GST Council, a constitutional body under Article 279A, guides India’s GST system. Formed under the 101st Amendment, it ensures uniform tax structure, resolves disputes between centre and states, recommends tax rates, and supports seamless GST administration nationwide.

GST Council is a constitutional body responsible for guiding India’s Goods and Services Tax system. Chaired by the Union Finance Minister, it brings together central and state representatives to make decisions on tax rates, exemptions, and compliance measures. The council plays a key role in ensuring a uniform tax structure, resolving disputes between the centre and states, and promoting fiscal federalism. It also focuses on simplifying the tax system, supporting businesses, and protecting the interests of consumers across the country.

The 56th GST Council Meeting 2025 will commence today, i.e., 03 and 4th September 2025, in New Delhi. The two-day conference will be led by Union Finance Minister Nirmala Sitharaman. The Council is likely to discuss India’s next-generation GST changes, which include rationalising tax rates and simplifying compliance. In the past, during his Independence Day speech this year, Prime Minister Narendra Modi emphasized how the Goods and Services Tax has helped the country. Mr. Modi highlighted the significance of the upcoming GST changes, which will benefit the average citizen, farmers, middle class, and MSMEs. The next-generation GST changes will be presented on Diwali, lowering taxes on critical commodities while also bringing assistance to local sellers and consumers.

GST Council is a constitutional body under Article 279A of the Indian constitution.

The GST Council has played a crucial role in establishing regulations, resolving conflicts, and guaranteeing the smooth operation of the GST system across the country since it was founded. Its main Objectives of GST Council include the following:

The GST Council, created by the 101st Constitutional Amendment Act, is a constitutional body entrusted with providing significant changes to the Goods and Services Tax. Significant GST Council Constitutional Provisions regarding the Council include:

Formation of the GST Council: Article 279A (1) requires the President to establish the GST Council within 60 days of the 101st Amendment Act, 2016.

GST Levy Date Recommendation: Under Article 279A (5), the GST Council is empowered to suggest the date on which GST is levied on particular items such as petroleum, diesel, petrol, natural gas, and aviation fuel.

Guiding Principles for Functioning: Article 279A (6) requires that the GST Council’s activities create a single national market and harmonize GST structures.

Procedural Framework: Article 279A (8) requires the GST Council to develop procedures for carrying out its powers.

Validity of GST Council Proceedings: Article 279A (10) guarantees the legality of GST Council proceedings irrespective of vacancies or faults, as long as they have no impact on the merits or procedural integrity.

GST on Specific Goods: The GST Council has been charged by Article 279A (11) with resolving disputes between the Government of India and States over GST implementation.

The GST council is likely to play a more effective role in ensuring fiscal federalism in the country by giving voice to the states. In the interest of the nation, there must be a consensual decision on issues concerning GST.

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series |

The GST Council is a constitutional body under Article 279A of the Indian constitution.

The GST council was formed for the smooth and efficient administration of the new tax regime under the GST system.

The decision-making will be based on a majority of not less than three-fourths of the weighted votes of the members present and voting at the meeting.

A recent decision of the Supreme Court ruled that the recommendations of the Goods and Services Tax (GST) Council are not binding on either the Union government or the states.

Goods and Service Tax (GST) is a tax regime that has replaced many indirect taxes in India such as the excise duty, VAT, services tax, etc. It is a comprehensive, multi-stage, destination-based tax that is levied on every value addition.

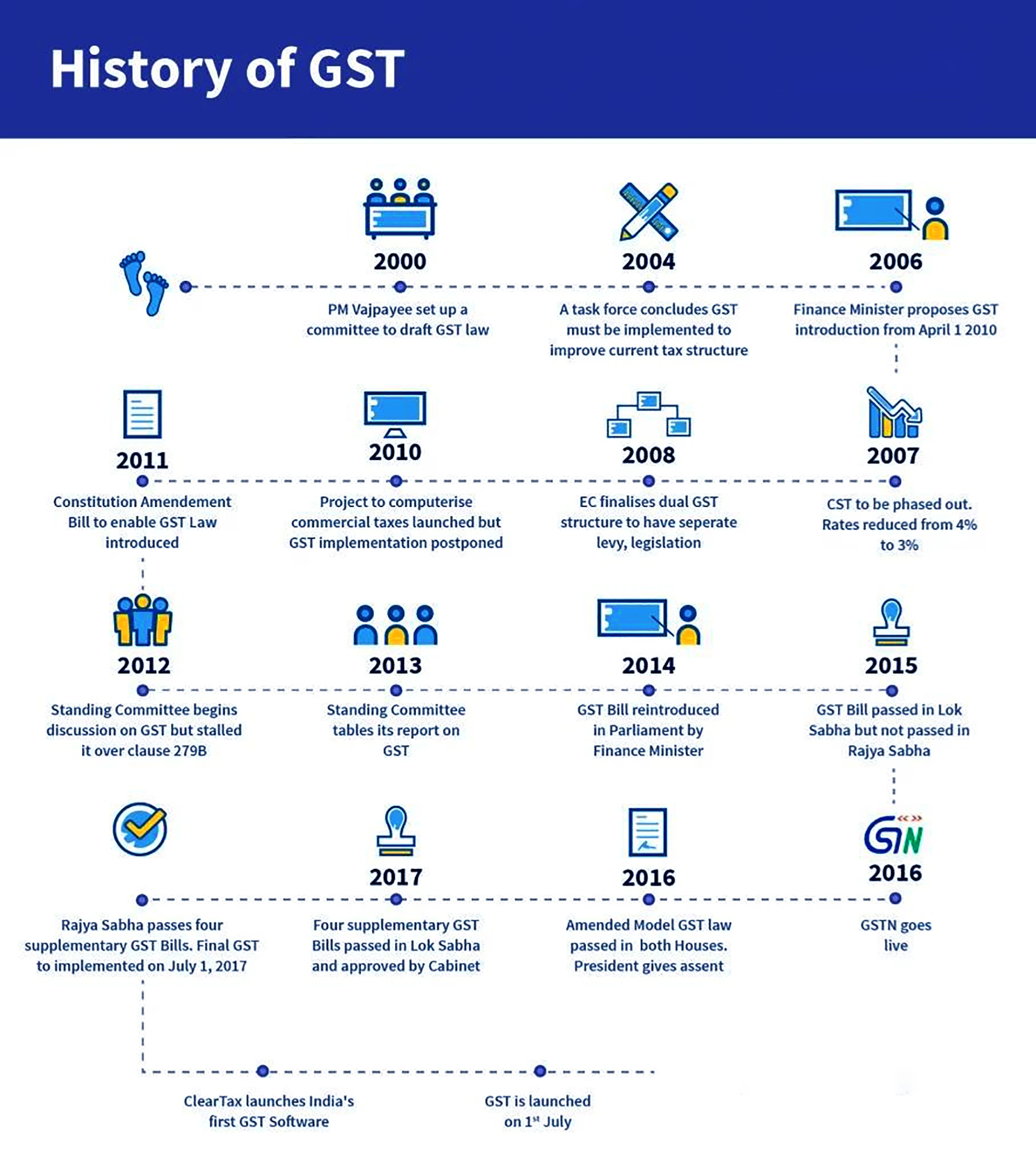

The Government of India brought the 101st Amendment Act of 2016 to introduce the Goods and Service Tax in the country.

GST has subsumed the majority of indirect taxes such as service tax, Value Added Tax (VAT), Central Excise, etc.

Currently, there are five GST slabs: 5%, 12%, 18% and 28%.

<div class="new-fform">

</div>