Recently, the revised priority sector lending (PSL) norms were announced by the Reserve Bank of India (RBI).

- It is aimed at improving credit flow into sectors like housing and clean energy, among others, will provide relief to some major banks, including HDFC Bank, RBL Bank, Federal Bank, and IndusInd Bank, to meet the targets organically.

- The revised norms will come into effect from April 1, 2025.

Revised Guidelines

- Revision of PSL target for Primary (Urban) Co-operative Bank (UCBs)

- Total Priority Sector: 60% of Adjusted Net Bank Credit (ANBC) or Credit Equivalent of Off-Balance Sheet Exposures (CEOBSE), whichever is higher

- Micro Enterprises: 7.5%

- Advances to Weaker Sections: 12%

- Expansion of the category of ‘Weaker Sections’: List of eligible borrowers under ‘Weaker Sections’ has been expanded

- Small and Marginal Farmers, Distressed farmers indebted to non-institutional lenders, Artisans, Individual members of SHGs or Joint Liability Groups,

- Scheduled Castes & Scheduled Tribes, Persons with disabilities, Minority communities notified by Government of India

- Individual women beneficiaries up to ₹2 lakh Enhancement of several loan limits

- There is a removal of the cap on loans by UCBs to individual women beneficiaries.

- Increased Loan Limits: Higher loan limits have been established for housing loans, allowing for broader PSL coverage.

- Expanded Renewable Energy Loans: The scope of loans classified under ‘renewable energy’ has been widened.

- Renewable Energy Loans: Loans up to Rs 35 crore for renewable energy-based power generators and public utilities, and up to Rs 10 lakh for individual households, will qualify for priority sector classification.

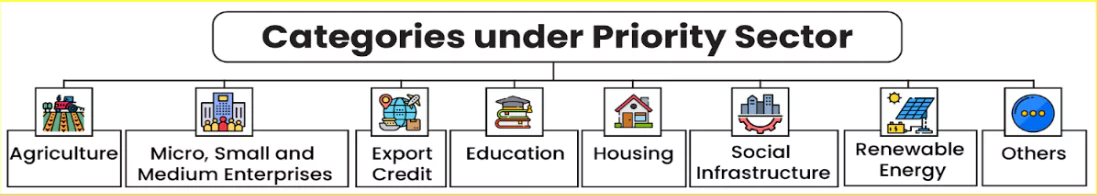

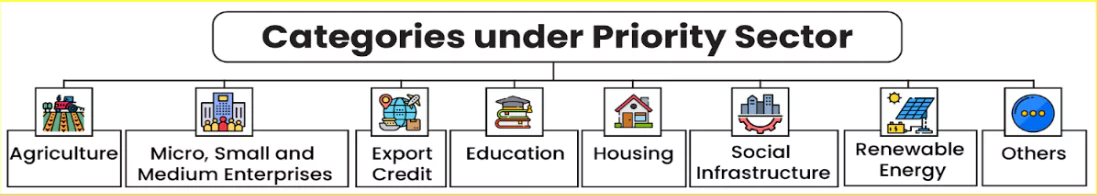

About Priority Sector Lending (PSL)

- Priority Sector Lending requires banks to give a minimum proportion of their loans to sectors of development importance or the sectors that have difficulty getting loans.

- RBI periodically updates the sectors that are eligible to get priority sector lending and the limits of loans.

- Banks can meet their PSL obligations by extending loans, providing credit facilities, and offering financial products and services to individuals, entities, and enterprises in the priority sectors.

- They can also fulfil their targets through investments in eligible instruments, such as bonds issued by entities engaged in priority sector activities.

- Case of Failure: In case, banks fail to meet their PSL targets, They have to deposit the allocated amount to the Rural Infrastructure Development Fund (RIDF) established with NABARD and to other funds with NABARD, SIDBI, Mudra, National Housing Bank, etc., as decided by the RBI from time to time.

Targets/Sub-targets for Priority Sector

| Categories |

Domestic Commercial Banks & Foreign Banks with 20 branches and above |

Foreign Banks with Less than 20 branches |

Regional Rural Banks |

Small Finance Banks |

| Total Priority Sector |

40% |

40% (upto 32% in form of Export Credit) |

75% |

75% |

| Agriculture |

18% |

Not applicable |

18% (Same as DCB) |

18% (Same as DCB) |

| Micro Enterprises |

7.5% |

Not applicable |

7.5% (Same as DCB) |

7.5% (Same as DCB) |

| Advances to Weaker Sections |

12% |

Not applicable |

15% |

12% (Same as DCB) |

Benefits of Priority Sector Lending

- Promotes Inclusive Growth: PSL ensures credit reaches underserved sectors like agriculture, MSMEs, and weaker sections, fostering economic inclusion and reducing disparities.

- Boosts Rural Development: By directing funds to agriculture and rural infrastructure, it enhances productivity, employment, and living standards in rural areas.

- Supports Small Businesses: Provides affordable credit to micro, small, and medium enterprises (MSMEs), encouraging entrepreneurship and job creation.

- Reduces Poverty: Access to finance for education, housing, and small-scale industries empowers marginalized groups, helping lift them out of poverty.

- Strengthens Financial Stability: Diversifies bank lending portfolios by balancing high-risk commercial loans with socially impactful investments, contributing to a resilient economy.

Challenges of Priority Sector Lending (PSL)

- High Risk of Default: Loans to sectors like agriculture or small businesses often carry higher credit risk due to economic volatility and borrowers’ limited repayment capacity.

- Monitoring Difficulties: Ensuring funds are used effectively in diverse, scattered sectors like rural areas or MSMEs is complex and resource-intensive for banks.

- Profitability Concerns: Lower interest rates and higher operational costs in priority sectors can reduce banks’ profit margins compared to commercial lending.

- Misallocation of Funds: Reports of funds being siphoned off or redirected (e.g., through middlemen or fake beneficiaries) are noted in critiques of PSL frameworks, especially in less regulated areas.

- Compliance Burden: Meeting mandatory PSL targets can strain banks, especially smaller ones, leading to inefficiencies or reliance on purchasing priority sector lending certificates.

What are Priority Sector Lending Certificates (PSLCs)?

- PSLCs are certificates that are issued against priority sector loans for banks.

- They allow banks to meet their targets and sub-targets when it comes to priority sector lending by buying the instruments.

- The banks use PSLCs to guard against shortfalls.

- The lending certificates also incentivize, through surplus, to lend more to priority sectors.

About Rural Infrastructure Development Fund (RIDF)

- It was established in 1995-96 by the Government of India, managed by NABARD, to provide loans to state governments and state-owned corporations for financing ongoing and new rural infrastructure projects.

- Purpose and Objectives:

-

- To supplement public-sector capital investment in rural infrastructure

- To address the inadequacy of critical infrastructure

- To promote sustainable and equitable agriculture and rural development

![]() 26 Mar 2025

26 Mar 2025