Context:

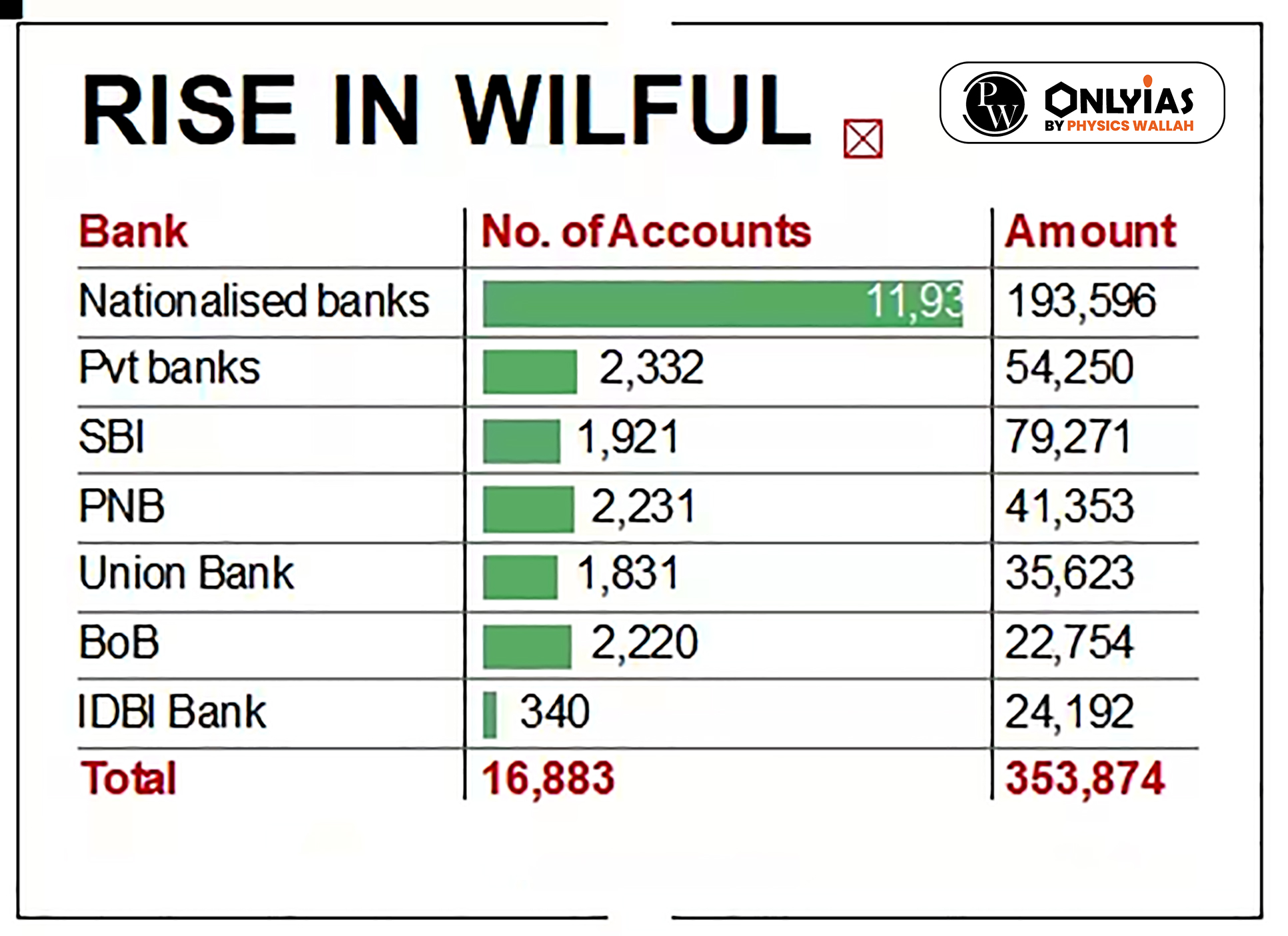

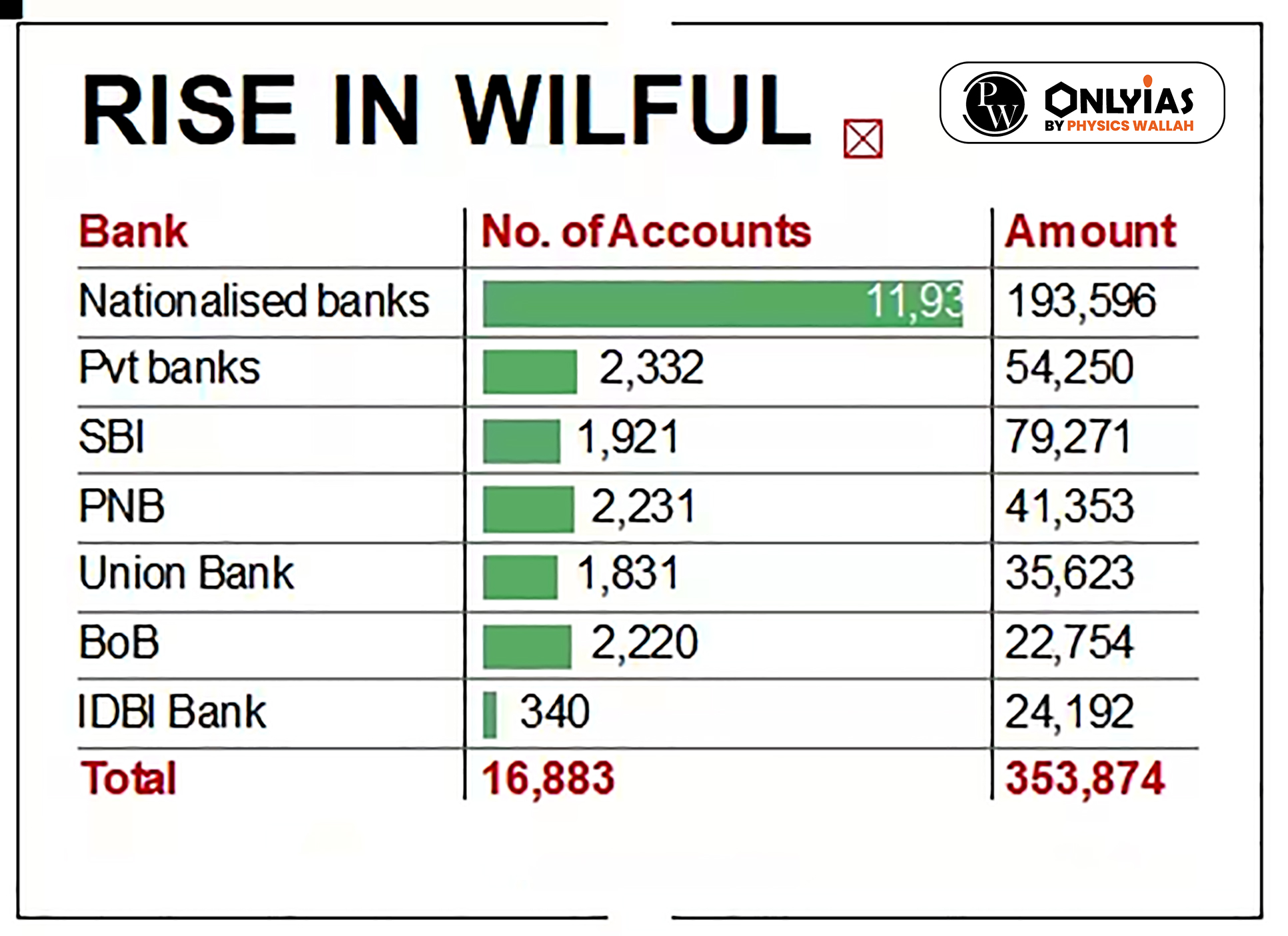

- Banks have filed suits against 36,150 NPA accounts to recover Rs 926,492 crore as of March 2023. Many legacy accounts will likely be added to the wilful default category when the RBI issues the final guidelines.

About Wilful Defaults: On September 21, the RBI proposed that lenders complete the process of classifying a borrower as a ‘wilful defaulter’ within six months of the account being declared as a non-performing asset (NPA).

- As per the RBI classification, a ‘wilful default’ would have occurred if the borrower has defaulted in meeting their repayment obligations to the lender even when they can honour the obligations.

- Interestingly, NPAs — loan accounts in which principal or interest is overdue for more than 90 days — which declined to a 10-year low of 3.9 percent in March 2023, is expected to fall further to 3.6 percent by March 2024, the RBI’s latest Financial Stability Report said.

RBI’s Position:On June 8, 2023, the RBI said in a circular that banks can undertake compromise settlements or technical write-offs regarding accounts categorized as wilful defaulters or fraud without prejudice to criminal proceedings against such debtors.

- Compromise Settlements to wilful defaulters is problematic for the banking sector as it will not only lead to erosion of public trust in the banking sector but also undermine the confidence of depositors.

| Compromise Settlement refers to a negotiated settlement where a borrower offers to pay and the bank agrees to accept in full and final settlement of its dues an amount less than the total amount due to them under the loan contract. |

Source: Indian Express

![]() 16 Oct 2023

16 Oct 2023