Context:

This article is based on the news “Let’s expand social security in India” which was published in the Live Mint. India needs to aspire to provide social security to all of its workforce, in a manner that is fiscally and administratively feasible.

What is Social Security?

- According to the ILO, social security is the protection provided to individuals and households to ensure access to health care and to guarantee income security, particularly in cases of old age, unemployment, sickness, invalidity, work injury, maternity or loss of a breadwinner.

Status of Social Security in India

- Informal Workforce: Approximately 91% (or around 475 million) of India’s workforce works in the informal sector. It lacks access to social security.

- In two decades, India will be an ageing society — for such workers with limited savings, there will be no significant social protection.

- Only 1 million out of 63 million Indian enterprises and approximately 7.5% of 550 million labor force contribute to monthly social security.

- Lack of Social Security Benefits for Salaried Workers: According to the Periodic Labour Force Survey Annual Report 2021-22, around 53% of the salaried workforce has no social security benefits in India.

- Such employees cannot access a provident fund, pension, health care and disability insurance.

- Just 1.9% of the workforce’s lowest 20% group has access to any benefits.

- Gender Disparity in Social Security Benefits: While 47.8 per cent of salaried men have these benefits, just 44.3 of these women have access to social security benefits.

- Status of Gig workers: They are considered outside the traditional employer-employee arrangement, form approximately 1.3% of India’s active labour force, but do not have access to any social security benefits.

- Poor Ranking: According to the 15th annual Mercer CFA Institute Global Pension Index (MCGPI) , India’s social security system is ranked poorly at 45 out of 47 countries in 2023.

Need for Universal Social Security in India

- Rising Ageing Population: The threat of aging poses a significant challenge for India as according to the United Nations Population Fund, India’s elderly population will double and overtake the number of children by 2050.

- The number of people aged 60 and above will increase from 149 million (14.9 crore) in 2022 to 347 million (34.7 crore) in 2050.

- Fragmented Nature of Schemes: The education assistance under the Private Commercial Transport Workers’ Accident Benefit Scheme is given to a maximum of two children of the driver, only if he suffers accidental death or permanent disability.

- There is no scholarship for his children if he is still alive and able-bodied.

- Exclusion of Gig Workers: Gig-workers’ children lack scholarships, either when the worker is alive or after his death, while construction workers’ children get scholarships from pre-school to post-graduation.

- Deficiencies Associated with Sector-Specific Schemes: The Unorganised Workers’ Social Security (UWSS) Act of 2008 aimed to provide universal social security to every unorganised worker and provide all nine benefits prescribed by the ILO.

- However, due to its several inherent deficiencies, only 4,30,198 registered workers availed themselves of sector-specific schemes, receiving only one or two benefits.

- Nine principal benefits of social security prescribed by the ILO include medical care, sickness, unemployment, old age, employment injury, family, maternity, invalidity and survivors’ benefits.

Legislations for Social Security in India

-

Employee Provident Fund Organisation (EPFO)

-

- It has been constituted under the Employees’ Provident Funds & Miscellaneous Provisions Act, 1952 to provide social security benefits to the workers in India.

- It administers three schemes: EPF Scheme 1952, Pension Scheme 1995 (EPS) and Insurance Scheme 1976 (EDLI).

-

Code on Social Security in 2020

-

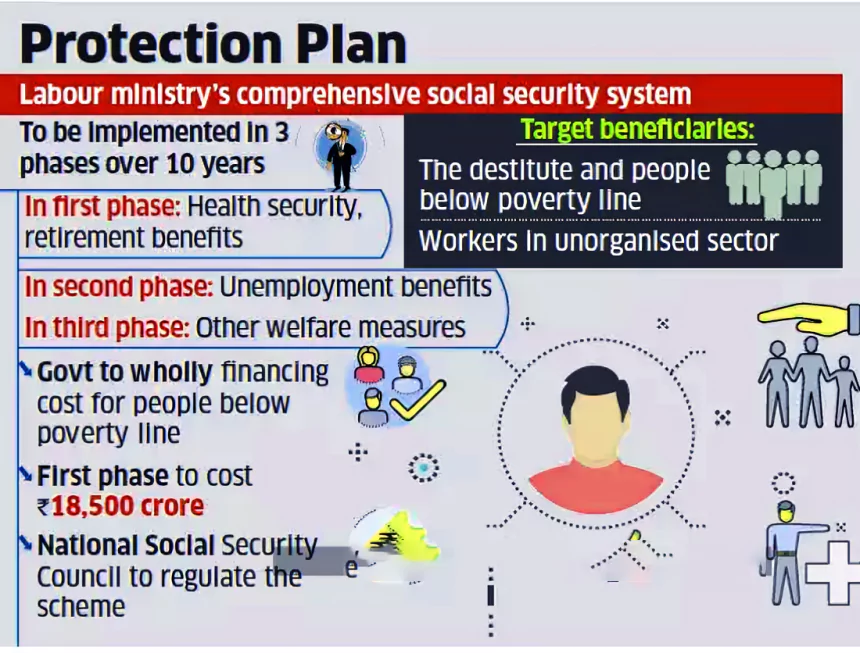

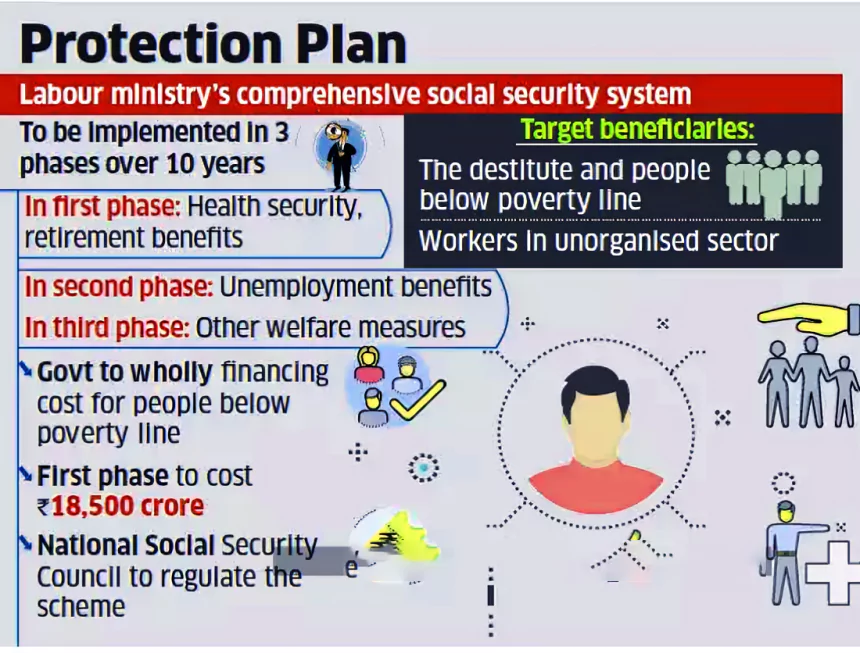

- It sought to provide a statutory framework to enable social security for the urban and rural poor, construction workers, gig and informal sector workers.

- It proposed the provision of life insurance, disability insurance, accident insurance, as well as maternity and health-care benefits along with old-age protection and crèche facilities for gig workers.

-

National Pension System (NPS)

-

- National Pension System is a voluntary retirement savings scheme laid out to allow the subscribers to make defined contribution towards planned savings thereby securing the future in the form of Pension.

- It is open to employees from the public, private and even the unorganised sectors except those from the armed forces.

Social Security Schemes in India

Here are some major Social Security Schemes in India;

-

National Social Assistance Programme (NSAP)

-

- It is the national database of unorganised workers including migrant workers, construction workers, gig and platform workers, etc.

-

Pradhan Mantri Shram Yogi Maandhan (PM-SYM)

-

- It is a government scheme meant for old age protection and social security of Unorganized Workers (UW).

-

Atal Pension Yojana (APY)

-

- It is an old age income security scheme for a savings account holder in the age group of 18-40 years who is not an income tax-payee. The scheme is mainly targeted at the poor, the under-privileged and workers in the unorganized sector.

Challenges with Social Security in India

- Lack of Competition: The monopoly held by the EPFO and Employees’ State Insurance (ESI) on work-related social security payments has negative effects on employers (high prices and corruption pressures), employees (bad treatment and disdain), and society (making informality more profitable than formality).

- Flawed Design of EPFO: With the rise of contractual employment, most employees have multiple employers.

- The current design of EPFO, records are linked to employers rather than to the thousands of orphaned accounts held by employees with the last estimate putting unclaimed balances at over ₹25,000 crore.

- Issue of Sustainability: The EPS diverts 8.33% of a subscriber’s salary to a defined-benefit plan. However, EPS fixes both pension benefits and contributions.

- The employers contribute 12 percent of basic wages towards social security schemes the EPFO runs.

- 8.33 percent out of the 12 percent contributed by the employers goes into the EPS. The remaining 3.67 percent is credited into the Employees Provident Fund.

- The November 2022 court decision declared the scheme unsustainable.

- It upheld the right to choose a greater pension by making unrestricted salary contributions to the EPS has made the plan even less sustainable.

- Limited Budget Spending: Policies are announced, but the budgetary allocation is inadequate with poor scheme utilization.

- Ex- the National Social Security Fund was established in FY11, with a meagre ₹1,000 crore allocation in comparison to the estimated requirement of about ₹22,841 crore.

- A Comptroller and Auditor General of India (CAG) audit on the scheme in FY17 identified that ₹1,927 crore (the entire amount accumulated since inception) had not been utilised.

- Challenges with the Code on Social Security (2020): It dealt fundamentally with formal enterprises and did not cover informal ones.

- The current Code does not cover informal workers as well as the contract workers who shift from one occupation to another in search of their livelihood. Ex- Construction workers.

- Moreover, it depends on the size of the enterprise in terms of the number of workers.

- Challenge with Formalisation of Workers: The registration of all the establishments (estimated to be over 65 million (6.5 crore) out of which two-thirds are in the unorganised sector) is a challenge.

- The e-Shram portal burdens the registration burden on informal workers, who are required to present a self-declaration and share their Aadhaar card.

- There is no responsibility/incentive given to their employer (even temporary) to foster registration.

- Bringing employers into the process would have formalised employee-employer relationships.

Best Global Practices: General Social Security Scheme of Brazil

- It is contribution-based and substitutes income loss for a worker (and his family), whether in partial or full.

- Unemployment insurance is paid from worker support funds, and health care is covered through the Unified Health System.

- Social security benefits can be availed of with a simple phone call or a visit to a bank, with no requirement to submit endless documents, as highlighted in Brazilian Good Practices in Social Security.

|

Social Security in India: Reforms Needed to Accelerate Formalization

- Advocacy for Competition: The former finance minister, Arun Jaitley, has called for more competition by allowing employee choice (not employer choice) on paying their contributions to either the EPFO or public-sector National Pension Scheme (NPS).

- This choice, made at the time of joining, could be open for annual changes, facilitated by easy interoperability between them.

- Choice for Workers: Employees should choose to contribute the whole amount to the Employee Provident Fund (EPF) account rather than the share that goes to the defined-benefit Employee Pension Scheme (EPS).

- Contrary to this, they can choose to make no employee contributions (the maximum is 12%).

Employee Pension Scheme (EPS)

- It is a scheme that pays pensions to employees and is available to employees who are members of the EPFO.

- Moreover, employees earning salaries up to Rs.15, 000 are eligible for the scheme.

- Under the scheme, the employer contributes 8.67% of the employee’s salary, up to Rs.1250, to the EPS account.

- The contribution is limited to Rs.1250 per month.

|

- Enhancing Effectiveness through Aadhar Linkages: Traceability, portability, and accessibility will be created by linking EPFO donations to an Aadhaar number. This modification will also enable marketing EPFO products to gig workers and independent contractors.

- Addressing Challenges of Contractual Employment: Making EPFO contributions to an Aadhaar number will create traceability, portability and access and enable EPFO products to be offered to self-employed and gig workers.

- Reforming the Employee Pension Scheme (EPS): The EPS needs to be taken out of the EPFO and combined with a publicly funded, universal old-age security pension programme, such as the Atal Pension Yojana.

- As a work-linked programme, the EPFO needs to continue being a defined-contribution plan in order to protect against age-related risks, insufficient investment income, and unmanageable cross-subsidization.

- Designing Inclusive Social Security System: Given the wide disparities among different types of workers (both under formal and informal categories), a social insurance system may be designed for three categories of worker-beneficiaries:

Best State Practices

- The Madhya Pradesh Unorganised Workers Welfare (MP) Act of 2003 offers an effective model for raising resources to fund universal social security, mandating employers to pay 5% of wages as a cess.

- It also mandates additional cesses on various state-level taxes and royalties to provide the government’s contribution to a single social security fund.

|

-

- Non-contributory for the poorest who fall below the poverty line; two

- Partial contribution by the non-poor workers and also non-poor self-employed (employers)

- For the formal workers, contributions by the employer and the employee under the EPFO.

- Strengthening Existing Schemes: The existing schemes, for example, the Employees’ Provident Fund (EPF), the Employees’ State Insurance Scheme (ESI), and the National Social Assistance Programme (NSAP) needs to be strengthened with budgetary support and expansion of coverage.

- Migrant Data Collection: Data task force on ‘International Portability of social security funds’ recommended that data on the susceptibilities and needs of migrants should be collected and analysed for the efficiency of social protection systems.

- This would facilitate the computation of the potential financial implications of transferable benefits and the estimation of the labour migrants’ effective social protection coverage.

- Social Security Fund: The fund, proposed in the Social Security Code, 2020 would be a step toward universal social security for workers.

Also Read: Fresh Formal Jobs Creation Falls 10% To 9.06 Mn In 2023

![]() 23 Jan 2024

23 Jan 2024