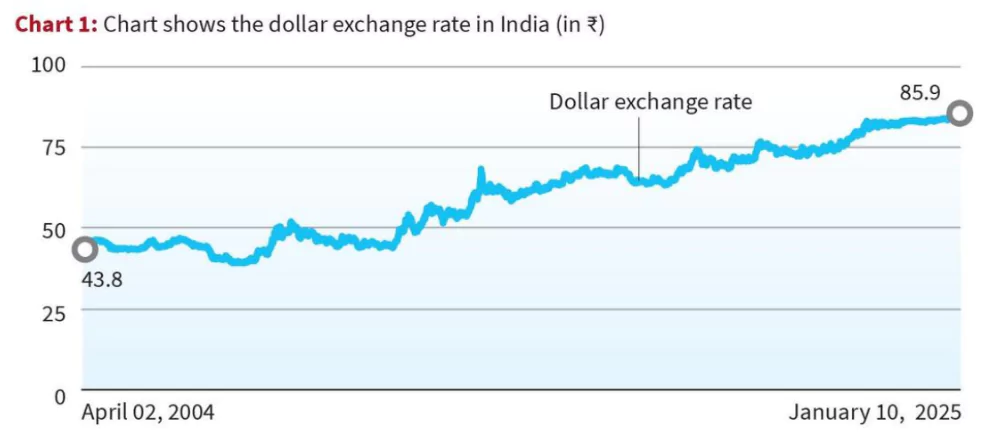

The Indian rupee has registered a sharp devaluation with respect to the dollar recently.

- The rupee has depreciated over 3.2% since September 2024 and has hit an all-time low of 86.71 against the US dollar.

RBI’s Response

- Intervention: RBI is intervening in the FOREX market by artificially increasing the supply of dollars in the foreign exchange market to support the decline of value of the rupee.

- As a result, India’s foreign exchange reserves dropped to an eight-month low of $640 billion from over $700 billion.

- RBI’s Traditional Stance: It has been to manage the rupee’s exchange value in such a way as to allow for a gradual depreciation in its value without too much volatility that could disrupt the economy.

Enroll now for UPSC Online Course

Reasons for the Depreciation

- US Dollar Strengthening: The US Dollar is getting stronger against other world currencies due to factors like improved macroeconomic scenario in the US including market expectations of reduced US trade deficits and safe-haven buying of dollar assets.

- Foreign Investors Exit: Due to expectations of a Fed Rate cut by the US, the bond yields in the US have risen attracting investors, who are exiting emerging markets like India.

- Trump Effect: The election of Donald Trump has also fueled speculations about the uncertainty regarding the new US government policies contributing to the rupee’s fall.

- Oil Crisis: Oil price volatility due to ongoing geopolitical tensions (Russia-Ukraine war, Middle East crisis, Red Sea shipping issues

- Higher Inflation in India: Higher inflation in India compared to the U.S. due to the Reserve Bank of India’s looser monetary policy is traditionally attributed for longer term trend of the rupee’s depreciation against the dollar

Impacts of the weakening of Rupee

- Imported Inflation: A weak rupee leads to expensive imports resulting in increase in the import bill of the country. Weaker rupee means more expensive imports which hike inflation in the country.

- Example: India’s import dependency on crude oil is nearly 88% and higher oil prices lead to higher transport costs, making food items costlier.

- Competitive Exports: A weaker rupee will help make exports more competitive and by protecting the interest of domestic manufacturers from cheap import substitutes.

- Export centric sectors like pharmaceuticals, textiles and IT sectors will stand to benefit from an improvement in export revenues in rupee terms

- Rise in Input Cost: The depreciation of the rupee leads to an increase in the cost of raw materials, components, and other inputs that are denominated in dollars.

- Trade Deficit: Higher import bill worsens trade deficit dampening economic growth by creating upward pressure on interest rates.

- Costlier Debt: Debt servicing costs of companies that have raised funds from overseas will go up.

- Foreign Education: Foreign education will become more expensive. Students now need to pay more rupees for every dollar charged by foreign institutions as fees.

- Remittances: Non-resident Indians (NRIs) who send money back home will end up sending more in the rupee value.

Check Out UPSC CSE Books From PW Store

Steps to Strengthen the Rupee

- To Sell Dollars: RBI can directly intervene in the foreign exchange market by selling US dollars from its foreign exchange reserves increasing dollar supply, reducing its demand and thus weakening the dollar relative to the rupee.

- Buying Rupees: By buying rupees, the RBI can increase the demand for the Indian currency, strengthening it.

- Interest Rate Adjustments: The RBI can adjust interest rates to influence the demand for the rupee. Higher interest rates can attract foreign investors, increasing the demand for the rupee.

- Liquidity Management: By controlling the liquidity in the market, the RBI can impact the exchange rate. Tightening liquidity can reduce inflationary pressures and strengthen the rupee

![]() 17 Jan 2025

17 Jan 2025