Recently, the Reserve Bank of India (RBI) issued three revised master directions on fraud risk management for Regulated Entities.

- These master directions have been prepared based on a comprehensive review of the earlier Master Directions, circular and emerging issues.

About Master Directions on Fraud Risk Management

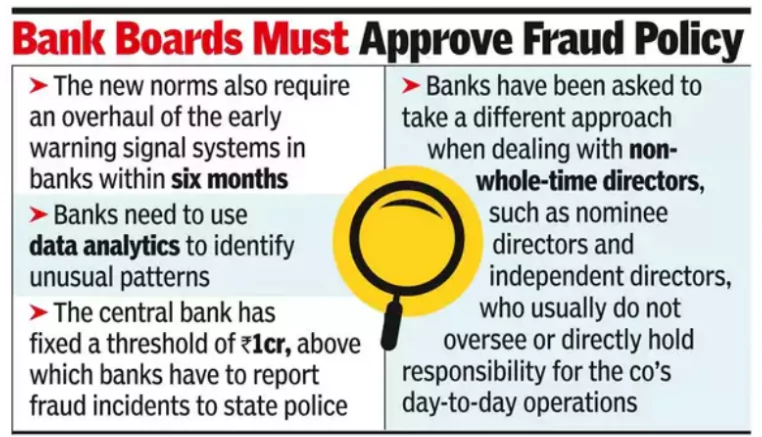

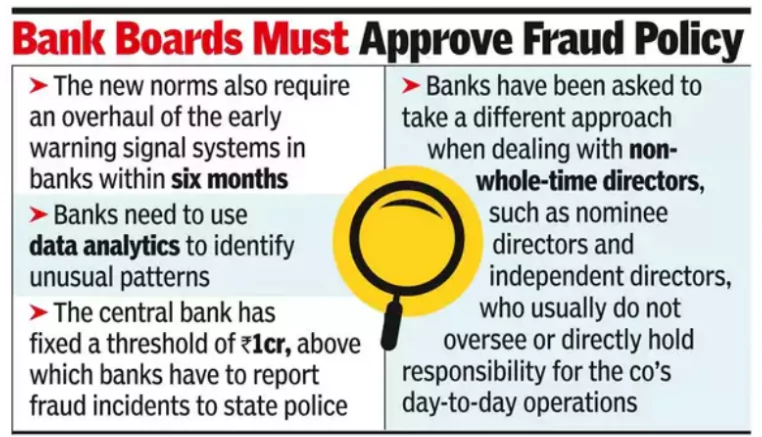

These Master Directions are principle-based and strengthen the role of the Board in overall governance and oversight of fraud risk management in the Regulated Entities (REs).

- Regulated Entities: These entities include:

- Commercial Banks (including Regional Rural Banks) and All India Financial Institutions

- Cooperative Banks (Urban Cooperative Banks / State Cooperative Banks / Central Cooperative Banks)

- Non-Banking Finance Companies (including Housing Finance Companies)

- Purpose: To encourage improved fraud risk management frameworks and systems in regional rural banks, housing finance companies, and rural cooperative banks.

- Followed Principle of Natural Justice: The directions mandate REs to comply with principles of natural justice in a time-bound manner before classifying persons/entities as fraud, taking into account the March 2023 Supreme Court Judgment on State Bank of India versus Rajesh Agarwal.

- In the SBI versus Rajesh Agarwal case, the Supreme Court batted for the rights of the borrower to be heard before an account is classified as fraud.

- Threshold: The central bank has fixed a threshold of Rs 1 crore above which banks have to report fraud incidents to state police.

- Private banks have to report frauds above Rs 1 crore to the Serious Fraud Investigation Office and the ministry of corporate affairs.

- For public sector banks, the Rs 6 crore threshold for reporting frauds to the CBI continues.

- Data Analytics and Market Intelligence Unit: Requirements for Data Analytics and Market Intelligence Unit for strengthening risk management systems have been mandated.

- Early Warning Signals (EWS) and Red Flagging of Accounts: The framework on EWS and Red Flagging of Accounts has been strengthened for early detection and prevention of frauds in the REs and timely reporting to law enforcement agencies and supervisors.

- The new norms also require an overhaul of the EWS systems in banks within six months. The EWS has to be integrated with systems and need to use data analytics to identify unusual patterns besides parametric indicators.

Enroll now for UPSC Online Course

Significance of Master Directions on Fraud Risk Management

- Audit and Control: These directions also emphasize the need for instituting robust internal audit and controls framework in the REs.

- Rationalization of the Compliance Burden: The RBI withdrew 36 existing circulars on the subject following the revisions, to rationalize rules and reduce compliance burden.

![]() 17 Jul 2024

17 Jul 2024