The recent amendments to banking laws streamline provisions and allow up to four nominees per account.

Key Provisions of the Banking Laws (Amendment) Bill

- Increased Nominees: The Bill allows depositors to nominate up to four nominees simultaneously, with the proportion of their shares specified.

- Successive Nomination: It introduces a successive nomination option, enabling depositors to list multiple nominees in a specific order.

- Nominees will be approached to claim funds in the order specified by the depositor.

- Substantial Interest in Shareholding: The threshold for determining “substantial interest” in shareholding for directorships has been increased from ₹5 lakh to ₹2 crore.

Enroll now for UPSC Online Course

Investor Education and Protection Fund (IEPF):

- The IEPF was established under the Companies Act, 1956, as amended by the Companies (Amendment) Act, 1999.

- Aim: To promote investor awareness and ensure the protection of investors’ interests.

|

- Provisions for Cooperative Banks: The tenure of directors in cooperative banks has been extended from 8 years to 10 years to align with regulatory changes.

- A director of a Central Cooperative Bank will now be allowed to serve on the board of a State Cooperative Bank.

- Investor Education and Protection Fund (IEPF): The Bill includes provisions to transfer unclaimed dividends, shares, interest, or redemption amounts of bonds to IEPF if they remain unclaimed for seven consecutive years.

- Individuals will be allowed to claim transfers or refunds from the IEPF for amounts or securities transferred to it.

About Nominee

- A nominee is a person designated to receive benefits or assets on behalf of another individual. This person is often chosen for convenience, privacy, or legal reasons.

- A nominee could be:

- Family Members: Spouses, children, or parents are common choices.

- Trusted Friends: Close friends can be nominated if they’re reliable.

- Legal Entities: Trusts or companies can be nominated.

- Legal Provisions for Nominees in India: Indian Contract Act, 1872 governs the legal relationship between the account holder and the nominee.

|

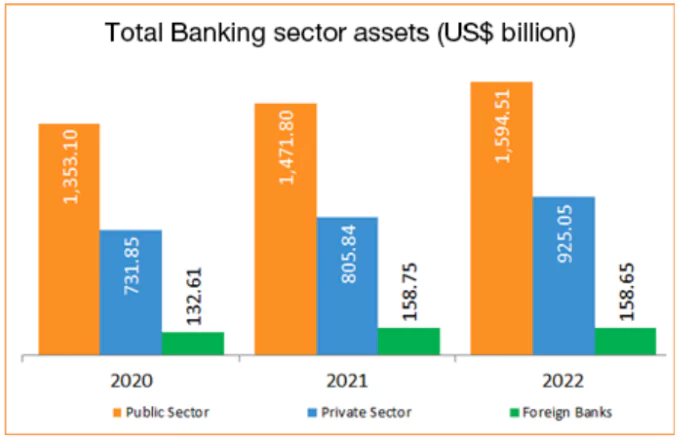

Key Statistics

- Indian banking system: The Indian banking system consists of 13 public sector banks, 21 private sector banks, 44 foreign banks, 12 Small finance banks.

- No. of ATMs: As of June 2024, the total number of micro-ATMs in India reached 15,17,580.

- Assets: In 2024, total assets in the public and private banking sectors were US$ 1861.72 billion and US$ 1264.28 billion, respectively.

- Assets of public sector banks accounted for 59.53% of the total banking assets (including public, private sector and foreign banks).

- Interest income: The interest income of public banks reached US$ 128.1 billion in 2024.

- In 2024, interest income in the private banking sector reached US$ 95.7 billion.

- Digital Transaction: India accounts for nearly 46% of the world’s digital transactions (as per 2022 data).

- As of July 2024, there were 602 banks actively using UPI.

|

Check Out UPSC CSE Books From PW Store

Indian Banking Sector

- Banks are Financial Intermediaries between borrowers and lenders.

- It accepts deposits from the public and lends money to businesses and consumers.

- Its primary liabilities are deposits and primary assets are loans and bonds.

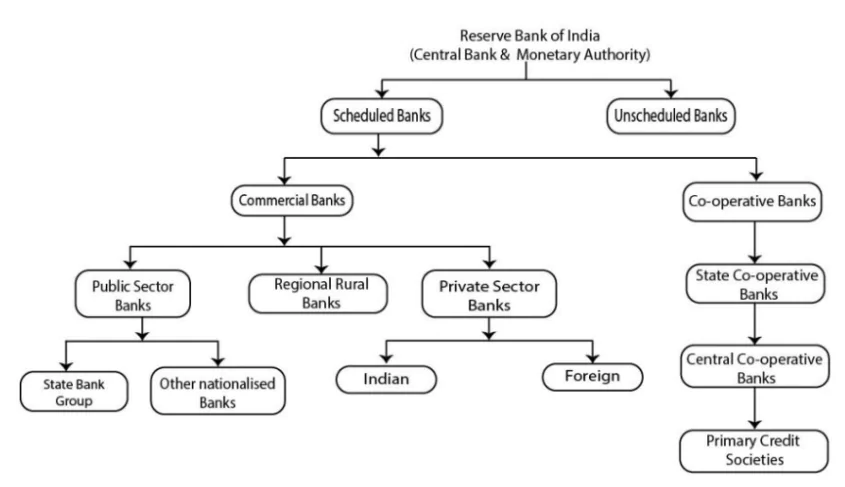

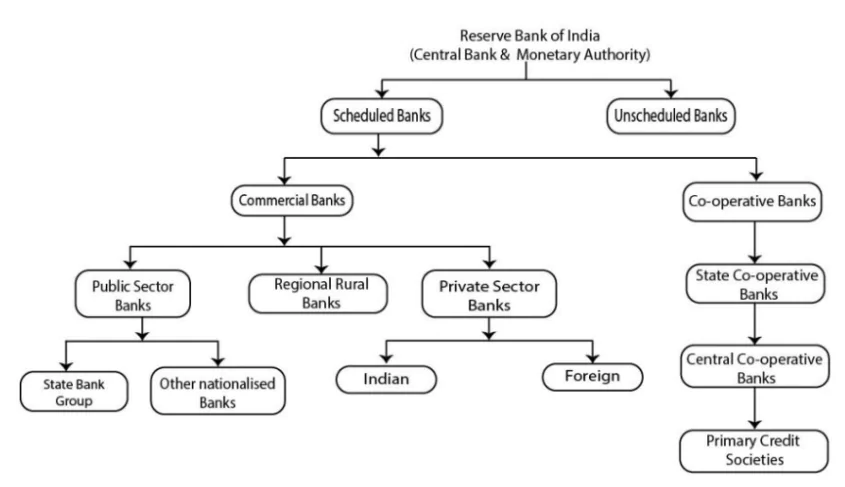

- Classification: Banks, forming part of the Banking System in India, can be divided into two categories – Scheduled Banks and Non-Scheduled Banks.

- Scheduled Banks: Those financial institutions that are listed in the 2nd Schedule of the Reserve Bank of India Act, 1934.

- This inclusion signifies that they meet specific criteria set by the RBI and are subject to its stricter regulations.

- Under the Second Schedule of RBI Act, 1934, these banks should raise at least Rs 5 lakhs and capital.

- Non-Scheduled Banks: Those financial institutions that do not meet the criteria to be included in the 2nd Schedule of the Reserve Bank of India Act, 1934.

- They operate under a different set of regulations as compared to Scheduled Banks.

Structure of Banking System

- The RBI is at the top of the structure of the Banking System in India and acts as the central bank of India. Beneath the central bank operates various types of following banks:

- Scheduled Commercial Banks in India are categorised in five different groups according to their ownership and/or nature of operation.

- These bank groups are:

(i) State Bank of India and its associates,

(ii) Nationalised Banks,

(iii) Regional Rural Banks,

(iv) Foreign Banks and

(v) Other Indian Scheduled Commercial Banks (in the private sector).

- Nationalised Banks: Nationalised banks are commercial banks that are owned and controlled by the government of a country.

- Nationalization of banks is the process where the government takes control of private banks and turns them into public sector entities.

- It has been done in three stages:

- 1969: The first major step in nationalization was taken by Prime Minister Indira Gandhi.

- 1980: The second round of nationalization included six banks: Oriental Bank of Commerce, Vijaya Bank, Punjab and Sind Bank, New Bank of India, Corporation Bank, and Andhra Bank

- 1991: The third stage began, where a few banks were authorized and called New Generation banks.

- The government invited private investors to invest in the country.

- Regional Rural Banks: RRBs are also known as Gramin Banks.

- RRBs were established in 1975 to help develop rural economies by providing credit and other services to small farmers, agricultural laborers, artisans, and small entrepreneurs.

- RRBs are owned by the Ministry of Finance, the Sponsored Bank, and the state government in a ratio of 50:35:15, respectively.

- RRBs are regulated by RBI and supervised by NABARD.

- Foreign Banks: A foreign bank is a bank that has its headquarters in one country but operates in other countries.

- Examples include Citibank, HSBC, and Standard Chartered Bank.

- Other Indian Scheduled Commercial Banks (in the private sector): A scheduled commercial bank (SCB) in India is a private sector bank that is listed in Schedule II of the Reserve Bank of India Act, 1934.

- Examples include, HDFC Bank, ICICI Bank, Axis Bank.

- Cooperative Banks: A cooperative bank is a financial institution that is owned and operated by its members, who are also the bank’s customers.

- These banks are often founded by people who share a common interest and are part of the same professional or regional group.

- Examples include Bharat Co-operative Bank, Saraswat Co-operative Bank, Cosmos Co-operative Bank, etc.

- Development Banks: A development bank is a financial institution that provides long-term financing and technical assistance to promote development in areas like agriculture, land, and production.

- Development banks can also accept deposits, offer investment products, and make business loans.

- National Bank for Agriculture and Rural Development (NABARD): 1982,

- Small Industries Development Bank of India (SIDBI): 1990

- Industrial Development Bank of India (IDBI): 1964

- Differentiated Banks: Differentiated banks are banks that provide specialized services or products to a specific group of customers.

- The Reserve Bank of India (RBI) introduced the concept of differentiated banks in India in 2013 following recommendations from the Nachiket Mor Committee.

- Small finance banks (SFBs): These banks offer basic banking services, such as accepting deposits and lending to small businesses, micro and small industries, and other unorganized sector entities. Examples: Ujjivan Small Finance Bank, Janalakshmi Small Finance Bank.

- Payment banks: These banks offer mobile banking, mobile payments, remittance services, and other banking services. Examples: Airtel Payments Bank, India Post Payments Bank.

- NBFC: A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 1956 that provides various financial services similar to banks but is not a bank.

Committees on Banking Sector Reforms

- Narasimham Committee I (1991): Suggested reducing government interference, recapitalizing weak banks, and strengthening management.

- Proposed reducing Statutory Liquidity Ration (SLR) and Cash Rreserve Ration (CRR) to improve liquidity and adopting prudential norms.

- R. H. Khan Committee (1997): Focused on enhancing credit delivery to the small-scale sector and improving the role of primary dealers in the financial system.

- Narasimham Committee II (1998): Recommended structural reforms, consolidating banks, and reducing government stakes in PSBs to less than 33%.

- Advocated for adopting international accounting standards and risk-based supervision.

- Raghuram Rajan Committee (2008): Suggested measures for financial inclusion, stability, and strengthening the banking sector.

- Financial Sector Legislative Reforms Commission (2011): Headed by Justice B. N. Srikrishna, aimed to streamline laws governing banking, insurance, and pensions.

- P.J. Nayak Committee (2014): Highlighted governance issues in PSBs, proposing reforms to empower boards and reduce government interference.

- Nachiket Mor Committee (2014): Recommended financial inclusion measures like setting up payment banks and universal electronic accounts.

- H.R. Khan Committee (2015): Addressed issues related to monetary policy, inflation targeting, and improving RBI’s Monetary Policy Committee functioning.

|

Major Challenges in India’s Banking Sector

- Low Capital Adequacy: Many Indian public sector banks (PSBs) struggle to meet Basel III requirements due to inadequate capital infusion.

- Recapitalization efforts by the Indian government have aimed to bridge this gap but remain a recurring challenge.

- High Non-Performing Assets (NPAs): NPAs in the Indian banking system increase the risk of capital erosion, making it harder to maintain the required CAR under Basel norms.

- As of September 24, 2024, the gross non-performing asset (NPA) of public sector banks (PSBs) was 3.12%.

- Low Credit to GDP Ratio: Bank credit to the commercial sector in India is only about 50% of GDP, far below the levels of most developed nations and China (where bank loans exceed GDP).

Check Out UPSC NCERT Textbooks From PW Store

| Credit to GDP ratio

The credit-to-GDP ratio is the total credit from all sectors, such as banks and other financial institutions, to households and non-profit institutions serving the public as a percentage of the country’s GDP.

It is a measure of the total credit in a country’s economy relative to its GDP |

-

- The only exception among developed countries with a similarly low ratio is the United States, which compensates for it with a well-developed debt market.

- Governance Issues in PSBs: Public Sector Banks (PSBs) face governance challenges such as limited autonomy, political interference, and inefficiencies in decision-making, often leading to poor financial performance.

- The GNPA ratio of PSBs is projected to increase from 3.7% in March 2024 to 4.1% in March 2025 while for private banks it is from 1.8% to 2.8%.

- Unmet Credit Demand for MSMEs: According to a 2022 Lok Sabha Standing Committee report, the unmet credit demand of MSMEs is ₹25 trillion, which constitutes 47% of their borrowing needs.

- Over 90% of India’s MSMEs are micro-sized and are best served by specialized NBFCs, as these entities are equipped to handle the high processing costs of small loans.

- However, banks meet only 15% of MSME credit requirements, leaving a significant gap in funding.

- Operational Challenges: Implementing complex risk assessment models under Basel III requires advanced IT infrastructure and skilled personnel, which many Indian banks lack.

- Smaller banks often struggle to invest in technology upgrades due to resource constraints.

- Global Competitiveness: Indian banks face competition from well-capitalized foreign banks that easily meet Basel III norms. This disparity puts Indian banks at a disadvantage in global markets.

- Dependence on Government Support: Public sector banks rely heavily on government capital infusion to meet Basel norms, which hampers their autonomy and efficiency.

- The Government infused ₹3,10,997 crore to recapitalise banks during the last five financial years i.e., from 2016-17 to 2020-21.

Basel Norms

- It encompasses international regulatory standards designed to ensure stability by offering guidelines on capital adequacy, risk management, and liquidity.

- The Basel Accords are 3 series of banking regulations (Basel I, II, and III) set by the Basel Committee on Bank Supervision (BCBS).

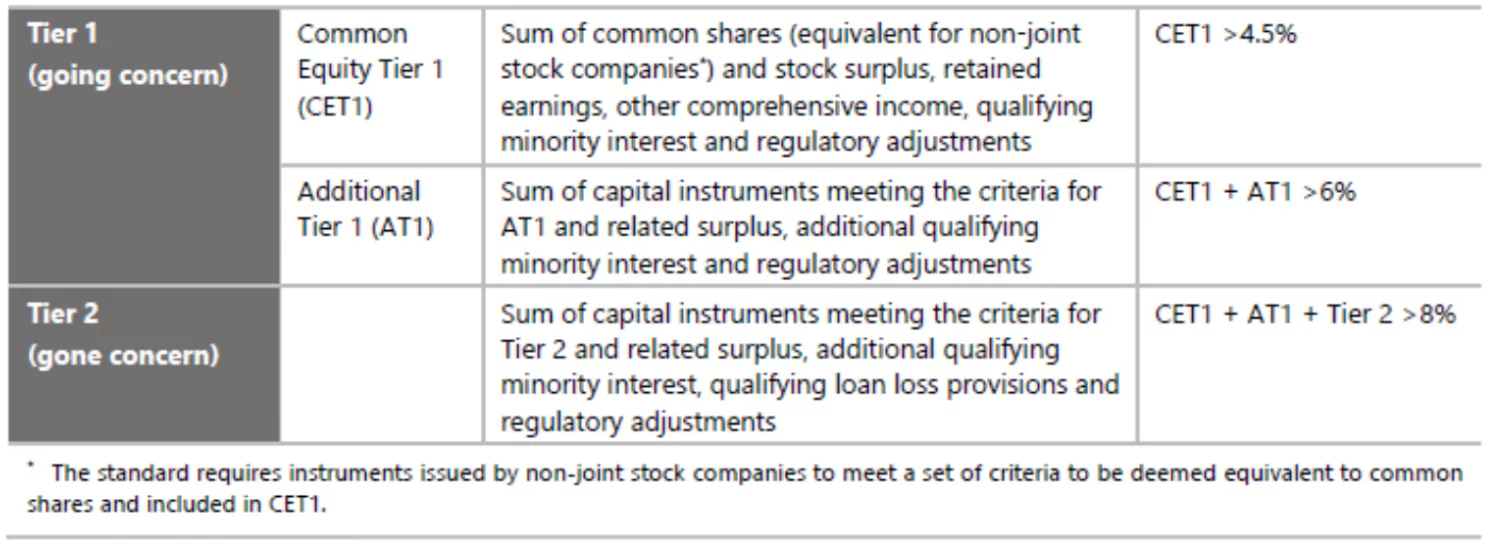

- Under Basel III, a bank’s tier 1 and tier 2 assets must be at least 10.5% of its risk-weighted assets.

- Tier 1: Primary funding source of the bank; Consists of shareholders’ equity and retained earnings.

- Tier 2: includes revaluation reserves, hybrid capital instruments and subordinated term debt, general loan-loss reserves, and undisclosed reserves.

- Tier 2 capital is considered less reliable than Tier 1 capital because it is more difficult to accurately calculate and more difficult to liquidate.

- Under Basel III norms Indian Banks must maintain a minimum capital base, including:

- A Common Equity Tier 1 (CET1) capital ratio of 4.5% of risk-weighted assets

- A Tier 1 capital ratio of 6%

- A total capital adequacy ratio of 8%

|

Key Government & Regulatory Initiatives for Banking Sector Reforms

- Indradhanush Plan (2015): Aimed at improving the performance of Public Sector Banks (PSBs) through reforms in areas such as appointments, capital infusion, and governance.

- Introduced the Bank Boards Bureau (BBB) to recommend appointments for top bank positions and provide strategic advice

- Recapitalization of Banks: Significant capital infusion by the government, including the ₹2.11 lakh crore recapitalization plan in 2017 to strengthen PSBs’ balance sheets.

- Ensures compliance with Basel III norms

- IBC (Insolvency and Bankruptcy Code) 2016: A landmark initiative for faster resolution of stressed assets.

- Enables banks to recover bad loans efficiently and strengthen credit discipline.

- PSB Amalgamation Drive: Consolidation of weaker PSBs with stronger ones to create larger, more efficient entities (e.g., the merger of Bank of Baroda, Vijaya Bank, and Dena Bank in 2019).

- Aimed at improving scale, efficiency, and reducing redundancies.

- Bad Bank (National Asset Reconstruction Company Limited): Established to take over large stressed assets and facilitate their resolution, enabling banks to focus on core activities like lending.

- Complements existing Asset Reconstruction Companies (ARCs).

- Account Aggregator Framework: Launched by the RBI to streamline financial data sharing among institutions, improving credit assessment and fostering financial inclusion.

- Privatization Initiatives: Announced plans to privatize two PSBs as part of broader economic reforms under the Union Budget 2021-22.

- Aligns with the recommendations of Narasimham and P.J. Nayak Committees to reduce government ownership in banks.

- Digital Banking Push: Initiatives like the Unified Payments Interface (UPI), e-RUPI, and digital-only banking units to promote cashless transactions and financial inclusion.

- In 2022, 75 DBUs were announced in 75 districts of the country to commemorate 75 years of India’s independence.

Enroll now for UPSC Online Classes

Way Forward for Banking Sector Reforms in India

- Strengthening Governance and Autonomy: Implementing recommendations of the P.J. Nayak Committee to enhance the governance of Public Sector Banks (PSBs).

- This includes reducing government stakes below 50%, offering greater autonomy, and ensuring professional management.

- Privatization and Consolidation: Privatizing weaker PSBs and consolidating stronger ones to reduce the burden on government resources while ensuring efficiency and competitiveness in the banking sector.

- Strengthening Credit Flow to MSMEs: Encouraging banks to lend more to Micro, Small, and Medium Enterprises (MSMEs), possibly through increased collaboration with Non-Banking Financial Companies (NBFCs).

- This will address the ₹25 trillion unmet credit demand in this sector.

- Adopting Technology and Innovation: Leveraging artificial intelligence, big data, and the Account Aggregator framework to improve credit assessments and enhance customer experiences.

- The Account Aggregator framework allows banks to collect detailed financial data on small borrowers, enabling better risk assessment.

- This will also help address Non-Performing Assets (NPAs) through better risk management

- Creating a Robust Bond Market: Encouraging large corporations to raise funds through bonds rather than bank loans.

- This will reduce the burden on banks and promote a diversified financial ecosystem, akin to developed economies.

- This approach is widely used in countries like the US, where even high-risk (“junk”) bonds often find buyers.

- Focus on Niche Banking and Development Finance: Establishing Development Finance Institutions (DFIs) for long-term infrastructure projects and promoting niche banking tailored to specific sectors like agriculture, MSMEs, and retail will enhance financial efficiency and accessibility.

- Reducing “Lazy Banking”: Indian banks tend to prioritize lending to large, well-known corporations due to the safety and profitability of such loans.

- This “lazy banking” limits their ability to assess risks and lend to smaller borrowers like MSMEs.

Conclusion

Reforms in India’s banking sector are critical to improving financial stability, enhancing credit accessibility, and fostering economic growth. By addressing governance challenges, expanding financial inclusion, and leveraging technology, the sector can become more resilient and competitive in a globalized economy

![]() 6 Dec 2024

6 Dec 2024