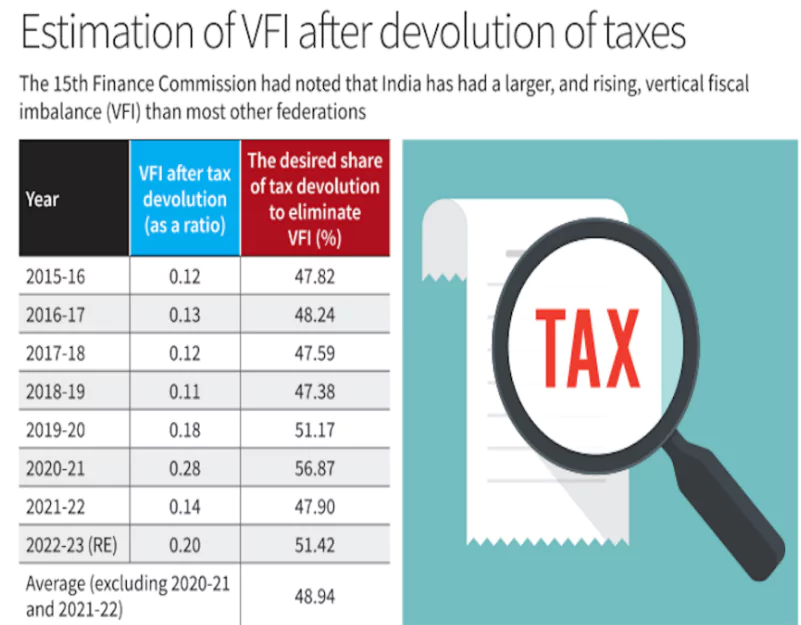

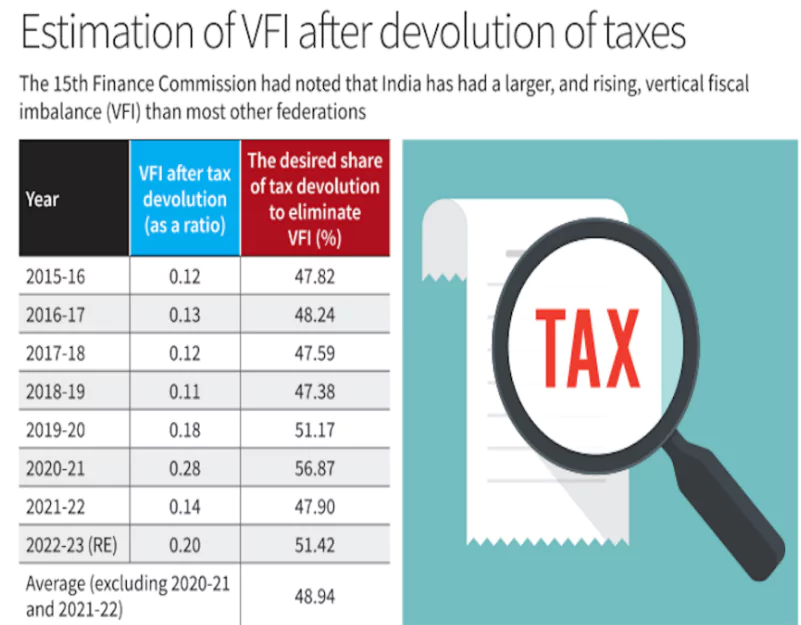

The role of the 16th Finance Commission should be to eliminate vertical fiscal imbalance in federal relations.

- The 16th Finance Commission of India was constituted on December 31, 2023, with Dr. Arvind Panagariya as its Chairman.

About Vertical Fiscal Imbalance

- About: Vertical fiscal imbalance refers to a situation in a federal system where there is a mismatch between the revenue-raising powers and expenditure responsibilities of different levels of government.

- Expenditure Data: As the 15th Finance Commission, states incur 61% of the revenue expenditure but collect only 38% of the revenue receipts.

- Dependency: Ability of the States to incur expenditures is dependent on transfers from the Union government.

- Calculating VFI in India: VFI = ORR/ORE

- ORR is the sum of the Own Revenue Receipts and the tax devolution from the Union government for all States.

- ORE is the Own Revenue Expenditure for all States.

- If this ratio is less than 1: It implies that the sum of own revenue receipts and tax devolution of the States is inadequate to meet the ORE of the States

Enroll now for UPSC Online Course

Agenda For The 16th Finance Commission

Focus Areas

|

Description

|

| Finance Devolution For Cities |

- Contribution of Indian Cities: Cities contribute around 66% of India’s GDP and about 90% of total government revenues and thus, are an important spatial zone for the overall development of India.

- Concerns:

-

- Inadequate Infrastructure: India’s economic scale is insufficient to meet rising needs.

- The World Bank estimates that $840 billion is needed for basic urban infrastructure in the next decade.

- Inadequate Devolution: Despite the efforts of five commissions since the 11th Finance Commission, financial devolution to cities remains inadequate.

- Impact on Development: Rapid urbanisation without appropriate fiscal action has adverse effects on development.

- The fiscal health of municipalities is poor, affecting both city productivity and quality of life.

|

| About the Taxation System |

- Impact of Goods and Service Tax (GST): It has reduced ULBs’ tax revenue (excluding property tax) from about 23% in 2012-13 to around 9% in 2017-18.

- Intergovernmental transfers (IGTs) to Urban Local Bodies (ULBs): In India, they are about 0.5% of GDP, much lower than the 2-5% typical of other developing nations.

-

- Example: South Africa allocates 2.6%, Mexico 1.6%, the Philippines 2.5%, and Brazil 5.1% of their GDPs to their cities.

- IGTs from States to ULBs are very low, with State Finance Commissions recommending only about 7% of States’ own revenue in 2018-19.

- Concerns:

- Persistency of Issues: Although IGTs make up about 40% of ULBs’ total revenue, issues persist regarding their predictability, earmarking for vulnerable groups, and horizontal equity.

- Parallel Agencies: The 13th Finance Commission observed that “parallel agencies and bodies are emasculating local governments both financially and operationally.”

- Example: Programs like the Member of Parliament Local Area Development Scheme and the Member of Legislative Assembly Local Area Development Scheme exacerbate this issue, distorting the federal structure.

- Need For: IGTs are crucial for ULBs, given their financial state and the need for stable support until their own revenues improve.

- Increasing the quantum of IGTs as a percentage of GDP is necessary.

|

| Census and Data |

- Concern:

- Reliance on Older Data: In the absence of the 2021 Census, reliance on 2011 data is inadequate for evidence-based fiscal devolution.

- Need For: India’s town figures must be captured by the 16th FC, including the significant migration to Tier-2 and 3 cities.

- India has approximately 4,000 statutory towns and an equal number of Census towns, with an estimated 23,000 villages, all of which are effectively

|

Check Out UPSC CSE Books From PW Store

![]() 6 Sep 2024

6 Sep 2024