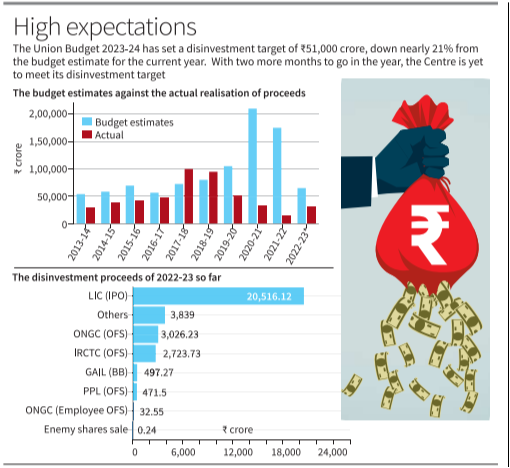

In the Union Budget for 2023-24, the government has set a disinvestment target of ₹51,000 crore.

![]() 9 Feb 2023

9 Feb 2023

English

हिन्दी

Context:

In the Union Budget for 2023-24, the government has set a disinvestment target of ₹51,000 crore.

About Disinvestment:

Types of Disinvestment:

Image Source: The Hindu

Need of Disinvestment:

Benefits:

News Source: The Hindu

<div class="new-fform">

</div>