![]() 5 Apr 2024

5 Apr 2024

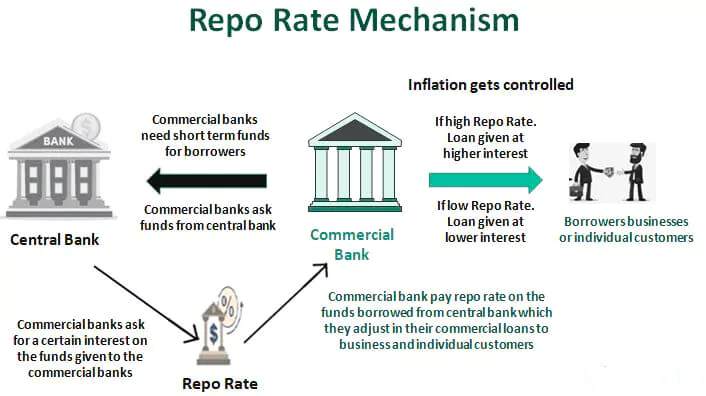

In the first RBI Monetary Policy Committee (MPC) announcement of the Financial Year 2024-25 (FY25), RBI Governor Shaktikanta Das has decided to keep the repo rate at 6.5%.

Borrowing from the Central Bank: During fund shortages, commercial banks borrow from the central bank at the repo rate.

Borrowing from the Central Bank: During fund shortages, commercial banks borrow from the central bank at the repo rate.

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

<div class="new-fform">

</div>