![]() 28 Dec 2024

28 Dec 2024

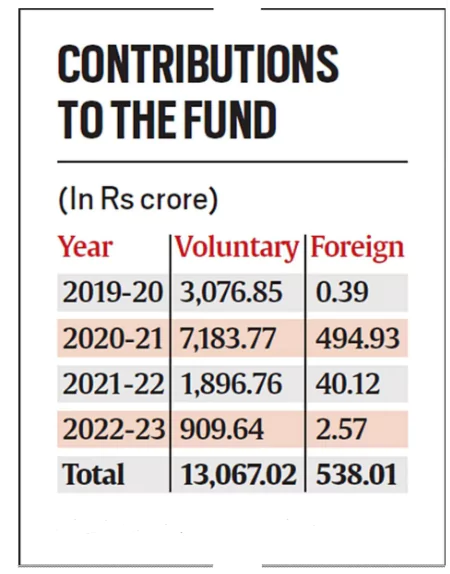

The Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund (PM CARES Fund) received Rs 912 crore in contributions during the financial year 2022-23 as donations continued to pour in even after the Covid pandemic.

Ex-Officio Trustees:

Ex-Officio Trustees:

<div class="new-fform">

</div>