![]() 10 Feb 2024

10 Feb 2024

English

हिन्दी

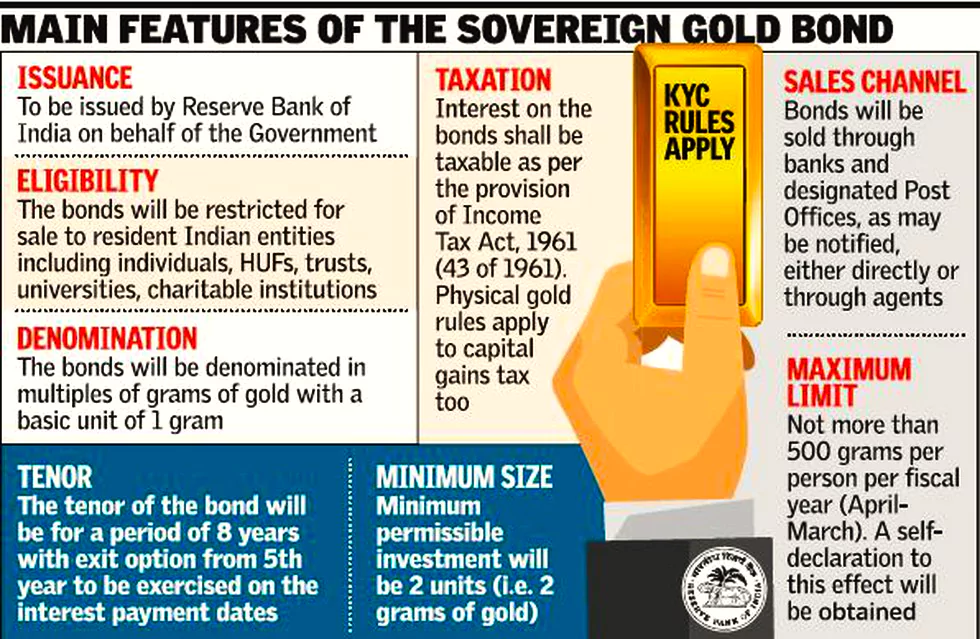

Sovereign Gold Bonds 2023-24 (Series IV) will be opened for subscription from 12th-16th February, 2024.

News Source: PIB

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

<div class="new-fform">

</div>