The central government will borrow ₹3.94 lakh crore via T-bills in January-March FY24, up from ₹2.47 lakh crore in October-December, per RBI’s auction calendar.

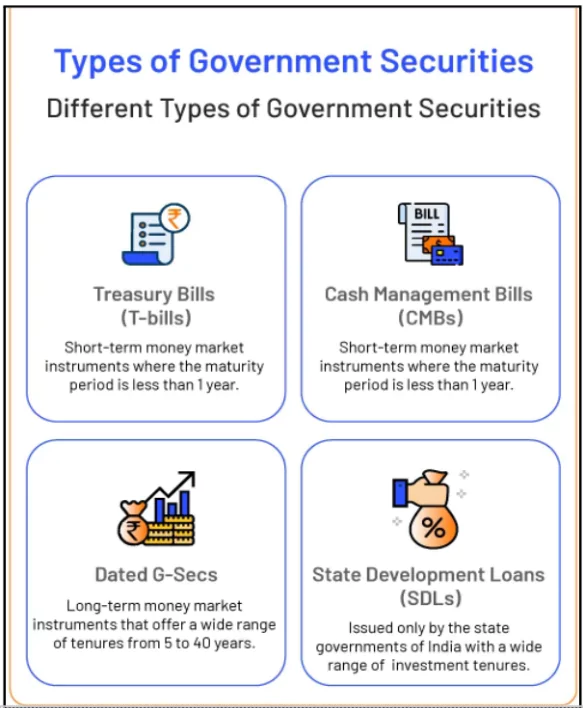

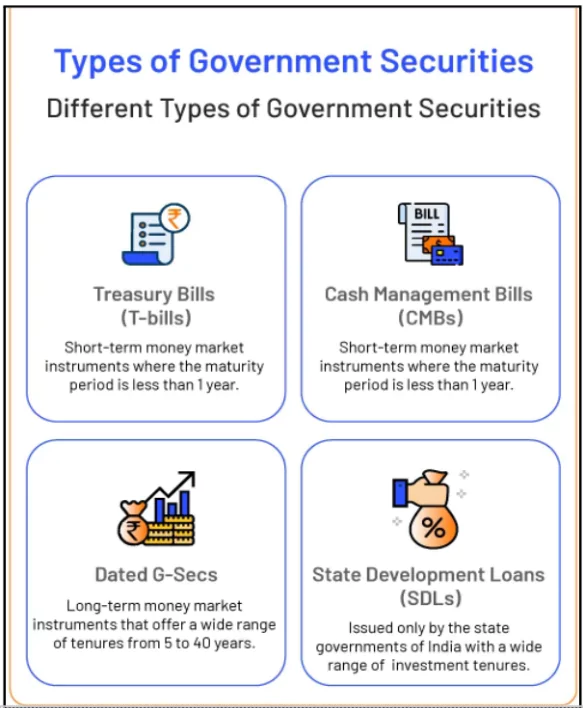

About Government Securities (G-Secs)

- G-Sec are tradable debt instruments issued by the Central or State Governments to manage fiscal deficits.

- Types:

-

- Short-term: Treasury bills (T-Bills) with maturities of 91 days, 182 days, or 364 days.

- Long-term: Government bonds or dated securities with maturity of one year or more.

- Issuance: The Central Government issues both T-bills and bonds.

- State Governments issue only bonds called State Development Loans (SDLs).

- Risk Profile: Considered risk-free due to government backing (termed gilt-edged instruments).

|

Enroll now for UPSC Online Classes

Key Highlights on T-Bills Borrowing

- Breakdown of Borrowing:

- ₹1.68 lakh crore via 91-day T-bills.

- ₹1.28 lakh crore via 182-day T-bills.

- ₹98,000 crore via 364-day T-bills.

- Increased Supply: T-bill borrowings have risen due to tight liquidity conditions in the market.

- Quarterly borrowing increased sharply compared to the previous quarter.

Flexibility in Auction: RBI, in consultation with the government, retains the flexibility to adjust auction amounts and timing based on market conditions and requirements.

Flexibility in Auction: RBI, in consultation with the government, retains the flexibility to adjust auction amounts and timing based on market conditions and requirements.

About Treasury Bills (T-Bills)

- Characteristics: They are Zero-coupon securities issued at a discount and redeemed at face value upon maturity. It was introduced in India for the first time in 1917.

- Purpose and Usage:

- Used to raise short-term funds by the government.

- Can be used by banks to meet Statutory Liquidity Ratio (SLR) requirements or as collateral for repo transactions with the RBI.

- Eligibility: Individuals, trusts, institutions, and banks can invest in T-bills.

Zero-Coupon Security

A zero-coupon security is a debt instrument that doesn’t pay periodic interest (coupons) to the holder.

Instead, it’s sold at a deep discount to its face value. At maturity, the investor receives the full face value of the bond. |

- Market Role: Key instruments for managing liquidity and funding within the financial system.

- Open Market Operations (OMOs): RBI buys or sells G-secs to manage liquidity and stabilize inflation.

- T-bills are often sold to absorb excess liquidity or purchased to inject liquidity.

- Auction Mechanisms: RBI conducts regular auctions for T-bills and G-secs to ensure smooth borrowing processes.

Advantages and Disadvantages of Treasury Bills

| Advantages of Treasury Bills |

Disadvantages of Treasury Bills |

| Safety and Security: Backed by the Indian government, making them low-risk investments. |

Liquidity Tightness: High borrowing through T-Bills can indicate constrained liquidity in the financial system. |

| Liquidity: Can be easily sold in the secondary market before maturity, offering ease of exit. |

Market Sensitivity: Increased supply of T-Bills may impact short-term interest rates and market stability. |

| Short-Term Investment Horizon: Ideal for meeting short-term financial goals like emergency funds or vacations. |

Investor Concentration: Predominantly held by financial institutions, limiting retail investor participation. |

| Diversification: Helps reduce overall portfolio risk by adding a low-risk asset class. |

Limited Returns: Yields are generally lower compared to other investment options with higher risks. |

Check Out UPSC NCERT Textbooks From PW Store

Way Forward

- Diversified Participation: Encourage greater involvement of retail investors in T-bill auctions through awareness campaigns.

- Efficient Liquidity Management: Streamline OMO operations to ensure balanced money supply.

- Policy Adaptability: Maintain flexibility in borrowing strategies to respond to evolving economic conditions.

- Market Stability: Monitor the impact of increased T-bill supply on short-term interest rates and market dynamics.

By addressing these challenges and leveraging effective monetary tools, the government and RBI can ensure stable borrowing conditions and robust financial market operations.

![]() 30 Dec 2024

30 Dec 2024

Flexibility in Auction: RBI, in consultation with the government, retains the flexibility to adjust auction amounts and timing based on market conditions and requirements.

Flexibility in Auction: RBI, in consultation with the government, retains the flexibility to adjust auction amounts and timing based on market conditions and requirements.