The Indian textile and apparel sector aims for $350 billion in annual business by 2030, projecting the creation of 3.5 crore jobs, but faces challenges in achieving a 10% compound annual growth rate (CAGR).

Textile Industry in India Overview

- Market Size: As of 2021, the textile and apparel industry was valued at approximately $153 billion, with domestic business contributing nearly $110 billion.

- Export Position: In FY22, India ranked as the third-largest textile exporter globally, capturing a 5.4% market share.

- Manufacturing Capacity: India possesses the second-largest manufacturing capacity in textiles, demonstrating robust capabilities across the value chain.

- Economic Contribution: The sector contributed about 2.3% to GDP in FY21 and accounted for 10.6% of total manufacturing Gross Value Added (GVA) in FY23.

- Employment: The textile and garment sector employs around 105 million people, both directly and indirectly.

- Government Export Target: The government aims to achieve $600 billion of textile exports by 2047 from $44 billion in FY22.

Enroll now for UPSC Online Course

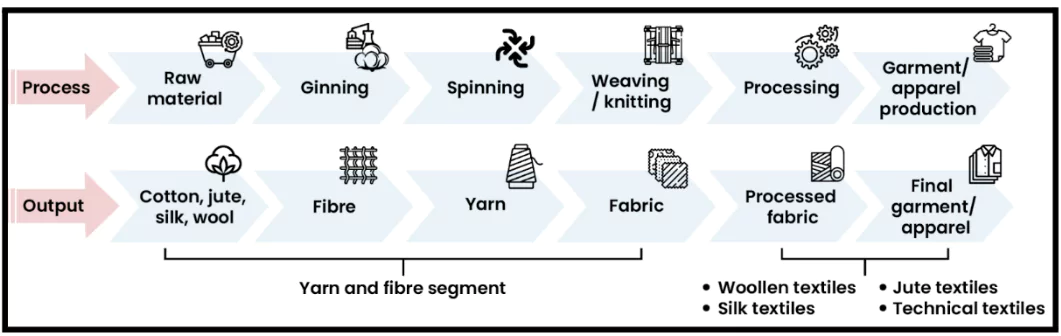

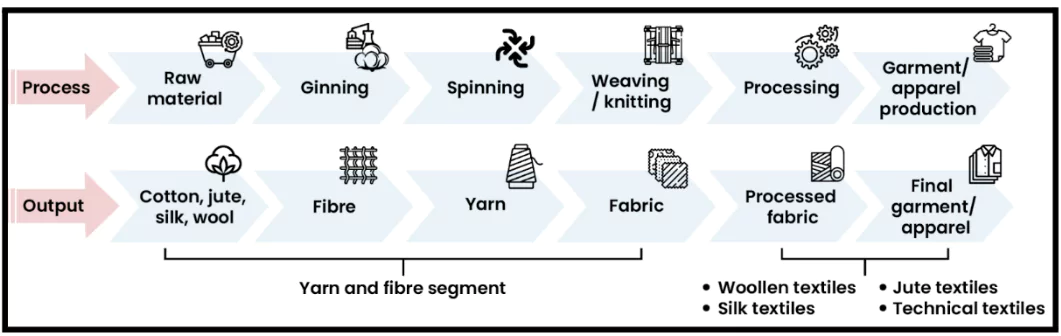

Key Segments of the Textile Industry in India

- Cotton: India is the largest producer of cotton (White Gold) and it cultivates all four species of cotton: Gossypium arboreum and G. herbaceum (Asian cotton), G. barbadense (Egyptian cotton), and G. hirsutum (American Upland cotton).

- Wool: India is the ninth-largest wool producer in the world.

- India produces three main categories of wool: Carpet Grade, Apparel Grade and Coarser Grade.

- Silk: India is the second-largest producer of silk in the world.

- India produces four types of natural silks: Mulberry, Eri, Tasar, and Muga.

- Man-Made Fibres (MMF): The Man-made Fibre (MMF) industry contributes 17% of India’s textile exports, and the country is the world’s sixth-largest exporter of MMF textiles.

- Technical Textiles: These are textile goods whose primary focus is on technical performance and functionality. They are used in a variety of industries, including construction, agriculture, aerospace, automotive, healthcare, protective gear, and home care.

Recent Declines in the Textile Sector

- Impact of Slowdown: A downturn in demand that began in 2022 worsened in FY24 with a slump in both exports and domestic demand.

- Manufacturing Setbacks: This decline significantly affected manufacturing clusters.

- For instance, Tamil Nadu, which has the largest spinning capacity in the country, saw the closure of nearly 500 textile mills in the last two years.

- In Tiruppur, a hub for knitwear production, many units reported a 40% drop in business during FY23.

Reasons for Export Slump and Decline in the Textile Sector

- Geopolitical Factors: The Russia-Ukraine war, the Red Sea crisis and the Israel-Hamas conflict, have lately made the international trade scenario much tougher for the Indian exporters.

- Example: Higher freight costs from Houthi disruptions, with rates increasing by 40-50%, may hinder textile exporters reliant on trade through the Suez Canal.

- Global Weak Demand: The May 2024 ITMF Global Textile Industry Survey (GTIS) indicated ongoing stagnation in the textile business climate, with weak demand remaining the primary concern since September 2022.

- High Raw Material Costs: The rising prices of raw materials, particularly cotton and Man-Made Fibres (MMF), further exacerbated the situation.

- Import Duty on Cotton: The imposition of a 10% import duty on cotton increased the cost of Indian cotton, making it less competitive compared to international prices.

- Quality Control Orders: The introduction of quality control orders for MMF disrupted the availability and price stability of raw materials, affecting production.

- Import Competition: Growing imports of fabrics and garments increased market competition.

Check Out UPSC CSE Books From PW Store

Overall Challenges in the Indian Textile Industry

- Raw Material Issues: Despite being the largest producer of cotton and having a robust raw material base, India faces significant challenges with high contamination levels and poor fibre quality, particularly in terms of fineness and length.

- In India, 94% of cotton seeds are genetically-modified BT cotton, requiring farmers to purchase new seeds annually, unlike traditional varieties where they can reuse seeds.

- Fragmentation of Sector: The textile sector is highly fragmented, dominated by numerous MSMEs, with challenges like limited product diversification, lack of technological advancements.

- Skill Gaps in the Workforce: Despite being labour-intensive, the industry faces a shortage of skilled workers, limiting productivity and innovation.

- Competition from Other Countries:

- High Operational Costs: Higher costs for land, labour, and capital in India make it less competitive than countries like Bangladesh, the Philippines, and Vietnam.

- The absence of Free Trade Agreements (FTAs) hampers India’s competitive edge in the global market.

- Logistical Challenges: Logistics is one of the major constraints with Indian exporters.

- For Example, the turnaround time (TAT) (from order to delivery) is 50 days for Bangladesh and 63 days for India, whereas the time taken to reach port is one day for Bangladesh and 7-10 days for India.

- Environmental Concerns: Water-intensive processes and high energy consumption in textile manufacturing raise environmental sustainability concerns, particularly with global shifts toward greener production methods.

- Slow Technology Adoption: The sector has been slow in adopting advanced technologies and automation, affecting efficiency and global competitiveness.

- Other Challenges:

- Direct retailing through e-commerce platforms is becoming increasingly popular among garment and home textile manufacturers, with many startups entering the market.

- Focus on Sustainability: Foreign brands are accelerating the adoption of Environmental, Social, and Governance (ESG) sustainability practices throughout their supply chains, setting specific sustainability targets for their vendors.

Policy Support and Incentives for the Textile Sector

- Investment Support: 100% FDI is permitted through the automatic route in the textiles sector.

-

- Total FDI inflows in the textiles sector stood at US$ 4.47 billion between April 2000- March 2024.

- Amended Technology Upgradation Fund Scheme (ATUFS): This Scheme supports technology upgradation in textiles with financial incentives and aims to improve production capabilities and boost employment.

- Production-Linked Incentive (PLI) Scheme: A Rs. 10,683 crore (US$ 1.44 billion) PLI scheme has been introduced for manmade fibre and technical textiles over a five-year period to promote the production of man-made fibre apparel, fabrics and products of technical textiles.

- Tax Policy Incentives: The Indian government has established a uniform Goods and Services Tax (GST) rate of 12% on man-made fabrics (MMF), MMF yarns, and apparel, effective from January 1, 2022.

- Special Economic Zones (SEZs): Textile units located in SEZs enjoy various tax exemptions, including income tax holidays, customs duty exemptions, and GST exemptions on supplies.

- Skill Development Initiatives:

- The SAMARTH Scheme (Scheme for Capacity Building in Textiles Sector) focuses on skill development, targeting 10 lakh individuals for textile-related jobs.

- Pradhan Mantri Kaushal Vikas Yojana (PMKVY): Offers short-term training programs to improve employability in the textile industry.

- Textile Sector Skill Council (TSSC): under the aegis of National Skill Development Corporation (NSDC) aims to develop a skilled workforce for the textile industry through setting curriculum for training and accreditation of trade competency.

- Infrastructure Support:

- PM-MITRA (Mega Integrated Textile Region and Apparel Parks) initiative aims to create world-class industrial infrastructure by establishing integrated textile parks, attracting investments, and boosting exports in the textile sector.

- Scheme for Integrated Textile Parks (SITP) aims to develop textile parks of international standards, with 54 parks sanctioned under the initiative.

- Power-Tex India aims to enhance the power loom sector by offering subsidies for technology upgrades and market expansion.

- Initiatives for Technical Textile: The Ministry of Textiles has launched National Technical Textiles Mission India (NTTM) to boost the adoption of technical textiles in India, capitalising on the sector’s rapid growth.

Enroll now for UPSC Online Classes

Way Forward for Textile Industries

- Reduce Import Duties: India should consider reducing import duties on essential raw materials and advanced machinery to enhance competitiveness in the textile sector.

- Upskilling of the Workforce: There should be priority given to upskilling of workforce for enhancing employee performance, minimising skill gaps, and improving overall competitiveness in the Industry.

- Leverage Opportunities in Technical Textiles: The government should actively promote technical textiles by incentivizing investment and enhancing research and development capabilities.

- This focus will drive growth in a sector projected to reach $42 billion by 2026, positioning India as a global leader.

- Increase MMF Market Share: Firms should invest in research and development, improve quality control, and strengthen capacity-building initiatives to train a skilled workforce in MMF production.

- Diversification and Value Chain Enhancement: India should diversify its textile exports to include high-demand items like trousers and jackets, while targeting emerging markets in Japan, Australia, and Africa.

- Additionally, investing in innovative designs and advanced technologies will strengthen its position in the global value chain.

- Leverage Start-Up Ecosystem: There is a need to harness India’s start-up ecosystem to drive innovation in traceability and sustainable textiles, enabling rapid adaptation to market changes through Government- Industry- Academia collaboration and Industry- Industry collaboration.

- Enhance Supply Chain Efficiency: Streamlining supply chain operations to reduce lead times and costs is critical.

- Utilising data analytics for inventory management and demand forecasting can improve responsiveness to market changes .

- Sustainability Initiatives: The textiles industry must adopt circular models to reduce carbon emissions and waste, focusing on eco-friendly practices.

- Aligning with international sustainability standards such as EU Strategy for Sustainable Textiles will enhance compliance and strengthen India’s position in the global market.

![]() 9 Oct 2024

9 Oct 2024