Over the past 2.5 years, investor’s reluctance to accept lower yields has limited the funds raised through Sovereign Green Bonds, as noted by the Secretary of Department of Economic Affairs.

About Sovereign Green Bonds

- SGrBs are debt instruments issued by the Government of India to fund environmentally sustainable projects.

- They aim to finance green infrastructure, including renewable energy, electric locomotives, and metro projects.

- India launched its SGrB framework in 2022 to mobilize resources for its low-carbon transition.

- Since then, the government has issued SGrBs eight times, raising nearly ₹53,000 crore.

What are Green Bonds?

- Green bonds are financial instruments issued by governments, corporations, or multilateral institutions to fund projects that reduce emissions and promote climate resilience.

- They typically offer lower yields compared to conventional bonds, referred to as the ‘greenium’ (green premium).

- Green Bonds can be issued in different structural formats.

- There are Green Revenue Bonds, Green Project Bonds and Green Securitised Bonds.

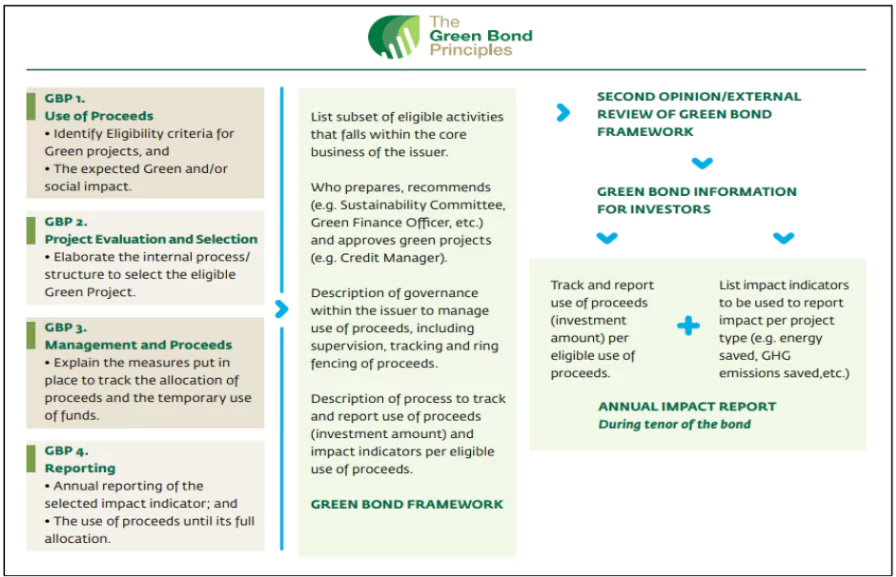

- The most commonly issued Green Bond is the Standard Green Use of Proceeds Bond, defined by ICMA( International Capital Market Association) as a standard recourse to the issuer debt obligation aligned with the Green Bond Principles (GBPs).

Green Bond Market Worldwide

- Countries like the US, China, and European nations have successfully leveraged green bonds.

- The global green bond market sees high single-digit greenium (7-8 basis points), offering cost advantages to issuers.

Limited Success of India’s Sovereign Green Bonds

- Investor Disinterest: Investors have been reluctant to accept lower yields, limiting the greenium to only 2-3 basis points or none at all.

- Many SGrBs have remained unsold, forcing the RBI to devolve them to primary dealers.

- Auction Struggles: In August 2024, only ₹1,697 crore was accepted against a planned ₹6,000 crore auction. Another ₹6,000 crore auction was withdrawn due to low investor participation.

- Liquidity and Market Challenges: SGrBs are mostly held until maturity, making secondary market trading illiquid.

- Unlike global markets, India lacks dedicated social impact funds or sustainable finance markets to drive demand.

Issues Affecting India’s Sovereign Green Bonds

- Low Greenium and Higher Yield Expectations: Investors expect higher returns, reducing the financial advantage of issuing green bonds.

- Without a strong greenium, green bonds provide no incentive over conventional bonds.

- Limited Domestic Buyer Base: India lacks institutional buyers like pension funds and social impact investment funds that prioritize sustainable financing.

Challenges in Raising Funds

- Due to lower-than-expected demand, the government revised its 2024-25 SGrB fundraising target from ₹32,061 crore to ₹25,298 crore.

- The shortfall has impacted key projects, such as grid-scale solar, where allocations were cut from ₹10,000 crore to ₹1,300 crore.

Way Forward

- Policy and Market Reforms: Strengthening India’s sustainable finance market and introducing tax incentives for green bond investors. Improving transparency in green bond reporting to build investor confidence.

- International Partnerships: Partnering with multilateral development banks such as World Bank, IFC to enhance credit ratings and attract foreign investors.

- Exploring Other Green Finance Options: India can look at alternative financing models like sustainability-linked bonds, which provide incentives based on environmental performance.

![]() 15 Feb 2025

15 Feb 2025