The Government informed Parliament that PLI disbursements crossed ₹21,000 crore, with applications clearance across 14 sectors since its launch.

About Production-Linked Incentive (PLI) scheme

- The PLI scheme, introduced in April 2020, aims to enhance India’s manufacturing capabilities and attract global companies to set up production facilities in the country.

- PLI 2.0 was introduced for IT Hardware for Enhancing India’s Manufacturing Capabilities and Enhancing Exports – Atmanirbhar Bharat in 2023.

|

Key Highlights of PLI Scheme Implementation

- Investment Mobilisation: The scheme has attracted investments worth ₹1.90 lakh crore, boosting manufacturing capacity across priority sectors.

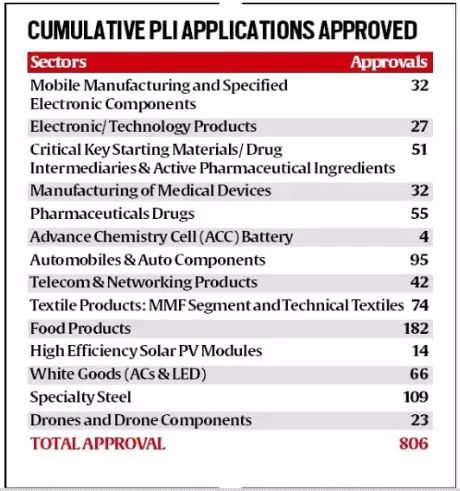

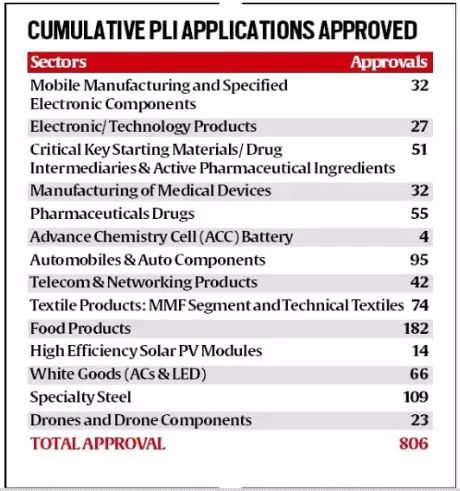

- Application Clearances: A total of 806 applications have been approved under various PLI schemes.

Higher approvals were seen in strong sectors like food products (182), specialty steel (109), and automobiles & auto components (95).

Higher approvals were seen in strong sectors like food products (182), specialty steel (109), and automobiles & auto components (95).

- Electronics and Mobile Manufacturing Success: Mobile phone production value rose 146% from ₹2.13 lakh crore (2020-21) to ₹5.25 lakh crore (2024-25).

- Exports of mobile phones surged 775%, from ₹22,870 crore in 2020-21 to ₹2,00,000 crore in 2024-25.

- Gains in Pharmaceuticals and Medical Devices: Pharmaceutical PLI led to cumulative sales of ₹2.66 lakh crore, with exports worth ₹1.70 lakh crore.

- India became a net exporter of bulk drugs (₹2,280 crore surplus in FY 2024-25 versus ₹1,930 crore deficit in FY 2021-22).

- In medical devices, 21 projects are manufacturing 54 unique products, including advanced equipment such as MRI, CT-scan, stents, and dialysis machines.

Concerns regarding the disbursement under PLI Scheme

- Low Disbursement Levels: Only ₹21,689 crore of incentives have been disbursed, which is low compared to the scheme’s total outlay of ₹1.97 lakh crore.

- Low disbursement is due to companies not meeting required performance benchmarks despite ongoing production.

- Limited Approvals in Sunrise Sectors: Only 4 applications in ACC batteries and 14 in high-efficiency solar PV modules have been cleared.

- In drones and drone components, approvals stood at just 23 applications.

Reason for low disbursement in Sunrise Sector

- Pricing Pressure from China: China’s dominance in EV technology, critical minerals, and solar modules has created severe pricing competition.

- Indian firms struggle to compete with China’s cost advantage, impacting project viability.

- Demand-Supply Mismatch: Private firms reported insufficient domestic demand, which limited their ability to meet PLI benchmarks.

- This has reduced incentive eligibility despite rising investments and production.

Implications of the PLI Scheme

- Capacity Building Achieved: The scheme has succeeded in increasing production capacity, even if incentive payouts remain modest.

- Positive Impact on Export Competitiveness: The electronics and pharmaceutical sectors have shown strong export performance, helping India move towards self-reliance and global integration.

- The PLI scheme is contributing to India’s emergence as a manufacturing hub for mobile phones and bulk drugs.

- Structural Weakness in Sunrise Sectors: Strategic sectors like batteries and solar modules are lagging, raising concerns about India’s ability to achieve clean energy and EV adoption goals.

- Policy and Implementation Challenges: The low incentive disbursement suggests a need to recalibrate targets and address demand constraints.

- Without resolving pricing and raw material supply issues, India’s sunrise sectors may fail to take off as intended.

Conclusion

The PLI scheme has strengthened traditional sectors and boosted exports, but sunrise sectors like batteries and solar modules remain weak due to pricing pressure, demand gaps, and Chinese dominance. Addressing these structural issues will be crucial for India to achieve its goals of energy security, EV growth, and global manufacturing leadership.

![]() 20 Aug 2025

20 Aug 2025

Higher approvals were seen in strong sectors like food products (182), specialty steel (109), and automobiles & auto components (95).

Higher approvals were seen in strong sectors like food products (182), specialty steel (109), and automobiles & auto components (95).