![]() 28 Feb 2025

28 Feb 2025

English

हिन्दी

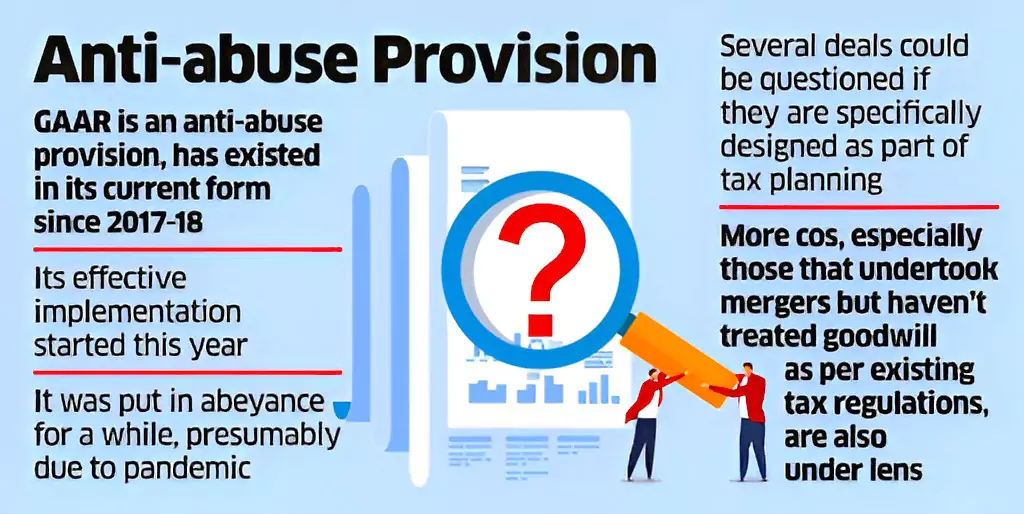

The Income Tax Bill 2025 proposes significant changes to General Anti Avoidance Rules (GAAR), allowing tax authorities to issue reassessment notices for earlier tax years that were previously time-barred.

<div class="new-fform">

</div>