The Prime Minister Shri Narendra Modi addressed the Nation on the 79th Independence Day from the Red Fort, Delhi.

- He announced next-generation GST reforms as a “Diwali gift” to reduce tax burdens and stimulate economic activity.

Key Highlights of PM’s Independence Day Speech

- Viksit Bharat 2047 Vision: PM Modi outlined a roadmap for a $10 trillion economy by 2047, emphasizing self-reliance, innovation, and citizen empowerment across defense, semiconductors, clean energy, and agriculture.

- Mission Sudarshan Chakra: A decade-long initiative to develop an indigenous defense shield by 2035, inspired by Shri Krishna’s Sudarshan Chakra, to protect strategic and civilian sites.

- GST Reforms: Next-generation reforms by Diwali 2025 to reduce taxes on essentials, simplify slabs, and support MSMEs, startups, and consumers for economic growth.

- PM Viksit Bharat Rozgar Yojana: ₹1 lakh crore scheme to create 3 crore jobs, offering ₹15,000 monthly incentives to first-time employees, boosting youth employment.

- Semiconductor Production: “Made-in-India” chips to be launched by end-2025, with six operational plants, reducing import dependence.

- Clean Energy Milestone: Achieved 50% non-fossil fuel electricity by 2025, with plans for tenfold nuclear energy expansion by 2047 and investments in solar, hydrogen, and hydro energy.

- National Deepwater Exploration Mission: To harness offshore energy resources, reducing fuel import dependency.

- Demography Mission: High-powered mission to address demographic imbalances due to infiltration in border areas, ensuring security and citizens’ rights.

- Women and Youth Empowerment: 3 crore women to become ‘Lakhpati Didis’ via self-help groups; youth urged to innovate in AI, jet engines, and space tech.

Key Features of GST Reforms

- Revised Tax Slabs:

- Current Slabs: 5%, 12%, 18%, 28%, plus compensation cess on luxury/sin goods.

- Proposed Slabs:

- Retain 5% (merit) and 18% (standard) slabs.

- Introduce a concessional rate (<1%) for precious metals (e.g., gold at 3%, semi-precious stones at 0.25%).

- High “sin rate” of 40% for 5-7 items (e.g., tobacco, gutka).

- Rate Reductions:

- 99% of items in 12% slab (e.g., daily-use items like toothpaste, soap, shampoo) to move to 5%.

- 90% of items in 28% slab (e.g., air conditioners, white goods) to shift to 18%.

- No Cess: Compensation cess (1%-290%) to be eliminated post-March 31, 2026, with rates merged into 40% for sin goods.

- Key Pillars of Reforms:

-

- Pillar 1: Structural Reforms:

- Inverted Duty Structure Correction: Align input and output tax rates to reduce input tax credit accumulation, supporting domestic value addition (e.g., textiles).

- Resolving Classification Issues: Streamline rate structures to minimize disputes, simplify compliance, and ensure equity across sectors.

- Stability and Predictability: Provide long-term clarity on rates and policy direction to boost industry confidence and improve business planning.

- Pillar 2: Rate Rationalization:

- Tax Reduction: Lower taxes on essential and aspirational goods (e.g., toothpaste, air conditioners) to enhance affordability and boost consumption.

- Simplified Slabs: Move to two main slabs (5% merit, 18% standard) with special rates for select items (e.g., 40% for sin goods).

- Compensation Cess End: Cess elimination by March 31, 2026, creates fiscal space for sustainable rate alignment.

- Pillar 3: Ease of Living:

- Registration: Seamless, technology-driven, time-bound GST registration, especially for startups/MSMEs.

- Returns: Pre-filled GST returns to reduce manual intervention and eliminate mismatches.

- Refunds: Faster, automated refund processing for exporters and sectors with inverted duty structures.

Benefits of GST Reforms 2025

Benefits for Consumers

- Lower Prices for Essential and Aspirational Goods: The proposed two-slab structure reduces the cost of daily-use and aspirational goods, enhancing affordability.

- Small FMCG sachets (₹10 or less) and household appliances like refrigerators will become cheaper, increasing purchasing power for the common man, women, students, and middle class.

- Boost in Consumption: Lower tax rates are expected to spur consumer spending, driving demand and economic activity, aligning with the Laffer Curve principle where reduced rates lead to higher consumption and revenue.

- Uniform Taxation: Similar items (e.g., all namkeen) will be taxed at the same rate, reducing confusion and ensuring transparent pricing, which builds consumer trust.

Benefits for MSMEs and Industries

- Simplified Compliance: The shift to two slabs (5% and 18%) minimizes classification disputes, reducing compliance costs for MSMEs and startups.

- Technology-driven measures like pre-filled GST returns and seamless registration processes simplify compliance, enabling small businesses to focus on growth.

- Correction of Inverted Duty Structure: Aligning input and output tax rates (e.g., in textiles) reduces input tax credit (ITC) accumulation, freeing up working capital for labor-intensive and export-oriented sectors like textiles and diamonds.

- Enhanced Business Planning: Long-term clarity on rates and policy direction fosters industry confidence, enabling better investment and operational planning.

Benefits for the Economy

- Increased Tax Compliance and Revenue: Simplified slabs and lower rates are expected to widen the tax net by reducing evasion, compensating for initial revenue losses (18% slab contributes 67%, 28% slab 11%, 12% slab 5%, 5% slab 7%).

- GST collections surged by 9.9% in March 2025, surpassing ₹1.96 trillion, indicating a robust tax base that can sustain reforms.

- Support for Atmanirbhar Bharat: Lower taxes and corrected duty structures promote domestic production and export competitiveness, aligning with self-reliance goals.

- Economic Growth and Sectoral Expansion: Reduced tax rates on sectors like electric vehicles, renewable energy equipment, and hospitality (e.g., hotels now taxed on actual charges, not declared tariffs) stimulate growth in sustainable and tourism industries.

- Digital Economy Taxation: Revised GST rules for online gaming, e-commerce, and digital services ensure fair taxation, boosting revenue from the growing digital economy.

Benefits for Governance

- Cooperative Federalism: The Centre’s engagement with states via the GST Council and GoM (led by Bihar Deputy CM Samrat Chaudhary) fosters consensus, strengthening federal collaboration.

- Enhanced Security and Transparency: Mandatory Multi-Factor Authentication (MFA) for all taxpayers from April 1, 2025, enhances GST portal security, reducing unauthorized access and fraud.

- Biometric authentication for company directors at GST Suvidha Kendras simplifies registration while preventing fraudulent applications.

- Faster Refunds:

- Automated refund processing for exporters and sectors with inverted duty structures improves cash flow and operational efficiency

About the Goods and Services Tax (GST)

Goods and Services Tax (GST) is one of the biggest economic and taxation reforms undertaken in India.

- Aim: To streamline the taxation structure in the country and replace a gamut of indirect taxes with a singular GST to simplify the taxation procedure.

- Refers: GST is essentially a consumption tax and is levied at the final consumption point. The principle used in GST taxation is the Destination Principle.

- It is levied on the value addition and provides set offs.

- It avoids the cascading effect or tax on tax which increases the tax burden on the end consumer.

- It is collected on goods and services at each point of sale in the supply line.

- Slabs for Tax Collection: 0%, 5%, 12%, 18%, and 28%

- Background and Evolution of GST in India:

- Proposed by: The idea of a nationwide GST in India was first proposed by the Kelkar Task Force on Indirect taxes in 2000.

- Introduction in the Parliament: After years of deliberation and negotiations between the Central and State Governments, the Constitution (122nd Amendment) Bill, 2014, was introduced in the Parliament to do away with multiple indirect taxes and to have a ‘One Nation One Tax’ system.

- Passed in the Parliament: The Constitution (122nd Amendment) Bill was passed as the Constitution (101st Amendment) Act in 2016 and the GST was introduced and enforced across the country on 1st July 2017.

Establishment of GST Council: The 2016 Constitutional amendment creates a GST Council consisting of the Union Finance Minister and representatives from all states to implement GST.

Establishment of GST Council: The 2016 Constitutional amendment creates a GST Council consisting of the Union Finance Minister and representatives from all states to implement GST.

- For assisting the GST Council, the office of the GST Council Secretariat was also established.

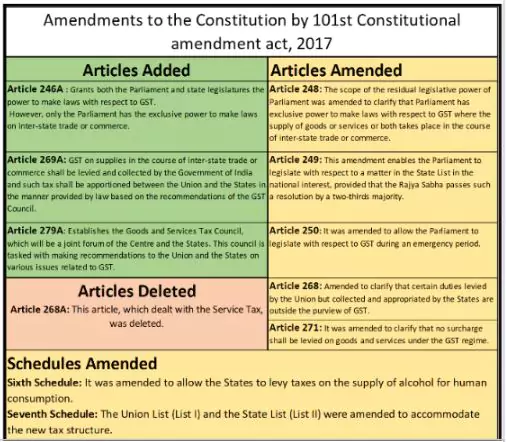

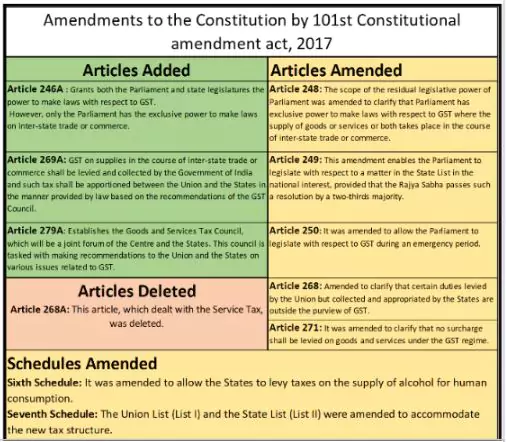

Constitutional Framework for Goods and Services Tax (GST)

101st Constitution Amendment Act: The Goods and Services Tax bill was passed in India in 2016.

- Article 246A: Both the Parliament and the State Legislatures will have concurrent powers to make laws related to GST.

- However, the Parliament will retain exclusive power to legislate in the case of inter-state trade of goods and services.

- Article 269A: In the case of inter-state trade where GST is levied and collected by the Union Government, the tax revenue proceeds to be apportioned by the Centre between the centre and states in a manner as may be provided by the Parliament by law on the recommendations of the GST Council.

- Article 279A: It empowers the President of India to constitute the GST Council and defines its composition and functioning.

Conclusion

The 2025 GST reforms, announced by PM Modi on August 15, 2025, aim to simplify the tax structure, reduce consumer and business burdens, and boost economic growth, aligning with Viksit Bharat 2047. However, challenges like revenue risks, federal consensus, and compliance complexities must be addressed to ensure effective implementation and equitable benefits across states and sectors.

![]() 16 Aug 2025

16 Aug 2025

Establishment of GST Council: The 2016 Constitutional amendment creates a GST Council consisting of the Union Finance Minister and representatives from all states to implement GST.

Establishment of GST Council: The 2016 Constitutional amendment creates a GST Council consisting of the Union Finance Minister and representatives from all states to implement GST.