2024

Question 1

Consider the following statements:

Statement-I: If the United States of America (USA) were to default on its debt, holders of US Treasury Bonds will not be able to exercise their claims to receive payment.

Statement-II: The USA Government debt is not backed by any hard assets, but only by the faith of the Government.

Which one of the following is correct in respect of the above statements?

(a)Both Statement-I and Statement-II are correct and Statement-II explains Statement-I.

(b) Both Statement-I and Statement-II are correct, but Statement-II does not explain Statement-I.

(c)Statement-I is correct, but Statement-II is incorrect.

(d)Statement-I is incorrect, but Statement-II is correct.

ExplanationAns: a

Exp:

Statement I is incorrect: If the U.S. government misses ro defaults on its debt payment, American or even foreginers debt holder can litigate or sue in either U.S. district court or the U.S. Court of Federal Claims, which oversees (among other things) disputes between the federal government and U.S. contractors. Thus, the holders of US Treasury Bonds will be able to exercise their claims to receive payment.

Statement II is correct: Treasury securities are backed by the full faith and credit of the U.S. government. Investment professionals use Treasury yields as the risk-free rate or the rate of return offered by an investment that carries no risk. The federal government has never defaulted on an obligation, and it’s universally believed it never will. Investors who hold T-bills can rest assured that they will not lose their investment.

Question 2

Consider the following statements:

Statement-I: Syndicated lending spreads the risk of borrower default across multiple lenders.

Statement-II: The syndicated loan can be a fixed amount/lump sum of funds, but cannot be a credit line.

Which one of the following is correct in respect of the above statements?

(a) Both Statement-I and Statement-II are correct and Statement-II explains Statement-I.

(b) Both Statement-I and Statement-II are correct, but Statement-II does not explain Statement-I.

(c) Statement-I is correct, but Statement-II is incorrect.

(d) Statement-I is incorrect, but Statement-II is correct.

ExplanationAns: c

Exp:

Statement I is correct: A syndicated loan is financing offered by a syndicate made up of a group of lenders that work together to provide funds for a borrower. The borrower can be a corporation, a large project, or a sovereign government. Syndicated loans involve large sums, which allows the risk to be spread out among several financial institutions to mitigate the risk in case the borrower defaults.

Statement II is incorrect: In a Syndicate loan, the borrower can be a corporation, a large project, or a sovereign government. The loan can involve a fixed amount of funds, a credit line, or a combination of the two.

Question 3

Consider the following statements in respect of the digital rupee:

1. It is a sovereign currency issued by the Reserve Bank of India (RBI) in alignment with its monetary policy.

2. It appears as a liability on the RBI’s balance sheet.

3. It is insured against inflation by its very design.

4. It is freely convertible against commercial bank money and cash.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 1 and 3 only

(c) 2 and 4 only

(d) 1, 2 and 4

ExplanationAns: d

Exp:

The Central Bank Digital Currency (CBDC) is the Reserve Bank of India’s official form of currency. The regulator stated that the RBI’s CBDC, also known as the Digital Rupee or e-Rupee, is interchangeable one-to-one at par with the fiat currency and is the same as a sovereign currency.

Main features of Digital Rupee

It is not insured against inflation by its very design. Thus, statement 3 is incorrect

Question 4

With reference to the Digital India Land Records Modernisation Programme, consider the following statements:

1. To implement the scheme, the Central Government provides 100% funding.

2. Under the Scheme, Cadastral Maps are digitised.

3. An initiative has been undertaken to transliterate the Records of Rights from local language to any of the languages recognized by the Constitution of India.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: d

Exp:

Digital India Land Records Modernization Programme (DILRMP) a Central Sector Scheme with 100% Central Government funding with effect from 1st April 2016. Hence , Statement 1 is correct

It has following major components:

Question 5

Consider the following statements:

1. In India, Non-Banking Financial Companies can access the Liquidity Adjustment Facility window of the Reserve Bank of India.

2. In India, Foreign Institutional Investors can hold the Government Securities (G-Secs).

3. In India, Stock Exchanges can offer Separate trading platforms for debts.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 3 only

(c) 1, 2 and 3

(d) 2 and 3 only

ExplanationAns: c

Exp:

Statement 1 in correct: Liquidity Adjustment Facility(LAF) is monetary policy tool of RBI to inject or absorbs liquidity. Under the LAF Scheme, Reserve Bank will continue to have the discretion to conduct overnight repo or longer term repo auctions at fixed rate or at variable rates depending on market conditions and other relevant factors. Under ,above provisions RBI has planned a Rs 50000-crore liquidity infusion through Targeted Long Term Repo Operations (TLTRO) 2.0 for NBFCs.

Statement 2 is correct: FPI can invest in G-secs. The Reserve Bank of India (RBI) on April 26, 2024 kept the investment limit by Foreign Portfolio Investors (FPI) in government securities unchanged at 6 percent of the outstanding securities stocks for 2024-25. Moreover, the central bank, in a statement, announced that it would maintain the FPI limits for investment in state government securities and corporate bonds at 2 percent and 15 percent, respectively, of the outstanding securities stocks for FY25.

Statement 3 is correct: In India, Stock Exchanges can offer Separate trading platforms for debts. NSE was the first exchange to offer a separate trading platform for debts.

Question 6

In India, which of the following can trade in Corporate Bonds and Government Securities?

1. Insurance Companies

2. Pension Funds

3. Retail Investors

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: d

Exp:

A Government Security (G-Sec) is a tradeable instrument issued by the Central Government or the State Governments. It acknowledges the Government’s debt obligation. Such securities are short term (usually called treasury bills, with original maturities of less than one year) or long term (usually called Government bonds or dated securities with original maturity of one year or more).

Question 7

Consider the following:

1. Exchange-Traded Funds (ETF)

2. Motor vehicles

3 .Currency swap

Which of the above is/are considered financial instruments?

(a) 1 only

(b) 2 and 3 only

(c) 1, 2 and 3

(d) 1 and 3 only

ExplanationAns : d

Exp:

Financial instrument is a contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity.

Following are the different types of financial instruments :

Thus motor Vehicles are not a type of financial instrument.

Question 8

With reference to the sectors of the Indian economy, consider the following pairs:

| Economic activity | Sector | |

| 1. | Storage of agricultural produce | Secondary |

| 2. | Dairy farm | Primary |

| 3. | Mineral exploration | Tertiary |

| 4. | Weaving cloth | Secondary |

How many of the pairs given above are correctly matched?

(a) Only one

(b) Only two

(c) Only three

(d) All four

ExplanationAns: b

Exp:

Question 9

With reference to physical capital in Indian economy, consider the following pairs:

| Items | Category | |

| 1. | Farmer’s plough | Working capital |

| 2. | Computer | Fixed capital |

| 3. | Yarn used by the weaver | Fixed capital |

| 4. | Petrol | Working capital |

How many of the above pairs are correctly matched?

(a) Only one

(b) Only two

(c) Only three

(d) All four

ExplanationAns: b

Exp:

Physical capital refers to tangible assets made by humans that a corporation buys or invests in and then uses to produce finished goods or services. It is one of the three factors of production together with land or natural resources and labor or human resources, involving physical assets, such as machines, cars, computers, buildings, etc. it is of two types:

Question 10

With reference to the rule/rules imposed by the Reserve Bank of India while treating foreign banks, consider the following statements:

1. There is no minimum capital requirement for wholly owned banking subsidiaries in India.

2. For wholly owned banking subsidiaries in India, at least 50% of the board members should be Indian nationals.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ExplanationAns: b

Exp:

Statement 1 is incorrect: As per RBI, the Wholly Owned Subsidiary (WOS) was to have a minimum capital requirement of Rs.300 crore i.e. Rs.3 billion and would need to ensure sound corporate governance. The WOS was to be treated on par with the existing branches of foreign banks for branch expansion with flexibility to go beyond the existing WTO commitments of 12 branches in a year and preference for branch expansion in under-banked areas.

Statement 2 is correct: As per RBI, the composition of the board of directors of Wholly owned Subsidiary (WOS) should meet the following requirements:

Question 11

With reference to Corporate Social Responsibility (CSR) rules in India, consider the following statements:

1. CSR rules specify that expenditures that benefit the company directly or its employees will not be considered as CSR activities.

2. CSR rules do not specify minimum spending on CSR activities.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ExplanationAns : a

Exp:

A company satisfying any of the following criteria during the immediately preceding financial year is required to comply with CSR provisions specified under section 135(1) of the Companies Act, 2013 read with the Companies (CSR Policy) Rules, 2014 made there under:

Statement 1 is correct : • The CSR projects or programs or activities that benefit only the employees of the company and their families shall not be considered as CSR activities in accordance with section 135 of the Act. • One-off events such as marathons/ awards/ charitable contribution/ advertisement/sponsorships of TV programmes etc. would not be qualified as part of CSR expenditure. • Expenses incurred by companies for the fulfillment of any Act/ Statute of regulations (such as Labour Laws, Land Acquisition Act etc.) would not count as CSR expenditure under the Companies Act. • Contribution of any amount directly or indirectly to any political party shall not be considered as a CSR activity. • Activities undertaken by the company in pursuance of its normal course of business.

Statement 2 is not correct: If the company has not completed three financial years since its incorporation, but it satisfies any of the criteria mentioned in section 135(1), the CSR provisions including spending of at least two per cent of the average net profits made during immediately preceding financial year(s) are applicable.

Example: Company A is incorporated during FY 2018-19, and as per eligibility criteria the company is covered under section 135(1) for FY 2020-21. The CSR spending obligation under section 135(5) for Company A would be at least two per cent of the average net profits of the company made during FY 2018-19 and FY 2019-20.

Question 12

With reference to the Indian economy, “Collateral Borrowing and Lending Obligations” are the instruments of:

(a) Bond market

(b) Forex market

(c) Money market

(d) Stock market

ExplanationAns: c

Exp:

Reserve Bank of India has been promoting collateralised borrowing / lending operations by market participants. The Clearing Corporation of India Ltd. (CCIL) has developed and introduced with effect from January 20, 2003 a money market instrument called Collateralised Borrowing and Lending Obligation (CBLO). since CCIL is considered as a non-bank institution, borrowing bank should classify its borrowing under CBLO as ‘Liability in India to Others’ which qualify for reserve requirements. Accordingly, scheduled commercial banks are required to include in their net demand and time liability (NDTL), the borrowing under CBLO. However, in order to develop CBLO as a money market instrument, it has been decided to grant banks a special exemption from CRR prescription subject to the bank maintaining statutory minimum CRR of 3%;.

2023

Question 1

Consider the following statements:

Statement-I: Interest income from the deposits in Infrastructure Investment Trusts (InvITs) distributed to their investors is exempted from tax, but the dividend is taxable.

Statement-II: InvITs are recognized as borrowers under the ‘Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002”.

Which one of the following is correct in respect of the above statements?

(a) Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

(b) Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

(c) Statement-I is correct but Statement-II is incorrect

(d) Statement-I is incorrect but Statement-II is correct

Ans: d

Exp:

Infrastructure Investment Trusts (InvITs) are infrastructure developer-sponsored Trusts that own, operate, and invest in completed and under- construction infrastructure projects. These infrastructure assets include roads and highways, power distribution networks, telecom towers, fiber

optic networks, etc.

Statement I is not correct: Any dividend or interest income that you get from an InvIT is completely taxable as per your Income Tax Slab rate. This income has to be declared every year in your Income Tax Return under the head “Income from Other Sources”. So if you are in the highest Income Tax bracket, you may have to pay 30% tax on any dividends or interest that you receive from an InvIT. Capital Gains taxation rules are applicable only if you sell your InvITs units. If you have stayed invested in InvITs for up to 3 years prior to the sale, Short Term Capital Gains (STCG) taxation rules are applicable.

Statement II is correct: InvITs and REITs now recognised as borrowers under the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest (SARFAESI) Act and lenders to these trusts have adequate statutory enforcement options, absence of which was earlier becoming a constraint for bankers to lend directly at trust level. Insurance regulatory and development authority of India (IRDAI) has recently allowed insurers to invest in debt instruments of InvITs and REITs rated AA and above as a part of their approved investments, which shows growing comfort of lenders as well as investors around such structures.

Hence, Statement-I is incorrect but Statement-II is correct.

Question 2

Consider the following statements:

Statement-I: In the post-pandemic recent past, many Central Banks worldwide had carried out interest rate hikes.

Statement-II: Central Banks generally assume that they have the ability to counteract the rising consumer prices via monetary policy means.

Which one of the following is correct in respect of the above statements?

(a) Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

(b) Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

(c) Statement-I is correct but Statement-II is incorrect

(d) Statement-I is incorrect but Statement-II is correct

Ans: a

Exp:

Statement I is correct: In the post-pandemic recent past, Financial conditions have tightened as central banks continue to hike interest rates. Amid the highly uncertain global environment risks to financial stability have increased substantially.

Statement II is correct: Central banks use monetary policy to manage economic fluctuations and achieve price stability, may it be inflation or deflation. Central banks conduct monetary policy by adjusting the supply of money, usually through buying or selling securities in the open market. Open market

operations affect short-term interest rates, which in turn influence longer-term rates and economic activity. When central banks lower interest rates, monetary policy is easing. When they raise interest rates, monetary policy is tightening. Hence, Both Statement-I and Statement-II are correct

and Statement-II is the correct explanation for Statement-I.

Question 3

Which one of the following activities of the Reserve Bank of India is considered to be part of ‘sterilization’?

(a) Conducting ‘Open Market Operations’

(b) Oversight of settlement and payment systems

(c) Debt and cash management for the Central and State Governments

(d) Regulating the functions of Non-banking Financial Institutions

Ans: a

Exp:

Sterilization is a form of monetary action in which a central bank seeks to limit the effect of inflows and outflows of capital on the money supply. Sterilization

most frequently involves the purchase or sale of financial assets by a central bank which is known as Open Market Operations and is designed to offset the effect of foreign exchange intervention. The sterilization process is used to manipulate the value of one domestic currency relative to another and is initiated in the foreign exchange market. It is used by central banks in order to stem the negative effects emerging from capital inflows or outflows from a country’s economy. For example, a U.S. investor looking to invest in India must use dollars to purchase rupees. If a lot of U.S. investors start buying up rupees,

the rupee exchange rate will increase. At this point, the Indian central bank can either let the fluctuation continue, which can drive up the price of Indian exports, or it can buy foreign currency with its reserves in order to drive down the exchange rate.

Question 4

Consider the following markets:

1. Government Bond Market

2. Call Money Market

3. Treasury Bill Market

4. Stock Market

How many of the above are included in capital markets?

(a) Only one

(b) Only two

(c) Only three

(d) All four

ExplanationAns: b

Exp:

Financial markets refer broadly to any marketplace where securities trading occurs, including the stock market, bond market, forex market, and derivatives

market. It is classified into:

Capital Market: Capital markets are financial markets where long-term securities such as stocks, bonds, and other financial instruments are bought and sold. These markets facilitate the transfer of capital from investors to those who need it to fund projects, expand their businesses, or make other

investments. This market includes:

Money Market: The money market is a short-term lending system. Borrowers tap it for the cash they need to operate from day to day. Lenders use it to

put spare cash to work. Examples of money market instruments include:

Question 5

Which one of the following best describes the concept of ‘Small Farmer Large Field’?

Ans: b

Exp:

About ‘Small Farmer Large Field’:

Question 6

Consider the following statements:

1. The Government of India provides Minimum Support Price for niger (Guizotia abyssinica) seeds.

2. Niger is cultivated as a Kharif crop.

3. Some tribal people in India use niger seed oil for cooking.

How many of the above statements are correct?

(a) Only one

(b) Only two

(c) All three

(d) None

ExplanationAns: c

Exp:

About Niger:

Niger seed is cultivated in India as a Kharif crop and is one of the 22 mandated crops for which Government of India announces Minimum Support Price (MSP).

According to a 2013 report by All India Coordinated Research Project (AICRP), Niger seed has traditionally “been the lifeline of tribal agriculture and economy in several states across India. The tribal population uses niger seed oil for cooking, the press cake post oil-extraction as livestock feed, and also consume the seeds as a condiment. Some features of the Niger seed are:

About Minimum Support Price:

Question 7

Consider the investments in the following assets:

1. Brand recognition

2. Inventory

3. Intellectual property

4. Mailing list of clients

How many of the above are considered intangible investments?

(a) Only one

(b) Only two

(c) Only three

(d) All four

ExplanationAns: c

Exp:

An asset is a resource with economic value that an individual, corporation, or country owns or controls. There are two types of asset categories:

Tangible Asset: Tangible assets are physical and measurable assets that are used in a company’s operations. Tangible assets form the backbone of a

company’s business by providing the means by which companies produce their goods and services. These includes:

Intangible Assets: Intangible assets are nonphysical assets used over the long term. Intangible assets are often intellectual assets, and as a result, it’s difficult to assign a value to them because of the uncertainty of future benefits. These Includes:

Question 8

Consider the following statements:

Statement-I: India accounts for 3.2% of global export of goods.

Statement-II: Many local companies and some foreign companies operating in India have taken advantage of India’s ‘Production-linked Incentive’ scheme.

Which one of the following is correct in respect of the above statements?

(a) Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

(b) Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

(c) Statement-I is correct but Statement-II is incorrect

(d) Statement-I is incorrect but Statement-II is correct

Ans: d

Exp:

Statement I is not correct: As per the WTO data India’s share in global exports for merchandise was 1.7 % and in global imports was 2.6 % which is much

less than 3.2%. For the year 2018 for service sector, India’s share in global exports was 3.5 % and imports was 3.2 %.

Statement II is correct: Production-Linked Incentive or PLI scheme is a scheme that aims to give companies incentives on incremental sales (over FY 2019-20) from products manufactured in domestic units. The scheme invites foreign companies to set up units in India, however, it also aims to encourage local companies to set up or expand existing manufacturing units and also to generate more employment and cut down the country’s reliance on imports from other countries.

Question 9

Consider the following statements with reference to India:

1. According to the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006’, the ‘medium enterprises’ are those with investments in plant and machinery between 15 crore and 25 crore.

2. All bank loans to the Micro, Small and Medium Enterprises qualify under the priority sector.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ExplanationAns: b

Exp:

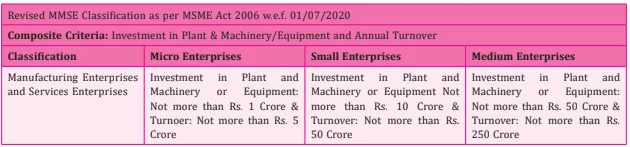

The classification of Micro, Small and Medium Enterprises is defined under the MSMED Act 2006 amendment dated 01/06/2020. The Micro, Small and Medium Enterprises is based on the Investment in Plant, Machinery or Equipment values (excluding land and building) and Annual Turnover.

Statement 2 is correct: The RBI works with banks to encourage them to lend money to priority economic sectors, including agriculture and related industries, education, affordable housing, and food for the less fortunate. All bank loans to MSMEs that meet the requirements outlined therein are eligible to be categorised as priority sector lending. Reserve Bank of India (RBI) has taken some measures for improving flow of credit to MSME sector are as

under:

Question 10

With reference to Central Bank digital currencies, consider the following statements:

1. It is possible to make payments in a digital currency without using the US dollar or SWIFT system.

2. A digital currency can be distributed with a condition programmed into it such as a time- frame for spending it.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ExplanationAns: c

Exp:

About Central Bank Digital Currencies:

Statement 1 is correct: A type of digital currency issued by a nation’s central bank is known as a central bank digital currency (CBDC). They resemble cryptocurrencies, with the exception that the central bank sets their value, which is equivalent to the nation’s fiat currency. Countries will be able to transact bilaterally and without the need of the Society for Worldwide Interbank Financial Telecommunication (SWIFT) or other comparable settlement systems in the direct exchange of digital currency.

Statement 2 is correct: CBDC isn’t a brand-new kind of money; rather, it’s a type of central bank electronic cash that may be used by individuals and organisations to make payments. Digital currency can be distributed with a condition programmed into it such as the time frame for spending it.

Question 11

In the context of finance, the term ‘beta’ refers to

(a) the process of simultaneous buying and selling of an asset from different platforms

(b) an investment strategy of a portfolio manager to balance risk versus reward

(c) a type of systemic risk that arises where perfect hedging is not possible

(d) a numeric value that measures the fluctuations of a stock to changes in the overall stock market

Ans: d

Exp:

About Beta:

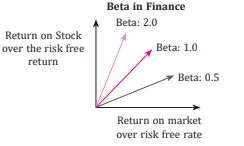

The Capital Asset Pricing Model (CAPM) is a model that describes the relationship between the expected return and risk of investing in a security. It shows

that the expected return on a security is equal to the risk-free return plus a risk premium, which is based on the beta of that security. The beta is a numeric value that is a measure of a stock’s risk (volatility of returns) reflected by measuring the fluctuation of its price changes relative to the overall market. In other words, it is the stock’s sensitivity to market risk. For instance, if a company’s beta is equal to 1.5 the security has 150% of the volatility of the market average. However, if the beta is equal to 1, the expected return on a security is equal to the average market return. A beta of -1 means security has a

perfect negative correlation with the market.

Question 12

In the context of finance, the term ‘beta’ refers to

(a) the process of simultaneous buying and selling of an asset from different platforms

(b) an investment strategy of a portfolio manager to balance risk versus reward

(c) a type of systemic risk that arises where perfect hedging is not possible

(d) a numeric value that measures the fluctuations of a stock to changes in the overall stock market

Ans: b

Exp:

About Self-Help Groups (SHGs):

Question 13

Consider the following statements:

Statement-I: India’s public sector health care system largely focuses on curative care with limited preventive, promotive and rehabilitative care.

Statement-II: Under India’s decentralized approach to health care delivery, the States are primarily responsible for organizing health services.

Which one of the following is correct in respect of the above statements?

(a) Both Statement-I and Statement-II are correct and Statement-II is the correct explanation for Statement-I

(b) Both Statement-I and Statement-II are correct and Statement-II is not the correct explanation for Statement-I

(c) Statement-I is correct but Statement-II is incorrect

(d) Statement-I is incorrect but Statement-II is correct

Ans: b

Exp:

Statement-I is correct: According to National Health Policy 2017 the public health care system in India is to improve health status through concerted policy action in all sectors and expand preventive, promotive, curative, palliative and rehabilitative services provided through the public health sector with focus on quality

Statement-II is correct: The states are primarily in charge of planning health services under India’s decentralised system for providing medical care. In the Indian Constitution health is a component of state subject as a part of the Seventh Schedule.

2022

Question 1

With reference to the Indian economy, consider the following statements:

1. If the inflation is too high, the Reserve Bank of India (RBI) is likely to buy government securities.

2. If the rupee is rapidly depreciating, RBI is likely to sell dollars in the market.

3. If interest rates in the USA or European Union were to fall, that is likely to induce RBI to buy dollars.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: b

Sub-Theme: Qualitative Tools to control

Statement 1 is incorrect: If the inflation is too high, Reserve Bank of India (RBI) is likely to reduce the money supply in the economy to control inflation. Thus, RBI sells the government securities so as to suck the excess money supply from the economy and to control the inflation.

Statement 2 is correct: RBI intervenes in the currency market to support the rupee because if it becomes a weak domestic unit then it can increase a country’s import bill. It can intervene directly in the currency market by buying and selling dollars. If RBI wishes to prop up rupee value, then it can sell dollars and when it needs to bring down rupee value, it can buy dollars.

Statement 3 is correct: When the US raises its domestic interest rates, this tends to make India less attractive for the currency trade. As a result, it pulls some money from the Indian market out and flows back to the US, thereby decreasing the value of India’s currency against the US dollar. Therefore, if interest rates in the USA or EU were to fall, then it is likely to induce RBI to buy dollars.

Question 2

Consider the following statements:

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: b

Sub-Theme: Credit Rating

Statement 1 is incorrect: In India, credit rating agencies are regulated by Securities and Exchange Board of India (SEBI).

Statement 2 is correct: ICRA (Investment Information and Credit Rating Agency of India Ltd.) was set up in 1991 by IFCI, LIC, SBI and select banks as well as financial institutions to rate debt instruments.

Statement 3 is correct: In India there are six credit rating agencies registered under Securities and Exchange Board of India (SEBI) namely, CRISIL, ICRA, CARE, SMERA, Fitch India and Brickwork Ratings.

Credit Rating

Question 3

With reference to the Banks Board Bureau (BBB)’, which of the following statements are correct?

Select the correct answer using the code given below.

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: b

Sub-Theme: Bank Board Bureau

Statement 1 is incorrect: Banks Board Bureau comprises the Chairman, three ex-officio members i.e. Secretary of the Department of Public Enterprises, Secretary of the Department of Financial Services and Deputy Governor of the Reserve Bank of India, and five expert members, two of which are from the private sector. The Chairman is selected by the central government and the RBI governor does not head it.

Statement 2 is correct: Banks Board Bureau recommends for the selection of head for Public Sector Banks and other key personnel if required.

Statement 3 is correct: BBB develops strategies for raising capital and improving performance of PSBs.

Banks Board Bureau

Question 4

In India, which one of the following is responsible for maintaining price stability by controlling inflation?

(a) Department of Consumer Affairs

(b) Expenditure Management Commission

(c) Financial Stability and Development Council

(d) Reserve Bank of India

ExplanationAns: d

Sub-Theme: Monetary Policy

Option (d) is correct: In India, the responsibility for maintaining price stability and controlling inflation lies with the Reserve Bank of India (RBI). The RBI is the central bank of India and is responsible for regulating the supply of money in the economy through various monetary policy measures such as adjusting interest rates, controlling the reserve ratios of banks, and buying or selling government securities in the open market.

MONETARY POLICY

Question 5

With reference to the expenditure made by an organization or a company, which of the following statements is/are correct?

Select the correct answer using the code given below.

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ExplanationAns: a

Sub-Theme: Expenditure

Statement 1 is correct: When a company funds are used to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment are known as Capital Expenditure (CapEx) of a Company.

Statement 2 is incorrect: Equity financing is the process of raising capital through the sale of shares. It is an example of non-debt capital receipts.

Capital Expenditure (CapEx) of a Company:

Equity financing:

Question 6

With reference to Indian economy, consider the following statements:

Which of the above statements is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ExplanationAns: c

Sub-Theme: Basic Concept of Economy

Statement 1 is correct: The household financial savings used in part to finance government borrowing. Governmental securities, often known as G-secs and Treasury Bills, are issued as a means of borrowing.

Statement 2 is correct: Over 93% of the total state debt is made up of internal debt. Internal loans, which account for the majority of the public debt, are further separated into marketable and non-marketable debt.

Question 7

“Rapid Financing Instrument” and “Rapid Credit Facility” are related to the provisions of lending by which one of the following?

(a) Asian Development Bank

(b) International Monetary Fund

(c) United Nations Environment Programme Finance Initiative

(d) World Bank

ExplanationAns: b

Sub-Theme: Financial Assistance

Rapid Financing Instrument (RFI) and Rapid Credit Facility (RCF) is an arm of the International Monetary Fund (IMF) which provides financial assistance to the countries in need,

|

NOTE: This was in the news due to Sri Lanka’s recent crisis and political instability. Therefore, it is very important to holistically cover the static portion and keep track of various national and international events w.r.t. UPSC syllabus. |

Question 8

With reference to the Indian economy, consider the following statements:

Which of the statements are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: c

Sub-Theme: Exchange Rate

Statement 1 is correct: NEER is the Weighted average of bilateral nominal exchange rates of the home currency in terms of foreign currencies. The nominal exchange rate is the amount of domestic currency needed to purchase foreign currency. Therefore, an increase/decrease in NEER indicates the appreciation/depreciation of Rupee against the weighted basket of currencies of its trading partners.

Statement 2 is incorrect: REER is the weighted average of nominal exchange rates adjusted for relative price differential between the domestic and foreign countries. Therefore, an increase in a nation’s REER is an indication that its exports are becoming more expensive and its imports are becoming cheaper, which simply means it is losing trade competitiveness.

Statement 3 is correct: A real effective exchange rate (REER) is the NEER adjusted by relative prices or costs, typically captured in inflation differentials between the home economy and trading partners. Higher the inflation higher will be divergence (difference between) NEER and REER.

Question 9

Consider the following statements:

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: a

Sub-Theme: Monetary Policy and External Commercial Borrowings

Statement 1 is correct: A tight monetary policy is implemented to contract economic growth. It involves increasing interest rates to constrain borrowing and to stimulate savings, this can discourage investment and depress asset prices. It makes borrowing less attractive as interest payment increases. Thus, tight monetary policy of the US Federal Reserve could lead to capital flight by the investors.

Statement 2 is correct: Capital flight can drive up the interest costs as there is reduced money supply in the system. Thus, it would lead to increase in the interest cost of firms that have external commercial borrowings.

Statement 3 is incorrect: ECB is basically a loan availed by an Indian entity from a non-resident lender in foreign currency whereas Devaluation is decreasing the value of currency within a fixed exchange rate system. Therefore, devaluation of the domestic currency would increase the currency risks associated with ECBs and will result in higher interest cost for borrowers.

|

NOTE: This is basically a conceptual based question by clubbing both the Monetary Policy and External Sector. Therefore, it underlines the importance of conceptual clarity of various economic tools, instruments, etc. |

Question 10

With reference to the Indian economy, what are the advantages of “Inflation-Indexed Bonds (IIBs)”?

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: a

Sub-Theme: Bonds and Securities

Statements 1 and 2 are correct: Inflation- Indexed Bonds is a debt market securities offered by the government to protect the savings from inflation and offer positive real rates of returns. The principal and interest are linked to WPI/ CPI. Inflation indexed bonds provide returns that are always in excess of inflation, ensuring that price rise does not erode the value of savings. Globally, IIBs were first issued in 1981 in the UK. In India, the Government of India through RBI issued IIBs (linked to WPI) in June 2013. They can be traded in the secondary market like other G-Secs and help the Government to reduce the coupon rates on its borrowings.

Statement 3 is incorrect: The existing tax provisions will be applicable on interest payment and capital gains on IIBs. There will be no special tax treatment for these bonds.

Question 11

Which of the following activities constitute a real sector in the economy?

Select the correct answer using the code given below.

(a) 1 and 2 only

(b) 2, 3 and 4 only

(c) 1, 3 and 4 only

(d) 1, 2, 3 and 4

ExplanationAns: a

Sub-Theme: Sectors of Economy

The real sector of an economy is the key section as activities of this sector persuade economic output and is represented by those economic segments that are essential for the progress of GDP of the economy.

Statements 1 and 2 are correct: The sector’s (Farming and Textile Mills) ability to produce enough goods and services to satisfy global demand makes it essential for the economy’s long-term viability.

Statements 3 and 4 are incorrect: The financial sector is an area of the economy that consists of businesses and institutions that offer financial services to wholesale and retail clients. A commercial bank lending money to a trading company or a corporate body issuing rupee denominated bonds overseas constitute financial sector activities and not real sector activities.

Question 12

With reference to Convertible Bonds, consider the following statements:

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ExplanationAns: c

Sub-Theme: Convertible Bond

Statement 1 is correct: A convertible bond is a fixed-income corporate debt security that yields interest payments but can be converted into a predetermined number of common stock or equity shares. Convertible bonds generally offer a lower coupon rate or rate of return in exchange for the value of the option to convert the bond into common stock. Investors will generally accept a lower coupon rate on a convertible bond, compared with the coupon rate on an otherwise identical regular bond, because of its conversion feature.

Statement 2 is correct: The option to convert to equity affords the bondholder a degree of indexation to rising consumer prices as equity prices can differ widely from the given interest and the difference in that can be used as a hedge for inflation.

2021

Question 1

Which one of the following is likely to be the most inflationary in its effects?

(a) Repayment of public debt

(b) Borrowing from the public to finance a budget deficit

(c) Borrowing from the banks to finance a budget deficit

(d) Creation of new money to finance a budget deficit

ExplanationAns: d

Sub-Theme: Inflation

Inflation is the rise in prices of goods and services within a particular economy wherein, the purchasing power of consumers decreases, and the value of the cash holdings erode. In India, the Ministry of Statistics and Programme Implementation (MoSPI) measures inflation. Some causes that lead to inflation include the creation of new money to finance a budget deficit. A Budget Deficit refers to a situation where total expenditure exceeds the total revenue.

Other Causes that lead to inflation are: Increase in demand, reduction in supply, demand-supply gap, excess circulation of money, increase in input costs, devaluation of currency, rise in wages among others.

|

NOTE: This question came verbatim from PYQ 2013. Therefore, it underlines the importance of solving and analysing PYQs. |

Question 2

Which of the following steps is most likely to be taken at the time of an economic recession?

(a) Cut in tax rates accompanied by an increase in interest rate

(b) Increase in expenditure on public projects

(c) Increase in tax rates accompanied by reduction of interest rate

(d) Reduction of expenditure on public projects

ExplanationAns: b

Sub-Theme: Recession

Additional Information:

Question 3

With reference to the Indian economy, demand-pull inflation can be caused/increased by which of the following?

Select the correct answer using the code given below.

(a) 1, 2 and 4 only

(b) 3, 4 and 5 only

(c) 1, 2, 3 and 5 only

(d) 1, 2, 3, 4 and 5

ExplanationAns: a

Sub-Theme: Types of Inflation

Demand-pull inflation is caused by an increase in demand and when the demand in the economy outgrows the supply in the economy. It can be summed up as a condition of “too much money chasing too few goods”. With reference to the Indian economy, demand- pull inflation can be caused/increased by the following:

Additional Information:

Question 4.

Consider the following statements:

Other things remaining unchanged, market demand for a good might increase if

(a) price of its substitute increases

(b) price of its complement increases

(c) the good is an inferior good and the income of the consumer increases

(d) its price falls

Which of the above statements are correct?

(a) 1 and 4 only

(b) 2, 3 and 4

(c) 1, 3 and 4

(d) 1, 2 and 3

ExplanationAns: a

Sub-Theme: Functions of Money Market

Question 5

Consider the following statements:

1. The Governor of the Reserve bank of India (RBI) is appointed by the Central Government.

2. Certain provisions in the Constitution of India give the Central Government the right to issue directions to the RBI in public interest.

3. The Governor of the RBI draws his power from the RBI Act.

Which of the above statements are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: c

Sub-Theme: Role and Functions of RBI/Banking Appointment

Statement 1 is correct: According to Section 8 of RBI ACT 1934, A Governor and (not more than four) Deputy Governors are to be appointed by the Central Government. Statement 2 is incorrect: According to Section 7 of RBI ACT 1934, The Central Government may from time to time give such directions to the Bank as it may, after consultation with the Governor of the Bank, consider it necessary in the public interest. There is no such provision in the constitution of India.

Statement 3 is correct: The Governor of the RBI draws his power from the RBI Act 1934. RESERVE BANK OF INDIA:

| Monetary Authority | • Formulates, implements and monitors the monetary policy.

• Maintaining price stability while keeping in mind the objective of growth. |

|

Regulator and Supervisor of the Financial System |

• Prescribes broad parameters of banking operations within which the country’s banking and financial system functions.

• Regulation and supervision of banks under Banking Regulation Act 1949. • Regulation and supervision of non-banking financial companies. • Protecting depositors’ interest |

| Manager of Foreign Exchanges | • Manages the Foreign Exchange Management Act, 1999.

• It facilitates external trade and payment • Promote development and maintenance of foreign exchange market in India. |

|

Issuer of Currency |

• RBI has the sole right to issue currency notes in India.

• Besides exchanges and destroys currency and coins not fit for circulation. • To give the public an adequate quantity of supplies of currency notes and coins and in good quality. |

| Developmental Role | • Performs a wide range of promotional functions to support national objectives such as making institutional arrangements for rural or agricultural finance. |

|

Financial Inclusion |

• The Reserve Bank has selected a bank led model for financial inclusion in India.

• RBI has undertaken a series of policy measures. E.g. Basic Savings Bank Deposit Account” (BSBDA), JAM Trinity, etc. |

|

Use of Technology |

• Devices such as ATMs, handheld devices to identify user accounts through a card and biometric identifier, Deposit taking machines and Internet banking and Mobile banking facility to provide the banking services to all sections of society with more ease. |

| Banker to Banks | • It maintains banking accounts of all scheduled banks. It also acts as a lender of last resort by providing funds to banks. |

| Banker to Government | • It performs merchant banking functions for the central and the state governments.

• It is entrusted to the central govt. ‘s money, remittances, exchange and manages its public debt as well. |

|

Governor of RBI |

• Appointment: Appointed after the proposal made by the Financial Sector Regulatory Appointments Search Committee (FSRASC), headed by the Cabinet Secretary.

• Term: According to Section 8 (4) of the RBI Act, the Governor and Deputy Governors shall hold office for such term not exceeding 3 years as the Central Government may fix when appointing them. • Re-Appointment: They are eligible for re-appointment. • Qualification: The RBI Act does not provide for any specific qualification for the governor. • Removal: The governor can be removed by the central government. |

|

|

Minimum Reserve System of RBI |

• With a minimum value of government-held gold of ₹ 200 crores (₹ 115 cr rupee should be in the form of gold or gold bullion and rest ₹ 85 cr should be in the form of foreign currencies) and the remaining is backed by the government securities issued and held by RBI. | |

|

Subsidiaries of RBI |

• Deposit Insurance and Credit Guarantee Corporation (DICGC)

• Bharatiya Reserve Bank Note Mudran Private Limited (BRBNMPL) • Reserve Bank Information Technology Private Ltd. (ReBIT) • Indian Financial Technology and Allied Services (IFTAS) |

|

|

Income and Expenditure of RBI |

INCOME | EXPENDITURE |

| • Returns from foreign currency assets

• Interest on rupee-denominated government bonds • Interest on overnight lending to commercial banks • Management commission on handling the borrowings of central and state governments. |

• Printing of currency

• Staff expenditure • Commission given to commercial banks. • Commission to primary dealers |

|

| ASSETS | LIABILITIES | |

| • Foreign currency assets | • Currency held by Public | |

| Assets and Liabilities of RBI | • Bill purchases and discounts

• Collaterals by commercial banks • Loan and advances |

• Vault cash held by commercial banks

• Government securities • Other liabilities |

| • Rupee securities | ||

| • Gold coin bullion |

Question 6

With reference to ‘Urban Cooperative banks’ in India consider the following statements:

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: b

Sub-Theme: Cooperative Bank

Statement 1 is incorrect: After Banking Regulation (Amendment) Act 2020 was passed, all the powers were transferred to RBI from the Registrars of the cooperative societies. Even some powers are left with the registrar but RBI powers will override them.

Statement 2 is correct: RBI has issued guidelines allowing cooperative banks to raise funds through the issuance of equity shares, preference shares and debt instruments.

Statement 3 is correct: Large cooperative banks with paid-up share capital and reserves of Rs.1 lakh were brought under the purview of the Banking Regulation Act 1949 with effect from 1st March 1966.

CO-OPERATIVE BANKS

Question 7

In India, the central bank’s function as the ‘lender of last resort’ usually refers to which of the following?

Select the correct answer using the code given below.

(a) 1 and 2

(b) 2 only

(c) 2 and 3

(d) 3 only

ExplanationAns: b

Sub-Theme: RBI

Option (b) is correct: In India, the central bank’s function as the ‘lender of last resort’ usually refers to providing liquidity to banks that are facing temporary financial difficulties and are unable to meet their obligations. The Reserve Bank of India (RBI) can lend money to these banks, either directly or through other channels, to help them meet their short-term liquidity needs and avoid a crisis. This function is important for maintaining financial stability in the banking system and ensuring that banks can continue to serve their customers even in times of stress.

Lender of Last Resort

Question 8

The money multiplier in an economy increases with which one of the following?

(a) Increase in the Cash Reserve Ratio in the banks

(b) Increase in the Statutory Liquidity Ratio in the banks

(c) Increase in the banking habit of the people

(d) Increase in the population of the country

ExplanationAns: c

Sub-Theme: Money Multiplier/Money Supply

Question 9

Which one of the following effects of the creation of black money in India has been the main cause of worry to the Government of India?

(a) Diversion of resources to the purchase of real estate and investment in luxury housing

(b) Investment in unproductive activities and purchase of precious stones, jewellery, gold,

(c) Large donations to political parties and growth of regionalism

(d) Loss of revenue to the State Exchequer due to tax evasion

ExplanationAns: d

Sub-Theme: Black Money

Option (d) is correct: The creation of black money in India causes the loss of revenue to the State Exchequer due to tax evasion, which is the main cause of worry for the Government of India.

Question 10

Consider the following statements:

The effect of the devaluation of a currency is that it necessarily:

Which of the above statements is/are correct?

(a) 1 only

(b) 1 and 2

(c) 3 only

(d) 2 and 3

ExplanationAns: a

Sub-Theme: BoP

Statement 1 is correct: Devaluation is decreasing the value of currency within a fixed exchange rate system. Exports become cheaper to foreign customers. Thus, it improves the competitiveness of domestic exports in the foreign markets.

Statement 2 is incorrect: Devaluation of a currency decreases the foreign value of the domestic currency. Example- Let us assume that the prevailing exchange rate of $1 is 20 Rs. So currently 1 Rs is worth $0.05. If the devaluation of currency is done and now the exchange rate of $1 is 50 Rs, this means 1 Rs is worth $0.02. So, the value of domestic currency (Rs) is decreased in terms of value of foreign currency ($).

Statement 3 is incorrect: Balance of Trade (BOT) is the difference between the value of exports and imports of a country in a given period of time. When foreign loans are valued in the native currency, devaluation also raises the debt burden on those loans. Devaluation might not, then, ultimately lead to an improvement in the trade balance. Hence, statements 3 is incorrect.

Question 11

Consider the following:

Which of the above can be included in Foreign Direct Investments?

(a) 1, 2 and 3

(b) 3 only

(c) 2 and 4

(d) 1 and 4

ExplanationAns: a

Sub-Theme: Foreign Investment

Statements 1, 2 & 3 are correct: Foreign Currency Convertible Bonds (FCCB), Foreign Institutional Investment with certain conditions (overall limit of 24%), and Global Depository Receipts (GDR) are the instruments for foreign investment in India.

Statement 4 is incorrect: Non-resident external deposits will create debts in the balance of payment accounts, hence not a part

of FDI.

Question 12

Indian Government Bond Yields are influenced by which of the following?

Select the correct answer using the code given below.

(a) 1 and 2 only

(b) 2 only

(c) 3 only

(d) 1, 2 and 3

ExplanationAns: d

Sub-Theme: Debt Instrument

Statement 1 is correct: Bond yield is the return an investor gets on that bond or on a particular government security. It depends on the price of the bond which is impacted by its demand. The actions of the US federal reserve can impact the investments flowing in India. This will lead to a decrease in demand for Government Securities (G-sec) and thus impacting its yield.

Statement 2 is correct: The actions of RBI directly impacts the bond yield because it is directly related to liquidity in the market which is controlled by RBI through various tools.

Statement 3 is correct: The purchasing capacity of an economy is directly related to inflation. So any change in short term rates will impact the demand and price of G-sec and thereby influencing the yield.

Question 13

With reference to India, consider the following statements:

Which of the statements given above is/are correct?

(a) 1 only

(b) 1 and 2

(c) 3 only

(d) 2 and 3

ExplanationAns: b

Sub-Theme: Debt Instrument

Statement 1 is correct: Bond yield is the return an investor gets on that bond or on a (T-Bills) and Government bonds. It is mandatory to open a Demat account for a retail investor to invest in ‘Treasury Bills’ and ‘Government of India Debt Bonds’ in the primary market.

Statement 2 is correct: The Negotiated Dealing System Order Matching is an electronic trading platform operated by the Reserve Bank of India to facilitate the issuing and exchange of government securities and other types of money market instruments.

Statement 3 is incorrect: CDSL was promoted by BSE Ltd. jointly with leading banks such as State Bank of India, Bank of India, Bank of Baroda, HDFC Bank, Standard Chartered Bank and Union Bank of India.

Question 14

With reference to ‘Water Credit’, consider the following statements:

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: c

Sub-Theme: Water Conservation

Statements 1 and 3 are correct: Water Credit is a powerful solution and the first to put microfinance tools to work in the water and sanitation sector. It helps bring small loans to those who need access to affordable financing and expert resources to make household water and toilet solutions a reality.

Statement 2 is incorrect: Water Credit Initiative is a loan program started by water.org to address the barrier of affordable financing for safe water and sanitation.

2020

Question 1

With reference to the Indian economy after the 1991 economic liberalisation, consider the following statements:

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 3 and 4 only

(c) 3 only

(d) 1, 2 and 4 only

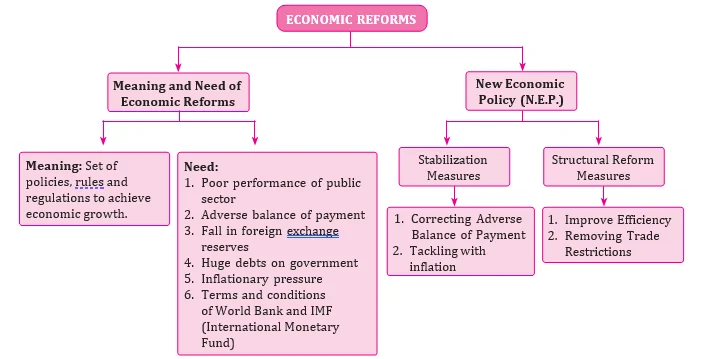

ExplanationAns: b

Sub-Theme: Economic Reforms

“Changing Structure of Rural Economy of India: Implications for Employment and Growth 2017,” is a report published by NITI Aayog, which made the following observations:

Statement 1 is incorrect: Both rural and urban regions have seen an improvement in worker productivity as well as the absolute level of income per worker. For rural areas, it was Rs. 37273 in 2004 -05 and Rs. 101755 in 2011-12, while for urban areas it was Rs. 120419 in 2004-05 and Rs. 282515 in 2011-12.

Statement 2 is incorrect: As per the 2011 Census, 68.8% of India’s population and 72.4% of the workforce resided in rural areas. However, the steady transition to urbanisation over the years has led to a decline in the rural share of the workforce, from 77.8% in 1993-94 to 70.9% in 2011-12.

Statement 3 is correct: About two-thirds of rural income is now generated in non- agricultural activities. Non-farm economy has increased in rural areas. The share of agriculture in the rural economy has decreased from 57% in 1993-94 to 39% in 2011-12.

Statement 4 is correct: After 2004-05, the rural areas have witnessed negative growth in employment in spite of high growth in output. The growth rate of rural employment was 1.45% during 1994-2005, which fell to -0.28% between 2005-12.

Question 2

Which of the following factors/policies were affecting the price of rice in India in the recent past?

Select the correct answer using the code given below.

(a) 1, 2 and 4 only

(b) 1, 3 and 4 only

(c) 2 and 3 only

(d) 1, 2, 3 and 4

ExplanationAns: d

Sub-Theme: Government Policies Factors/Policies Affecting the Price of Rice in recent past are:

Question 3

With reference to chemical fertilisers in India, consider the following statements:

1. At present, the retail price of chemical fertilisers is market-driven and not administered by the

2. Ammonia, which is an input of urea, is produced from natural gas.

3. Sulphur, which is a raw material for phosphoric acid fertilizer, is a by-product of oil refineries.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 2 only

(d) 1, 2 and 3

ExplanationAns: b

Sub-Theme: Agriculture Fertilizer

Statement 1 is incorrect: The Union Government subsidizes fertilizers to ensure that fertilizers are easily available to farmers at reasonable prices and the county remains self- sufficient in agriculture. Thus, the fertilizer price in India is administered by the government.

Statement 2 is correct. Ammonia’s chemical formula is NH3. It is a colourless gas and is used as an industrial chemical in the production of fertilizers, plastics, synthetic fibers, dyes and other products. It occurs naturally in the environment from the breakdown of organic waste matter and may also find its way to ground and surface water sources through industrial effluents, contamination by sewage or through agricultural runoff. In the Haber– Bosch process, the atmospheric nitrogen (N2) is converted to ammonia (NH3) by reacting it with hydrogen (H2), (this Hydrogen is provided by breaking methane (CH4) from natural gas) while maintaining the high temperatures and pressures.

Statement 3 is correct. In India, the domestic production of elemental sulphur is limited to by-product recoveries from petroleum refineries and fuel oil used as feedstock for manufacturing fertilizer.

|

NOTE: This particular question is a multi- dimensional one that covers the aspect of Economy, Government policies, and sound knowledge in chemistry, preferably Environmental chemistry. Here, by asking this question UPSC might have wanted to check the analytical ability of aspirants from a multi-dimensional perspective. |

Question 4

In India, which of the following can be considered as public investment in agriculture?

Select the correct answer using the code given below.

(a) 1, 2 and 5 only

(b) 1, 3, 4 and 5 only

(c) 2, 3 and 6 only

(d) 1, 2, 3, 4, 5 and 6

ExplanationAns: c

Sub-Theme: Public investment in agriculture

Public Investment: It is an investment by the State (Central, state and local governments orthrough publicly owned companies) to build the nation’s capital stock by devoting resources to the basic physical infrastructure (such as roads, bridges, rail lines, airports, and water distribution), research and development, etc. that leads to increased output and/or living standards.

The following can be considered as Public Investment in Agriculture.

Additional Information:

Question 5

Under the Kisan Credit Card scheme, short-term credit support is given to farmers for which of the following purposes?

Select the correct answer using the code given below:

(a) 1, 2 and 5 only

(b) 1, 3 and 4 only

(c) 2, 3, 4 and 5 only

(d) 1, 2, 3 4 and 5

ExplanationAns: b

Sub-Theme: Agricultural credit

Announced in the 1998–1999 budget, the Kisan Credit Card Scheme aims to provide farmers with the institutional credit they need to meet their financial needs at various phases of farming. It is implemented by all public sector banks, regional rural banks, and cooperative banks across the nation. Under the Kisan Credit Card scheme, short-term credit support is given to farmers for the following purposes:

Additional Information:

|

NOTE: Statement 2 talks about “Purchase of combine harvesters, tractors and mini trucks” which is not a short term investment. It needs heavy capital and is not possible with short-term credit support provided under KCC. By this reasoning and general understanding if we eliminate statement 2, we will get correct answer i.e., ‘Option (b) 1, 3 and 4 only’ |

Question 6.

Consider the following statements:

1. In the case of all cereals, pulses and oil-seeds, the procurement at Minimum Support Price (MSP) is unlimited in any State/UT of India.

2. In the case of cereals and pulses, the MSP is fixed in any State/UT at a level to which the market price will never rise.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ExplanationAns: d

Sub-Theme: MSP

Statement 1 is incorrect: Procurement of all cereals, pulses and oilseeds at Minimum support price is open-ended. It is limited since our buffer stock is limited. Open ended procurement means whatever foodgrains are offered by the farmers, within the stipulated procurement period and which conforms to the quality specifications prescribed by Government of India, are purchased at MSP (and bonus/ incentive, if any) by the Government agencies including FCI for central Pool.

Statement 2 is incorrect: Market price has no link with minimum support price and it can go below or above the MSP, depending upon the demand of the crop in the market.

Question 7

The term ‘West Texas Intermediate’, sometimes found in news, refers to a grade of

(a) Crude oil

(b) Bullion

(c) Rare earth elements

(d) Uranium

ExplanationAns: a

Sub-Theme: Crude oil Trade

Crude Oil Trade:

Difference of WTI and Brent Crude oil:

| WTI | Brent |

| Benchmark for oil extracted from America | Benchmark for crude oil obtained from

the North Sea near Norway, Sweden, and UK |

| Benchmark used by US oil prices | Benchmark used for OPEC oil prices |

| Traded on New York Mercantile Exchange | Traded on International Exchange in London |

| Low share at international trade but futuristic opportunities | Two-third of the world’s crude contracts are signed Brent oil Benchmark |

Question 8

With reference to Trade-Related Investment Measures (TRIMS), which of the following statements is/are correct?

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: c

Sub-Theme: WTO Agreements

Statement 1 is correct: Trade-Related Investment Measure (TRIMs) provides quantitative restrictions on imports by foreign investors. TRIMs agreement stipulates that certain measures adopted by Governments to regulate FDI can cause trade-restrictive and distorting effects.

Statement 2 is incorrect: As per Article 1 of the TRIMs agreement, it applies only to investment measures related to trade in goods and not in services.

Statement 3 is correct: TRIMs are not intended to deal with the regulation of investment as such and does not impact directly on WTO members’ ability to regulate and place conditions upon the entry and establishment of foreign investment.

Question 9

Consider the following statements:

1. The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI).

2. The WPI does not capture changes in the prices of services, which CPI does.

3. The Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 only

(c) 3 only

(d) 1, 2 and 3

ExplanationAns: a

Sub-Theme: Inflation

Statement 1 is correct: The Wholesale Price Index (WPI) measures wholesale price changes. The Wholesale goods or services sold by businesses to smaller businesses for selling further. The WPI does not include services. The weightage for food is lower in WPI whereas the weightage of food in the CPI is close to 50%.

Statement 2 is correct: WPI indicates the wholesale price, whereas CPI shows the retail price i.e., the price at which people make purchases from the retail market. WPI does not show the impact of inflation on the people. Any policy should consider the impact on the people. WPI does not account for the price of services. It is an international best practice – most of the countries have shifted to CPI.

Statement 3 is incorrect. The Reserve bank of India adopted the new Consumer Price Index (CPI) (combined) as the key measure of inflation in 2014. The Consumer Price Index measures retail-level price changes. It includes services as well.

Question 10

If another global financial crisis happens in the near future, which of the following actions/policies are most likely to give some immunity to India?

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 1, 2 and 3

ExplanationAns: a

Sub-Theme: Mechanism to counter Financial crisis

Statement 1 is correct: Due to the global economic crisis, both creditor and debtor nations face hardships to keep the economy afloat. Various political and economic considerations make it difficult to come to the rescue of a distressed nation. Hence India should not depend on short term borrowings.

Statement 2 is incorrect: Opening up to more foreign banks would lead to enhanced exposure to the global economy, and hence an increased risk. Strengthening the domestic banks would prove more helpful in a situation like a global economic crisis.

Statement 3 is incorrect: Capital account convertibility means no restriction on the amount you can convert into foreign currency to enable you to acquire any foreign assets and vice versa. In a situation of a financial crisis, it will be a big mistake. It can create a situation of “Capital flight” where a foreign investor can withdraw all his money at once.

Question 11

If you withdraw Rs. 1,00,000 in cash from your Demand Deposit Account at your bank, the immediate effect on aggregate money supply in the economy will be:

(a) To reduce it by 1,00,000

(b) To increase it by 1,00,000

(c) To increase it by more than 1,00,000

(d) To leave it unchanged

ExplanationAns: d

Sub-Theme: Demand and Supply of Money

Demand Deposit

Question 12

What is the importance of the term “Interest Coverage Ratio” of a firm in India?

1. It helps in understanding the present risk of a firm that a bank is going to give a loan to.

2. It helps in evaluating the emerging risk of a firm that a bank is going to give a loan to.

3. The higher a borrowing firm’s level of Interest Coverage Ratio, the worse is its ability to service its debt.

Select the correct answer using the code given below.

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: a

Sub-Theme: Banking Interest

Statements 1 and 2 are correct: The interest coverage ratio is a debt and profitability ratio used to determine how easily a company can pay interest on its outstanding debt.

Lenders, investors, and creditors often use this formula to determine a company’s riskiness relative to its current debt or for future borrowing.

Statement 3 is incorrect: The higher the coverage ratio, the easier it should be to make interest payments on its debt or pay dividends. Interest Coverage Ratio:

Question 13

If the RBI decides to adopt an expansionist monetary policy, which of the following would it not do?

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: b

Sub-Theme: Monetary policy

Statement 1 is incorrect: Reducing SLR leaves more liquidity with banks, which in turn can fuel growth and demand in the economy.

Statement 2 is correct: With the increase of MSF Rate, cost of borrowing increases for banks resulting in reduced available resources to lend.

Statement 3 is incorrect: Under expansionary monetary policy, RBI reduces repo rate and bank rate to increase liquidity in the banking sector.

RBI Monetary Policy:

| Tool | Contractionary Policy | Expansionary Policy |

| Cash Reserve Ratio (CRR) | Increase | Decrease |

| Repo Rate | Increase | Decrease |

| Statutory Liquidity Ratio (SLR) | Increase | Decrease |

| Marginal Standing Facility Rate (MSF) | Increase | Decrease |

Question 14

Consider the following statements:

1. In terms of short-term credit delivery to the agriculture sector, District Central Cooperative Banks (DCCBs) deliver more credit in comparison to Scheduled Commercial Banks and Regional Rural Banks.

2. One of the most important functions of DCCBs is to provide funds to the Primary Agriculture Credit societies.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ExplanationAns: b

Sub-Theme: Cooperative Banking

Statement 1 is incorrect: Although the focus of rural cooperative lending is agriculture, the share in credit flow to the agriculture of rural cooperatives is only 12.1%, as compared to 76% of Scheduled Commercial Banks (SCBs), and 11.9% of Regional Rural Banks.

Statement 2 is correct: DCCBs mobilise deposits from the public and provide credit to the public and PACS.

District Central Co-operative Banks (DCCBs):

3-tier structure of Short term Co-operative Banks:

Question 15

In the context of the Indian economy, non-financial debt includes which of the following?

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 1, 2 and 3

ExplanationAns: d

Sub-Theme: Debt Financing

Option (d) is correct: Types of non-financial debt are Housing loans owed by households, Amounts outstanding on credit cards, Treasury bills, Credit Card balance etc.

Debt Financing:

Question 16

With reference to the international trade of India at present, which of the following statements is/are correct?

1. India’s merchandise exports are less than its merchandise imports.

2. India’s imports of iron and steel, chemicals, fertilisers and machinery have decreased in recent years.

3. India’s exports of services are more than its imports of services.

4. India suffers from an overall trade/current account deficit.

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 and 4 only

(c) 3 only

(d) 1, 3 and 4 only

ExplanationAns: d

Sub-Theme: BoP

Statement 1 is correct: The major portion of India’s current account deficit is in the area of merchandise trade. As per RBI’s data, India’s Merchandise exports during April-August 2019- 2020 was USD 133.14 billion, as compared to USD 210.39 billion of imports during the same period.

Statement 2 is incorrect: Between 2011–12 and 2018–19, the composition of imports by commodity reveals that imports of iron and steel, organic chemicals, and industrial machinery have experienced positive growth rates as a percentage of total imports.

Statement 3 is correct: India has a surplus of net services (service exports minus service imports). India’s Service exports during April- August 2019- 2020 was USD 67.24 billion, as compared to USD 39.25 billion of imports during the same period.

Statement 4 is correct: Current Account Deficit (CAD) or trade deficit is the shortfall between exports and imports. As per Economic Survey 2019-20, India’s CAD was 2.1% in 2018-19, and 1.5% of GDP in H1 of 2019-20.

Question 17

With reference to Foreign Direct Investment in India, which one of the following is considered its major characteristic?

(a) It is the investment through capital instruments essentially in a listed company.

(b) It is a largely non-debt creating capital flow.

(c) It is an investment that involves debt-servicing.

(d) It is the investment made by foreign institutional investors in the Government Securities.

ExplanationAns: b

Sub-Theme: Foreign Investment – FDI

Option (a) is incorrect: FDI is the investment through a capital instrument by a non- resident entity/person resident outside India in an unlisted Indian company, or 10% or more of the post issue paid-up equity capital on a fully diluted basis of a listed Indian company.

Option (b) is correct: A non-debt creating capital flow is the one where there is no direct repayment obligation for the residents. FDI is largely a non-debt creating capital flow.

Option (c) is incorrect: Debt servicing is the regular repayment of interest and principal on a debt for a particular period. FDI has no link with this concept.

Option (d) is incorrect: The investment can be made in equities or equity linked instruments or debt instruments issued by the company. Thus, FDI isn’t directly associated with government securities.

Question 18

“Gold Tranche” (Reserve Tranche) refers to:

(a) A loan system of the World Bank

(b) One of the operations of a Central Bank

(c) A credit system granted by WTO to its members

(d) A credit system granted by IMF to its members

ExplanationAns: d

Sub-Theme: Functions of IMF

Option (d) is correct: A Reserve Tranche is a portion of the required quota of currency each member country must provide to the IMF that can be utilized for its own purposes without a service fee or economic reform conditions.

Gold or Reserve Tranche:

There are no interest costs for the initial 25% reserve tranche. Any additional items would incur a service charge.

Question 19

With reference to the Indian economy, consider the following statements:

1. ‘Commercial Paper’ is a short-term unsecured promissory note.

2. ‘Certificate of Deposit’ is a long-term instrument issued by the Reserve Bank of India to a

3. ‘Call Money’ is a short term finance used for interbank transactions.