![]() 7 Nov 2025

7 Nov 2025

English

हिन्दी

The ‘State of State Finances 2025’ report has been released by PRS Legislative Research.

Widening Inequality Among States:

Widening Inequality Among States:

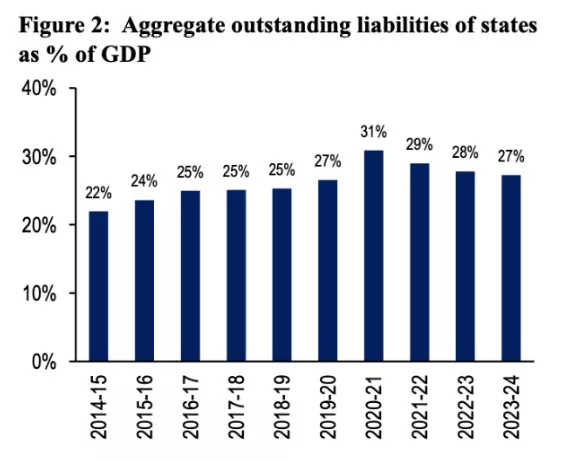

Persistent High Debt Levels: States’ debt-to-GDP ratio (27.5%) remains above pre-pandemic levels; Only Gujarat, Maharashtra, and Odisha meet the FRBM’s 20% target.

Persistent High Debt Levels: States’ debt-to-GDP ratio (27.5%) remains above pre-pandemic levels; Only Gujarat, Maharashtra, and Odisha meet the FRBM’s 20% target. Check Out UPSC CSE Books

Visit PW Store

Fiscal Framework

|

|---|

<div class="new-fform">

</div>