Context

Insurance companies have issued approximately 700 insurance surety bonds valued at around ₹3,000 crore.

- In November 2023, NHAI decided to accept insurance surety bonds as part of the monetization program for an upcoming Toll Operate Transfer (TOT) package bid.

Toll Operate Transfer (TOT)

- This model was introduced by the government of India.

- Objective: To manage public – funded projects efficiently and enhance development of Infrastructure.

- Operational Framework: Under TOT, operational projects, which have been running for at least two years, are put up for bidding.

- PPP Model: Projects under TOT emphasise collaboration between private sector entities and the government.

|

-

- It was the first time anyone used these bonds like a bank guarantee for road projects.

- NHAI has received a total of 164 insurance surety bonds.

- Among these, 20 bonds are designated for performance security, while 144 are for bid securities.

Enroll now for UPSC Online Course

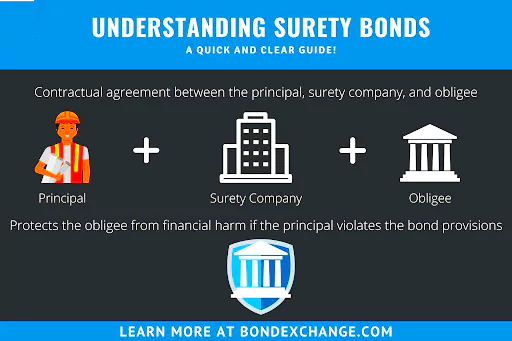

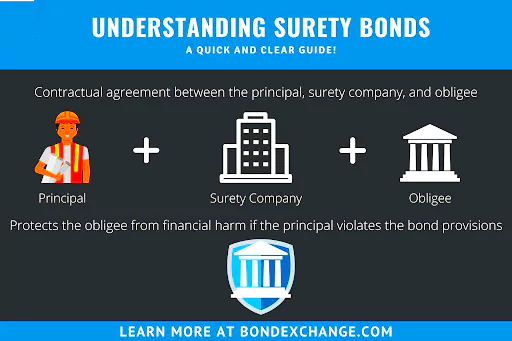

About Surety Bonds

- A surety bond is a method for transferring risk where an insurance company provides a guarantee to a beneficiary or obligee.

- It is a legally binding three party contract.

- This guarantee ensures that the principal or contractor will fulfill their contractual obligations.

- If the principal fails to deliver, the insurer compensates the obligee with monetary payment.

- Parties Involved:

- The Surety:

- The insurance company, like SBI General, offers the financial guarantee to the obligee.

- Obligee or Beneficiary:

- Examples include the government or infrastructure development authorities.

- They are the ones who require the surety bond and typically benefit from it.

- Principal:

- This could be the owner or contractor.

- The principal purchases the surety bond from an insurer as a guarantee.

- They commit to fulfilling their obligations as per the contract they’ve entered into.

| Feature |

Benefit |

Drawback |

| Financial Guarantee |

- Protects the party receiving a service (obligee) from losing money if the party providing the service (principal) fails to fulfill their contractual obligations.

- This could involve completing a project, following regulations, or providing a refund.

|

- Can be expensive for the principal to obtain, especially if they have poor credit or the bond amount is large.

- The cost is typically a percentage of the bond amount.

|

| Increased Trust

and Credibility |

- Signals to the obligee that the principal is a reputable business and is committed to fulfilling their contractual agreements.

- This can be particularly important when dealing with unknown companies or for projects requiring significant financial investment.

|

- This Does not guarantee the quality of the work performed by the principal.

- It simply ensures that the project will be completed, or that the obligee will be financially compensated if not.

|

| Facilitates Business Opportunities |

- May be required by law or regulation in order to obtain licenses, permits, or contracts, especially in industries like construction, finance, or where handling public funds is involved.

- Having a surety bond can give businesses a competitive edge by demonstrating financial responsibility.

|

- Obtaining a bond can be a time-consuming process.

- The surety company will assess the principal’s financial health and risk profile before issuing a bond, which may involve submitting financial statements and undergoing credit checks.

|

| Faster Project Completion |

- In the event that the principal defaults on their obligations, the surety company will step in and take necessary steps to ensure the project is finished.

- This minimizes delays and disruptions for the obligee.

|

- The principal may be subject to a detailed financial evaluation by the surety company (underwriting review) before a bond is issued.

- This can involve disclosing financial information that may not be readily available.

|

| Security to all parties |

- Provides a sense of security for all parties involved in the agreement.

- The obligee knows they will be financially compensated if the principal defaults.

- The surety company has a system for vetting principals to minimize the risk of having to pay out claims.

|

- The claims process for recovering funds from a surety bond can be complex and time-consuming, especially if there is a dispute between the obligee and the principal regarding the validity of the claim.

|

Enroll now for UPSC Online Classes

![]() 16 May 2024

16 May 2024