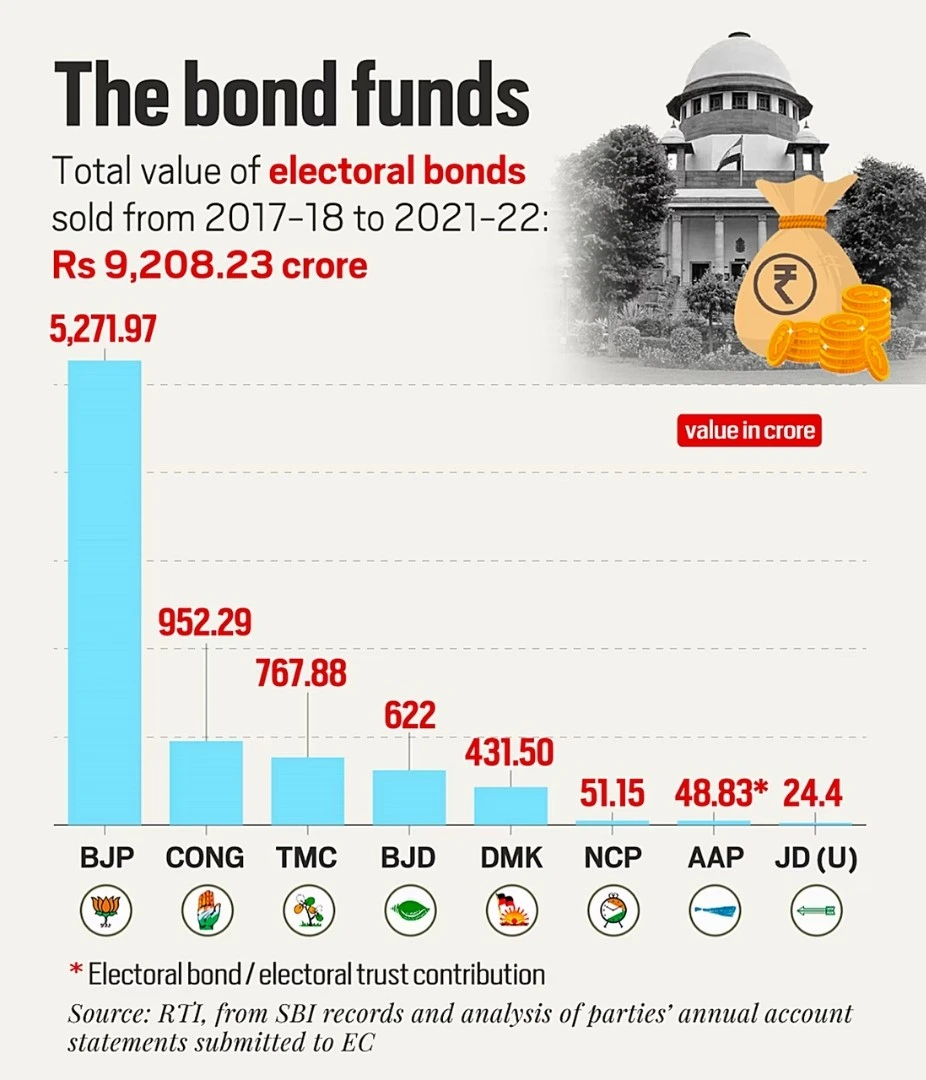

Different Views On Electoral Bonds and Political Funding:

|

|---|

Chilean Experiment – Reserved Contributions:

|

|---|

To get PDF version, Please click on "Print PDF" button.

SC Verdict on Newsclick Shows Adherence to Due Pro...

Stay Invested: On Chabahar and India-Iran Relation...

Credit Rating Agencies, Impact on India’s De...

Catapulting Indian Biopharma Industry

Globalisation Under Threat, US Import Tariffs Have...

Global Report on Hypertension, Global Insights and...

<div class="new-fform">

</div>