The Reserve Bank of India (RBI) has announced the list of Non-Banking Financial Companies (NBFCs) in the Upper Layer (UL) under Scale Based Regulation (SBR) for the year 2024-25

Highlights of Recent RBI Release

The NBFC Upper Layer (UL) list for 2024-25 includes Tata Sons Private Ltd, Bajaj Finance Ltd, LIC Housing Finance Ltd, and Aditya Birla Finance Ltd, among others.

Enroll now for UPSC Online Course

About NBFC Regulation

- Regulatory Powers: RBI regulates NBFCs under the RBI Act, 1934, with powers to register, inspect, and supervise NBFCs meeting the 50-50 principal business criteria.

- 50-50 Principal Business Criteria: Financial activity constitutes over 50% of total assets and gross income.

- Requirements for NBFC Registration

-

- Must be a company registered under Section 3 of the Companies Act, 1956.

- Minimum Net Owned Fund (NOF) of ₹200 lakh.

About Scale-Based Regulation (SBR) Framework

- The Scale-Based Regulation (SBR) framework, introduced by the Reserve Bank of India in 2021, is a regulatory framework designed to classify Non-Banking Financial Companies (NBFCs) based on their asset size and scoring criteria.

- The aim is to strengthen risk management, apply proportional regulation, and address systemic risks in the NBFC sector.

- Objectives of the SBR Framework

- Mitigation of Systemic Risks: To reduce the impact of financial contagion and safeguard the overall financial ecosystem.

- Proportional Regulation: To ensure that regulatory intensity corresponds to the scale and complexity of NBFC operations.

- Enhanced Risk Management: To improve the operational resilience and governance standards of NBFCs.

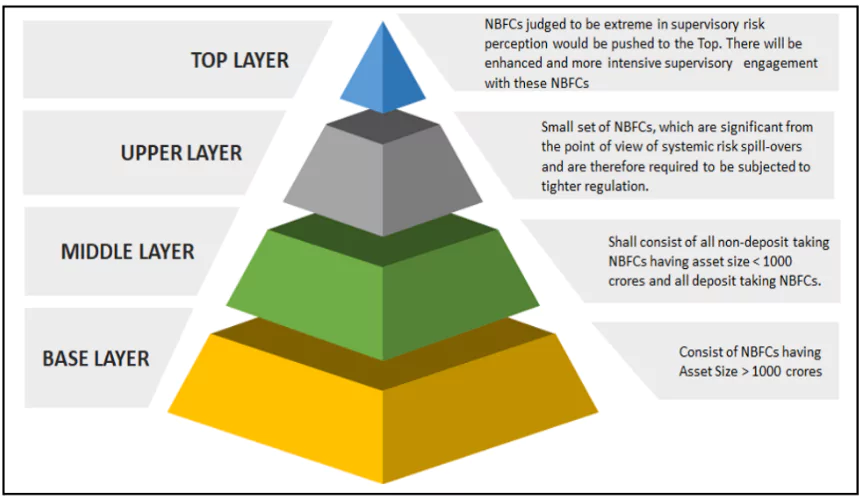

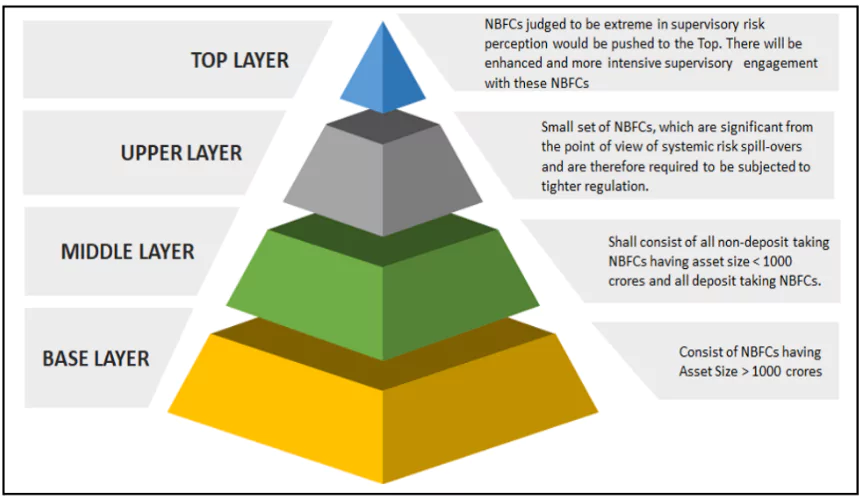

Categorization of NBFCs

Categorization of NBFCs

- Base Layer (NBFC-BL): Includes smaller NBFCs with limited risk to the system.

- Middle Layer (NBFC-ML): Comprises larger entities with moderate systemic importance.

- Upper Layer (NBFC-UL): High-risk NBFCs based on scoring methodology and systemic importance.

- Top Layer (NBFC-TL): Rarely occupied, for entities posing exceptional risks.

- Features of Enhanced Regulations

- NBFC-ULs are subjected to stricter regulatory requirements for at least five years.

- This includes increased compliance, monitoring, and governance norms

Check Out UPSC CSE Books From PW Store

Difference Between Banks and NBFCs

| Parameter |

Banks |

NBFCs |

| Demand Deposits |

Can accept demand deposits |

Cannot accept demand deposits |

| Payment and Settlement System (PSS) |

Part of PSS; can issue cheques |

Not part of PSS; cannot issue cheques |

| Deposit Insurance |

Deposits insured by Deposit Insurance and Credit Guarantee Corporation |

No deposit insurance facility available |

| Reserve Ratios (CRR, SLR) |

Must maintain Reserve Ratios prescribed by RBI |

Not required to maintain Reserve Ratios |

| Regulation Act |

Regulated under Banking Regulation Act, 1949 |

Regulated under Companies Act, 1956 |

| Foreign Direct Investment (FDI) |

Up to 74% FDI allowed for private sector banks (49% under automatic route) |

100% FDI allowed |

![]() 18 Jan 2025

18 Jan 2025

Categorization of NBFCs

Categorization of NBFCs