Context:

- This article is based on the news “India’s space economy to soar to $40 billion by 2040: Union Minister” Which was published in the Live Mint. According to Deloitte consultancy, private investments in the Space sector increased by 77 percent between 2021 and 2022 with the Opening of 190 Indian space start-ups. It was twice as many as a year earlier.

Current Status of Indian SpaceTech Sector

- The Indian SpaceTech sector has received $62 million in funding in 2023 so far, registering a 60% increase, compared to the same period last year, according to data research firm Tracxn.

- Companies like Skyroot, for instance, have launched India’s first privately built rocket, Vikram-S, into space, with plans to revolutionize satellite launches.

- The Indian Space Policy 2023 formally laid down the regulations for privatizing space missions in India, and also denoted clear guidelines of operations for NewSpace India Limited (Nsil) — Isro’s commercial arm — and Indian National Space Promotion and Authorization Centre (IN-SPACe).

- Private startups can thus offer satellite communication services, operate on-ground mission control centres, place their own satellites in orbit, establish and commercially-run privately-owned remote satellite services, undertake space safety projects, and also “engage in the commercial recovery of an asteroid resource or a space resource.”

Potential of India’s Space Sector:

- Space economy: At present, the Indian space economy is valued at around ₹6,700 crore ($8.4 billion) with a 2% share in the global space economy.

- Revenue From Satellite launch: Revenue from launching European satellites amounted to EUR 230-240 million. Launches for American satellites brought in around $170-180 million.

- Future Prospect: As per IN-SPACe’s projection, India’s space economy has the potential to reach ₹35,200 crore ($44 billion) by 2033 with about 8% of the global share.

- Export Share: At present, the share of the domestic market is ₹6,400 crore ($8.1 billion). The export market share is ₹2,400 crore ($0.3 billion)

Status of Privatisation of Space Sector:

- As per SpaceTech Analytics, India is the sixth-largest player in the industry internationally having 3.6% of the world’s space-tech companies (as of 2021). The U.S. holds the leader’s spot housing 56.4% of all companies in the space-tech ecosystem.

- Other major players include the U.K. (6.5%), Canada (5.3%), China (4.7%) and Germany (4.1%).

- According to the Economic Survey of India, there have been over 100 active space companies since 2012.

Rise of Spacetech Startups in India:

- In November 2022, the first privately developed rocket, Vikram-S was launched by the Indian space startup Skyroot Aerospace

- Agnikul Cosmos, a private Indian company set up India’s first launch pad at the Satish Dhawan Space Centre.

- Bellatrix Aerospace, another Indian space startup, is engaged in advanced in-space propulsion systems and rocket propulsion technologies.

|

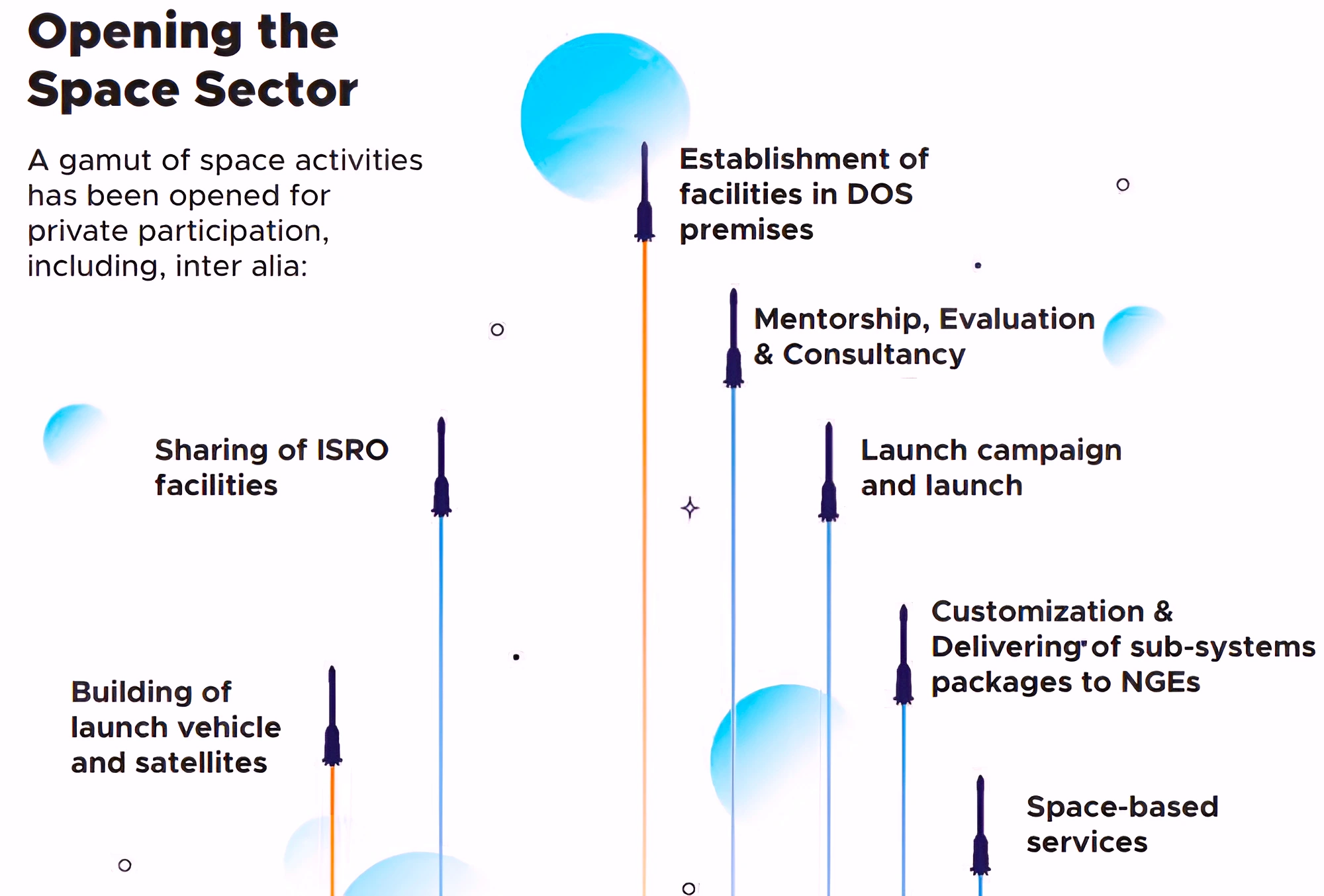

India allows Private Participation:

- Enhancing Foreign direct investment: It will also serve as a key driver for attracting more foreign direct investment for space startups and related technology companies in India.

- FDI in the space sector will allow more Indian spacetech companies to collaborate with foreign investors and foster more knowledge exchange, and better-funded research and development.

- At present, FDI in the space sector is permitted up to 100% in the area of satellite establishment and operations, but only through the Government route.

- Realizing the vision of ‘’Make in India”: The vision of “Make in India” and “Aatmanirbhar Bharat” initiatives call for a remodeling of the mostly government-led space sector of the country.

- Policy Framework and Goals: The Private Sector participation will help India increase its share in the global space economy from about 2 per cent to 9 percent by 2030, according to a recent report by Deloitte India.

- The Indian Space Policy 2023 provides a framework that prioritizes private players’ involvement in the space sector.

- Socio-Economic Impact of Space Applications: Empowering the private sector amplifies the socio-economic impact of space applications.

- By finding innovative solutions to pressing challenges in areas such as agriculture, disaster management, or communication, the private sector can bring significant improvement to people’s lives.

- For Example: Companies like Pixxel have introduced technologies for earth observation, while Dhruva Space and Bellatrix Aerospace are contributing to the sector through their unique offerings.

- Emerging Opportunities in the Global Space Sector: Future opportunities in fascinating areas like space tourism and commercial recovery of space resources are coming up, promising an enormous scope of growth in the sector.

- ISRO’s Focus on Core Competencies: India’s space industry comprises a significant number of small and medium-sized enterprises that supply components for satellite and launch vehicle manufacturing.

- Encouraging private participation could free up ISRO to focus on science, research and development, interplanetary exploration, and strategic launches.

Impact of Reforms:

- Accelerated Innovation and Technology Development: Private players are expected to bring fresh perspectives, innovation, and a competitive spirit to the space sector, leading to the development of cutting-edge technologies and solutions.

- Enhanced Access to Space Technologies: Increased private participation will make space technologies more accessible to a wider range of users, including government agencies, industries, and startups. This will drive the adoption of space-based solutions across various sectors.

- PSLV Productionisation One of the major breakthroughs in commercialization is PSLV productionisation through Industry.

- NSIL and HAL exchanged the MOU for producing 5 nos. of PSLVs. L&T is partnering with HAL in the consortium

- Transfer Of Technology: Non-disclosure agreements and MOUs for transfer of technologies have been signed between ISRO centers and several private sector companies.

- To capture the small satellite launching market ISRO has developed a Small Satellite Launch Vehicle (SSLV) with a view to transfer the technology to the industry. The first development flight was launched. The technology will be transferred to the industry after successful qualification.

- Investment in Space Sector: Ranking 7th globally in terms of funding, the Indian space startup sector has seen significant funding growth, from Rs 28 million in 2020 to Rs 112 million in 2022, with Rs 62 million invested in the first half of the current year. This surge can be attributed to increased demand for space-based solutions, cost-effective satellite manufacturing, reduced launch costs, and advancements in supporting technologies like AI and 3D printing.

- IFSCA entered into an MoU with DoS on July 29, 2022, at Ahmedabad in the presence of the Hon’ble Prime Minister to promote international investments in the Space sector.

- Human Resource Development: ISRO and the Ministry of Skill Development & Entrepreneurship (MSDE) have launched a skill development program in the space domain.

- 40 young professionals from across the country and 100 ISRO staff were trained in the last 2 months at National Skill Training Institutes (NSTI) under MSDE.

- This Programme will continue every month for imparting skilled courses for ISRO Staff.

- Capacity Building Commission (CBC) in association with STI-CB cell, PSA’s office, and ISRO has launched a Leadership Training Programme for 32 scientists from 8 science ministries. ISRO has taken the lead in hosting the program.

Centre’s Efforts in Privatisation of Space Sector:

- Indian Space Policy, 2023: The Indian Space Policy, 2023 has provided much-needed clarity on the role of private sector participants and removed stern barriers to their entry into the sector.

- IN-SPACe: The Indian National Space Promotion and Authorisation Centre (IN-SPACe) is a single-window, independent, nodal agency that functions as an autonomous agency in the Department of Space (DOS).

- It was formed following the Space sector reforms to enable and facilitate the participation of private players.

- New Space India Limited (NSIL): It was incorporated in 2019, as a wholly-owned Government of India Undertaking / Central Public Sector Enterprise (CPSE), under the administrative control of the Department of Space (DOS) to commercially exploit the research and development work of Indian Space Research Organisation (ISRO).

- Space Remote Sensing Policy of India – 2020:

- To promote the commercialization of space technology, the “Space Remote Sensing Policy – 2020” (SpaceRS Policy – 2020) aims to motivate different stakeholders in the nation to actively participate in space-based remote sensing operations.

- Government-owned, company-operated (GOCO) system: With a thrust towards privatisation of the space sector, the Indian Space Research Organisation (Isro) has thrown open the doors for its RF (radio frequency) systems and electromagnetic actuator manufacturing to private players through a government-owned, company-operated (GOCO) system.

- A GOCO facility is a model used by the federal government in which the government pays a privately owned company to operate a facility that the government owns.

|

Challenges:

- Access to capital: In terms of lack of financing, private capital is still not flowing freely and blindly through to space-based enterprises like it is with internet-, digital media- and hardware-related technology businesses.

- For Example: In 2015, approximately $129 billion in VC funding was deployed globally across 7,872 deals. Of this total, just over $2 billion was deployed to space-based companies across 44 deals.

- Access to insurance: There also is a lack of adequate and secured insurance, which is because of the inability of insurers to see and test the reliability of space-based technologies in the recent past

- Ability to create self-sustaining markets: An inability to forge self-sustaining commercial markets in the past puts into question the commercial viability of space-based enterprises.

- For Instance, Two decades ago, the commercial satellite business was expected to achieve independence within a few years of being established, but government involvement is still needed to this day to see projects to the execution phase.

Antrix-Devas Case:

- In 2005, Antrix, a commercial and marketing arm of the Indian Space Research Organisation (ISRO) signed a satellite deal with Devas Multimedia.

- According to the contract, Antrix was to build and operate two satellites, and using the transponder capacity of those two satellites, Devas was to provide multimedia services to mobile subscribers in India.

What went wrong?

- The Manmohan Singh government in 2011 terminated the contract after allegations emerged that the deal included “quid pro quo” between Antrix officials and Devas.

- Miffed by the termination of the contract, the company approached the International Chamber of Commerce (ICC) and in 2015, an arbitral tribunal found that the termination of the contract was wrong.

Verdict of Supreme Court:

- The apex court dismissed Devas’ appeal against a tribunal’s 2021 order that it should wind up operations on grounds of fraud.

|

The Pros And Cons Of Privatizing Space Exploration

- Reduce exploration Cost: Companies like SpaceX, Blue Origin, Virgin Galactic, and Arianespace have revolutionized the space sector by reducing costs and turnaround time, with innovation and advanced technology.

- Tourism: Blue Origin, a private spaceflight company founded by Amazon CEO Jeff Bezos, is developing a reusable rocket system that could take passengers on trips beyond Earth’s atmosphere.

- Natural Resources: In 2017, Luxembourg became the first European country to establish a legal framework securing private rights over resources mined in space, and similar steps have been taken at the domestic level in Japan and the United Arab Emirates.

Cons:

- Regulation: Though it is a profitable investment, regulation of private sector participation is not easy.

- The time taken for regulatory clearances and unstable political institutions can cause delays and hurdles in the decision-making of investors.

- Spacecraft emissions: The participation of the private sector in the aerospace industry has led to an enormous increase in the number of launches that will likely continue to grow in spacecraft emissions.

- For Instance, Atmospheric scientists, Martin Ross and Darin Toohey (2019), explained that particulate emissions from rockets may have a significant impact on the global climate.

- Growing number of collisions and Orbital debris: NASA researchers, Matney, Vavrin, and Manis (2017), suggest that satellite constellations and the increase of launches due to private sector participation are leading to a growing number of collisions, and consequently, orbital debris.

- Orbital debris poses a serious threat to both satellites and manned space exploration, such as the inhabitants of the International Space Station.

Way Forward:

- Enable and promote Non-Governmental Entities (NGE): To carry out independent space activities Provide a level playing field and favorable regulatory environment for players within the Indian private sector, to allow them to become independent actors in the space sector instead of being solely vendors or suppliers to the government program.

- Open up ISRO Infrastructure and Facilities: The reform also aims to make national space infrastructure developed over the years, available for use by the private industry through a business-friendly mechanism.

- Facilities pertaining to testing, tracking and telemetry, launch-pads, and laboratories, created by ISRO, would also enable the private space industry to climb the value chain.

- Demand-driven approach for the development of Space Assets: Optimizing the utilization of space assets such as satellites and launch capacity by determining accountability amongst various stakeholders.

- Creation of new assets to be made contingent on confirmation of demand from user agencies/ entities.

- Upskilling the human power: DoS and the Ministry of Skill Development & Entrepreneurship (MSDE), under an MoU, conduct ISRO Technical Training Programme (ITTP) at various National Skill Training Institutes (NSTIs) across the country to upskill/reskill 4000 Technicians / Technical / Scientific Assistants of ISRO in four to five years in phased manner to give a boost to private sector participation in space sector.

Also Read: I2U2’s Space Venture and Strategic Significance

Conclusion:

With a robust regulatory framework, more schemes to promote ease of doing business for spacetech businesses, and a pathway for private sector investment, the country’s space sector holds the potential to become a trailblazer in the global space market.

![]() 27 Nov 2023

27 Nov 2023