![]() 7 Feb 2024

7 Feb 2024

English

हिन्दी

This article is based on the news “Why is fiscal consolidation so important? | Explained” which was published in the Hindu. The states of Karnataka and Kerala are bringing their protest against the Centre’s alleged biased fiscal policies to the national capital, Delhi.

| Relevancy for Prelims: Fiscal Federalism, Parliament Budget Session 2024 Live Updates, Union Budget 2024-25, Interim Budget 2024-2025, , Federalism, and Finance Commission.

Relevancy for Mains: Fiscal Federalism In India: Current Status, Challenges and Way Forward. |

|---|

Broad Principles Associated With Fiscal Federalism:

|

|---|

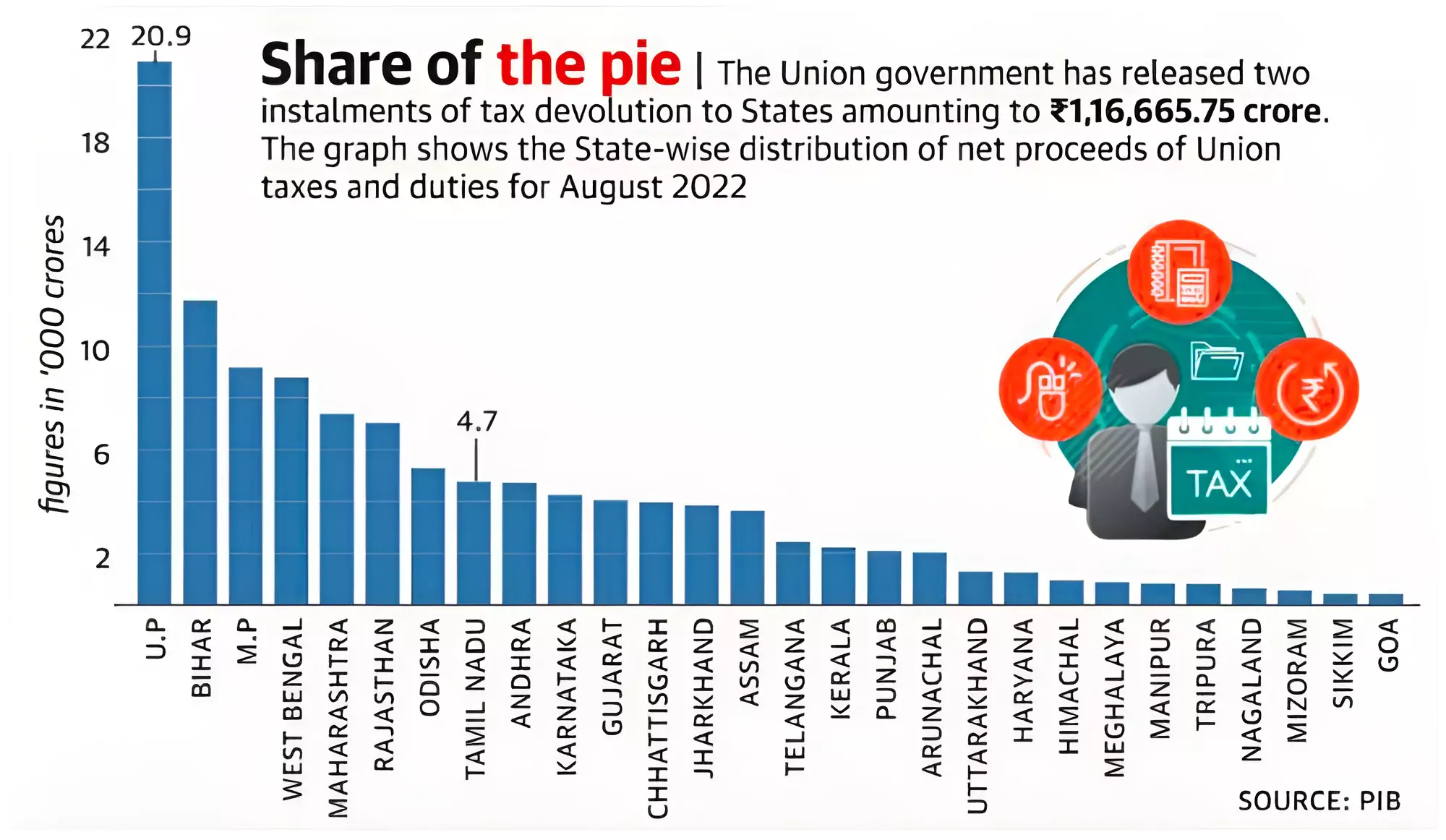

According to the Reserve Bank of India’s (RBI) of State Finances: A Study of Budgets of 2023-24 report, due to increase in cesses and surcharges, the divisible pool has shrunk from 88.6 percent of gross tax revenue in 2011-12 to 78.9 percent in 2021-22 despite the 10-percentage point increase in tax devolution recommended by the 15th finance panel.

According to the Reserve Bank of India’s (RBI) of State Finances: A Study of Budgets of 2023-24 report, due to increase in cesses and surcharges, the divisible pool has shrunk from 88.6 percent of gross tax revenue in 2011-12 to 78.9 percent in 2021-22 despite the 10-percentage point increase in tax devolution recommended by the 15th finance panel.

Views of Earlier Commissions and Committees on Centre State Relations in India |

|

First Administrative Reforms Commission (1966) |

|

Rajamannar Committee (1969) |

|

Sarkaria Commission (1988) |

|

Punchhi Commission (2010) |

|

Report of the Sub-Group of Chief Ministers on Rationalisation of Centrally Sponsored Schemes (2015) |

|

Review Tax-Sharing Principles: In line with India’s evolving fiscal federalism, its mandate could center on consolidating the indirect tax base between the Union and states.

Review Tax-Sharing Principles: In line with India’s evolving fiscal federalism, its mandate could center on consolidating the indirect tax base between the Union and states.

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

<div class="new-fform">

</div>