![]() 16 Jan 2026

16 Jan 2026

English

हिन्दी

The Reserve Bank of India (RBI) has proposed reopening the licensing window for new urban co-operative banks (UCBs).

| Capital to Risk-Weighted Assets Ratio measures a bank’s capital adequacy by expressing its capital funds as a percentage of its risk-weighted assets. |

|---|

Eligibility: The RBI Proposal only for large co-operative credit societies with a minimum of 10 years of active operation and a good financial track record of at least 5 years.

Eligibility: The RBI Proposal only for large co-operative credit societies with a minimum of 10 years of active operation and a good financial track record of at least 5 years.

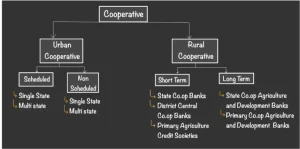

Tiered Regulatory Structure

|

|---|

Check Out UPSC CSE Books

Visit PW Store

| Aspect | Urban Cooperative Banks (UCBs) | Commercial Banks |

| Ownership | UCBS are owned by their members, who are both depositors and borrowers under the cooperative principle. | Commercial Banks are owned by shareholders, which may include the Government (in PSBs), institutions, or private investors. |

| Regulation | They are subject to dual regulation, where the RBI regulates banking operations, while State Governments/Central Government regulate management and incorporation. | They are regulated solely by the Reserve Bank of India (RBI) under the Banking Regulation Act, 1949. |

| Lending Focus | They Primarily lend to small traders, salaried persons, self-employed individuals, and MSMEs in urban and semi-urban areas. | They have a diversified lending portfolio, including large industries, infrastructure, MSMEs, agriculture, retail, and services sectors. |

| Voting Rights | Follows the “one member, one vote” principle, irrespective of the number of shares held. | Follow the “one share, one vote” principle, where voting rights are proportional to shareholding. |

<div class="new-fform">

</div>