India has become the global leader in fast payments, as noted by the International Monetary Fund (IMF) in its report “Growing Retail Digital Payments: The Value of Interoperability,” highlighting Unified Payments Interface’s (UPI’s) transformative impact.

Key Highlights of the Report

- Global Leadership in Digital Payments: India’s Unified Payments Interface is also now the world’s number one real-time payment system.

Massive Transaction Volume: UPI handles more than 640 million transactions every day, compared to Visa’s 639 million.

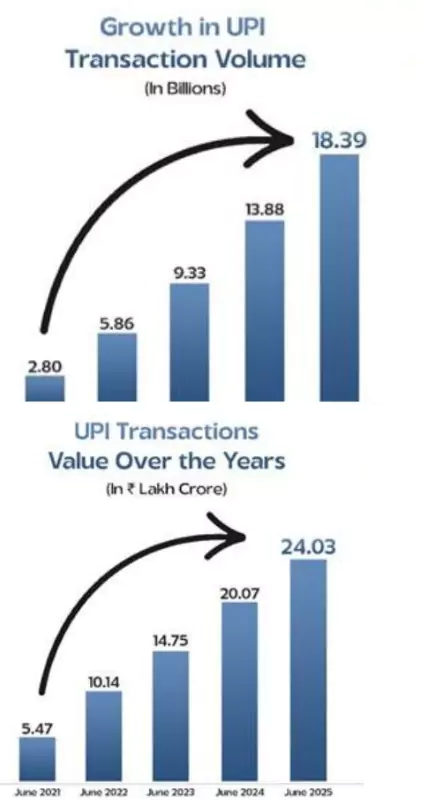

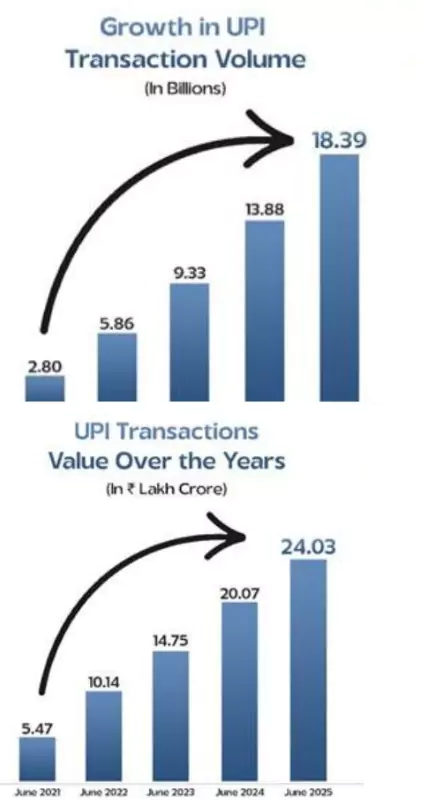

Massive Transaction Volume: UPI handles more than 640 million transactions every day, compared to Visa’s 639 million. - Latest Figures (June 2025): UPI processed over 18 billion transactions monthly.

- In June alone, UPI processed transactions worth ₹24.03 lakh crore, a 32% rise in transaction volume compared to the same month last year.

- Dominant Force: UPI now handles a huge 85% of all digital payments in India and nearly half of all real-time digital transactions across the world.

- Massive Reach: The platform now serves 491 million individuals and 65 million merchants.

- Interoperability in Action: Before UPI, digital payments were restricted to closed platforms. UPI enabled true interoperability between banks and apps, giving users freedom of choice and fostering competition, which led to rapid adoption and widespread daily use.

- Strategic Push for Global Reach

- International Presence: UPI is now operational in seven countries: the UAE, Singapore, Bhutan, Nepal, Sri Lanka, France, and Mauritius.

- European Foray: UPI’s entry into France is particularly significant, marking its first foray into Europe. This allows Indian consumers and businesses to make and receive payments seamlessly abroad.

- BRICS Expansion: The Indian PM has actively pushed for UPI’s expansion within the BRICS grouping, expanding by including various new member states, expecting to boost remittance flows and financial inclusion.

Globalising UPI: India’s Push for Digital Payment Diplomacy

- RBI’s Strategic Push for Global Reach: The Reserve Bank of India (RBI) has identified internationalisation of UPI as a key objective in its Payments Vision 2025.

- RBI’s Payments Vision 2025 is a strategic roadmap focused on enhancing the digital payments ecosystem in India, aiming for secure, convenient, and affordable payment solutions for all users.

- MEA’s Role in Global Expansion: The Ministry of External Affairs (MEA) is actively working to promote UPI adoption abroad, aligned with India’s geopolitical and soft power strategy.

- UPI’s Global Transaction Share: UPI now accounts for almost 50 per cent of transactions globally. This shows the strength of an open and interoperable system built for speed and simplicity.

- Global Leadership: According to the ACI Worldwide Report 2024, India now accounts for around 49% of global real-time payment transactions as of 2023, underscoring its leadership in digital payment innovation.

- UPI for Non-Resident Indians (NRIs): NRIs can now link their international mobile numbers to Indian bank accounts to use UPI.

- Supported in countries like:

- Australia, Canada, France, Hong Kong, Malaysia

- Oman, Qatar, Saudi Arabia, Singapore, UAE

- UU, USA

- Enables real-time INR transactions in India, improving financial connectivity for the diaspora.

- UPI for Foreign Tourists: “UPI One World”: Launched to allow foreign visitors to use UPI while traveling in India.

- Tourists must complete full KYC verification using their passport and valid Indian visa.

- Promotes ease of doing business and tourism by enabling cashless payments for international visitors.

About Unified Payments Interface (UPI)

-

- Refers: A system that allows users to link multiple bank accounts to a single mobile application, combining various banking features, seamless fund routing, and merchant payments.

- It enables instant real-time payments through a mobile phone.

- Launch: Launched in 2016 by the National Payments Corporation of India (NPCI).

- NPCI is a non-profit body set up in 2008 by the RBI and Indian Banks’ Association to manage retail payments in India. It provides a secure, efficient infrastructure for both physical and digital transactions.

- Core Idea: Connects 675 banks through a single, unified system, making digital transactions easy and affordable.

- Key Features: Instant money transfers, bill payments, merchant payments, peer-to-peer transfers, 24/7 accessibility.

Significance of UPI:

- Interoperability: UPI allows users to send money across different banks and apps using a single, common protocol. This interoperability boosted competition and improved services.

- Ease and Security: Users can make secure transactions via mobile apps with only a UPI ID, eliminating the need to share sensitive bank details.

- Convenient Features: Features like QR code payments, app-based customer support, and 24×7 access have made UPI convenient even for small, everyday transactions.

- Affordability for Businesses: For small businesses, UPI offers a zero-cost or low-cost method to accept digital payments, especially useful in rural and semi-urban areas. Its speed and affordability make it accessible for everyone.

UPI Recent Developments

- Conversational Voice Payments: Introduced by NPCI at the Global Fintech Fest 2024.

- Allows users to complete transactions using voice commands in multiple Indian languages.

- Aimed at making digital payments more accessible to the elderly, semi-literate, visually impaired, and people in rural areas.

- UPI Lite (For Offline Transactions): Designed for low-value transactions without internet access, enhancing rural and emergency usage.

- Supports offline QR code scanning and debit processing even in low-connectivity areas.

- As of 2024, RBI increased the limit to ₹1,000 per transaction, with a total daily balance limit of ₹5,000, encouraging wider adoption.

- UPI Vouchers: Offers prepaid, purpose-specific vouchers tied to a recipient’s mobile number.

- Useful for targeted government welfare schemes, direct benefit transfers (DBTs), corporate gifting, and charitable aid.

- Ensures privacy and accountability, as the voucher can only be redeemed by the intended mobile recipient.

- UPI 123PAY (Launched in 2021): A joint initiative by NPCI and Naffa Innovations to enable UPI transactions via feature phones.

- Empowers users in low-bandwidth and remote areas to make secure payments through IVR (Interactive Voice Response) and voice commands.

- Part of a broader mission to promote digital financial inclusion for the unbanked and underbanked.

- Increase in UPI Transaction Limits: On 8 December 2023, the RBI raised UPI transaction limits from ₹1 lakh to ₹5 lakh for specific categories such as Education institutions, Hospitals, and Government and tax payments.

- This expansion enhances UPI’s role in high-value digital payments, reducing reliance on NEFT/RTGS.

The Digital Foundation Behind UPI

- Jan Dhan Yojana (PMJDY)- Financial Inclusion: This scheme was the first big step. It helped open bank accounts for millions who had never used a bank before.

- As of July 9, 2025, over 55.83 crore accounts have been opened. These accounts let people receive government benefits directly and save money safely.

- Aadhaar- A Digital Identity for All: Aadhaar gives every person a unique ID linked to their fingerprints or eyes. It makes proving identity easy and secure.

- By June 30, 2025, over 142 crore Aadhaar cards had been issued. Aadhaar is now used for many digital services, including UPI.

- Connectivity and 5G Rollout: India has rolled out 5G faster than most countries, with 4.74 lakh base stations now active across nearly all districts.

- The country also has a massive mobile user base of 116 crore.

- At the same time, internet data prices dropped from ₹308/GB in 2014 to just ₹9.34/GB in 2022. This means more people can now use digital services quickly and affordably.

|

Impact of UPI: Beyond Technology

-

- Empowering Vulnerable Groups: It has had a profound impact on small businesses, street vendors, and migrant workers, offering them an easy and efficient way to transfer money and receive payments.

- COVID-19 Catalyst: Its adoption was greatly sped up during the Covid-19 pandemic, as people sought safer, contactless alternatives to cash transactions.

- Behavioral Shift and Trust: UPI’s success also comes from the behavioral shift it inspired, where trust in the system and its accessibility were key.

- Voice Boxes: A simple yet significant innovation, voice boxes at small shops announce payment amounts, building trust among vendors who were often wary of digital payments.

- User Choice: UPI’s design allows users to choose their preferred payment apps, regardless of their bank, giving consumers more power.

- RuPay Credit Card Integration: The integration of RuPay credit cards with UPI is a revolutionary step, allowing users to make payments through their credit lines instead of drawing from savings accounts.

- The RuPay Credit Card is a domestic credit card network developed by the NPCI to promote self-reliance in the payments ecosystem and offer a cost-effective alternative to global card networks like Visa and Mastercard.

Challenges to UPI’s Inclusive and Scalable Growth

- Cybersecurity Risks and Fraud: With rising UPI usage, cyber frauds like phishing, identity theft, and fake UPI links are increasing.

- In FY 2023–24, Indians lost ₹1,087 crore in over 1.34 million UPI fraud cases.

- Total fraud since FY 2022–23 has crossed ₹2,145 crore across 2.7 million incidents.

- Infrastructure Gaps and Digital Divide: While 95.15% villages have 3G/4G, broadband and smartphone access remains patchy in remote areas. This limits full participation in digital payments.

- Digital Literacy and Exclusion: Many Indians, especially in rural and elderly populations, lack the skills or confidence to use UPI safely. This can lead to fraud vulnerability or non-usage.

- Transaction Limits & Merchant Concerns: The standard ₹1 lakh UPI limit (higher for some use cases) can restrict high-value transfers.

- Small merchants are facing GST compliance notices due to UPI volumes, leading to fear and return to cash-based payments.

- Operational Stability and Scalability: UPI’s success rate is high, but occasional downtimes, especially during peak hours, affect trust.

- Even a 0.8% failure rate (2024) can disrupt millions of transactions.

- Global Merchant Adoption: UPI is accepted in 7 countries, but widespread global adoption is slow.

- Local payment regulations, competition from native systems, and lack of partnerships pose hurdles.

- Customer Support Gaps: Many users face delayed or unclear grievance redressal, especially during failed or disputed UPI transactions.

- Market Concentration Risk: Over 85% of UPI volume flows through two apps, posing risks of systemic failure and reduced competition.

- Awareness and Data Privacy: Limited user awareness of UPI features and weak transparency in app-level data handling remain concerns.

Way Forward for a Resilient and Inclusive UPI Ecosystem

-

- Cybersecurity and Fraud Prevention: Deploy advanced fraud analytics and dynamic risk assessment tools to monitor suspicious UPI transactions in real-time.

- Public Awareness Campaigns: 40% of UPI frauds stem from user negligence (RBI). Launch targeted digital hygiene campaigns via TV, radio, and vernacular media.

- Support Infrastructure: Expand use of Central Payments Fraud Information Registry (CPFIR) and the 1930 Cyber Helpline for fast, accessible fraud reporting.

- Multi-Factor Authentication: Introduce biometric or behavioral authentication, especially for high-risk transactions, beyond the current PIN-only system.

- Digital Infrastructure Expansion: As per TRAI (2023), 25 crore Indians still lack mobile access. Accelerate telecom and broadband expansion in underserved rural areas.

- Invest in BharatNet: Ensure time-bound rollout of fiber-optic internet to all Gram Panchayats under the BharatNet program.

- Scalable Architecture: Upgrade NPCI and banking infrastructure to reduce downtime and maintain <15-second transaction response times across the network.

- Inclusion Through Innovation: Scale up UPI Lite (via Near Field Communication (NFC)) and UPI123Pay for feature phone users, ensuring reach beyond smartphones.

- NFC is a short-range wireless connectivity technology that allows devices in proximity to communicate with each other.

-

-

- QR-Based Micro Payments: Expand low-cost QR code solutions in rural markets, local shops, and mandis.

- Regional Customization: Launch multilingual, voice-assisted UPI apps with simple interfaces to support low-literacy users and senior citizens.

- Training Programs: Conduct localized digital literacy drives for women SHGs, farmers, and small entrepreneurs to bridge the digital divide.

- Policy and Regulatory Reforms: Reassess the zero-Merchant Discount Rate (MDR) policy; consider a tiered MDR model or government-funded support for Payment Service Providers (PSPs).

- Merchant Discount Rate (MDR) is a fee charged by banks and payment service providers (like PhonePe, Google Pay, etc.) to merchants for processing digital payment transactions. It’s typically a percentage of the transaction amount, and it helps cover infrastructure, cybersecurity, and operational costs.

- In December 2019, the Government of India announced a Zero MDR policy on UPI and RuPay transactions

-

- Grievance Redressal: Create a unified, app-integrated redressal system with mandated resolution timelines and real-time tracking.

- User-Centric Design: Enforce UI/UX (User Interface and User Experience) guidelines to ensure apps are simple, transparent, and secure in both design and data sharing.

- Cross-Border Integration and Global Diplomacy: Sign bilateral MoUs with central banks and fintech regulators for currency conversion, interoperability, and mutual QR code recognition.

- Target Use Cases: Prioritize tourism (Indian travelers using UPI abroad) and remittances (real-time, low-cost transfers to Indian accounts).

- Merchant Enablement and Small and Medium Enterprise (SME) Digitization: Organize regional GST awareness drives for small merchants on digital payment reconciliation and compliance.

- Reconciliation Support: Offer easy-to-use dashboards and apps for merchants to manage transactions and file returns efficiently.

- Dynamic Incentives: Provide cashbacks, transaction-linked rewards, or tax rebates to onboard first-time digital users in the SME sector.

Conclusion

UPI embodies the constitutional vision of economic justice and digital empowerment, fostering inclusive growth, reducing inequalities, and positioning India as a global fintech leader committed to accessible, secure, and citizen-centric digital public infrastructure.

![]() 23 Jul 2025

23 Jul 2025

Massive Transaction Volume: UPI handles more than 640 million transactions every day, compared to Visa’s 639 million.

Massive Transaction Volume: UPI handles more than 640 million transactions every day, compared to Visa’s 639 million.