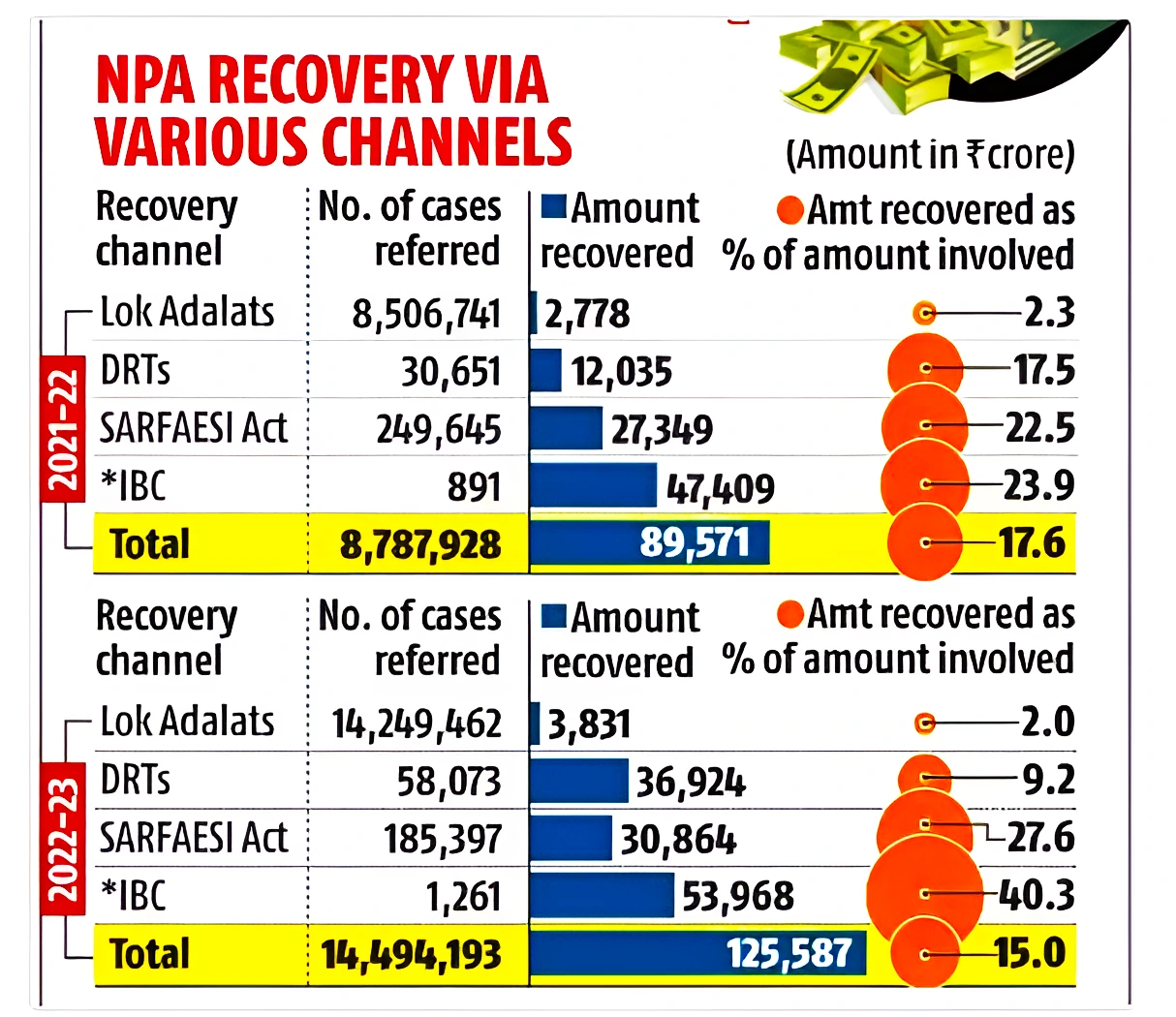

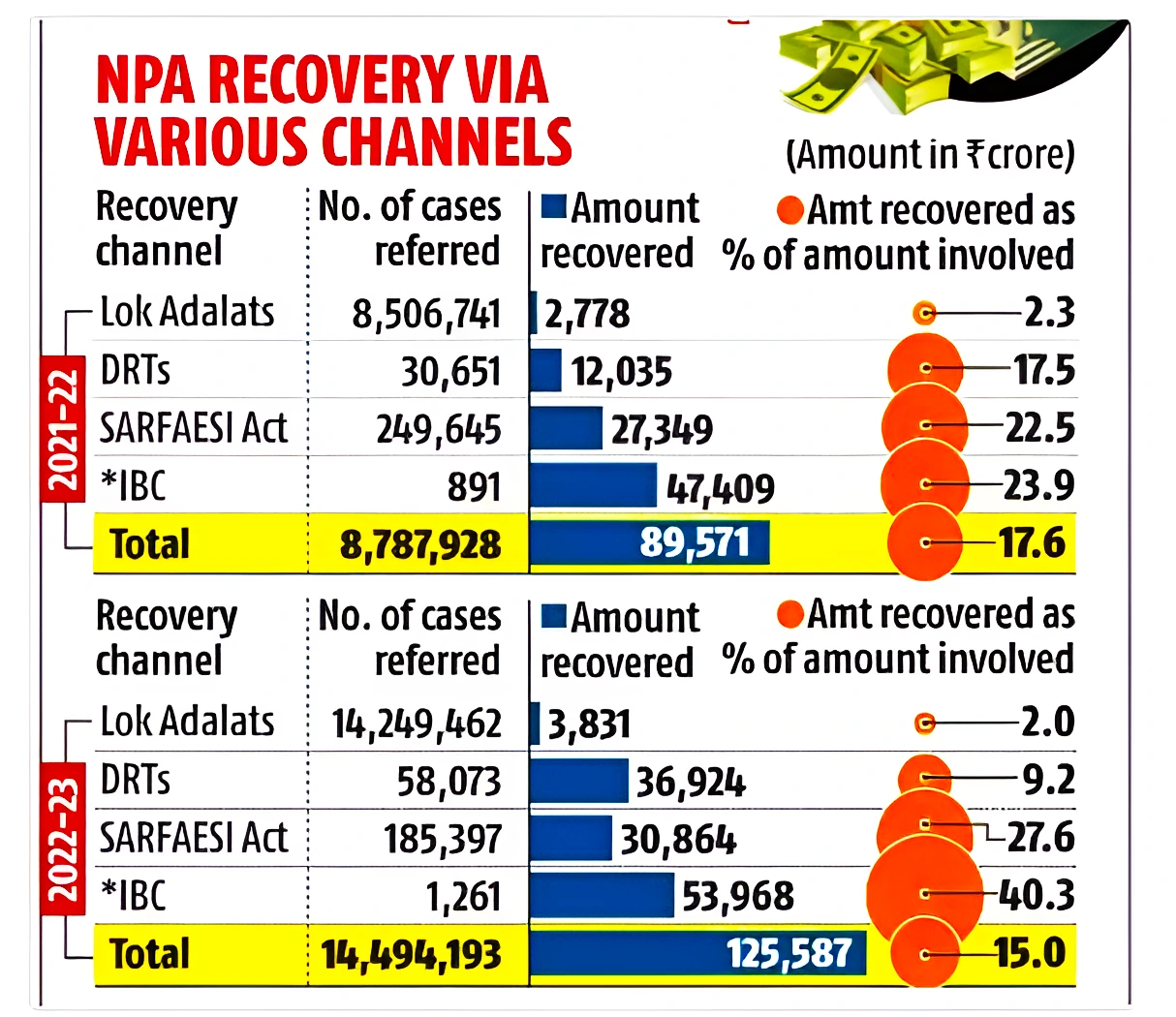

Context: The year 2022-23 saw a sharp rise of cases referred to debt recovery tribunal (DRT) and the amount involved shot up to Rs 4.02 trillion in FY23 compared to Rs 69,000 crore.

NPAs: Amount Recovery Via Debt Recovery Tribunal Falls to 9.2%

- Decline in Recovered Amount of NPAs (Non-Performing Assets): The amount recovered via debt recovery tribunals (DRTs) fell to 9.2% in FY23 compared to 17.5% in FY22.

- Hence, recovery of non-performing assets fell to 15% in FY23 from 17.6% in FY22 .

- Number of Cases referred to the recovery channel of SARFAESI Act decreases, while in case of others (Lok Adalats, DRTs and the Insolvency and Bankruptcy Code (IBC)), number of referred cases increase in FY23 in comparison to FY22.

- The amount recovered as percentage of the amount involved is decreased for Lok Adalats and debt recovery tribunal (DRTs), while increased for SARFAESI Act and IBC in FY23 in comparison to FY22.

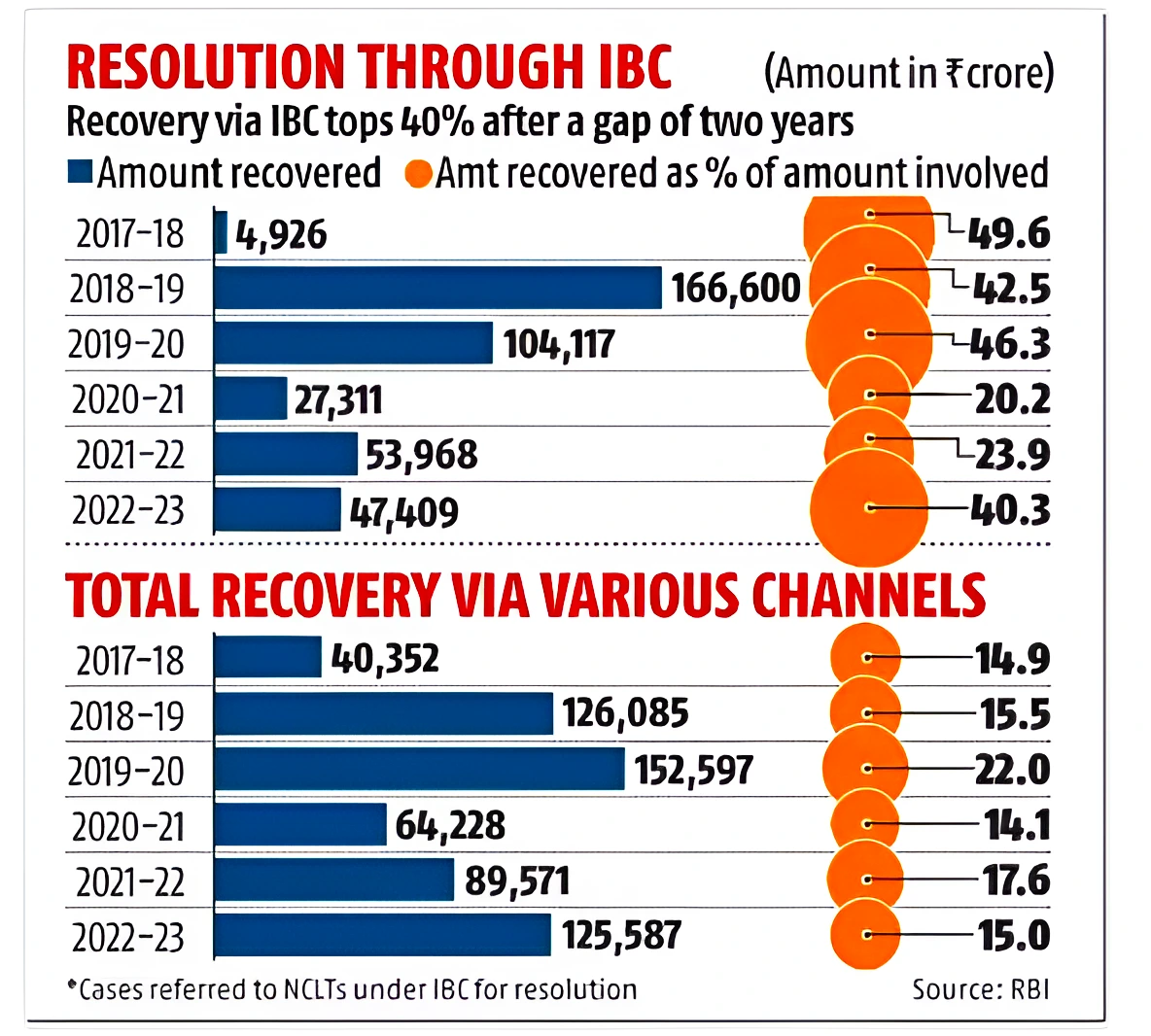

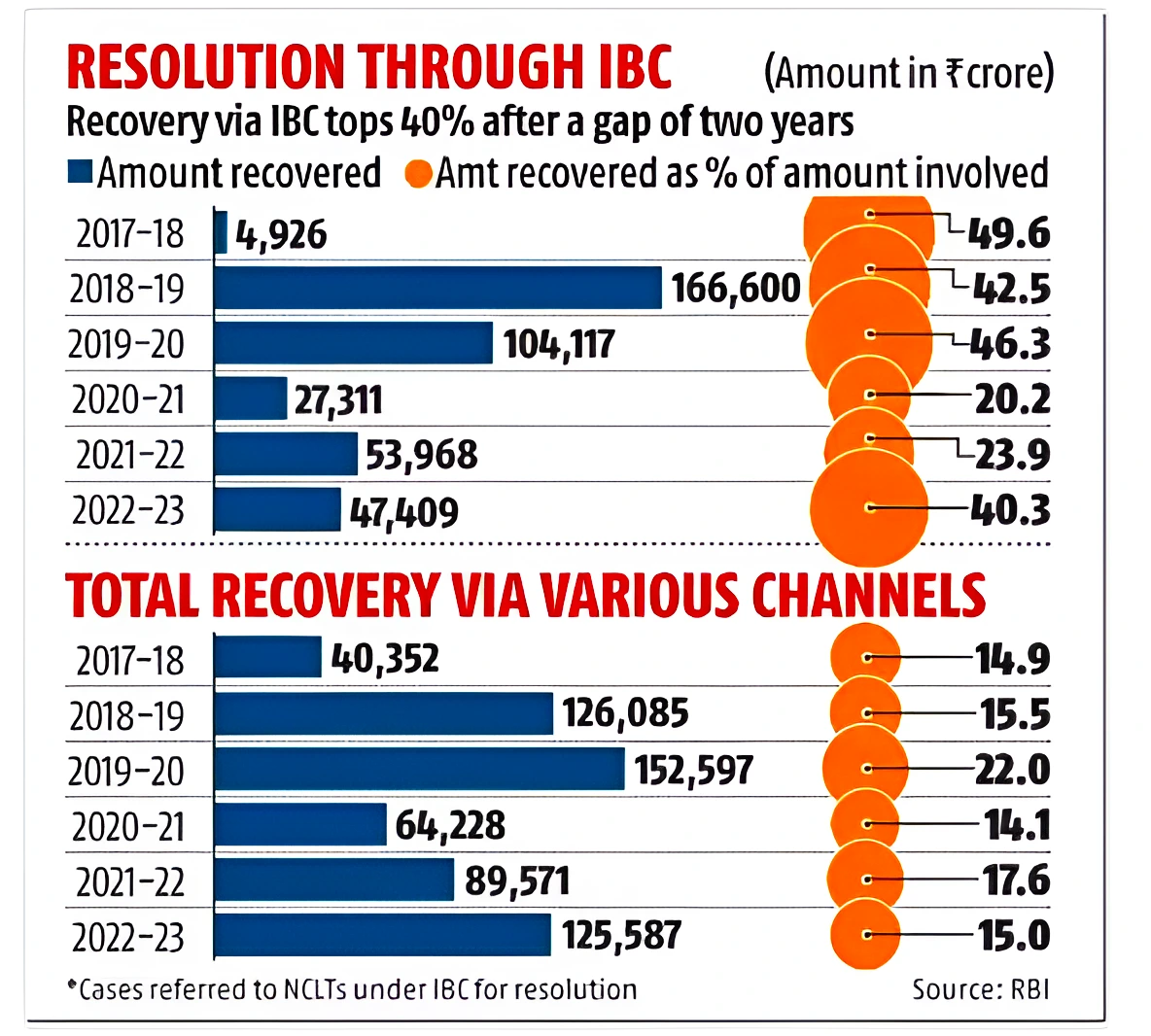

- Improvement in Recovery through IBC: Recoveries via IBC were back to over 40% in FY23 after a gap of two years.

Except for FY20, total recoveries via various channels as percentage of amount were around mid-teens levels.

Except for FY20, total recoveries via various channels as percentage of amount were around mid-teens levels.- For Resolution through IBC:

- In the last six Financial Years, the highest amount was recovered in 2018-19 (₹166,600 crore).

- In the last six Financial Years, the highest amount that was recovered as percentage of the amount involved in 2017-18 (₹49.6 crore).

- For Total Recovery via Various Channels:

- In the last six Financial Years, the highest amount was recovered in 2019-20 (₹152,597 crore).

- In the last six Financial Years, the highest amount that was recovered as percentage of the amount involved in 2019-20 (₹22.6 crore).

Must Read: Asset Quality Of Indian Banks

News Source: Business Standard

![]() 2 Jan 2024

2 Jan 2024

Except for FY20, total recoveries via various channels as percentage of amount were around mid-teens levels.

Except for FY20, total recoveries via various channels as percentage of amount were around mid-teens levels.