As per Article 280(1), the Finance Commission is a constitutional body formed by the President every five years to recommend on Centre-State financial relations and tax distribution.

Finance Commission (Article 280): The Sixteenth Finance Commission (SFC) held its first meeting to discuss the terms of reference (ToR) and other matters. The Union Cabinet has approved the terms of reference for the 16th Finance Commission of India. The approval of ToR will play a crucial role in determining the financial distribution between the central and state governments for the period starting April 1, 2026.

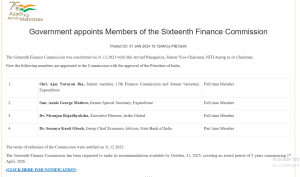

The 16th Finance Commission of India has been formed to define the distribution of the Centre’s tax revenue to the states for a period of five years, beginning from FY 2026-27. It will present its recommendations by 31 October 2025. Below are the details of the Commission’s composition.

This Commission is responsible for reviewing fiscal policies and recommending the distribution of resources between the Centre and states to enhance fiscal stability and economic growth for the five-year award period starting 1 April 2026.

The 16th Finance Commission of India has been set up to redefine the distribution of tax revenues between the Centre and the states for the fiscal period starting FY 2026-27. The Commission, led by a team of distinguished economic experts, is expected to submit its recommendations by 31 October 2025. Below is the composition of the Commission:

Ready to boost your UPSC 2026 preparation? Join PW’s UPSC online courses today!

UPSC Exam Related Articles

UPSC Prelims 2025 Exam

UPSC Notification 2025

UPSC Preparation 2025

UPSC Eligibility 2025

UPSC Exam Pattern

UPSC Syllabus

Finance Commission is a quasi-judicial body provided by Article 280 of the constitution.

The President of India constitutes the Finance Commission by appointing members every fifth year or at such a time that is considered necessary.

The members of the commission are appointed for the duration as specified in presidential order. Members are eligible for reappointment.

The main function of the commission is to distribute the shares of net proceeds of tax between the Union and the States and the allocation between the States of the respective shares of such proceeds.

Arvind Panagariya is the chairman of the 16th Finance Commission.

For distribution, the commission has suggested 12.5% weightage to demographic performance, 45% to income, 15% each to population and area, 10% to forest and ecology, and 2.5% to tax and fiscal efforts.

According to Article 280, the President of India must appoint a Finance Commission every five years to propose policies for grants-in-aid, the allocation of taxes between the Union and the States, and strategies to increase state funding for local bodies.

Formed under Article 280 of the Indian Constitution, the Finance Commission is a constitutional body formed to divide up certain tax resources between the federal government and the state governments.

No, the Finance Commission is not a permanent authority. The President of India constitutes the finance commission every five years or earlier, if it requires establishment.

K.C. Neogy served as the first chairman of the Finance Commission of India when it was formed in 1951. The First Finance Commission was constituted on 22.11.1951

The current and Sixteenth Finance Commissioner of India is Shri Arvind Panagariya. The Sixteenth Finance Commission was constituted on 31.12.2023 and Shri Arvind Panagariya is a former Vice Chairman of NITI Aayog.

R.K. Shanmukham Chetty was India's first Finance Minister after independence. He served as the first Finance Minister of India from 1947 to 1949. He released India's first Union Budget after independence.

The Role of finance commission is to resolve budgetary imbalances, promote collaborative federalism in India, and guarantee a fair division of financial resources among the federal and state governments.

When it comes to fiscal federalism and income distribution, the Finance Commission is a constitutional authority. NITI Aayog is an advisory organisation that works to promote joint federalism and equitable development plans among governments.

<div class="new-fform">

</div>