Amid global trade war, China has suspended the export of rare earth elements (REEs), used in technologies ranging from smartphones, semiconductor fabrication and defence equipment.

What Are Rare Earth Elements (REEs)?

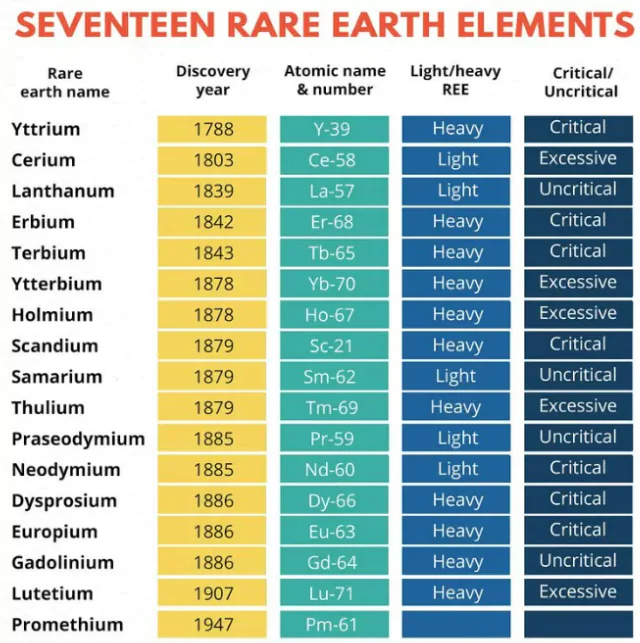

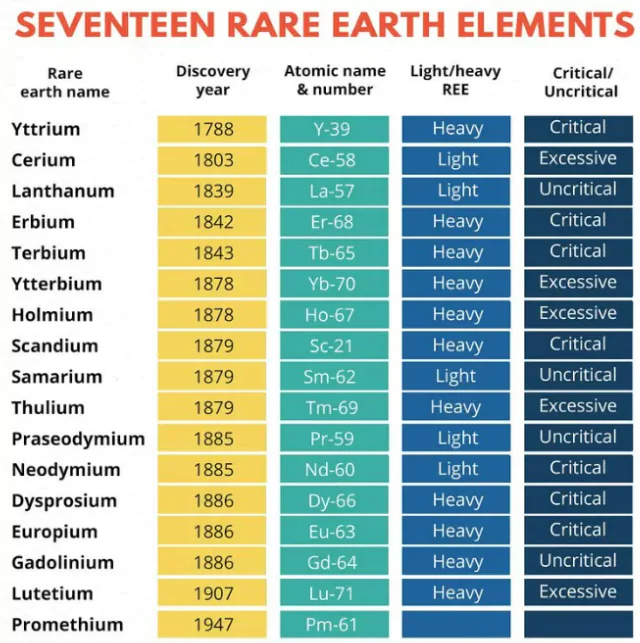

- Rare Earth Elements (REEs) are a group of 17 metallic elements known for their unique magnetic, conductive, and luminescent properties.

- Despite their name, they are not scarce but are rarely found in concentrated, economically viable deposits.

- Hard to Extract & Replace: They are difficult to mine and process economically, and currently, there are no easy substitutes for their high-tech applications.

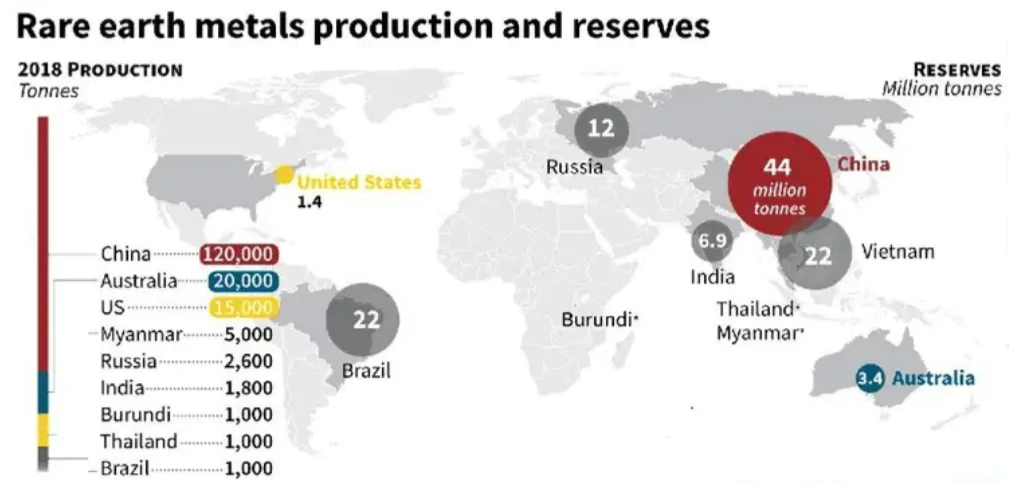

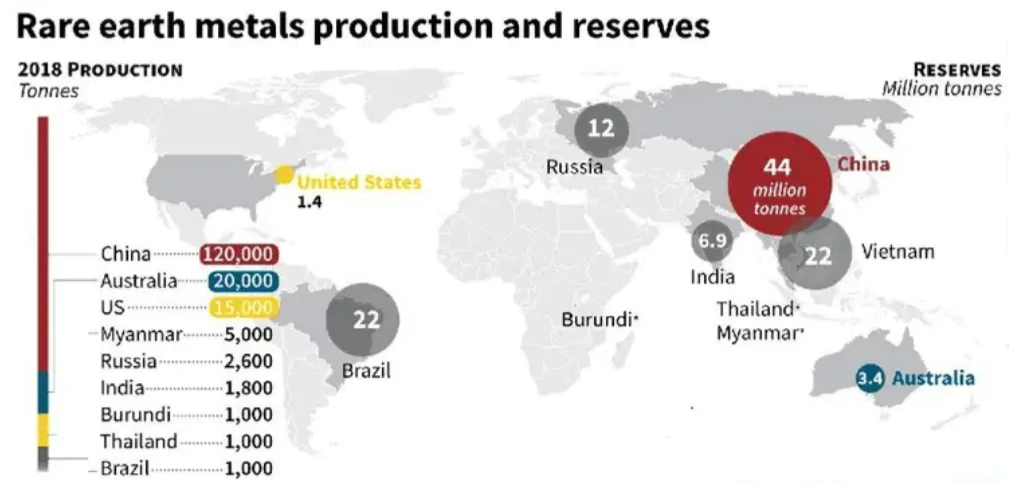

Geographical Hotspots of Rare Earth Elements (REEs)

- Uneven Distribution: REEs are unevenly dispersed across the globe, with some specific regions being prominent hotspots.

- China: China has the largest share of the world’s reserve of RREs – 44 million metric tons, with production of 2,70,000 metric tons annually.

- According to the United States Geological Survey (2025), China accounted for over one-third of the world’s total REE production.

- China also controls over 90% of global magnet production capacity, creating substantial vulnerabilities across industries.

- Bayan Obo deposit: Bayan Obo deposit in Inner Mongolia has enabled China to maintain its dominant position in the global supply of REEs since the 1990s.

- Brazil: Brazil has the Second largest reserves – 21 million metric tons.

- USA: The US holds 1.9 million metric tons of reserves.

- Due to its substantial reserves in California USA emerged as the leading global producer of rare earth during the 1970s and early 1980s.

- However, this dominance collapsed in the 1990s due to environmental and political factors.

- India: India holds the fifth-largest reserves of Rare Earth Elements globally.

Key Properties of Rare Earth Elements

- High Magnetic Strength: Many REEs, particularly neodymium and dysprosium, exhibit strong magnetic properties, making them essential in high-performance magnets.

- High Conductivity: REEs have excellent electrical conductivity, contributing to their use in electronic devices.

- High Melting Points: Most REEs have high melting points, making them suitable for high-temperature applications.

- Catalytic Properties: They can act as catalysts in various chemical reactions, making them valuable in refining and industrial processes.

- Optical Properties: Some REEs, like europium and terbium, are used in phosphors and lasers due to their ability to emit light.

Uses of REEs

- High-tech applications: Smartphones, semiconductors, wind turbines, EVs, and defense systems (e.g., missile guidance, radar).

- Green energy transition: Essential for permanent magnets in wind turbines (neodymium) and EV motors (dysprosium).

- Defense & aerospace: Used in jet engines, sonar systems, and satellite tech.

- Batteries: REEs like lanthanum are integral to nickel-metal hydride (NiMH) batteries used in hybrid vehicles.

- Medical Imaging: Used in MRI scanners, PET scans, and other imaging equipment due to their magnetic properties.

India’s Position in Rare Earth Elements (REEs)

- India’s Rare Earth Reserves: India holds the fifth-largest reserves of Rare Earth Elements globally, estimated at 6.9 million metric tons.

- These reserves are primarily found in:

- Andhra Pradesh (highest reserves)

- Karnataka

- Odisha

- Kerala (rich in monazite sands)

- Despite large reserves, India contributes less than 1% of global REE production.

- Key Mineral:

- Monazite: Monazite is India’s primary source of REEs, containing rare earths and thorium (a radioactive material).

- Light REEs (Abundant in India): Lanthanum, Cerium, Samarium

- Heavy REEs (Limited Supply): Dysprosium, Terbium (China dominates global production)

Government Initiatives to Boost REE Production and Refining

- MMDR Act Amendment, 2023: The Mines and Minerals (Development and Regulation) Act was amended to classify rare earths as “Critical Minerals”.

- It would allow their auction by the Centre and enable private sector participation in exploration and mining.

- National Critical Minerals Mission (2025): This mission aims to ensure secure and sustainable access to critical minerals like REEs through exploration, processing, recycling, and international partnerships, aligned with India’s energy transition and Atmanirbhar Bharat goals.

- Opening up to Private Sector: Earlier restricted to the public sector (IREL), the government has now allowed private companies to explore and mine non-atomic REEs.

- Strengthening Indian Rare Earths Limited (IREL): IREL is the nodal PSU for REE extraction from monazite sands. The government is expanding IREL’s processing capacity and upgrading technology for efficient separation and refining.

- Strategic International Collaborations: India has signed MoUs with countries like Australia and the US to collaborate on exploration, technology sharing, and securing REE supply chains.

- REE Theme Park: Rare Earth and Titanium Theme Park, is a futuristic concept developed by IREL (India) Limited in Bhopal, Madhya Pradesh.

- It aims to showcase technologies for rare earth processing and utilization.

|

Challenge in REE Self-Sufficiency

- Monopoly of IREL: Indian Rare Earths Limited (IREL), a government entity, has a near-monopoly on REE mining and processing, discouraging private investment.

- Though India opened REE mining to private players in 2025, bureaucratic delays and unclear policies slow progress.

- Weak refining & processing: India lacks advanced facilities to separate and refine REEs, forcing exports of raw minerals (e.g., neodymium to Japan) instead of value-added products.

- No magnet production: China controls 90% of rare earth magnet manufacturing, while India has zero domestic production for EVs, wind turbines, and defense systems.

- Environmental & Regulatory Hurdles: Monazite sands (India’s primary REE source) contain thorium, requiring strict handling under atomic energy laws.

- Past illegal mining has led to restrictions, delaying new projects despite recent relaxations.

- Technological & Financial Gaps: India spends 0.6-0.7% of GDP on R&D vs. China’s 2.6%, limiting innovation in extraction and alternatives.

- Proposed ₹16,300 crore National Critical Mineral Mission may be inadequate for full supply-chain development.

- Slow international partnerships: While India collaborates with the US, Australia, and Japan, scaling up takes years—China built dominance over decades.

Way Forward to Boost REE Production in India

- Encourage Private Sector Participation: Allow greater private investment in exploration and mining of REEs.

- IREL’s partnership with Japan’s Toyota Tsusho** (Andhra Pradesh plant) is a model for **advanced processing, similar JVs should be encouraged .

- Enhance Technological Capacity: Invest in advanced extraction, refining, and separation technologies, especially for heavy REEs.

- Set up REE R&D clusters under institutions like Bhabha Atomic Research Centre (BARC), CSIR–NML, and DRDO.

- Build Strategic International Partnerships: Expand critical mineral alliances with countries like Australia, USA, and Japan.

- Khanij Bidesh India Ltd (KABIL) is scouting for lithium/cobalt assets in Argentina, Chile, and Africa. China’s dominance in African mines is a hurdle, India must offer better terms & sustainable mining models.

- Develop REE-Based Industrial Ecosystems: Promote downstream industries in electronics, EVs, defence, and renewables using REEs.

- India targets 30% EV sales by 2030, boosting demand for Neodymium–Iron–Boron (NdFeB) magnets used in EV motors.

- Promote E-Waste Recycling: Scale up urban mining of REEs from electronic waste.

- Karnataka State Pollution Control Board and Indian Institute of Science are working on extracting rare earths from magnets and fluorescent lamps.

- Focus on Environmental Sustainability: Mandate eco-friendly and zero-waste technologies in REE production.

- Community engagement models (e.g., U.S. “Right-to-Know” laws) can ensure sustainable mining

Conclusion

Rare Earth Elements are indispensable for the 21st-century economy, from smartphones to satellites, from electric vehicles to advanced weapons systems. India’s potential as a significant REE player remains untapped. With the right policy support, technology infusion, and sustainability focus, REEs can power India’s strategic autonomy and clean tech future.

![]() 10 Jun 2025

10 Jun 2025