A 10-year roadmap released by NITI Aayog projects that India’s $265-billion technology services sector could expand to $750–850 billion by 2035, contributing to the Viksit Bharat 2047 vision.

- The roadmap identifies five priority growth levers:

- Agentic AI,

- Software and Products,

- Digital Infrastructure,

- Innovation-led Engineering, and

- India-for-India solutions.

About the Technology Services Sector

- The technology services sector comprises IT services, business process management (BPM), digital engineering, cloud services, cybersecurity, AI solutions, and enterprise modernization support delivered to global and domestic clients.

- The sector includes software development, Enterprise Resource Planning (ERP) implementation, cloud migration, data analytics, AI model deployment, cybersecurity management, and digital transformation consulting.

- Key Features

- Export-Oriented Growth Model: The sector earns a significant share of revenue through exports, especially from the United States, and contributes nearly 7% of India’s GDP.

- Talent-Driven Competitive Advantage: India’s large pool of skilled, cost-effective engineers has enabled sustained global competitiveness and scalability.

- Transition Toward AI-Led Delivery: The industry is shifting from labour-arbitrage models to IP-led, AI-enabled, outcome-based service delivery frameworks.

- Global Technology Services Landscape: The global technology services market is valued at approximately $1.3 trillion.

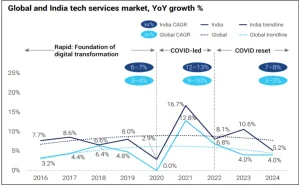

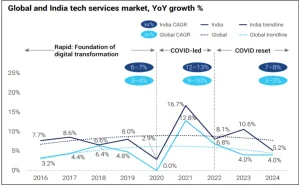

- It has witnessed phases of rapid digital adoption (2015–2020), COVID-driven acceleration (2020–2022), and post-pandemic AI-led disruption (2022–2024).

Current Status of the Technology Services Sector in India

- Market Share: India’s technology services industry currently generates about $265 billion annually and commands nearly 20% of the global market share.

- Growth in the Sector: The sector grew at 11–13% Compound Annual Growth Rate (CAGR) during the COVID surge but has moderated to 7–8% CAGR amid macroeconomic uncertainty, geopolitical tensions, visa restrictions, and early-stage AI disruption.

- Largest Share: Nearly 60% of exports are concentrated in the US market, making the industry sensitive to regulatory and economic changes in that region.

- Expanding Data Infra: India generates about 20% of global data, with data center capacity currently at 1.4 GW, expected to expand significantly over the next decade.

India’s Potential in the Technology Services Sector

- AI-Led Transformation Opportunity: Artificial Intelligence, especially GenAI and Agentic AI, is redefining service delivery models. India can evolve into a global hub for AI integration, model engineering, and governance.

- Expansion into Adjacent Markets: India can tap into adjacent global spend pools such as enterprise operations automation, SaaS products, digital infrastructure, AI-native platforms, and R&D engineering, with a combined Total Addressable Market (TAM) of nearly $14 trillion.

- Infrastructure and Data Advantage: India can position itself as a global AI infrastructure hub by expanding data center capacity from 1.4 GW to 10–12 GW by 2035 and increasing GPU-enabled infrastructure for AI workloads.

- Domestic Market Leverage (India-for-India Play): Rapid digital adoption in governance, UPI-based payments, health-tech, and multilingual AI platforms presents strong domestic growth opportunities.

- Innovation and IP Creation: By increasing R&D spending to 1–2% of revenues and building platform-based solutions, Indian firms can transition toward defensible intellectual property and higher value capture.

Government Initiatives to Boost the Technology Sector

- IndiaAI Mission (2024): The mission aims to build indigenous foundational AI models, create computer infrastructure, and establish an inclusive AI innovation ecosystem through the IndiaAI Innovation Centre.

- Research, Development and Innovation (RDI) Fund under ANRF: A ₹1 lakh crore fund provides concessional financing for high-risk deep-tech sectors such as semiconductors, quantum computing, and AI.

- National Deep Tech Startup Policy: The policy addresses funding, IP, and regulatory bottlenecks, providing extended benefits to commercialize deep-tech innovations.

- Digital India FutureLABS (2024): This initiative promotes next-generation electronics system design and fosters collaboration among academia, startups, and government for indigenous IP development.

- BharatGen (2024): BharatGen focuses on developing multimodal Large Language Models in Indian languages to enhance public service delivery and multilingual AI access.

Recommendations to Achieve India’s Potential

- Invest in Defensible IP and Platformization: Firms must allocate 1–2% of revenues to R&D and convert repeatable services into scalable, AI-native platforms.

- Reimagine Delivery Models with Agentic AI: The industry should transition to “human + agent + platform” models and shift toward outcome-linked commercial contracts.

- Diversify Markets and Vertical Focus: Companies must expand into different sectors like healthcare, defense, semiconductors, cybersecurity and different destinations such as Japan, the Middle East, and the domestic market,

- Scale AI-Focused Reskilling and Change Management: Workforce transformation should prioritize AI literacy, problem-solving, governance skills, and adaptive learning capabilities.

Conclusion

India’s technology services sector stands at an AI-driven inflection point; strategic innovation, infrastructure expansion, and IP-led growth can transform it into a $750–850 billion global leader by 2035.

![]() 14 Feb 2026

14 Feb 2026