![]() 27 May 2025

27 May 2025

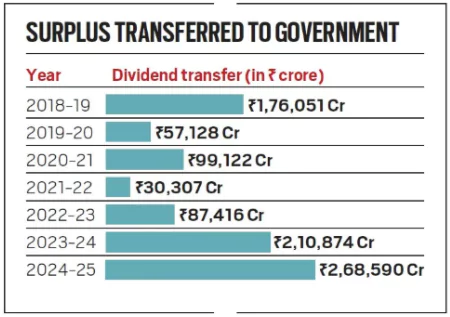

The RBI Central Board approved a record surplus transfer of ₹2.69 lakh crore to the Central Government for the financial year 2024–25.

RBI Central BoardThe Central Board of the Reserve Bank of India (RBI) is the apex decision-making body of the central bank. It oversees RBI’s general affairs and policy formulation. Composition: It is a 21 member body.

Functions

|

|---|

Bank for International Settlements (BIS)

|

|---|

| Income Sources of RBI | Expenditure of RBI |

| Interest Income: Earnings from domestic & foreign govt securities

Forex Transactions: Gains from buying/selling foreign exchange (e.g., dollar sales) Revaluation Gains: From exchange rate-led appreciation of foreign assets Deposits with Banks: Interest from deposits with foreign central banks & BIS Lending Operations: Interest from short-term lending like LAF Fees and Charges: Commissions for govt transactions & bond handling |

Interest Paid: On reverse repo operations and MSS bonds

Currency Printing: Costs related to printing & managing notes Establishment Costs: Salaries, pensions & admin expenses Provisions & CRB: Allocations to Contingent Risk Buffer and other reserves Depreciation: On buildings, IT systems, and infrastructure |

Economic Capital Framework (ECF)

|

|---|

Contingent Risk Buffer (CRB)

How is the CRB maintained ?

|

|---|

<div class="new-fform">

</div>