The Indian fintech sector has reacted positively to the Reserve Bank of India’s (RBI’s) recent self-regulatory initiative, but several challenges must be addressed for effective implementation.

About Fintech Sector

Fintech, a combination of the terms “financial” and “technology,” refers to businesses that use technology to enhance or automate financial services and processes.

- Key factors driving Growth:

- Favourable demographic of tech-savvy youth

- Access to capital

- Various Government initiatives such as the JAM trinity, Unified Payments Interface, etc

- Advancements in internet and mobile technology

- Common types of Fintech Companies in India:

- Payment: These offer digital payment solutions, such as mobile wallets, online payment gateways, and peer-to-peer (P2P) payments. Example- Bharatpe

- Lending: These offer digital lending solutions, such as personal loans, business loans, and credit cards. Example- CRED

- Insurance: These offer digital insurance solutions, such as health insurance, life insurance, and car insurance. Example- Digit Insurance

- Investment: They offer digital investment solutions, such as stock trading, mutual funds, and cryptocurrency trading. Example- Zerodha

- RegTech: They offer regulatory technology solutions, such as compliance software and risk management tools. Example- Razorpay

- Status in India: India is home to the third-highest number of fintechs globally, with more than 9,000 fintechs, holding a 14% share of Indian start-up funding.

-

- In 2022 alone, Indian fintech startups secured an impressive US$ 5.65 billion, positioning it as the second-most-funded startup sector in the country.

- Adoption Rate: India has the highest FinTech adoption rate globally of 87% which is significantly higher than the Global average rate of 64%.

- Digital Transactions: Fintech companies account for 70% of digital payment transactions, marking a two-fold rise in their share during FY22 compared to FY19.

- Financial Inclusion: More than 10 million people and small businesses gained access to savings accounts, insurance, investment options, and credit facilities through mobile-based services and digital platforms.

- The adult population with bank accounts increased from 53% to 78%.

- Keeping pace with Innovation: The Indian fintech ecosystem has witnessed remarkable growth in recent years, with over 2,100 startups currently operating in the space.

Enroll now for UPSC Online Course

About Self-Regulatory Organisations in the Financial Technology Sector (SRO-FT)

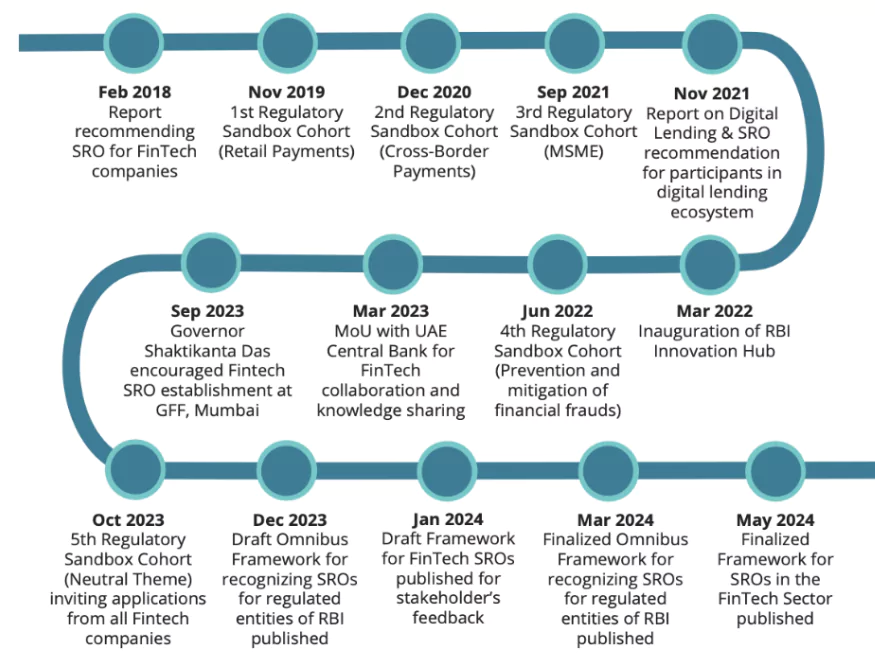

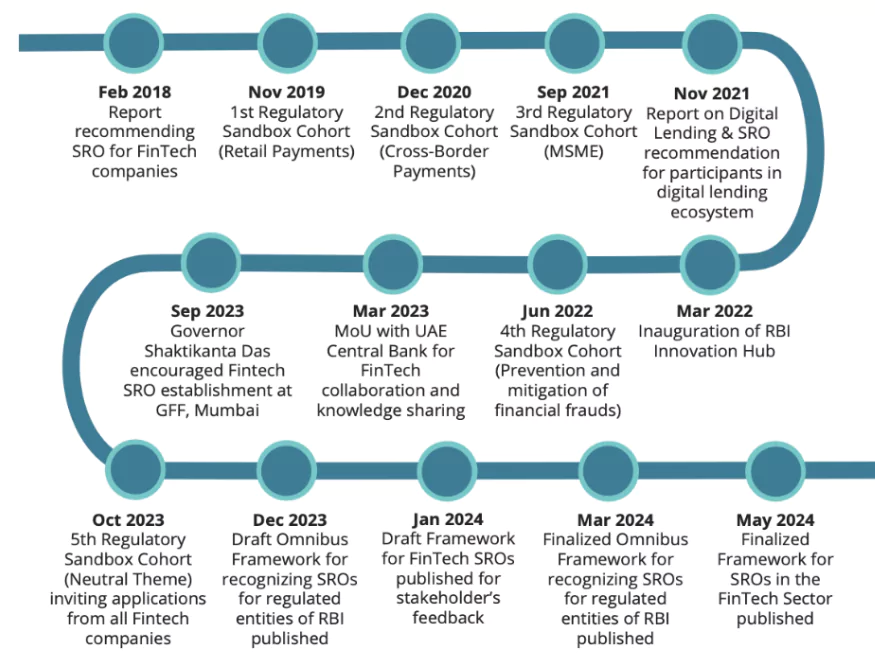

Self-regulatory models are not new in India. The success of self-regulation in India’s over-the-top media sector, demonstrated by the Internet and Mobile Association of India’s code of ethics, underscores the potential advantages of self-regulation.

- Refers: A non- governmental organisation that has regulatory power over an industry or profession.

- Need: To ensure that the growth of the fintech sector is accompanied by responsible practices.

- India’s fintech sector is experiencing rapid growth and evolution, driven by a high demand for digital payments and loans.

- Implementing appropriate regulatory frameworks can help to ensure:

- Sustainable development

- Mitigate risks

- Foster long-term stability within the sector

- Aim: To encourage entities to ensure representative membership from across the fintech sector.

- To protect customers, promote ethics, equality and participants in the ecosystem.

- Structure:

- Non-profit Structure: SRO-FTs must be established as not-for-profit companies.

Minimum Net Worth Requirement: SRO-FTs need to maintain a minimum net worth of Rs 2 crore within one year of being recognized by the RBI.

Minimum Net Worth Requirement: SRO-FTs need to maintain a minimum net worth of Rs 2 crore within one year of being recognized by the RBI.- Shareholding: Have diversified shareholding, with no single entity holding more than 10% of the shares.

- Criteria for SROs in Fintech:

- Apply to RBI: All interested entities have to apply to RBI for getting recognition as SROs.

- Letter of Recognition: Regulator issues a letter of recognition upon finding suitability of the entities.

- Membership and Governance:

- Representative Membership: Reflects the entire sector, including regulated entities like account aggregators and P2P lenders, NBFCs, and non-regulated entities.

Independent and Impartial Functioning: To remain free from any single member’s influence.

Independent and Impartial Functioning: To remain free from any single member’s influence.- Knowledge Repository: Act as a knowledge repository and avoid conflicts of interest.

- Membership Flexibility: Fintech companies may join more than one SRO and are encouraged to participate in at least one.

- Surveillance Mechanisms: For detecting exceptions, while maintaining confidentiality and collecting important data.

- There is a provision of cautioning, reprimanding, counselling, or even expulsion from the SRO in case of violation of rules and regulation.

- A reasonable penalty can also be imposed.

- Dispute Resolution Framework: SROs are required to establish a dispute resolution framework for its members within the Fintech industry.

- In addition to it, this body is responsible for proactively addressing industry-wide concerns beyond individual member interests.

- Representation of the Interest: SROs are responsible for representing the interests of its members when interacting with the RBI.

- Along with it, it has to keep the RBI updated on fintech developments.

- It is responsible for collecting and sharing data with the RBI to aid in policy making.

- SROs are to report regulatory violations and systemic issues within the sector to the RBI.

- Mandates: These SROs, envisioned as industry-led bodies, will be tasked with the establishment and enforcement of regulatory standards, the promotion of ethical conduct, the maintenance of market integrity, the resolution of disputes, and the fostering of transparency and accountability among their members.

- Set Rules and Standards: For entities in the industry by collaborating with all stakeholders.

- Regulatory Authority: Regulate in place of or alongside government regulation.

- Self regulatory process uses impartial mechanisms for its administration.

- All members operate in a disciplined way due to impartial mechanisms and accept the penal actions.

- Its regulatory power is independent of the government grants.

- Focus on Users Protection: SRO-FTs are obligated to address instances of user harm, such as fraud, mis-selling of financial products, and unauthorised transactions.

- Others: The promotion of ethical conduct, the maintenance of market integrity and the fostering of transparency and accountability among their members.

Check Out UPSC CSE Books From PW Store

| Feature |

Benefit |

Challenge |

| Objective Operation and Healthy Growth |

- Promotes responsible innovation within a stable regulatory environment.

- Encourages long-term, sustainable development in the fintech sector.

|

- Balancing innovation with regulatory compliance can be complex.

|

| Phased Regulatory Compliance |

- Provides a clear path for fintech companies to navigate regulations.

- Reduces uncertainty and helps companies prepare for future oversight.

|

- The specific timeline and requirements for phased compliance may not be immediately clear.

|

| Industry Standards and Best Practices |

- Establishes a common ground for ethical conduct across the fintech sector.

- Improves transparency, disclosure, and data privacy practices for consumers.

|

- Developing and enforcing consistent standards across a diverse sector can be challenging.

|

| Representative Membership |

- Ensures all voices within the fintech sector are heard.

- Promotes inclusivity and addresses the needs of various segments.

|

- Reaching a consensus among different types of members on standards and regulations might be difficult.

|

| Independent Governance |

- Fosters trust and confidence in the SRO’s decision-making.

- Reduces the risk of undue influence from any single entity.

|

- Ensuring true independence from powerful members can be a challenge.

|

| Member Development and Conduct |

- Upskills the fintech workforce and promotes responsible business practices.

- Encourages a culture of compliance and consumer protection.

|

- Enforcing disciplinary actions against members may face resistance.

|

| Collaboration with Regulators |

- Creates a channel for open communication between the industry and regulators.

- Provides valuable insights for shaping regulations that are both innovative and consumer-centric.

|

- Building trust and a productive working relationship with regulators may take time.

- The fintech ecosystem in India is notably fragmented, making it difficult to unify diverse stakeholders under a single SRO.

|

Global Trends on Fintech Regulatory Landscapes

Globally, the regulatory landscapes for fintechs vary significantly, reflecting the diverse approaches nations take for balancing innovation and oversight.

- China: Recent regulatory measures have imposed stricter controls on non-bank payment institutions, aiming to enhance supervision and mitigate systemic risks.

- United States: Entities such as the Financial Industry Regulatory Authority (FINRA) play a pivotal role in overseeing broker-dealers, despite criticisms regarding its proximity to the industry it regulates.

- The National Futures Association (NFA) oversees the derivatives market, promoting ethical conduct and market integrity.

- The Municipal Securities Rulemaking Board (MSRB) establishes and enforces standards in the municipal securities market.

- Atlantic and the United Kingdom: They have transitioned from a model of pure self-regulation to a more government-centric approach, with the Financial Conduct Authority (FCA) now overseeing most financial services.

- Nonetheless, the Takeover Panel remains a notable example of effective self-regulation, particularly in mergers and acquisitions.

- Japan: Extensive use of SROs is evident in organisations like the Japan Securities Dealers Association (JSDA) and the Investment Trusts Association of Japan.

|

Way Forward

As the fintech sector in India evolves, the introduction of SROs is anticipated to play a crucial role in its development.

- Innovation with Responsible Practices: To fundamentally transform fintech operations, SROs, supported by effective leadership and robust governance, need to align innovation with responsible practices.

- Strategic Measures: To optimise the effectiveness of self-regulation, the RBI should establish sector-specific categorisations and tailored regulatory approaches to address the diverse nature of fintech entities and their activities.

- Robust Safeguards: To mitigate conflicts of interest and prevent anti-competitive behaviour.

- Transparency and Accountability: Robust Safeguards must be accompanied by transparent guidelines for membership criteria and decision-making processes.

- Independent oversight mechanisms should also be established to ensure rigorous enforcement of regulations.

- Incentivising SRO participation and defining clear selection criteria for SRO candidates will further enhance the regulatory framework.

- Collaborative and Dynamic Approach: The shift towards self-regulation represents a significant departure from traditional regulatory models, fostering a more collaborative and dynamic approach within India’s fintech sector.

- The collaborative approach will enhance consumer trust and support the sustainable growth of India’s fintech ecosystem.

Enroll now for UPSC Online Classes

Conclusion

India has embarked on a different path, embracing a self-regulatory model where fintechs themselves are empowered to set and enforce compliance norms, thereby fostering a culture of responsible innovation.

![]() 22 Aug 2024

22 Aug 2024

Minimum Net Worth Requirement: SRO-FTs need to maintain a minimum net worth of Rs 2 crore within one year of being recognized by the RBI.

Minimum Net Worth Requirement: SRO-FTs need to maintain a minimum net worth of Rs 2 crore within one year of being recognized by the RBI. Independent and Impartial Functioning: To remain free from any single member’s influence.

Independent and Impartial Functioning: To remain free from any single member’s influence.