The USA Federal Reserve is all set for a rate cut soon which is likely to have widespread impact on the global markets and particularly on India.

- It will be the first rate cut by the US Federal Reserve since March 2020

The Fed may go for a 25 basis point cut in its key rate to the 5.00%-5.25% range, or a 50 basis point reduction to 4.75%-5.00%

The Fed may go for a 25 basis point cut in its key rate to the 5.00%-5.25% range, or a 50 basis point reduction to 4.75%-5.00%

- Future Speculation: The Rate cuts will continue well in future as the central bank is widely expected to keep lowering rates to around 4.5% or even 4% by the end of the year, with more cuts in 2025.

- Goal: To achieve a soft landing ie. a sustained high levels of inflation being brought down without setting off a recession.

- Factors Behind The US Fed’s Rate Decision:

- Low Inflation: The inflation in the US has dropped to 2.5% from a mid-2022 peak of over 9%.

- Cooling Labour Force Rates: Hiring and wage growth have slowed, the number of job openings per worker has dropped and part-time work has risen as compared to full-time employment.

- The unemployment rate recently rose to 4.2%

- Shrinking Manufacturing Sector: The Rate cuts will lower the borrowing rates driving investments in the economy also resulting in more employment opportunities.

- The U.S. manufacturing sector shrank for the 11th time in the past 12 months, indicating a decline in overall production and demand.

- Inverted Yield-Curve: The yield curve reflects the difference between the 10-year yield and the 2-year yield is an indicator of a recession in the US.

- The yield curve has ‘un-inverted’ sparking recession fears which has lead the Fed to implement more substantial and frequent rate cuts in the coming months

Enroll now for UPSC Online Classes

About US Federal Rate Changes

- The Federal Funds Rate is a primary Monetary Policy Tool in the hands of the US Federal Reserve through which it influences employment and inflation by controlling the availability and cost of credit in the economy.

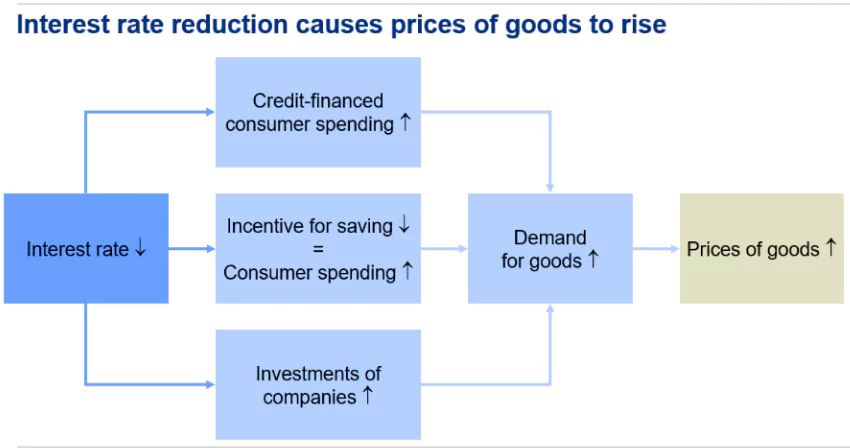

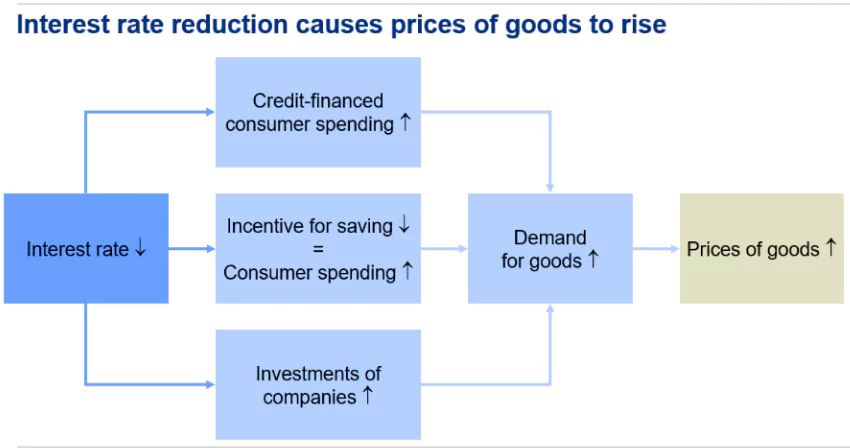

- Effects: Changes in the federal funds rate influence other interest rates, which in turn influence borrowing costs for households and businesses, as well as broader financial conditions.

- Authority: The Federal Open Markets Committee sets the federal funds rate to guide overnight lending among U.S. banks

Impacts on India

- Attract Investment: With the Fed Rate cuts, the difference between the interest rates of the US and the other country widens thus making countries such as India more attractive for the currency carry trade.

- The lower the rate in the US, the higher the arbitrage opportunity

- A Bulls Run in Stock Market: A rate cut by the Fed typically leads to increased foreign investment in emerging markets, including India. As US treasury yields decrease, investors may seek higher returns in Indian equities, potentially driving up stock prices

- Certain rate-sensitive sections, such as the banking, realty, and automobile sectors, tend to benefit significantly due to the US Fed rate cut

- Currency Markets: The Indian Rupee is likely to be strengthened making imports cheaper and exports costlier.

- Gold Prices: Gold prices are expected to move upwards as lower interest rates will make the fixed-income investments, such as bonds less attractive therefore increasing its demand.

- Drives Global Growth: Interest rate cuts reduce the cost of borrowing in U.S. dollars, thereby creating easier liquidity conditions for companies around the world

- Inflow of Funds into Emerging Markets: Lower U.S. interest rates should also lower the yield available on U.S. assets such as Treasurys, thus investors will be tempted towards the emerging markets for better yields.

- Influence RBI Policy Rate Stance: RBI too like the other central banks initiates a policy Rate change based on the cues offered by the US Fed.

- The RBI last cut the repo rate by 40 basis points to 4% in May 2020 during Covid-19 pandemic just like the US Fed.

Check Out UPSC NCERT Textbooks From PW Store

![]() 18 Sep 2024

18 Sep 2024

The Fed may go for a 25 basis point cut in its key rate to the 5.00%-5.25% range, or a 50 basis point reduction to 4.75%-5.00%

The Fed may go for a 25 basis point cut in its key rate to the 5.00%-5.25% range, or a 50 basis point reduction to 4.75%-5.00%