Recently, the Reserve Bank of India (RBI) Governor said the central bank is focusing on making Unified Payments Interface (UPI) and RuPay, the card payments network of the country, “truly global”.

- RBI Governor recently announced that the Unified Lending Interface (ULI) will soon be introduced to facilitate frictionless credit delivery.

The Central Government on Financial Inclusion

India is among the few countries that has launched Central Bank Digital Currency (CBDC) or e-rupee pilots in wholesale and retail segments (digital rupee in the wholesale in November 2022 and in the retail segment in December 2022).

- Focus on:

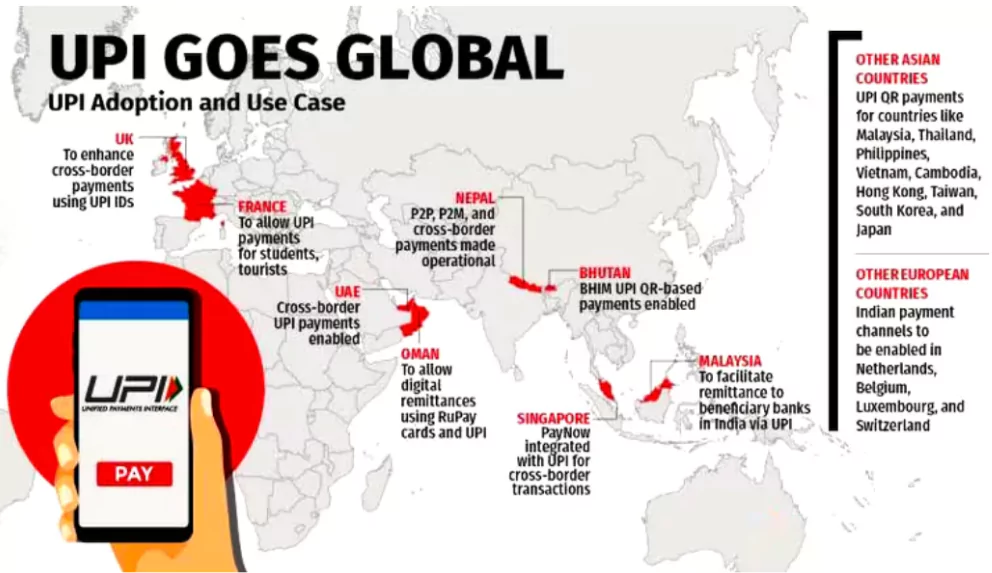

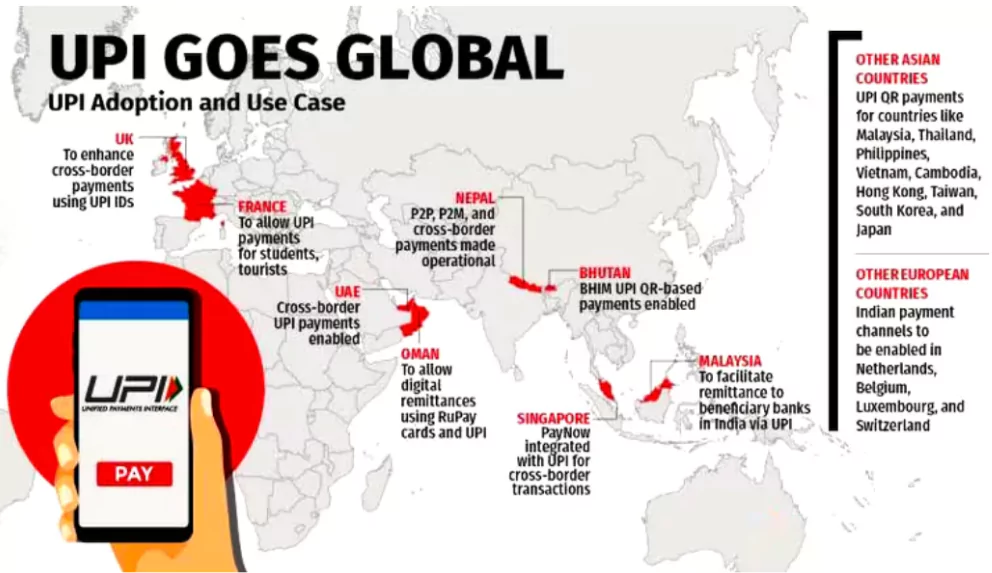

- Facilitating QR (quick-response) code-based payment acceptance through UPI apps at international merchant locations.

- Interlinking UPI with Fast Payment Systems (FPS) of other countries for cross-border remittances.

- Financial Inclusion

- Deployment of UPI-like infrastructure in foreign jurisdictions

- Consumer Protection

- Cyber Security

- Sustainable Finance

- CBDC

Enroll now for UPSC Online Classes

Central Bank Digital Currency (CBDC):

- Application: It is another example of possible international co-operation.

- Usage: The RBI is utilising features like programmability to provide credit or government assistance to landless tenant farmers and carbon credits to farmers through CBDC.

- Programmability feature of CBDC refers to programming the money by tying the end use.

|

- Earlier Achievements: India is engaged actively in international fora and bilateral agreements to foster economic cooperation with many countries.

Global Financial Connectivity: Notable progress has already been made in Bhutan, Nepal, Sri Lanka, Singapore, the UAE, Mauritius, Namibia, Peru, France and others.

Global Financial Connectivity: Notable progress has already been made in Bhutan, Nepal, Sri Lanka, Singapore, the UAE, Mauritius, Namibia, Peru, France and others.- UPI Integration: In 2023, UPI and its equivalent network in Singapore, PayNow, were integrated for enabling faster remittances between citizens of the two countries.

- UPI QR code is currently accepted in countries like Bhutan, France, Mauritius, Sri Lanka, Nepal, and UAE.

- Acceptance of RuPay Card: Nepal, Bhutan, Singapore, Mauritius, and UAE.

- Cards from these countries are also accepted in India.

- Significance: This segment of the fintech sector attracted about USD 6 billion in investments in the last two years.

- Digital financial inclusion has unique advantages of scalability and cost-effectiveness.

- New trinity of JAM-UPI-ULI (Unified Logistics Interface) will be a revolutionary step forward in India’s digital infrastructure journey.

Check Out UPSC NCERT Textbooks From PW Store

About Unified Payments Interface (UPI)

UPI is an instant real-time payment system to facilitate inter-bank transactions through mobile phones.

- Launched: By the National Payment Corporation of India (NPCI) in 2016 in conjunction with the RBI and the Indian Banks Association (IBA).

- It requires all the customers to register with NPCI through a virtual payment address called UPI ID.

- For normal UPI the transaction limit is up to Rs 1 Lakh per transaction.

About RuPay

RuPay is a domestically designed global card payment network.

- Refers: RuPay is a financial services and payment services system launched in 2012.

- Developed by: NPCI

About Central Bank Digital Currency (CBDC)

CBDC is a digital form of currency notes issued and backed by a central bank.

- Refers: CBDCs is a new variant of central bank money different from physical cash or central bank reserve/settlement accounts.

- It will be a central bank liability, denominated in an existing unit of account, which serves both as a medium of exchange and a store of value.

About JAM

JAM stands for Jan Dhan-Aadhaar-Mobile.

- Refers: Jam is an initiative by the Government of India to link the Aadhaar cards, mobile numbers, and Jan Dhan accounts of Indian citizens.

- Goal: To prevent government subsidy leaks.

|

![]() 29 Aug 2024

29 Aug 2024

Global Financial Connectivity: Notable progress has already been made in Bhutan, Nepal, Sri Lanka, Singapore, the UAE, Mauritius, Namibia, Peru, France and others.

Global Financial Connectivity: Notable progress has already been made in Bhutan, Nepal, Sri Lanka, Singapore, the UAE, Mauritius, Namibia, Peru, France and others.