![]() 8 Feb 2024

8 Feb 2024

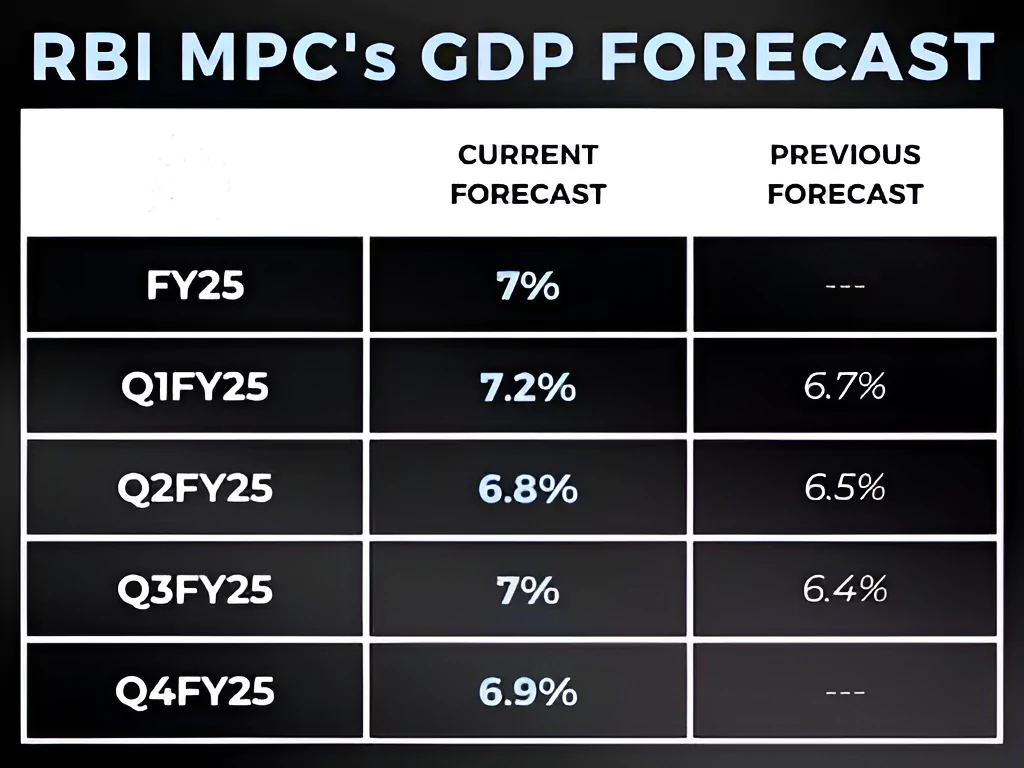

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) has kept the repo rates unchanged for the sixth time in a row at 6.5 per cent.

| The repo rate is the interest rate at which the RBI lends to commercial banks. |

|---|

Taking into account this growth-inflation dynamics and the fact that transmission of the cumulative 250 bps policy rate hike is still underway,

Taking into account this growth-inflation dynamics and the fact that transmission of the cumulative 250 bps policy rate hike is still underway,

What is the Monetary Policy Committee (MPC)?

Function: The MPC determines the policy interest rate (repo rate) required to achieve the inflation target. The Decision-Making Monetary Policy Committee

Members of Monetary Policy Committee

|

|---|

News Source: All India Radio

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

<div class="new-fform">

</div>