitive in global markets.

- Boost Participation in International Trade: Focus on improving trade-related jobs by increasing integration into international markets, aligning with global trade practices.

![]() 16 Sep 2024

16 Sep 2024