Recently, Tamil Nadu Chief Minister M.K. Stalin alleged that the Union government was withholding funds for the State’s Metro rail completion and other vital projects.

- This highlights government’s tax policies that reduce aggregate financial transfers to States, weakening cooperative federalism.

Union Fiscal Transfers To States

The Union government’s fiscal transfers to States are made through two mechanisms:

1. Finance Commission

- Article 280 of the Indian Constitution: The Indian President needs to set up a Finance Commission every five years, starting two years after the Constitution begins.

- Article 281 of the Indian Constitution: In connection with the suggestions from the Finance Commission, the President is required to present the Commission’s recommendations along with an explanation to both houses of Parliament.

Enroll now for UPSC Online Course

About Finance Commission

- Composition: The Finance commission composition consists of a chairman and four other members, all appointed by the president.

- Tenure: The Members of the finance commission are appointed for the duration specified in presidential order.

- Members are eligible for reappointment.

Functions of Finance Commission:

- Existing Functions: It is tasked with making recommendations to the President on the following matters:

- Tax Distribution: Distributing shares of net proceeds of tax between the Union and the States and the allocation between the States of the respective shares of such proceeds

- Rules for grants-in-aid: The rules that govern grant-in-aid to the states by the centre from Consolidated Fund of India

- Tax Devolution at State Level: Augmenting the consolidated fund of the state to supply resources to panchayats and municipalities based on recommendations of the state finance commission

- Miscellaneous Matter: Any other matter referred by the President to the Commission in the interests of sound finance.

- Submit Report: A report is submitted to the President, who lays it before both houses of the Parliament. The report is followed by an explanatory memorandum on the actions taken on its recommendations.

- Previous Functions:

- Grants for Specific States: Previously the Finance Commission used to suggest grants to the states of Assam, Bihar, Odisha, and West Bengal regarding the sharing of net proceeds of export duties imposed on jute products. This was valid for only 10 years.

|

2. Variety of Central government Schemes.

- The Union government employs two other routes for direct financial transfers to the States – Centrally Sponsored Schemes (CSS) and Central Sector Schemes (CSec Schemes)

- Overall Allocation: Combined allocation for CSS and CSec Schemes in 2023-24 is ₹19.4 lakh crore. Only ₹4.25 lakh crore devolved to states.

- Union Government Influences The Priorities of The States Through CSS

- Union government proposes the schemes and States implement them, committing their financial resources as well. Union provides partial funding and another part is to be committed by States.

- Allocation for CSS increased from ₹2.04 lakh crore (2015-16) to ₹4.76 lakh crore (2023-24) through 59 CSS

- Actual financial transfers to states under CSS in 2023-24 were ₹3.64 lakh crore, with ₹1.12 lakh crore retained by the Union government.

- Inter-State Inequity: The Wealthier states can afford matching funds and leverage Union finances. Poorer states need to borrow, increasing their liabilities and accentuating inter-state inequality.

- Csec Schemes and Exclusive Control

- Fully funded by the Union government for sectors under its control.

- Allocation increased from ₹5.21 lakh crore (2015-16) to ₹14.68 lakh crore (2023-24).

- Potential for Bias: Union government may allocate resources to benefit specific states or constituencies.

Incongruence of Article 282 with the Letter and Spirit of 7th Schedule

- Article 282 enables the Union (as well as the states) to make discretionary grants, even beyond their respective legislative competences, for any ‘public purpose’.

- Originally, it was an extraordinary provision that was to be used very sparingly.

|

Tax Revenue Disparities Analysis

- Increasing Its Discretionary Expenditure:

- Centralization of Expenditure: Decline or stagnation in financial transfers to states (tax devolution or grants-in-aid) increases discretionary funds for the Union government.

- Impact on Equity: This centralization can affect the equitable distribution of financial resources among states.

- Reduction: Union government not only reduced the financial transfers to States but also increased its own total revenue to increase its discretionary expenditure.

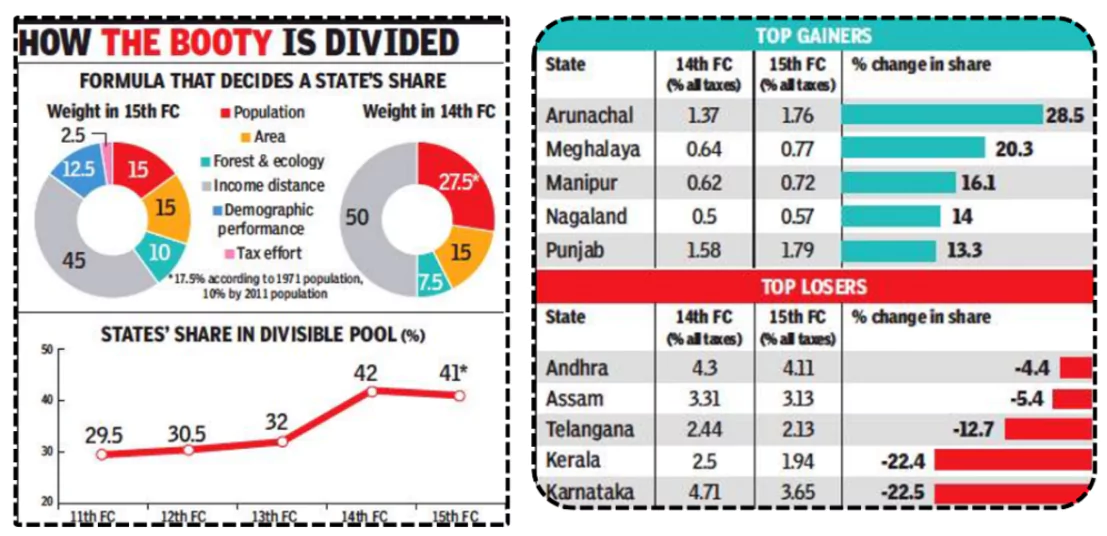

- Declining State Share: Contradicting Finance Commission Recommendations:

- Disparity: Fourteenth and Fifteenth Finance Commissions recommended 42% and 41%, respectively, of the net tax revenue to be the shares of States, the share of the gross tax revenue was just 35% in 2015-16 and 30% in 2023-24

Check Out UPSC CSE Books From PW Store

- Gross Tax Revenue: The total revenue collected by the government from all types of taxes, including direct taxes (like income tax, corporate tax) and indirect taxes (like GST, excise duty, customs duty).

- Net Tax Revenue: The revenue that remains with the central government after accounting for the portion that is shared with the states

|

-

- Increase in Gross Tax: While the gross tax revenue of the Union government increased from ₹14.6 lakh crore in 2015-16 to ₹33.6 lakh crore in 2023-24,

- Increase in State Share: States’ share in the Union tax revenue increased from ₹5.1 lakh crore to ₹10.2 lakh crore between these two years.

- Gross tax revenue of the Union government more than doubled while the share of States just doubled.

- Declining Grants-In-Aid:

- Decline in Absolute Amount: Grants-in-aid to States is another statutory grant recommended by the Finance Commission. The grants-in-aid to States declined in absolute amount from ₹1.95 lakh crore in 2015-16 to ₹1.65 lakh crore in 2023-24.

Statutory Powers

- They are derived from laws passed by the legislature (such as Parliament in India) and are explicitly granted and defined in statutes.

- These powers are backed by legal authority and are enforceable through the judicial system.

Non-Statutory Powers

- They are those exercised by the government that are not explicitly provided for or regulated by legislation.

- They are often based on conventions, traditions, administrative practices, or delegated authority from statutory powers.

|

- Non-Statutory Transfers:

-

- Lack Legal Basis: CSS and CSec Schemes involve non-statutory financial transfers, lacking legal basis or Finance Commission formulas. These transfers account for 12.6% of gross tax revenue.

- Limited State Autonomy: Non-statutory grants are tied to specific schemes, restricting states’ freedom in public expenditure.

- Total financial transfers (statutory and non-statutory) were 47.9% of gross tax revenue in 2023-24.

- Decline in Statutory Transfers: The combined share of the statutory financial transfers in the gross tax revenue of the Union government declined from 48.2% to 35.32%

Reasons Behind Declining States’ Share: Cess and Surcharge

- The net tax revenue, from which the States’ share is determined, excludes

Enroll now for UPSC Online Classes

Cess

- Definition: Cess is a form of tax imposed by the government over and above the existing taxes like income tax or goods and services tax (GST).

- Purpose: Cesses are typically levied to fund specific purposes, such as education cess, health cess, or infrastructure development.

- Collection: Cesses are collected by the government and are earmarked for the specific purposes for which they are imposed.

- Examples: Examples of cess in India include the Swachh Bharat Cess, Krishi Kalyan Cess, and Education Cess.

- Application: Cesses may be imposed temporarily or permanently, depending on the government’s fiscal policy and the intended duration of the funding requirement.

Surcharge

- Definition: Surcharge is an additional charge or tax imposed on the existing tax liability of an individual or entity.

- Purpose: Surcharge is often levied to meet temporary revenue needs or to ensure higher tax incidence on specific categories of taxpayers.

- Rates: Surcharge rates vary depending on the income or turnover slab, often increasing progressively with higher income or turnover brackets.

|

-

- Revenue collections under cess and surcharge

- Revenue from Union Territories

- Tax administration expenditure.

- Among the three factors: Revenue collection through cess and surcharge is the highest and increasing.

- In 2015-16: Revenue collection through cess and surcharge accounted for 5.9% (₹85,638 crore) of the gross tax revenue

-

- By 2023-24: The ratio surged to 10.8% (₹3.63 lakh crore).

- Implication: This substantial increase underscores the Union government’s strategic move to channel funds through cess and surcharge, enabling it to implement its own schemes in specific sectors.

- The increasing reliance on cess and surcharge not only enhances the Union’s financial autonomy but also limits the resources available for devolution to the States.

Measures to Strengthen the Federal Finance Structure

- Strengthening Finance Commission Mandate: Empower the Finance Commission to address contemporary fiscal challenges more comprehensively.

- For instance: Periodic review and adjustment of revenue-sharing formulas to reflect economic changes.

- Enhancing GST Council Efficiency: Improve the functioning of the GST Council for better coordination and dispute resolution.

- For example: Introducing a mechanism for faster decision-making and conflict resolution can significantly improve the efficiency of the council.

- Reforming Centrally Sponsored Schemes: Rationalise CSS to provide states with greater flexibility in fund utilisation.

- For instance: Transforming certain CSS into block grants would enable states to tailor funding to their specific local needs and priorities.

- Promoting Fiscal Discipline: Encourage fiscal discipline among states through incentive-based transfers and performance-linked grants.

- For instance: Under the 15th Finance Commission, performance-based incentives and grants are provided for the social sector, rural economy, governance reforms, and power sector reforms.

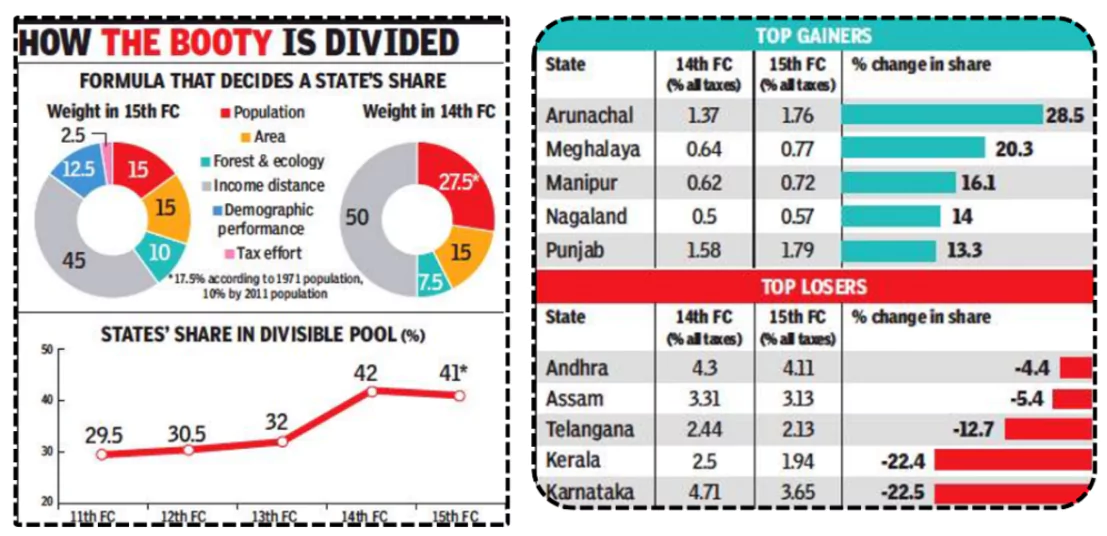

- Addressing Regional Disparities: Implement targeted interventions and special packages for underdeveloped regions.

- For example: The North East Special Infrastructure Development Scheme (NESIDS) focuses on infrastructure in Northeastern states.

- Enhancing State Revenue Capacities: Support states in enhancing their revenue-generating capacities through tax reforms and compliance improvements.

- For instance: Providing technical assistance by the union government for better tax administration at the state level.

- Improving Transparency and Accountability: Enhance transparency and accountability in intergovernmental fiscal transfers through regular audits and public reporting.

Check Out UPSC NCERT Textbooks From PW Store

Conclusion

The future of Centre-State financial relations in India hinges on the establishment of a robust federal finance structure. This can be achieved by strengthening institutions, reforming centrally sponsored schemes, and promoting fiscal discipline. These measures will ensure balanced regional development and effectively address the diverse fiscal needs of all states.

![]() 15 Jul 2024

15 Jul 2024