The government has introduced new features and expanded outreach efforts to improve the implementation of the Pradhan Mantri Shram Yogi Maandhan (PM-SYM) scheme.

About Pradhan Mantri Shram Yogi Maandhan (PM-SYM) Scheme

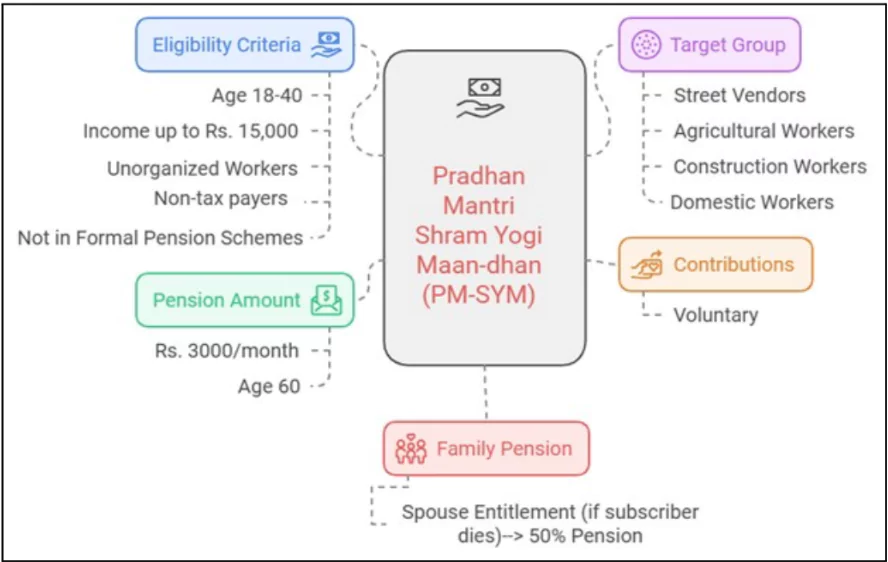

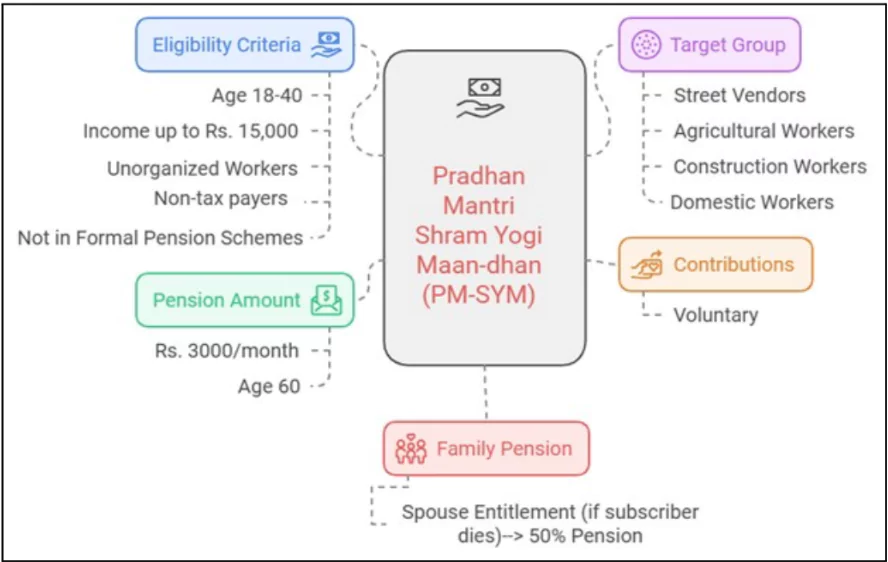

- PM-SYM is a voluntary and contributory pension scheme aimed at providing financial security to workers in the unorganised sector.

- Launched in Interim Budget 2019 by the Ministry of Labour and Employment as a Central Sector Scheme.

- Life Insurance Corporation of India (LIC) is the Pension Fund Manager along with CSC eGovernance Services India Limited (CSC SPV), are responsible for managing contributions and disbursing pensions.

Key Features of the Scheme

- Eligibility Criteria: Workers in the unorganised sector with a monthly income of up to ₹15,000.

- Age limit for enrolment: 18 to 40 years.

- Exclusions:

- Income taxpayers.

- Those covered under EPF, ESIC, or NPS.

- Individuals already receiving government pension benefits.

- Pension and Contribution Structure: Assured pension of ₹3,000 per month after 60 years of age.

- Workers contribute a fixed amount based on age at enrolment, ranging from ₹55 per month (at age 18) to ₹200 per month (at age 40).

- The government matches the worker’s contribution on a 1:1 basis.

- Family Pension: After the subscriber’s death, the spouse receives 50% of the pension amount.

About Unorganised Sector in India

- Definition: The unorganised sector includes rural and urban labour engaged in small and family enterprises with minimal government regulation.

- Employment is casual, seasonal, and lacks job security due to scattered workplaces and absence of trade unions.

- Examples of Unorganised Sector Workers:

- Agricultural labourers, handloom workers and powerloom workers.

- Rag pickers, beedi workers, cine workers, salt workers and ship-breaking workers.

- Sericulture, coir, khadi industries, and small-scale industries.

- Contribution to the Economy

-

- The unorganised sector contributes around 50% to the national income.

- Over 30.51 crore unorganised workers registered on the e-Shram portal (2024).

|

- Exit Options:

- Before 10 years: Refund of the contributed amount with savings bank interest.

- After 10 years but before 60 years: Refund with accrued interest.

- If both subscriber and spouse pass away: The entire corpus is credited back to the pension fund.

- Enrolment Process:

- Aadhaar-based registration through Common Service Centres (CSCs) or the Maandhan portal.

- Contributions are made via auto-debit from a savings bank or Jan-Dhan account.

Implementation and Current Status

Coverage and Enrolment

- Implemented across 36 States/UTs.

- Total enrolments as of March 2025: 46,12,330 workers.

- Top 3 States with highest enrolments: Haryana, Uttar Pradesh, Maharashtra.

Recent Enhancements in the Scheme

- Extended account revival period from one year to three years for workers facing financial difficulties.

- Integration with the e-Shram portal for better tracking and accessibility.

- Awareness campaigns via SMS, government communication, and social media.

- “Donate-a-Pension” initiative to allow employers to contribute on behalf of workers.

Conclusion

The PM-SYM scheme is a significant step towards financial security for India’s unorganised workforce. By ensuring a minimum pension, providing flexible contribution options, and introducing new outreach efforts, the government aims to expand coverage and create an inclusive social security system.

![]() 6 Mar 2025

6 Mar 2025