The newly formed coalition government in India must redouble its efforts on economic reforms, particularly related to manufacturing.

- A coalition government is one in which multiple political parties come together and often reduce the dominance of the party that has won the highest number of seats.

About Manufacturing Sector in India

Manufacturing is an integral and huge part of the economy. It involves processing and refining raw materials, such as ore, wood, and foodstuffs, into finished products, such as metal goods, furniture, and processed foods. Converting these raw materials into something more useful adds value.

- Contribution: The manufacturing sector in India contributes 16-17% of GDP.

- It employs over 27.3 million workers.

- India is the third most sought-after manufacturing destination in the world and has the potential to export goods worth US$ 1 trillion by 2030.

- Target: India aims to increase the manufacturing sector’s contribution to 25% of the economy’s output by 2025 as per the goal of Make in India.

- Achievement: Manufacturing exports have registered the highest ever annual exports of US$ 447.46 billion with 6.03% growth during FY23 surpassing the previous year (FY22) record exports of US$ 422 billion.

- By 2030, the Indian middle class is expected to have the second-largest share in global consumption at 17%.

- India is ranked 63 among 190 economies in the ease of doing business, according to the latest World Bank annual ratings.

- The Eight Core Industries Index expanded by 6.5% year-on-year in the first two months of FY25, buoyed primarily by increased activity in essential sectors such as coal, natural gas, and electricity.

- The eight core sectors of the Indian economy are electricity, steel, refinery products, crude oil, coal, cement, natural gas and fertilizers.

Enroll now for UPSC Online Course

Opportunities for Manufacturing Sector in India

India is an attractive hub for foreign investments in the manufacturing sector. Several mobile phone, luxury, and automobile brands, among others, have set up or are looking to establish their manufacturing bases in the country.

- World’s Largest Population: India surpassed China in 2023 to become the world’s most populous nation. Companies that manufacture in India will have a huge built-in market.

- Relatively Low Labour Cost: According to the World Data, worker salary/income in India is 82% lower than China, 70% lower than Thailand, 49% lower than Indonesia, and 40% lower than both Vietnam and the Philippines.

- Strong Labour Availability: India has a large working-age population with a lot of engineers who are mostly bilingual.

- China Plus One Strategy: India has certainly been a prime beneficiary of the China Plus One strategy, whereby manufacturers are decreasing their dependence on China for production and expanding elsewhere, particularly to Southeast Asia and India.

Need to Improve Manufacturing Sector in India

The manufacturing sector of India has the potential to reach US$ 1 trillion by 2025.

- Powerful Domestic Compulsions: India has a massive employment-creation requirement. About half of Indian labour remains mired in low-productivity agriculture.

- If India’s attempts to enact major farming reforms are successful, there could be a fast, massive transition of employment out of agriculture.

- Broad Domestic Market and Demand: The Indian manufacturing sector has seen strong demand for their goods from both domestic and external clients.

- According to an SBI report, the manufacturing Purchasing Managers’ Index soared in June 2024, driven by robust demand and the highest hiring activity in 19 years.

- By 2030, the Indian middle class is expected to have the second-largest share in global consumption at 17%.

- Sectoral Advantage: Key manufacturing sectors such as chemicals, pharmaceuticals, automotive, electronics, textiles, etc., have experienced significant growth in recent years.

- The Indian Cellular and Electronics Association (ICEA) predicts that India has the potential to scale up its cumulative laptop and tablet manufacturing capacity to US$ 100 billion by 2025 through policy interventions.

- Maintenance of Goods Trade Deficit: Despite a perception that India is “anti-trade”, India had a little over $1 trillion in goods trade in the last 12 months and a $250 billion deficit during that period.

- Imported Items: Hydrocarbons account for over one-quarter of India’s imports and manufactured goods such as electronics are a substantial component.

- Outreach to the Market of Global South: According to the UN, Indian manufacturing is shifting in Global Value Chains from Europe to Asia.

- The share of foreign value-added in India’s domestic final demand from Global Southern partners rose from 27% in 2005 to 45% in 2015.

- Others: To boost economic growth, to excel in the defence sector self-reliance, competitive advantage, rise of MSME, etc.

Challenges Faced by Manufacturing Sector in India

The manufacturing sector is regarded as the backbone of both social and economic development. However, facing various following issues:

- Rise in Automation: Innovation in manufacturing has taken a predominantly skill-biased form, reducing demand for workers with relatively low levels of education.

- New technologies such as automation, robots and 3D printing directly substitute physical capital for labour.

- As automation permeates manufacturing processes, the skills demanded of manufacturing workers is evolving. Jobs that require manual labour and repetitive tasks are declining.

- As per the World Bank, only 24% of India’s workforce possesses the skills required for complex manufacturing jobs in contrast to 52% in the US and 96% in South Korea.

- Global Quality Competition: Firms need to produce according to the exacting quality standards set by global value chains that impacts unskilled labour and can easily be substituted for physical capital and skilled labour.

- While firms in India and other developing countries have an incentive to use more labour-intensive techniques, competing in the global marketplace requires employing production techniques that cannot differ significantly from those used in the frontier economies.

- Reliance on outdated technology and inadequate infrastructure hinders the ability of Indian manufacturers to compete globally and meet international quality standards.

- Limited Growth: The rising skill- and capital-intensity of manufacturing means that formal segments of manufacturing have lost the ability to absorb significant amounts of labour.

- They have effectively become ‘enclave sectors,’ not too different from mining, with limited growth potential and few positive effects on the supply side of the rest of the economy.

- Decline in India’s Manufacturing Base: As per World Bank data, manufacturing is in relative decline, making up only 13% of the GDP in 2022.

- This compares unfavorably to markets such as Vietnam (25%), Bangladesh (22%), Malaysia (23%), Indonesia (18%), Mexico (21%), and China (28%).

- India’s continued urbanisation resulted in hundreds of millions of agriculture workers relocating to cities to find formal employment in the coming decades.

- A failure to generate low-skilled employment could push staggering stress on India’s governance structures.

- States and Their Business Environments: The rankings of States’ business environments called the “Business Reforms Action Plan (BRAP)”, has not been updated since the COVID-19 pandemic.

- It is also considered weak as it focused on States’ self-reporting on their local business practices which was often at odds with actual investor experiences.

- Also, the complex regulatory environment acts as a deterrent for businesses looking to set up manufacturing units in India.

- Example: Land Acquisition is a complex process in India, and NITI Aayog suggests Land Titling Act yet to pass by legislature.

- Difficult to Receive States’ Consent: The central government’s plan to help craft model industry laws for States to consider has been underwhelming. Getting all States to focus on thoughtful, transparent industrial policies is a difficult task.

- High Input Cost and Chinese Competition: As per RBI, 2022 the logistics costs in India are 14% higher compared to the global average which impacts the overall competitiveness.

- Also, as per WTO, China remains the world’s leading manufacturer, accounting for nearly 30% of global manufacturing output in 2022.

Check Out UPSC CSE Books From PW Store

Various Initiatives taken by the Indian Government

The Government of India has taken several initiatives to promote a healthy environment for the growth of the manufacturing sector in the country. Some of the notable initiatives and developments are:

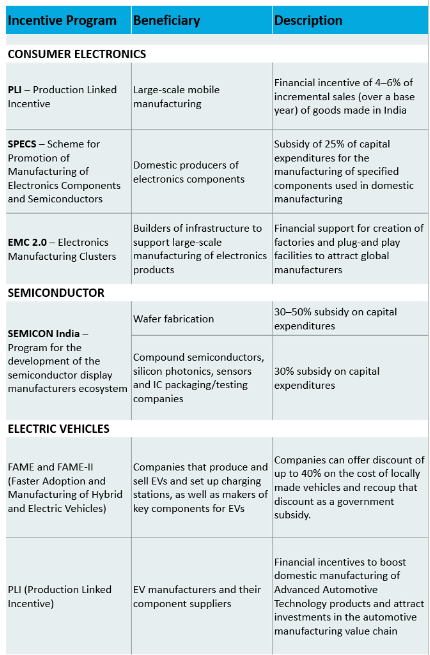

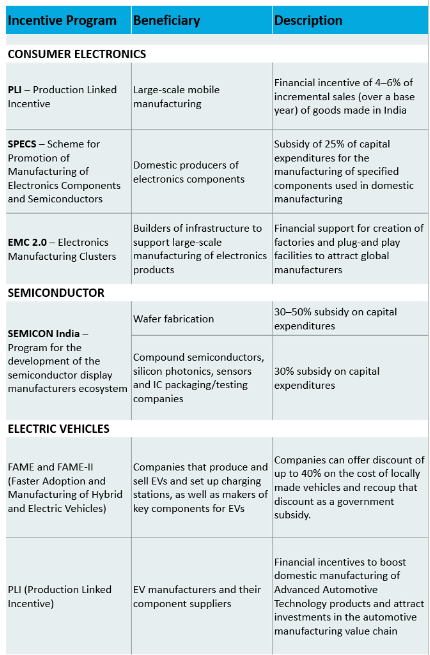

- Rise in Allocation for the Production Linked Incentive (PLI) Scheme: In the Interim Union Budget 2024-2025, it saw a substantial increase, a 360% rise to Rs 6,903 crore for the Semiconductors and Display Manufacturing Ecosystem and a 623% surge to Rs 3,500 crore for the Automobile sector.

- For Defence Manufacturing: In the Interim Union Budget 2024-25, the Ministry of Defence has been allocated Rs. 621,541 crore (US$ 74.78 billion), marking a significant increase of approximately 4.72% from the previous allocation of Rs. 593,538 crore (US$ 71.41 billion).

- For Sunrise Industries: The budget also allocated funds for the creation of a Rs 1-lakh crore (US$ 12 billion) innovation fund for sunrise domains, providing a substantial boost for the startup industry.

- On Promotion of Electric Vehicles (EVs): It is through the expansion of EV charging networks, thereby offering opportunities for small vendors in manufacturing and maintenance.

- Skill Development: Under the Skill India mission, Pradhan Mantri Kaushal Vikas Yojana (PMKVY) has trained over 1.40 crore candidates since 2015, as per Skill India Digital data.

- In the Short-term Training (STT) program, 42% of certified candidates found placement opportunities, with 24.39 lakh candidates successfully placed out of 57.42 lakh certified.

- For Electronics System Design and Manufacturing (ESDM) Sector: Various initiatives such as Make in India, Digital India and Startup India have given the much-needed thrust to the ESDM sector in India.

- Moreover, the government’s endeavours such as Modified Special Incentive Scheme (M-SIPS), Electronics Manufacturing Clusters, Electronics Development Fund and National Policy on Electronics 2019 (NPE 2019) have been a huge success.

- PLI Scheme has been notified for Large Scale Electronics Manufacturing to attract large investments in the mobile phone manufacturing and specified electronic components, including Assembly, Testing, Marking and Packaging units.

- Goods and Services Tax (GST): Some significant economic reforms that should have helped to attain the target, most notably the approval of the Goods and Services Tax (GST) in 2017, which largely unified India’s State-level tax codes.

- By GST, logistic costs are reduced by 10-12%.

- Mega Investment Textiles Parks (MITRA) Scheme: Plans to create seven world-class textile parks over three years to foster global industry champions through economies of scale and agglomeration.

- SAMARTH Udyog Bharat 4.0: An initiative by the Ministry of Heavy Industries & Public Enterprises to increase the competitiveness of the manufacturing sector through advanced manufacturing and rapid transformation hubs.

- Others: Unification of Labour Laws, Make in India 2.0, Liberalised Foreign Direct Investment, Start-up India, Atmanirbhar Bharat Campaign, Special Economic Zones, MSME Innovative Scheme, Ease of Doing Business, etc.

Way Forward

India’s manufacturing sector is poised to reach US$ 1 trillion by 2025-26, led by Gujarat, Maharashtra, and Tamil Nadu, fueled by investments in automobile, electronics, and textile industries.

- Policy Attention: Most factors of production such as electric power, water, sanitation, labour regulations, land acquisition rules, and environment regulations are primarily controlled by India’s State governments.

- Hence, the Indian government needs to provide a much higher degree of policy attention.

- Emphasis on Job-Creation: The government should also consider putting stronger emphasis on job-creating manufacturing sectors such as textiles, paper mills, and furniture, instead of pushing almost exclusively for investments in capital-intensive sectors such as semiconductors and robotics.

- Go beyond Delhi-Mumbai-Bengaluru Circuit: Senior U.S. officials visiting India must commit to engaging a wider set of large States on the importance and opportunity from the current evolution of global supply chains.

- Comprehensive Ecosystem for Manufacturing: The time has come to build a comprehensive ecosystem that requires a supportive ecosystem including education, training and infrastructure.

- The economic reforms of 1991 overlooked this need for a supportive ecosystem.

- Establishment of State-level Economic Advisory Councils: Composed by experts from academia, industry, and government, such a Council needs to advise state governments on economic policies, including manufacturing incentives and regulatory frameworks.

- Review and Update of BRAP Rankings: Overhaul the BRAP to include independent evaluations and audits alongside self-reporting.

- There is a need to ensure transparency and accuracy in ranking states’ business environments to provide credible guidance for investors.

- Others: To achieve the potential growth, more investment in infrastructure, encouragement of export-oriented manufacturing, further financial assistance to MSMEs and simplified and enabling regulations are required.

- Emphasis on Skill Development: It could alleviate the shortage of skilled labour in the manufacturing industry and enhance its competitive edge.

- Example: Vietnam has transformed into a global manufacturing hub, due to its’ relatively large, well-educated and skilled labour force.

Enroll now for UPSC Online Classes

Conclusion

India’s national election provided an opportunity to assess and redirect policy. But India’s core needs behind the current manufacturing push — jobs, trade, and security — will not change. More work needs to be done to attain desired results, especially at the State level in India, for “Make in India” to further accelerate.

![]() 12 Jul 2024

12 Jul 2024