Context: This article is based on the news “52% drop in toy imports in 8 years, 239% jump in exports: Commerce Ministry” which was published in the Business Standard. The Indian Institute of Management (IIM) Lucknow recently conducted a case study on the “Success Story of Made in India Toys.”

| Relevancy for Prelims: Indian Toys, Market Size of Indian Toys, National Action Plan for Toys (NAPT), MSMEs (Micro, Small, and Medium Enterprises), and Production-linked incentive (PLI) Scheme for Toy industry.

Relevancy for Mains: Toy Industry in India: Current Status, Significance, Potential, Challenges, and Way Forward. |

The Toy industry in India as the Sunrise Sector (Findings of the Report):

- Favourable Government Policies (2014-20): The government’s efforts have facilitated the development of a favorable manufacturing ecosystem for the Indian toy industry (See Image for Details).

India doubled the number of manufacturing units.

India doubled the number of manufacturing units.- 12 percent decrease in reliance on imported inputs.

- A 10 percent compound annual growth rate (CAGR) increase in gross sales value and an overall increase in labor productivity.

- Rising Toy Industry in India: India’s toy industry witnessed a 52 percent decline in imports of toys and a 239 percent rise in exports in 2022-23 compared with 2014-15.

- Global Integration and Market Access: India is emerging as a top exporting nation of toys due to the country’s integration into the global toy value chain, along with zero-duty market access for domestically manufactured toys in countries, including UAE and Australia.

Continue To Read: Indian Toy Industry: Exports Witnessed Significant Growth

About Indian Toys: Background, Transformation, and Significance

-

Historical Roots

- The toy industry in India can be traced back to the Indus Valley Civilization.

- The original toys comprised whistle-shaped parrots, toy monkeys, and miniature farm carts. All these toys were made from natural materials such as bamboo sticks, hay, and natural clay-like soil, rocks, and fiber cloth.

-

Modern Transformation of Indian Toys

-

- The advent of progressive technology and mechanisms has stimulated companies to produce fresh and inventive toys.

- India aims to be a global toy hub by 2025-2030.

Significance of Indian Toys

- Employment Intensive Sector: The Toy Industry of India provides employment opportunities, particularly in rural areas where many artisans are involved.

- India’s toy market has the potential to grow to $2-3 billion by 2024 (from $1.7 billion in 2017), and for every $100 million investment in the sector, 20,000 direct jobs, and 8,000 indirect jobs can be created.

- Expanding Manufacturing: It will aid in Make in India’s effort by encouraging and promoting domestic manufacturing which will help create jobs and lessen reliance on toy imports.

- Indian toys market size reached USD 1.7 Billion in 2023 from USD 1.4 BIllion in 2021.

- Export Potential and Foreign Exchange Earnings: Ingenious toys produced using themes, tales, and characters drawn from India’s diverse cultural heritage will appeal to the Indian and foreign markets, gaining foreign exchange for India (See Infographics).

Strengthening Education and Skill Development: Toys serve as entertainment and educational resources.

Strengthening Education and Skill Development: Toys serve as entertainment and educational resources. -

- Children’s learning experiences can be enriched by educational toys that emphasize STEAM (science, technology, engineering, arts, and mathematics) disciplines.

- As technology and science advanced, the demand for toys that serve as a medium for problem-solving skills, STEM education and concept development saw an upward trajectory.

- Cultural Ambassador of India: It features characters and stories from ancient Indian culture, stimulating curiosity and learning among people about the country’s rich culture.

- Modi Toys commemorates ‘Atma Nirbhar Indian Toys,’ with inspiration from India’s artistic tradition, culture, and heritage, along with its mythological tales and characters.

- Empowering Rural Women: It has helped local women to use traditional art and tap into local markets.

- Ex- In Jharkhand, women are learning to use sawdust, soil, clothes, and other things for making toys and selling products by organizing regular exhibitions in various fairs.

Indian Toy Industry: Current Status

- Sector Growth: According to Invest India, the Indian toy industry is projected to reach $3 billion by 2028, growing at a CAGR of 12 percent between 2022-28.

- Net Toy Exporter: The country became a net exporter of toys during 2020-21 and 2021-22, ending decades of import dominance.

- Market Size: Domestic market size is estimated at $ 1.5 Bn.

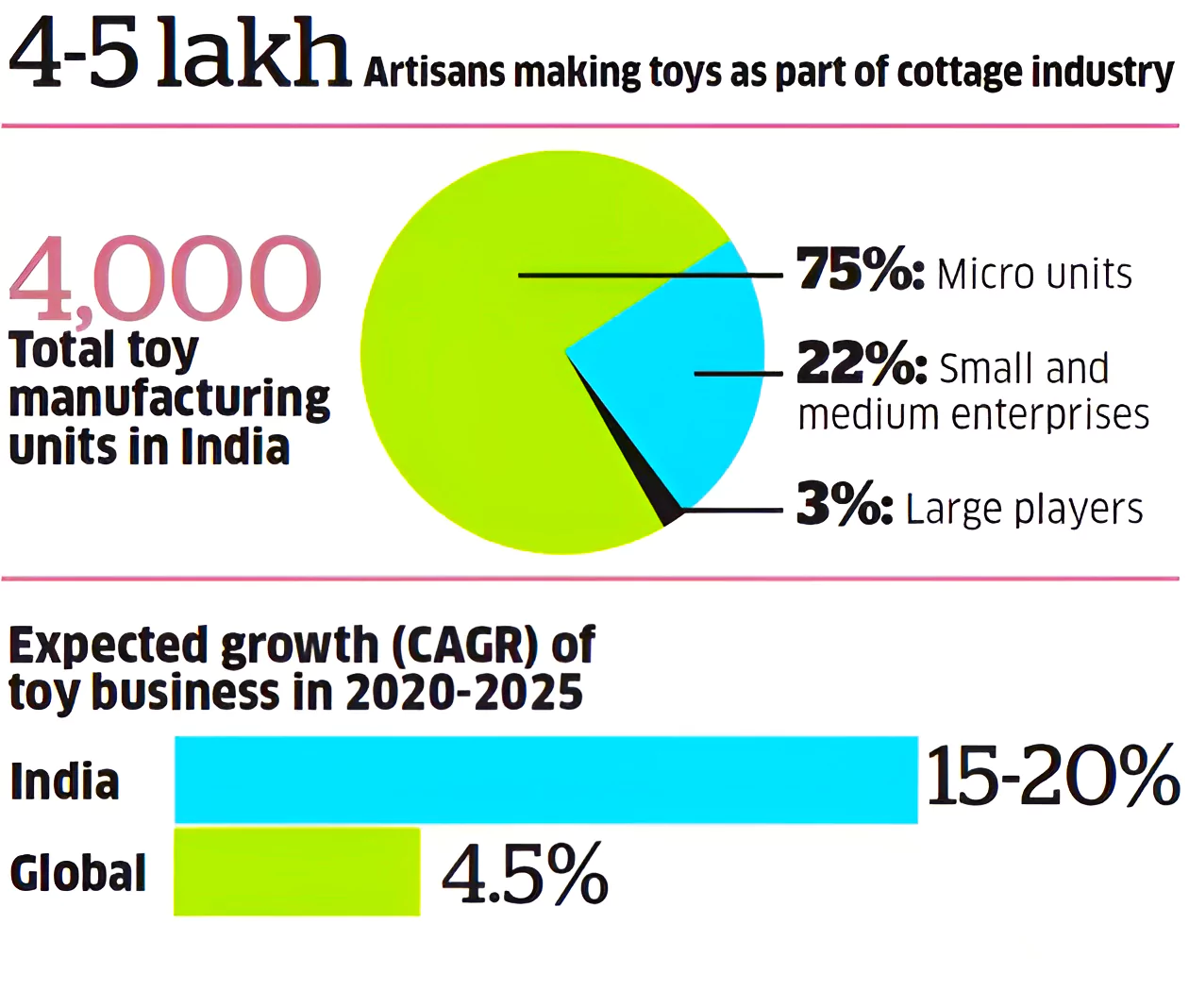

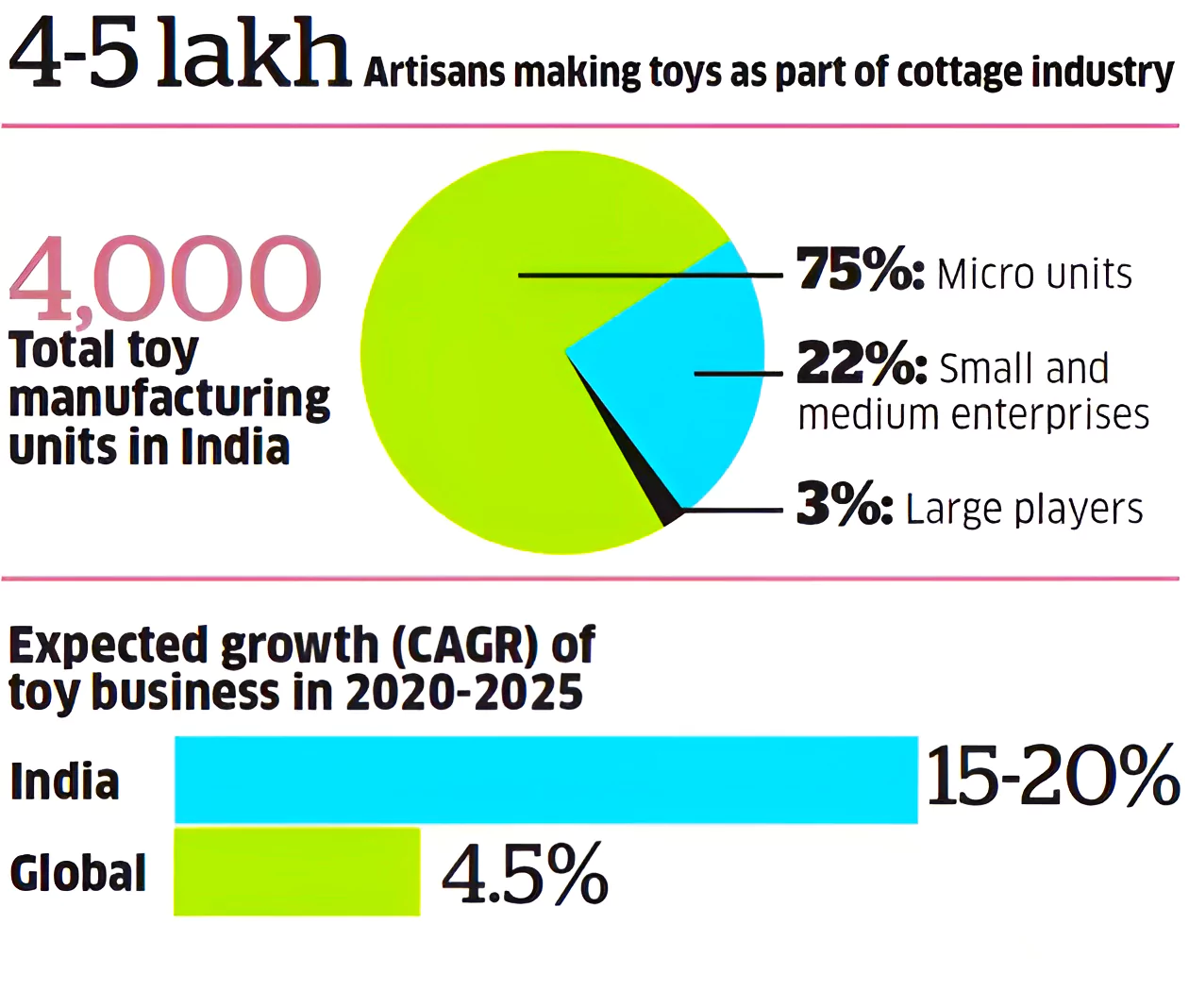

- MSME Driving Growth of Sector: Nearly 4,000 toy industry units, classified under the MSME (Micro, Small, and Medium Enterprises) category, propel the sector’s evolution.

|

Potential of Indian Toy Industry

- Market Size: With consumers becoming increasingly well-informed, there is a rise in the demand for diverse, educational, and high-quality toys.

- Consumer Base: About 25 percent of the Indian population falls into the 0-14-year category, a huge customer segment.

- Low-Cost Labour: According to a study by KPMG-FICCI, low-cost labour in India offers a significant growth prospect for the toy industry.

- India’s labor cost per hour is $1.7 compared to China’s $5.8.

- Anticipation of a Surge in STEM Concepts in Toy Industry: There is an anticipation of a greater infusion of STEM (Science, Technology, Engineering, and Mathematics) concepts into educational toys.

- These innovative toys will equip children with essential skills for the digital age, such as coding and robotics knowledge.

- International Support: India’s toymakers have begun to get support from global buyers. US-based retail giant Walmart is looking to source toys from Indian suppliers.

-

- Walmart has set a target of USD 10 billion for overall imports from India, including Indian toys.

- China Plus One Strategy: With countries looking for alternatives to Chinese products, the Indian toy industry may serve as an alternative import destination for toys.

- According to Statista, China has been the world’s largest toy market, exporting 59.2% of the total toy trade value in 2022.

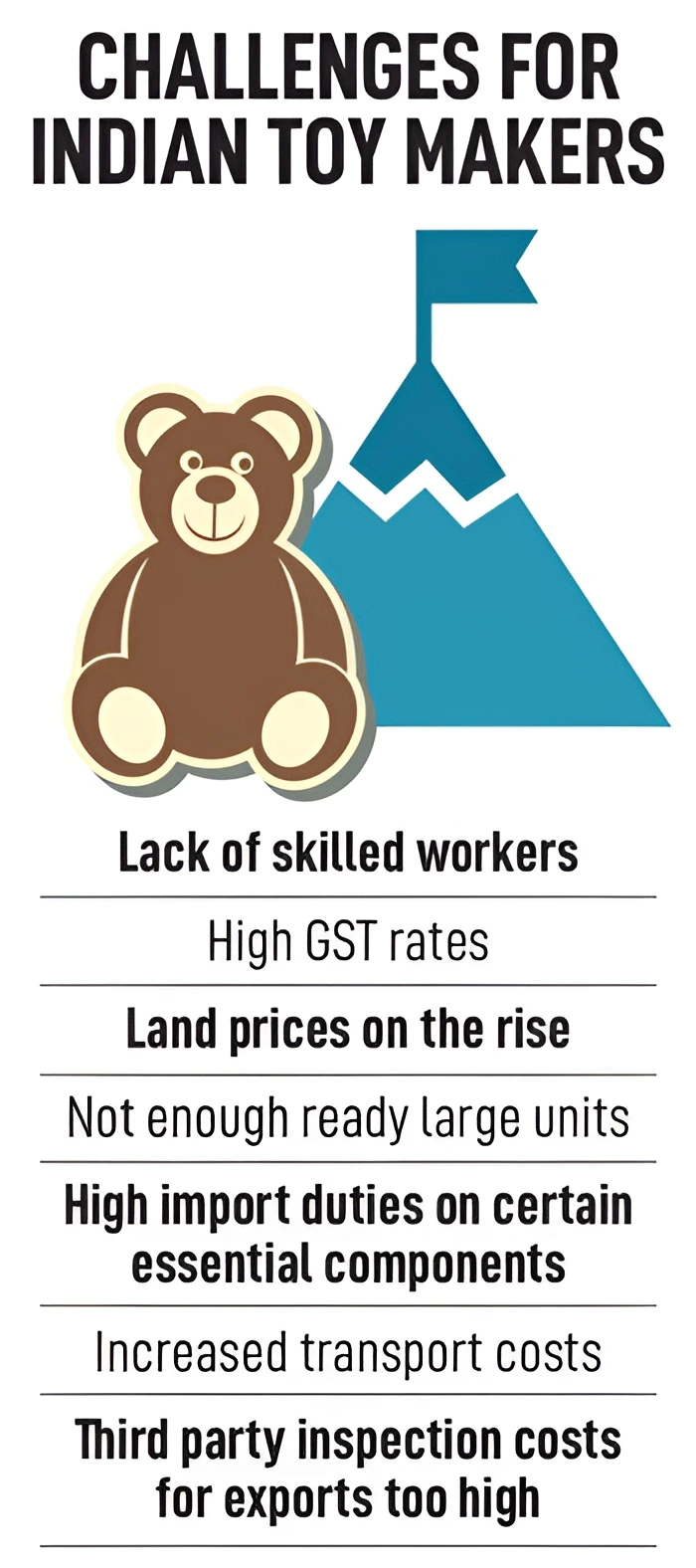

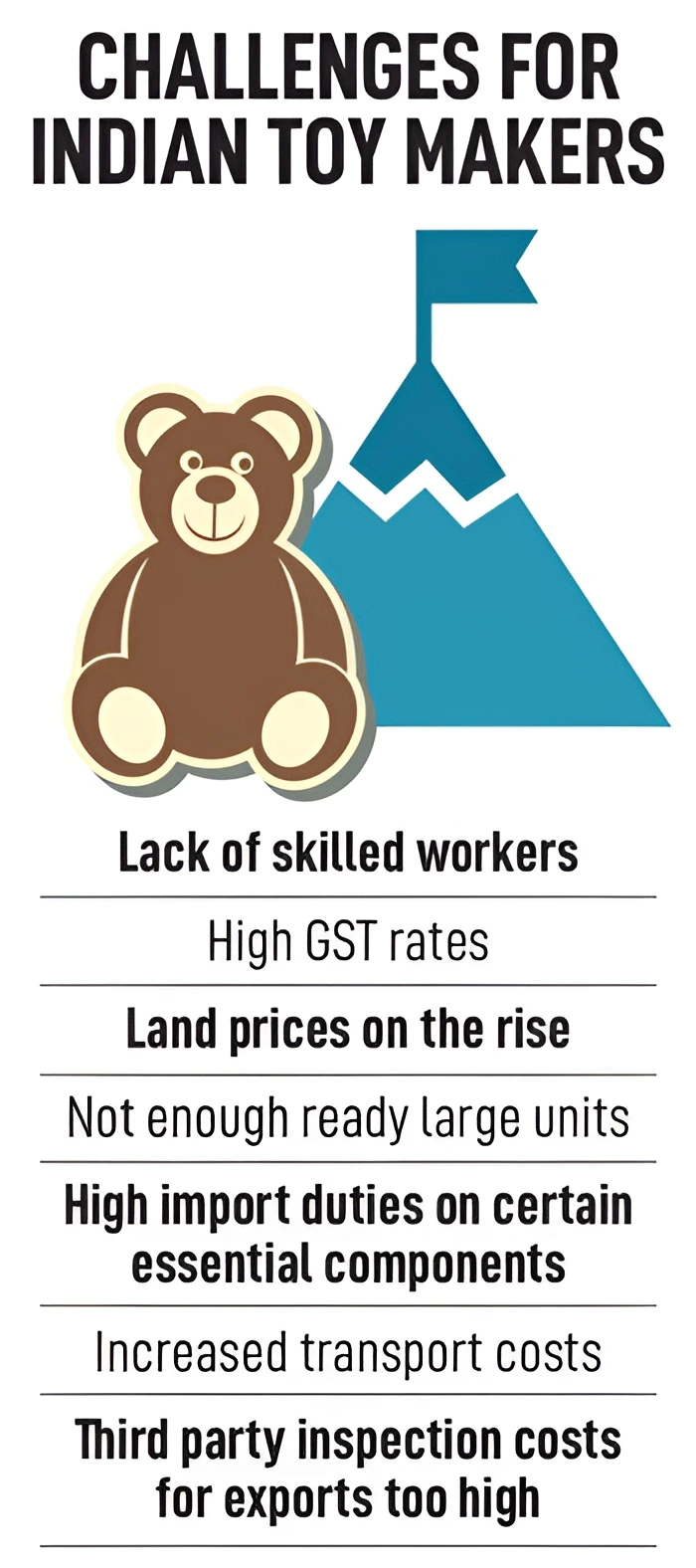

What Challenges Are Associated with the Toy Industry in India?

- Fragmented and Unorganised Sector: The toy industry is still highly fragmented, dominated by local producers (60 percent of India’s 4,000 toy manufacturers are unorganized), and lacks innovation, and resources to invest in equipment and technology.

- Currently, the toy manufacturers in India are mostly located in NCR, Maharashtra, Karnataka, Tamil Nadu and clusters across central Indian states.Extremely small units have dominated the sector; around 75% are micro units and 22% are small and medium enterprises. It’s not viable for small units to buy machines and equipment to ensure production quality and meet stringent quality standards set by the QCO.

- Import Dependency for Raw Materials: According to a KPMG-FICCI report, India has to import most of the raw materials and machines from China and other Asian countries to manufacture toys.

- India has to import even the fabric used to make plush toys from China.

- Lack of Technology: India lacks engineering for toy manufacturing such as 3D product prototyping, as it does have certified testing facilities that help meet global quality standards.

- There’s no toy design institute, nor do our courses have any industry interface. India builds more manual and traditional toys, accounting for just 16% of total toy sales worldwide.

- HIgh Import Duty on Machinery: There has been an increase in the production of electronic and battery-operated toys in India, but small toy manufacturers cannot buy equipment to produce them because of high import duties.

- Untapped Potential: Within the global toy industry, which boasts a vast market size exceeding 10 lakh crore, India’s current contribution stands at just 1 percent, indicating substantial untapped potential.

What are the Government Initiatives for the Toy Industry?

- National Action Plan for Toys (NAPT): It provides comprehensive support to promote ‘Vocal for Local’ in toys through the National Action Plan for Toys (NAPT) by bringing together 20+ Ministries/ Departments.

- Increase in Customs Duty: Basic Customs Duty (BCD) on imported toys increased from 20 percent to 60 percent in February 2020 and 70 percent in March 2023.

- Rules in the QCO are framed under Section 16 of the BIS Act, 2016 which make it mandatory for toys for children aged 14 years or younger to conform to seven Indian Standards for Safety of Toys.

- Quality Control Order (QCO) for toys: It was issued in 2020, with effect from January 1, 2021, to prevent the sale of cheap quality goods in the market.

- Licences to Micro-sale units Without Testing Facility: Special provisions were notified by the Bureau of Indian Standards (BIS) in 2020, to grant licences to micro-sale units manufacturing toys without a testing facility for one year and without establishing an in-house testing facility, which was further extended by three years.

- Cluster-based Approach to Support Domestic Toy Industry: The Ministry of Micro, Small and Medium Enterprises (MSME) supports 19 toy clusters under the Scheme of Funds for the Regeneration of Traditional Industries (SFURTI).

- Promotional Initiatives: These have also been undertaken to promote indigenous toys and encourage innovation, including the Indian Toy Fair 2021, Toycathon, etc.

- Toy Park in Noida: This toy park will house industrial units for the manufacturing and export of toys, including high-quality electronic toys, playground equipment, soft toys, slides, plastic toys, wooden toys, and board games.

|

Way Forward to the Indian Toy Industry

- Production-linked incentive (PLI) Scheme for Toy industry: The government needs to introduce the scheme for the toy industry in India as it will foster a manufacturing ecosystem for quality toys for domestic and global markets.

- More players will enter the industry, making it a more organized sector and boosting the demand for “made-in-India” toys.

- Fostering Innovation and Creativity: The Indian toy business needs to prioritize innovation and creativity to succeed in the contemporary market.

- Toy makers may incorporate technology like augmented reality, virtual reality, and IoT (Internet of Things) into toys as it will help encourage learning and cognitive growth.

- Promoting Entrepreneurship: A thriving ecosystem of toy entrepreneurs may be cultivated with the help of government assistance in the form of finance, education, and infrastructure development.

- By supporting innovation and entrepreneurship through incubators and research centers, the environment required for long-term success can be created.

- Reform steps in policy and technology will pave the way for product innovation. For instance, demand for toys based on Chotta Bheem has a huge demand domestically.

- Learning from Global Leaders: India can learn about improving per capita consumption of toys from the US which has a strong toy market.

- On the other hand, China is known as the world’s toy factory. India can leverage its strengths, such as its workforce and technological abilities, to enhance its toy manufacturing capabilities.

- Promoting Industry Competitiveness: The government could assist the sector by establishing additional clusters, providing export subsidies, and including toys in India’s Free Trade Agreements (FTAs).

- Upskilling and Reskilling: Re-skilling the 7 million artisans in the country to help them meet the industry’s evolving demands while framing labor laws and regulations that protect workers’ rights can help reap dividends.

- Joint Collaboration for Competitive Edge: Collaborating between the toy industry and the government is needed to position India as a competitive alternative to existing global toy hubs such as China and Vietnam. These efforts include:

- Creation and implementation of a dedicated toy policy

- Setting up of a nodal agency like National Creative Hub (C-Hub)

- Investing in brand-building

- Collaborating with regional artisans

- Strategic tie-ups with global players to leverage science, technology, engineering, art, and math toys.

Conclusion

Toy manufacturing is an ideal sector to boost a sluggish economy. Resolution of quality, skilling, and supply chain challenges will pave the way for the anticipated growth of the Indian toy industry.

![]() 8 Jan 2024

8 Jan 2024

India doubled the number of manufacturing units.

India doubled the number of manufacturing units.

Strengthening Education and Skill Development: Toys serve as entertainment and educational resources.

Strengthening Education and Skill Development: Toys serve as entertainment and educational resources.