2022

Question 1

With reference to the Indian economy, consider the following statements:

1. If the inflation is too high, the Reserve Bank of India (RBI) is likely to buy government securities.

2. If the rupee is rapidly depreciating, RBI is likely to sell dollars in the market.

3. If interest rates in the USA or European Union were to fall, that is likely to induce RBI to buy dollars.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: b

Sub-Theme: Qualitative Tools to control

Statement 1 is incorrect: If the inflation is too high, Reserve Bank of India (RBI) is likely to reduce the money supply in the economy to control inflation. Thus, RBI sells the government securities so as to suck the excess money supply from the economy and to control the inflation.

Statement 2 is correct: RBI intervenes in the currency market to support the rupee because if it becomes a weak domestic unit then it can increase a country’s import bill. It can intervene directly in the currency market by buying and selling dollars. If RBI wishes to prop up rupee value, then it can sell dollars and when it needs to bring down rupee value, it can buy dollars.

Statement 3 is correct: When the US raises its domestic interest rates, this tends to make India less attractive for the currency trade. As a result, it pulls some money from the Indian market out and flows back to the US, thereby decreasing the value of India’s currency against the US dollar. Therefore, if interest rates in the USA or EU were to fall, then it is likely to induce RBI to buy dollars.

Question 2

Consider the following statements:

The rating agency popularly known as ICRA is a public limited company.

Brickwork Ratings is an Indian credit rating agency.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: b

Sub-Theme: Credit Rating

Statement 1 is incorrect: In India, credit rating agencies are regulated by Securities and Exchange Board of India (SEBI).

Statement 2 is correct: ICRA (Investment Information and Credit Rating Agency of India Ltd.) was set up in 1991 by IFCI, LIC, SBI and select banks as well as financial institutions to rate debt instruments.

Statement 3 is correct: In India there are six credit rating agencies registered under Securities and Exchange Board of India (SEBI) namely, CRISIL, ICRA, CARE, SMERA, Fitch India and Brickwork Ratings.

Credit Rating

Question 3

With reference to the Banks Board Bureau (BBB)’, which of the following statements are correct?

BBB recommends for the selection of heads for Public Sector Banks.

BBB helps the Public Sector Banks in developing strategies and capital raising plans.

Select the correct answer using the code given below.

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: b

Sub-Theme: Bank Board Bureau

Statement 1 is incorrect: Banks Board Bureau comprises the Chairman, three ex-officio members i.e. Secretary of the Department of Public Enterprises, Secretary of the Department of Financial Services and Deputy Governor of the Reserve Bank of India, and five expert members, two of which are from the private sector. The Chairman is selected by the central government and the RBI governor does not head it.

Statement 2 is correct: Banks Board Bureau recommends for the selection of head for Public Sector Banks and other key personnel if required.

Statement 3 is correct: BBB develops strategies for raising capital and improving performance of PSBs.

Banks Board Bureau

Question 4

In India, which one of the following is responsible for maintaining price stability by controlling inflation?

(a) Department of Consumer Affairs

(b) Expenditure Management Commission

(c) Financial Stability and Development Council

(d) Reserve Bank of India

ExplanationAns: d

Sub-Theme: Monetary Policy

Option (d) is correct: In India, the responsibility for maintaining price stability and controlling inflation lies with the Reserve Bank of India (RBI). The RBI is the central bank of India and is responsible for regulating the supply of money in the economy through various monetary policy measures such as adjusting interest rates, controlling the reserve ratios of banks, and buying or selling government securities in the open market.

MONETARY POLICY

Question 5

With reference to the expenditure made by an organization or a company, which of the following statements is/are correct?

Debt financing is considered capital expenditure, while equity financing is considered revenue expenditures.

Select the correct answer using the code given below.

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ExplanationAns: a

Sub-Theme: Expenditure

Statement 1 is correct: When a company funds are used to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment are known as Capital Expenditure (CapEx) of a Company.

Statement 2 is incorrect: Equity financing is the process of raising capital through the sale of shares. It is an example of non-debt capital receipts.

Capital Expenditure (CapEx) of a Company:

Equity financing:

Question 6

With reference to Indian economy, consider the following statements:

Dated securities issued at market related rates in auctions form a large component of internal debt.

Which of the above statements is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ExplanationAns: c

Sub-Theme: Basic Concept of Economy

Statement 1 is correct: The household financial savings used in part to finance government borrowing. Governmental securities, often known as G-secs and Treasury Bills, are issued as a means of borrowing.

Statement 2 is correct: Over 93% of the total state debt is made up of internal debt. Internal loans, which account for the majority of the public debt, are further separated into marketable and non-marketable debt.

Question 7

“Rapid Financing Instrument” and “Rapid Credit Facility” are related to the provisions of lending by which one of the following?

(a) Asian Development Bank

(b) International Monetary Fund

(c) United Nations Environment Programme Finance Initiative

(d) World Bank

ExplanationAns: b

Sub-Theme: Financial Assistance

Rapid Financing Instrument (RFI) and Rapid Credit Facility (RCF) is an arm of the International Monetary Fund (IMF) which provides financial assistance to the countries in need,

|

NOTE: This was in the news due to Sri Lanka’s recent crisis and political instability. Therefore, it is very important to holistically cover the static portion and keep track of various national and international events w.r.t. UPSC syllabus. |

Question 8

With reference to the Indian economy, consider the following statements:

An increase in the Real Effective Exchange Rate (REER) indicates an improvement in trade

An increasing trend in domestic inflation relative to inflation in other countries is likely to cause an increasing divergence between NEER and REER.

Which of the statements are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: c

Sub-Theme: Exchange Rate

Statement 1 is correct: NEER is the Weighted average of bilateral nominal exchange rates of the home currency in terms of foreign currencies. The nominal exchange rate is the amount of domestic currency needed to purchase foreign currency. Therefore, an increase/decrease in NEER indicates the appreciation/depreciation of Rupee against the weighted basket of currencies of its trading partners.

Statement 2 is incorrect: REER is the weighted average of nominal exchange rates adjusted for relative price differential between the domestic and foreign countries. Therefore, an increase in a nation’s REER is an indication that its exports are becoming more expensive and its imports are becoming cheaper, which simply means it is losing trade competitiveness.

Statement 3 is correct: A real effective exchange rate (REER) is the NEER adjusted by relative prices or costs, typically captured in inflation differentials between the home economy and trading partners. Higher the inflation higher will be divergence (difference between) NEER and REER.

Question 9

Consider the following statements:

Capital flight may increase the interest cost of firms with existing External Commercial Borrowings (ECBs).

Devaluation of domestic currency decreases the currency risk associated with ECBs.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: a

Sub-Theme: Monetary Policy and External Commercial Borrowings

Statement 1 is correct: A tight monetary policy is implemented to contract economic growth. It involves increasing interest rates to constrain borrowing and to stimulate savings, this can discourage investment and depress asset prices. It makes borrowing less attractive as interest payment increases. Thus, tight monetary policy of the US Federal Reserve could lead to capital flight by the investors.

Statement 2 is correct: Capital flight can drive up the interest costs as there is reduced money supply in the system. Thus, it would lead to increase in the interest cost of firms that have external commercial borrowings.

Statement 3 is incorrect: ECB is basically a loan availed by an Indian entity from a non-resident lender in foreign currency whereas Devaluation is decreasing the value of currency within a fixed exchange rate system. Therefore, devaluation of the domestic currency would increase the currency risks associated with ECBs and will result in higher interest cost for borrowers.

|

NOTE: This is basically a conceptual based question by clubbing both the Monetary Policy and External Sector. Therefore, it underlines the importance of conceptual clarity of various economic tools, instruments, etc. |

Question 10

With reference to the Indian economy, what are the advantages of “Inflation-Indexed Bonds (IIBs)”?

IIBs provide protection to the investors from uncertainty regarding inflation.

The interest received as well as capital gains on IIBs are not taxable.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: a

Sub-Theme: Bonds and Securities

Statements 1 and 2 are correct: Inflation- Indexed Bonds is a debt market securities offered by the government to protect the savings from inflation and offer positive real rates of returns. The principal and interest are linked to WPI/ CPI. Inflation indexed bonds provide returns that are always in excess of inflation, ensuring that price rise does not erode the value of savings. Globally, IIBs were first issued in 1981 in the UK. In India, the Government of India through RBI issued IIBs (linked to WPI) in June 2013. They can be traded in the secondary market like other G-Secs and help the Government to reduce the coupon rates on its borrowings.

Statement 3 is incorrect: The existing tax provisions will be applicable on interest payment and capital gains on IIBs. There will be no special tax treatment for these bonds.

Question 11

Which of the following activities constitute a real sector in the economy?

Textile mills converting raw cotton into fabrics

A commercial bank lending money to a trading company

A corporate body issuing Rupee Denominated Bonds overseas.

Select the correct answer using the code given below.

(a) 1 and 2 only

(b) 2, 3 and 4 only

(c) 1, 3 and 4 only

(d) 1, 2, 3 and 4

ExplanationAns: a

Sub-Theme: Sectors of Economy

The real sector of an economy is the key section as activities of this sector persuade economic output and is represented by those economic segments that are essential for the progress of GDP of the economy.

Statements 1 and 2 are correct: The sector’s (Farming and Textile Mills) ability to produce enough goods and services to satisfy global demand makes it essential for the economy’s long-term viability.

Statements 3 and 4 are incorrect: The financial sector is an area of the economy that consists of businesses and institutions that offer financial services to wholesale and retail clients. A commercial bank lending money to a trading company or a corporate body issuing rupee denominated bonds overseas constitute financial sector activities and not real sector activities.

Question 12

With reference to Convertible Bonds, consider the following statements:

The option to convert to equity affords the bondholder a degree of indexation to rising consumer prices.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ExplanationAns: c

Sub-Theme: Convertible Bond

Statement 1 is correct: A convertible bond is a fixed-income corporate debt security that yields interest payments but can be converted into a predetermined number of common stock or equity shares. Convertible bonds generally offer a lower coupon rate or rate of return in exchange for the value of the option to convert the bond into common stock. Investors will generally accept a lower coupon rate on a convertible bond, compared with the coupon rate on an otherwise identical regular bond, because of its conversion feature.

Statement 2 is correct: The option to convert to equity affords the bondholder a degree of indexation to rising consumer prices as equity prices can differ widely from the given interest and the difference in that can be used as a hedge for inflation.

2021

Question 1

Which one of the following is likely to be the most inflationary in its effects?

(a) Repayment of public debt

(b) Borrowing from the public to finance a budget deficit

(c) Borrowing from the banks to finance a budget deficit

(d) Creation of new money to finance a budget deficit

ExplanationAns: d

Sub-Theme: Inflation

Inflation is the rise in prices of goods and services within a particular economy wherein, the purchasing power of consumers decreases, and the value of the cash holdings erode. In India, the Ministry of Statistics and Programme Implementation (MoSPI) measures inflation. Some causes that lead to inflation include the creation of new money to finance a budget deficit. A Budget Deficit refers to a situation where total expenditure exceeds the total revenue.

Other Causes that lead to inflation are: Increase in demand, reduction in supply, demand-supply gap, excess circulation of money, increase in input costs, devaluation of currency, rise in wages among others.

|

NOTE: This question came verbatim from PYQ 2013. Therefore, it underlines the importance of solving and analysing PYQs. |

Question 2

Which of the following steps is most likely to be taken at the time of an economic recession?

(a) Cut in tax rates accompanied by an increase in interest rate

(b) Increase in expenditure on public projects

(c) Increase in tax rates accompanied by reduction of interest rate

(d) Reduction of expenditure on public projects

ExplanationAns: b

Sub-Theme: Recession

Additional Information:

Question 3

With reference to the Indian economy, demand-pull inflation can be caused/increased by which of the following?

Fiscal stimulus

Inflation-indexing wages

Higher purchasing power

Rising interest rates

Select the correct answer using the code given below.

(a) 1, 2 and 4 only

(b) 3, 4 and 5 only

(c) 1, 2, 3 and 5 only

(d) 1, 2, 3, 4 and 5

ExplanationAns: a

Sub-Theme: Types of Inflation

Demand-pull inflation is caused by an increase in demand and when the demand in the economy outgrows the supply in the economy. It can be summed up as a condition of “too much money chasing too few goods”. With reference to the Indian economy, demand- pull inflation can be caused/increased by the following:

Additional Information:

Question 4.

Consider the following statements:

Other things remaining unchanged, market demand for a good might increase if

(a) price of its substitute increases

(b) price of its complement increases

(c) the good is an inferior good and the income of the consumer increases

(d) its price falls

Which of the above statements are correct?

(a) 1 and 4 only

(b) 2, 3 and 4

(c) 1, 3 and 4

(d) 1, 2 and 3

ExplanationAns: a

Sub-Theme: Functions of Money Market

Question 5

Consider the following statements:

1. The Governor of the Reserve bank of India (RBI) is appointed by the Central Government.

2. Certain provisions in the Constitution of India give the Central Government the right to issue directions to the RBI in public interest.

3. The Governor of the RBI draws his power from the RBI Act.

Which of the above statements are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: c

Sub-Theme: Role and Functions of RBI/Banking Appointment

Statement 1 is correct: According to Section 8 of RBI ACT 1934, A Governor and (not more than four) Deputy Governors are to be appointed by the Central Government. Statement 2 is incorrect: According to Section 7 of RBI ACT 1934, The Central Government may from time to time give such directions to the Bank as it may, after consultation with the Governor of the Bank, consider it necessary in the public interest. There is no such provision in the constitution of India.

Statement 3 is correct: The Governor of the RBI draws his power from the RBI Act 1934. RESERVE BANK OF INDIA:

| Monetary Authority | • Formulates, implements and monitors the monetary policy.

• Maintaining price stability while keeping in mind the objective of growth. |

|

Regulator and Supervisor of the Financial System |

• Prescribes broad parameters of banking operations within which the country’s banking and financial system functions.

• Regulation and supervision of banks under Banking Regulation Act 1949. • Regulation and supervision of non-banking financial companies. • Protecting depositors’ interest |

| Manager of Foreign Exchanges | • Manages the Foreign Exchange Management Act, 1999.

• It facilitates external trade and payment • Promote development and maintenance of foreign exchange market in India. |

|

Issuer of Currency |

• RBI has the sole right to issue currency notes in India.

• Besides exchanges and destroys currency and coins not fit for circulation. • To give the public an adequate quantity of supplies of currency notes and coins and in good quality. |

| Developmental Role | • Performs a wide range of promotional functions to support national objectives such as making institutional arrangements for rural or agricultural finance. |

|

Financial Inclusion |

• The Reserve Bank has selected a bank led model for financial inclusion in India.

• RBI has undertaken a series of policy measures. E.g. Basic Savings Bank Deposit Account” (BSBDA), JAM Trinity, etc. |

|

Use of Technology |

• Devices such as ATMs, handheld devices to identify user accounts through a card and biometric identifier, Deposit taking machines and Internet banking and Mobile banking facility to provide the banking services to all sections of society with more ease. |

| Banker to Banks | • It maintains banking accounts of all scheduled banks. It also acts as a lender of last resort by providing funds to banks. |

| Banker to Government | • It performs merchant banking functions for the central and the state governments.

• It is entrusted to the central govt. ‘s money, remittances, exchange and manages its public debt as well. |

|

Governor of RBI |

• Appointment: Appointed after the proposal made by the Financial Sector Regulatory Appointments Search Committee (FSRASC), headed by the Cabinet Secretary.

• Term: According to Section 8 (4) of the RBI Act, the Governor and Deputy Governors shall hold office for such term not exceeding 3 years as the Central Government may fix when appointing them. • Re-Appointment: They are eligible for re-appointment. • Qualification: The RBI Act does not provide for any specific qualification for the governor. • Removal: The governor can be removed by the central government. |

|

|

Minimum Reserve System of RBI |

• With a minimum value of government-held gold of ₹ 200 crores (₹ 115 cr rupee should be in the form of gold or gold bullion and rest ₹ 85 cr should be in the form of foreign currencies) and the remaining is backed by the government securities issued and held by RBI. | |

|

Subsidiaries of RBI |

• Deposit Insurance and Credit Guarantee Corporation (DICGC)

• Bharatiya Reserve Bank Note Mudran Private Limited (BRBNMPL) • Reserve Bank Information Technology Private Ltd. (ReBIT) • Indian Financial Technology and Allied Services (IFTAS) |

|

|

Income and Expenditure of RBI |

INCOME | EXPENDITURE |

| • Returns from foreign currency assets

• Interest on rupee-denominated government bonds • Interest on overnight lending to commercial banks • Management commission on handling the borrowings of central and state governments. |

• Printing of currency

• Staff expenditure • Commission given to commercial banks. • Commission to primary dealers |

|

| ASSETS | LIABILITIES | |

| • Foreign currency assets | • Currency held by Public | |

| Assets and Liabilities of RBI | • Bill purchases and discounts

• Collaterals by commercial banks • Loan and advances |

• Vault cash held by commercial banks

• Government securities • Other liabilities |

| • Rupee securities | ||

| • Gold coin bullion |

Question 6

With reference to ‘Urban Cooperative banks’ in India consider the following statements:

They can issue equity shares and preference shares.

They were brought under the purview of the Banking Regulation Act, 1949 through an Amendment in 1966.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: b

Sub-Theme: Cooperative Bank

Statement 1 is incorrect: After Banking Regulation (Amendment) Act 2020 was passed, all the powers were transferred to RBI from the Registrars of the cooperative societies. Even some powers are left with the registrar but RBI powers will override them.

Statement 2 is correct: RBI has issued guidelines allowing cooperative banks to raise funds through the issuance of equity shares, preference shares and debt instruments.

Statement 3 is correct: Large cooperative banks with paid-up share capital and reserves of Rs.1 lakh were brought under the purview of the Banking Regulation Act 1949 with effect from 1st March 1966.

CO-OPERATIVE BANKS

Question 7

In India, the central bank’s function as the ‘lender of last resort’ usually refers to which of the following?

Providing liquidity to the banks having a temporary crisis

Lending to governments to finance budgetary deficits

Select the correct answer using the code given below.

(a) 1 and 2

(b) 2 only

(c) 2 and 3

(d) 3 only

ExplanationAns: b

Sub-Theme: RBI

Option (b) is correct: In India, the central bank’s function as the ‘lender of last resort’ usually refers to providing liquidity to banks that are facing temporary financial difficulties and are unable to meet their obligations. The Reserve Bank of India (RBI) can lend money to these banks, either directly or through other channels, to help them meet their short-term liquidity needs and avoid a crisis. This function is important for maintaining financial stability in the banking system and ensuring that banks can continue to serve their customers even in times of stress.

Lender of Last Resort

Question 8

The money multiplier in an economy increases with which one of the following?

(a) Increase in the Cash Reserve Ratio in the banks

(b) Increase in the Statutory Liquidity Ratio in the banks

(c) Increase in the banking habit of the people

(d) Increase in the population of the country

ExplanationAns: c

Sub-Theme: Money Multiplier/Money Supply

Question 9

Which one of the following effects of the creation of black money in India has been the main cause of worry to the Government of India?

(a) Diversion of resources to the purchase of real estate and investment in luxury housing

(b) Investment in unproductive activities and purchase of precious stones, jewellery, gold,

(c) Large donations to political parties and growth of regionalism

(d) Loss of revenue to the State Exchequer due to tax evasion

ExplanationAns: d

Sub-Theme: Black Money

Option (d) is correct: The creation of black money in India causes the loss of revenue to the State Exchequer due to tax evasion, which is the main cause of worry for the Government of India.

Question 10

Consider the following statements:

The effect of the devaluation of a currency is that it necessarily:

Increases the foreign value of the domestic currency

Improves the trade balance

Which of the above statements is/are correct?

(a) 1 only

(b) 1 and 2

(c) 3 only

(d) 2 and 3

ExplanationAns: a

Sub-Theme: BoP

Statement 1 is correct: Devaluation is decreasing the value of currency within a fixed exchange rate system. Exports become cheaper to foreign customers. Thus, it improves the competitiveness of domestic exports in the foreign markets.

Statement 2 is incorrect: Devaluation of a currency decreases the foreign value of the domestic currency. Example- Let us assume that the prevailing exchange rate of $1 is 20 Rs. So currently 1 Rs is worth $0.05. If the devaluation of currency is done and now the exchange rate of $1 is 50 Rs, this means 1 Rs is worth $0.02. So, the value of domestic currency (Rs) is decreased in terms of value of foreign currency ($).

Statement 3 is incorrect: Balance of Trade (BOT) is the difference between the value of exports and imports of a country in a given period of time. When foreign loans are valued in the native currency, devaluation also raises the debt burden on those loans. Devaluation might not, then, ultimately lead to an improvement in the trade balance. Hence, statements 3 is incorrect.

Question 11

Consider the following:

Foreign institutional investment with certain conditions

Global depository receipts

Non-resident external deposits

Which of the above can be included in Foreign Direct Investments?

(a) 1, 2 and 3

(b) 3 only

(c) 2 and 4

(d) 1 and 4

ExplanationAns: a

Sub-Theme: Foreign Investment

Statements 1, 2 & 3 are correct: Foreign Currency Convertible Bonds (FCCB), Foreign Institutional Investment with certain conditions (overall limit of 24%), and Global Depository Receipts (GDR) are the instruments for foreign investment in India.

Statement 4 is incorrect: Non-resident external deposits will create debts in the balance of payment accounts, hence not a part

of FDI.

Question 12

Indian Government Bond Yields are influenced by which of the following?

Actions of the Reserve bank of India

Inflation and short-term interest rates

Select the correct answer using the code given below.

(a) 1 and 2 only

(b) 2 only

(c) 3 only

(d) 1, 2 and 3

ExplanationAns: d

Sub-Theme: Debt Instrument

Statement 1 is correct: Bond yield is the return an investor gets on that bond or on a particular government security. It depends on the price of the bond which is impacted by its demand. The actions of the US federal reserve can impact the investments flowing in India. This will lead to a decrease in demand for Government Securities (G-sec) and thus impacting its yield.

Statement 2 is correct: The actions of RBI directly impacts the bond yield because it is directly related to liquidity in the market which is controlled by RBI through various tools.

Statement 3 is correct: The purchasing capacity of an economy is directly related to inflation. So any change in short term rates will impact the demand and price of G-sec and thereby influencing the yield.

Question 13

With reference to India, consider the following statements:

The ‘Negotiated Dealing System-Order Matching’ is a government securities trading platform of the Reserve Bank of India.

‘Central Depository Services Ltd’ is jointly promoted by the Reserve Bank of India and the Bombay Stock Exchange.

Which of the statements given above is/are correct?

(a) 1 only

(b) 1 and 2

(c) 3 only

(d) 2 and 3

ExplanationAns: b

Sub-Theme: Debt Instrument

Statement 1 is correct: Bond yield is the return an investor gets on that bond or on a (T-Bills) and Government bonds. It is mandatory to open a Demat account for a retail investor to invest in ‘Treasury Bills’ and ‘Government of India Debt Bonds’ in the primary market.

Statement 2 is correct: The Negotiated Dealing System Order Matching is an electronic trading platform operated by the Reserve Bank of India to facilitate the issuing and exchange of government securities and other types of money market instruments.

Statement 3 is incorrect: CDSL was promoted by BSE Ltd. jointly with leading banks such as State Bank of India, Bank of India, Bank of Baroda, HDFC Bank, Standard Chartered Bank and Union Bank of India.

Question 14

With reference to ‘Water Credit’, consider the following statements:

It is a global initiative launched under the aegis of the World Health Organization and the World

It aims to enable poor people to meet their water needs without depending on subsidies.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: c

Sub-Theme: Water Conservation

Statements 1 and 3 are correct: Water Credit is a powerful solution and the first to put microfinance tools to work in the water and sanitation sector. It helps bring small loans to those who need access to affordable financing and expert resources to make household water and toilet solutions a reality.

Statement 2 is incorrect: Water Credit Initiative is a loan program started by water.org to address the barrier of affordable financing for safe water and sanitation.

2020

Question 1

With reference to the Indian economy after the 1991 economic liberalisation, consider the following statements:

The % age share of rural areas in the workforce steadily increased.

In rural areas, the growth in the non-farm economy increased.

The growth rate in rural employment decreased.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 3 and 4 only

(c) 3 only

(d) 1, 2 and 4 only

ExplanationAns: b

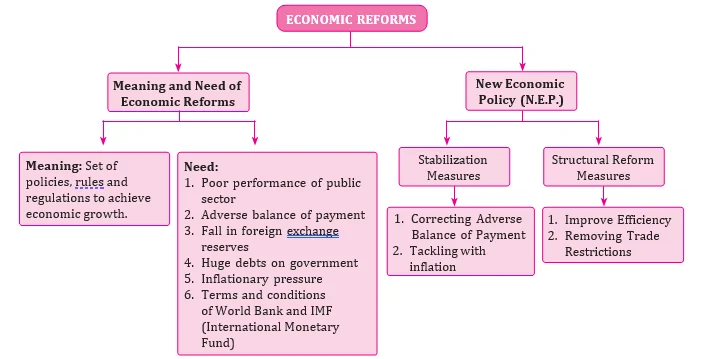

Sub-Theme: Economic Reforms

“Changing Structure of Rural Economy of India: Implications for Employment and Growth 2017,” is a report published by NITI Aayog, which made the following observations:

Statement 1 is incorrect: Both rural and urban regions have seen an improvement in worker productivity as well as the absolute level of income per worker. For rural areas, it was Rs. 37273 in 2004 -05 and Rs. 101755 in 2011-12, while for urban areas it was Rs. 120419 in 2004-05 and Rs. 282515 in 2011-12.

Statement 2 is incorrect: As per the 2011 Census, 68.8% of India’s population and 72.4% of the workforce resided in rural areas. However, the steady transition to urbanisation over the years has led to a decline in the rural share of the workforce, from 77.8% in 1993-94 to 70.9% in 2011-12.

Statement 3 is correct: About two-thirds of rural income is now generated in non- agricultural activities. Non-farm economy has increased in rural areas. The share of agriculture in the rural economy has decreased from 57% in 1993-94 to 39% in 2011-12.

Statement 4 is correct: After 2004-05, the rural areas have witnessed negative growth in employment in spite of high growth in output. The growth rate of rural employment was 1.45% during 1994-2005, which fell to -0.28% between 2005-12.

Question 2

Which of the following factors/policies were affecting the price of rice in India in the recent past?

Government’s trading

Government’s stockpiling

Consumer subsidies

Select the correct answer using the code given below.

(a) 1, 2 and 4 only

(b) 1, 3 and 4 only

(c) 2 and 3 only

(d) 1, 2, 3 and 4

ExplanationAns: d

Sub-Theme: Government Policies Factors/Policies Affecting the Price of Rice in recent past are:

Question 3

With reference to chemical fertilisers in India, consider the following statements:

1. At present, the retail price of chemical fertilisers is market-driven and not administered by the

2. Ammonia, which is an input of urea, is produced from natural gas.

3. Sulphur, which is a raw material for phosphoric acid fertilizer, is a by-product of oil refineries.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 2 only

(d) 1, 2 and 3

ExplanationAns: b

Sub-Theme: Agriculture Fertilizer

Statement 1 is incorrect: The Union Government subsidizes fertilizers to ensure that fertilizers are easily available to farmers at reasonable prices and the county remains self- sufficient in agriculture. Thus, the fertilizer price in India is administered by the government.

Statement 2 is correct. Ammonia’s chemical formula is NH3. It is a colourless gas and is used as an industrial chemical in the production of fertilizers, plastics, synthetic fibers, dyes and other products. It occurs naturally in the environment from the breakdown of organic waste matter and may also find its way to ground and surface water sources through industrial effluents, contamination by sewage or through agricultural runoff. In the Haber– Bosch process, the atmospheric nitrogen (N2) is converted to ammonia (NH3) by reacting it with hydrogen (H2), (this Hydrogen is provided by breaking methane (CH4) from natural gas) while maintaining the high temperatures and pressures.

Statement 3 is correct. In India, the domestic production of elemental sulphur is limited to by-product recoveries from petroleum refineries and fuel oil used as feedstock for manufacturing fertilizer.

|

NOTE: This particular question is a multi- dimensional one that covers the aspect of Economy, Government policies, and sound knowledge in chemistry, preferably Environmental chemistry. Here, by asking this question UPSC might have wanted to check the analytical ability of aspirants from a multi-dimensional perspective. |

Question 4

In India, which of the following can be considered as public investment in agriculture?

Computerization of Primary Agricultural Credit

Social Capital development.

Free electricity supply to farmers.

Waiver of agricultural loans by the banking system

Setting up cold storage facilities by the governments.

Select the correct answer using the code given below.

(a) 1, 2 and 5 only

(b) 1, 3, 4 and 5 only

(c) 2, 3 and 6 only

(d) 1, 2, 3, 4, 5 and 6

ExplanationAns: c

Sub-Theme: Public investment in agriculture

Public Investment: It is an investment by the State (Central, state and local governments orthrough publicly owned companies) to build the nation’s capital stock by devoting resources to the basic physical infrastructure (such as roads, bridges, rail lines, airports, and water distribution), research and development, etc. that leads to increased output and/or living standards.

The following can be considered as Public Investment in Agriculture.

Additional Information:

Question 5

Under the Kisan Credit Card scheme, short-term credit support is given to farmers for which of the following purposes?

Purchase of combine harvesters, tractors and mini trucks.

Consumption requirements of farm households

Post-harvest expense

Construction of a family house and setting up a village cold storage facility.

Select the correct answer using the code given below:

(a) 1, 2 and 5 only

(b) 1, 3 and 4 only

(c) 2, 3, 4 and 5 only

(d) 1, 2, 3 4 and 5

ExplanationAns: b

Sub-Theme: Agricultural credit

Announced in the 1998–1999 budget, the Kisan Credit Card Scheme aims to provide farmers with the institutional credit they need to meet their financial needs at various phases of farming. It is implemented by all public sector banks, regional rural banks, and cooperative banks across the nation. Under the Kisan Credit Card scheme, short-term credit support is given to farmers for the following purposes:

Additional Information:

|

NOTE: Statement 2 talks about “Purchase of combine harvesters, tractors and mini trucks” which is not a short term investment. It needs heavy capital and is not possible with short-term credit support provided under KCC. By this reasoning and general understanding if we eliminate statement 2, we will get correct answer i.e., ‘Option (b) 1, 3 and 4 only’ |

Question 6.

Consider the following statements:

1. In the case of all cereals, pulses and oil-seeds, the procurement at Minimum Support Price (MSP) is unlimited in any State/UT of India.

2. In the case of cereals and pulses, the MSP is fixed in any State/UT at a level to which the market price will never rise.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ExplanationAns: d

Sub-Theme: MSP

Statement 1 is incorrect: Procurement of all cereals, pulses and oilseeds at Minimum support price is open-ended. It is limited since our buffer stock is limited. Open ended procurement means whatever foodgrains are offered by the farmers, within the stipulated procurement period and which conforms to the quality specifications prescribed by Government of India, are purchased at MSP (and bonus/ incentive, if any) by the Government agencies including FCI for central Pool.

Statement 2 is incorrect: Market price has no link with minimum support price and it can go below or above the MSP, depending upon the demand of the crop in the market.

Question 7

The term ‘West Texas Intermediate’, sometimes found in news, refers to a grade of

(a) Crude oil

(b) Bullion

(c) Rare earth elements

(d) Uranium

ExplanationAns: a

Sub-Theme: Crude oil Trade

Crude Oil Trade:

Difference of WTI and Brent Crude oil:

| WTI | Brent |

| Benchmark for oil extracted from America | Benchmark for crude oil obtained from

the North Sea near Norway, Sweden, and UK |

| Benchmark used by US oil prices | Benchmark used for OPEC oil prices |

| Traded on New York Mercantile Exchange | Traded on International Exchange in London |

| Low share at international trade but futuristic opportunities | Two-third of the world’s crude contracts are signed Brent oil Benchmark |

Question 8

With reference to Trade-Related Investment Measures (TRIMS), which of the following statements is/are correct?

They apply to investment measures related to trade in both goods and services.

They are not concerned with the regulation of foreign investment.

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: c

Sub-Theme: WTO Agreements

Statement 1 is correct: Trade-Related Investment Measure (TRIMs) provides quantitative restrictions on imports by foreign investors. TRIMs agreement stipulates that certain measures adopted by Governments to regulate FDI can cause trade-restrictive and distorting effects.

Statement 2 is incorrect: As per Article 1 of the TRIMs agreement, it applies only to investment measures related to trade in goods and not in services.

Statement 3 is correct: TRIMs are not intended to deal with the regulation of investment as such and does not impact directly on WTO members’ ability to regulate and place conditions upon the entry and establishment of foreign investment.

Question 9

Consider the following statements:

1. The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI).

2. The WPI does not capture changes in the prices of services, which CPI does.

3. The Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 only

(c) 3 only

(d) 1, 2 and 3

ExplanationAns: a

Sub-Theme: Inflation

Statement 1 is correct: The Wholesale Price Index (WPI) measures wholesale price changes. The Wholesale goods or services sold by businesses to smaller businesses for selling further. The WPI does not include services. The weightage for food is lower in WPI whereas the weightage of food in the CPI is close to 50%.

Statement 2 is correct: WPI indicates the wholesale price, whereas CPI shows the retail price i.e., the price at which people make purchases from the retail market. WPI does not show the impact of inflation on the people. Any policy should consider the impact on the people. WPI does not account for the price of services. It is an international best practice – most of the countries have shifted to CPI.

Statement 3 is incorrect. The Reserve bank of India adopted the new Consumer Price Index (CPI) (combined) as the key measure of inflation in 2014. The Consumer Price Index measures retail-level price changes. It includes services as well.

Question 10

If another global financial crisis happens in the near future, which of the following actions/policies are most likely to give some immunity to India?

Opening up to more foreign banks

Maintaining full capital account convertibility

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 1, 2 and 3

ExplanationAns: a

Sub-Theme: Mechanism to counter Financial crisis

Statement 1 is correct: Due to the global economic crisis, both creditor and debtor nations face hardships to keep the economy afloat. Various political and economic considerations make it difficult to come to the rescue of a distressed nation. Hence India should not depend on short term borrowings.

Statement 2 is incorrect: Opening up to more foreign banks would lead to enhanced exposure to the global economy, and hence an increased risk. Strengthening the domestic banks would prove more helpful in a situation like a global economic crisis.

Statement 3 is incorrect: Capital account convertibility means no restriction on the amount you can convert into foreign currency to enable you to acquire any foreign assets and vice versa. In a situation of a financial crisis, it will be a big mistake. It can create a situation of “Capital flight” where a foreign investor can withdraw all his money at once.

Question 11

If you withdraw Rs. 1,00,000 in cash from your Demand Deposit Account at your bank, the immediate effect on aggregate money supply in the economy will be:

(a) To reduce it by 1,00,000

(b) To increase it by 1,00,000

(c) To increase it by more than 1,00,000

(d) To leave it unchanged

ExplanationAns: d

Sub-Theme: Demand and Supply of Money

Demand Deposit

Question 12

What is the importance of the term “Interest Coverage Ratio” of a firm in India?

1. It helps in understanding the present risk of a firm that a bank is going to give a loan to.

2. It helps in evaluating the emerging risk of a firm that a bank is going to give a loan to.

3. The higher a borrowing firm’s level of Interest Coverage Ratio, the worse is its ability to service its debt.

Select the correct answer using the code given below.

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: a

Sub-Theme: Banking Interest

Statements 1 and 2 are correct: The interest coverage ratio is a debt and profitability ratio used to determine how easily a company can pay interest on its outstanding debt.

Lenders, investors, and creditors often use this formula to determine a company’s riskiness relative to its current debt or for future borrowing.

Statement 3 is incorrect: The higher the coverage ratio, the easier it should be to make interest payments on its debt or pay dividends. Interest Coverage Ratio:

Question 13

If the RBI decides to adopt an expansionist monetary policy, which of the following would it not do?

Increase the Marginal Standing Facility Rate

Cut the Bank Rate and Repo Rate

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

ExplanationAns: b

Sub-Theme: Monetary policy

Statement 1 is incorrect: Reducing SLR leaves more liquidity with banks, which in turn can fuel growth and demand in the economy.

Statement 2 is correct: With the increase of MSF Rate, cost of borrowing increases for banks resulting in reduced available resources to lend.

Statement 3 is incorrect: Under expansionary monetary policy, RBI reduces repo rate and bank rate to increase liquidity in the banking sector.

RBI Monetary Policy:

| Tool | Contractionary Policy | Expansionary Policy |

| Cash Reserve Ratio (CRR) | Increase | Decrease |

| Repo Rate | Increase | Decrease |

| Statutory Liquidity Ratio (SLR) | Increase | Decrease |

| Marginal Standing Facility Rate (MSF) | Increase | Decrease |

Question 14

Consider the following statements:

1. In terms of short-term credit delivery to the agriculture sector, District Central Cooperative Banks (DCCBs) deliver more credit in comparison to Scheduled Commercial Banks and Regional Rural Banks.

2. One of the most important functions of DCCBs is to provide funds to the Primary Agriculture Credit societies.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ExplanationAns: b

Sub-Theme: Cooperative Banking

Statement 1 is incorrect: Although the focus of rural cooperative lending is agriculture, the share in credit flow to the agriculture of rural cooperatives is only 12.1%, as compared to 76% of Scheduled Commercial Banks (SCBs), and 11.9% of Regional Rural Banks.

Statement 2 is correct: DCCBs mobilise deposits from the public and provide credit to the public and PACS.

District Central Co-operative Banks (DCCBs):

3-tier structure of Short term Co-operative Banks:

Question 15

In the context of the Indian economy, non-financial debt includes which of the following?

Amounts outstanding on credit cards

Treasury bills

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 1, 2 and 3

ExplanationAns: d

Sub-Theme: Debt Financing

Option (d) is correct: Types of non-financial debt are Housing loans owed by households, Amounts outstanding on credit cards, Treasury bills, Credit Card balance etc.

Debt Financing:

Question 16

With reference to the international trade of India at present, which of the following statements is/are correct?

1. India’s merchandise exports are less than its merchandise imports.

2. India’s imports of iron and steel, chemicals, fertilisers and machinery have decreased in recent years.

3. India’s exports of services are more than its imports of services.

4. India suffers from an overall trade/current account deficit.

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 and 4 only

(c) 3 only

(d) 1, 3 and 4 only

ExplanationAns: d

Sub-Theme: BoP

Statement 1 is correct: The major portion of India’s current account deficit is in the area of merchandise trade. As per RBI’s data, India’s Merchandise exports during April-August 2019- 2020 was USD 133.14 billion, as compared to USD 210.39 billion of imports during the same period.

Statement 2 is incorrect: Between 2011–12 and 2018–19, the composition of imports by commodity reveals that imports of iron and steel, organic chemicals, and industrial machinery have experienced positive growth rates as a percentage of total imports.

Statement 3 is correct: India has a surplus of net services (service exports minus service imports). India’s Service exports during April- August 2019- 2020 was USD 67.24 billion, as compared to USD 39.25 billion of imports during the same period.

Statement 4 is correct: Current Account Deficit (CAD) or trade deficit is the shortfall between exports and imports. As per Economic Survey 2019-20, India’s CAD was 2.1% in 2018-19, and 1.5% of GDP in H1 of 2019-20.

Question 17

With reference to Foreign Direct Investment in India, which one of the following is considered its major characteristic?

(a) It is the investment through capital instruments essentially in a listed company.

(b) It is a largely non-debt creating capital flow.

(c) It is an investment that involves debt-servicing.

(d) It is the investment made by foreign institutional investors in the Government Securities.

ExplanationAns: b

Sub-Theme: Foreign Investment – FDI

Option (a) is incorrect: FDI is the investment through a capital instrument by a non- resident entity/person resident outside India in an unlisted Indian company, or 10% or more of the post issue paid-up equity capital on a fully diluted basis of a listed Indian company.

Option (b) is correct: A non-debt creating capital flow is the one where there is no direct repayment obligation for the residents. FDI is largely a non-debt creating capital flow.

Option (c) is incorrect: Debt servicing is the regular repayment of interest and principal on a debt for a particular period. FDI has no link with this concept.

Option (d) is incorrect: The investment can be made in equities or equity linked instruments or debt instruments issued by the company. Thus, FDI isn’t directly associated with government securities.

Question 18

“Gold Tranche” (Reserve Tranche) refers to:

(a) A loan system of the World Bank

(b) One of the operations of a Central Bank

(c) A credit system granted by WTO to its members

(d) A credit system granted by IMF to its members

ExplanationAns: d

Sub-Theme: Functions of IMF

Option (d) is correct: A Reserve Tranche is a portion of the required quota of currency each member country must provide to the IMF that can be utilized for its own purposes without a service fee or economic reform conditions.

Gold or Reserve Tranche:

There are no interest costs for the initial 25% reserve tranche. Any additional items would incur a service charge.

Question 19

With reference to the Indian economy, consider the following statements:

1. ‘Commercial Paper’ is a short-term unsecured promissory note.

2. ‘Certificate of Deposit’ is a long-term instrument issued by the Reserve Bank of India to a

3. ‘Call Money’ is a short term finance used for interbank transactions.

4. ‘Zero-Coupon Bonds are the interest-bearing short term bonds issued by the Scheduled Commercial Banks to corporations.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 4 only

(c) 1 and 3 only

(d) 2, 3 and 4 only

ExplanationAns: c

Sub-Theme: Instruments of Money Market

Statement 1 is correct: Commercial Paper is a money market instrument for financing working capital requirements of companies. It is an unsecured instrument issued in the form of promissory notes which can be issued for a period ranging from 15 days to one year.

Statement 2 is incorrect: Certificate of Deposit are short term money market instruments issued by Commercial Banks and special financial institutions which are freely transferable between parties. Its maturity period ranges from 91 days to 1 year. These can be issued to individuals, cooperatives and companies.

Statement 3 is correct: Call money is a money market instrument used by the banks to meet their temporary requirement of cash. They borrow and lend money from each other normally on a daily basis. It has a maturity period of one day to fifteen days and is used by banks for adjusting to their short-term liquidity imbalances.

Statement 4 is incorrect: Zero coupon Bond is a type of bond which is issued at a discount to its face value, at which it will be redeemed. There are no intermittent payments of interests and they are generally issued for long tenure.

2019

Question 1

With reference to India’s Five -Year Plans, which of the following statements is/are correct?

1. From the Second Five -Year Plan, there was a determined thrust towards substitution of basic and capital good industries.

2. The Fourth Five -Year Plan adopted the objective of correcting the earlier trend of increased concentration of wealth and economic power.

3. In the Fifth Five -Year Plan, for the first time, the financial sector was included as an integral part of the Plan.

Select the correct answer using the code given below.

(a) 1 and 2 only

(b) 2 only

(c) 3 only

(d) 1, 2 and 3

ExplanationAns: a

Sub-Theme: Economic Planning

Statement 1 is correct: From the Second Five Year Plan (1956-61), there was determined thrust towards substitution of basic and capital goods industries. This plan focused on Rapid Industrialization with an emphasis on capital goods and heavy industries. It was based on the PC Mahalanobis Model.

Statement 2 is correct: The Fourth Plan (1969-74) provided a necessary corrective to the earlier trend which helped particularly the stronger sections in agriculture as well as in industry to enable them rapidly to enlarge and diversify the production base. It has adopted the objective of correcting the earlier trend of increased concentration of wealth and economic power. Thus, it targeted Growth with Stability and progressive achievement of self- reliance.

Statement 3 is incorrect: The Fifth plan (1974-78) aimed at removal of poverty and attaining self-reliance. The financial sector became an integral part of the plan in the Ninth five -year plan (1997-2002).

Question 2

The economic cost of food grains to the Food Corporation of India is Minimum Support Price and bonus (if any) paid to the farmers plus:

(a) Transportation cost

(b) Interest cost only

(c) Procurement incidentals and distribution

(d) Procurement incidentals and charges for godowns.

ExplanationAns: c

Sub-Theme: Government Policies/Food Security

Food Corporation of India (FCI):

Costs and Prices (CACP) was established in 1965.

Question 3

Among the agricultural commodities imported by India, which one of the following accounts for the highest imports in terms of value in the last five years?

(a) Spices

(b) Fresh fruits

(c) Pulses

(d) Vegetable oils

ExplanationAns: d

Sub-Theme: Agricultural commodity Trading

Import of Agricultural commodities:

Question 4

With reference to land reforms in independent India, which one of the following statements is correct?

(a) The ceiling laws were aimed at family holdings and not individual holdings.

(b) The major aim of land reforms was providing agricultural land to all the landless.

(c) It resulted in cultivation of cash crops as a predominant form of cultivation.

(d) Land reforms permitted no exemptions to the ceiling limits.

ExplanationAns: b

Sub-Theme: Land Reforms

Land Reforms in Independent India:

Additional Information:

Question 5

Among the following, which one is the largest exporter of rice in the world in the last five years?

(a) China

(b) India

(c) Myanmar

(d) Vietnam

ExplanationAns: b

Sub-Theme: Agricultural commodity Trading

In recent years (2014-18), Vietnam’s rice exports were between 13 and 16 percent, Thailand’s between 22 and 25 percent, and India’s between 25 and 26 percent. Since the beginning of this decade, India has been the leading exporter of rice worldwide (2011-12).

Question 6

Consider the following statements:

1. Coal sector was nationalised by the Government of India under Indira Gandhi.

2. Now, coal blocks are allocated on lottery basis.

3. Till recently, India imported coal to meet the shortages of domestic supply, but now India is self-sufficient in coal products.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 3 only

(d) 1, 2 and 3

ExplanationAns: a

Sub-Theme: Coal Sector

Statement 1 is correct: The nationalisation was done in two phases, the first with the coking coal mines in 1971-72 and then with the non -coking coal mines in 1973. Indira Gandhi served as the Prime Minister of the country from 1971-1973.

Statement 2 is incorrect: After the Supreme Court cancelled the coal block allocations in 2014. To manage and reallocate the cancelled blocks in a transparent and accountable manner, the Coal Mines (Special Provisions) Act, 2015 enabled the provisions for ‘allocation of coal mines by way of auction and allotment for the sale of coal’.

Statement 3 is incorrect: India has the 5th largest coal reserves in the world, but due to the monopolies of some firms, it cannot produce enough coal to meet the shortages. It imports coal to meet the shortages. Domestic coal has been able to meet only 75% of our annual coal demand. About 200 mt of imports are used to make up for the shortage of local coal supply.

|

NOTE: Even if we don’t know the exact answer, we can still attempt the questions through elimination method. For example, observing the third statement, ‘self sufficient in coal products’ sounds absurd. Now if we have covered daily newspapers and NCERTs (geography) then we know that India holds the 5th biggest coal reserves in the world but due to incapacity of coal production by monopolistic firms, it imports coal to meet the shortages of domestic supply. Hence, statement 3 is wrong and by eliminating this single statement we can arrive at the correct answer. |

Question 7

The Service Area Approach was implemented under the purview of

(a) Integrated Rural Development Programme

(b) Lead Bank Scheme

(c) Mahatma Gandhi National Rural Employment Guarantee Scheme

(d) National Skill Development Mission

ExplanationAns: b

Sub-Theme: Government Policies/Financial Inclusion

Option (b) is correct: Service Area Approach is a developed version of the “area approach” method of the Lead Bank Scheme.

Service Area Approach (SAA):

Question 8

The Chairman of public sector banks are selected by the:

(a) Banks Board Bureau

(b) Reserve Bank of India

(c) Union Ministry of Finance

(d) Management of concerned bank

ExplanationAns: (a)

Sub-Theme: PSU Bank/Banking Appointment

Option (a) is correct: Banks Board Bureau recommends for selection of heads – Public Sector Banks and Financial Institutions and helps banks in developing strategies and capital raising plans.

Bank Board Bureau

Composition:

Question 9

Which of the following is not included in the assets of a commercial bank in India?

(a) Advances

(b) Deposits

(c) Investments

(d) Money at call and short notice

ExplanationAns: b

Sub-Theme: Banking mechanism

Bank Assets:

Question 10

Which of the following is issued by registered foreign portfolio investors to overseas investors who want to be part of the Indian stock market without registering themselves directly?

(a) Certificate of Deposits

(b) Commercial Paper

(c) Promissory Note

(d) Participatory Note

ExplanationAns: d

Sub-Theme: Foreign Investment

P-Notes or Participatory Notes

Question 11

Which one of the following is not the most likely measure the Government/ RBI takes to stop the slide of the Indian rupee?

(a) Curbing imports of nonessential goods-and promoting exports

(b) Encouraging Indian borrowers to issue rupee denominated Masala Bonds

(c) Easing conditions relating to external commercial borrowing

(d) Following an expansionary monetary policy

ExplanationAns: d

Sub-Theme: RBI monetary policy

Option (a) is incorrect: This would help control imports and thus the depreciation of the rupee.

Option (b) is incorrect: Masala bonds were brought in to curb the slide of rupee since the borrowing is rupee-dominated and does not put pressure on our currency through borrowing dollars.

Option (c) is incorrect: Easing ECBs will lead to higher borrowing abroad and would temporarily bridge the deficit of forex in India preventing the slide of rupee.

Option (d) is correct: An expansionary monetary policy may lead to lower interest rates and thus flight of foreign capital from India (which would get better returns abroad). Also, such a policy may fuel inflation and higher imports through higher government spending and further cause a slide of the rupee.

Question 12

The money multiplier in an economy increases with which one of the following?

(a) Increase in the Cash Reserve Ratio in the banks

(b) Increase in the Statutory Liquidity Ratio in the banks

(c) Increase in the banking habit of the people

(d) Increase in the population of the country

ExplanationAns: (c)

Sub-Theme: Money Multiplier/Money Supply

Question 13

In the context of India, which of the following factors is/are contributor/contributors to reducing the risk of a currency crisis?

Increasing the government expenditure

Remittances from Indians abroad

Select the correct answer using the code given below.

(a) 1 only

(b) 1 and 3 only

(c) 2 only

(d) 1, 2 and 3

ExplanationAns: b

Sub-Theme: Currency crisis/BoP

Currency crisis is brought about by a decline in the value of a country’s currency which negatively affects an economy. It creates instabilities in exchange rates, meaning that one unit of a certain currency no longer buys as much as it used to in another currency.

Statements 1 and 3 are correct: The foreign current earnings of India’s IT sector and remittances from abroad would lead to more inflow of foreign currencies in the economy and boost the foreign exchange reserves.

Statement 2 is incorrect: Increasing government expenditure will have no effect on the value of the currency since it is not related to change in foreign exchange reserves or any currency fluctuations.

Question 14

Consider the following statements:

1. Most of India’s external debt is owed by governmental entities.

2. All of India’s external debt is denominated in US dollars.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ExplanationAns: d

Sub-Theme: External Debt

Statement 1 is incorrect: As per the Government report on External debt, December 2018-Commercial borrowings are the largest component of external debt with a share of 37.1%, followed by NRI deposits (23.9%) and short-term trade credit (19.9%).

Statement 2 is incorrect: US dollar- denominated debt continued to be the largest component of India’s external debt with a share of 45.9 % at the end of December 2018, followed by the Indian Rupee (24.8 %), SDR (5.1 %), Yen (4.9 %) and Euro (3.1 %).

Question 15

Consider the following statements:

1. Purchasing Power Parity (PPP) exchange rates are calculated by comparing the prices of the same basket of goods and services in different

2. In terms of PPP dollars, India is the sixth largest economy in the world.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ExplanationAns: a

Sub-Theme: Purchasing Power

Statement 1 is correct: PPP is an economic theory that compares different countries’ currencies through a “basket of goods” approach. The PPP between two countries measures the amount of one country’s currency required to purchase a basket of goods and services in the country that is compared to the amount of another country’s currency in order to purchase a similar basket of goods and services. e.g. -If a dumpling is selling in India for Rs100 and in China for ¥2, this would imply a PPP exchange rate of 1¥ to Rs 50.

Statement 2 is incorrect: In terms of PPP dollars. China is the world’s largest economy, followed by the US and India at third position (2018) respectively.

Question 16

In a given year in India, official poverty lines are higher in some States than in others because:

(a) Poverty rates vary from State to State

(b) Price levels vary from State to State

(c) Gross State Product varies from State to State

(d) Quality of public distribution varies from State to State

ExplanationAns: b

Sub-Theme: Poverty

2018

Question 1

Increase in absolute and per capita real GNP does not connote a higher level of economic development, if:

(a) Industrial output fails to keep pace with agricultural output.

(b) Agricultural output fails to keep pace with industrial output.

(c) Poverty and unemployment increase.

(d) Imports grow faster than exports.

ExplanationAns: c

Sub-Theme: Economic Growth

Option (c) is correct: It is possible that an increase in absolute and per capita Gross National Product (GNP) will only reflect the economic growth of a small portion of society, leaving the rest of the population in poverty and unemployment. This is because the concept of per capita real income or per capita GDP are not able to capture the true picture in terms of non-monetary social indicators. Thus, an increase in absolute and per capita real GNP does not connote a higher level of economic development, if poverty and unemployment increase.

Additional Information: Economic Growth and Economic Development:

Question 2

Consider the following statements:

The Government does not impose any customs duty on all the imported edible oils as a special

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ExplanationAns: a

Sub-Theme: Agricultural commodity Trading

Statement 1 is correct: India occupies a prominent position in the world oilseeds industry with contribution of around 10% in worldwide production. But the demand of edible oils (extracted from oilseeds in addition to palm oil) is significantly higher than the domestic production, leading to dependence on imports (60% of requirement).

Statement 2 is incorrect: Government imposes customs duty on edible oils to safeguard the interests of the domestic oil crushing industry. The duty on two major edible oils, namely crude sunflower seed oil and crude canola/ rapeseed/mustard is 25% while crude soybean oil attracts 30% duty.

Question 3

Consider the following:

Barley

Coffee

Finger millet

Groundnut

Sesamum

Turmeric

The Cabinet Committee on Economic Affairs has announced the Minimum Support Price for which of the above?

(a) 1, 2, 3 and 7 only

(b) 2, 4, 5 and 6 only

(c) 1, 3, 4, 5 and 6 only

(d) 1, 2, 3, 4, 5, 6 and 7

Ans: b

Sub-Theme: MSP

Question 4

Consider the following statements:

1. Capital Adequacy Ratio (CAR) is the amount that banks have to maintain in the form of their own funds to offset any loss that banks incur if the account-holders fail to repay dues.

2. CAR is decided by each individual bank.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ExplanationAns: a

Sub-Theme: Measures of NPA Resolution

Statement 1 is correct: Capital Adequacy Ratio (CAR) is the ratio of a bank’s capital in relation to its risk weighted assets and current liabilities.

Statement 2 is incorrect: CAR is decided by central banks and bank regulators to prevent commercial banks from taking excess leverage and becoming insolvent in the process.

Question 5

Which one of the following statements correctly describes the meaning of legal tender money?

(a) The money which is tendered in courts of law to defray the fee of legal cases

(b) The money which a creditor is under compulsion to accept in settlement of his claims

(c) The bank money in the form of cheques, drafts, bills of exchange etc.

(d) The metallic money in circulation in a country

ExplanationAns: b

Sub-Theme: Money as a legal tender

Legal tender is any official medium of payment recognized by law which the creditor is obligated to accept towards repayment of a debt.

Question 6

Consider the following statements:

1. The Reserve Bank of India manages and services Government of India Securities but not any State Government Securities.

2. Treasury bills are issued by the Government of India and there are no treasury bills issued by the state Governments.

3. Treasury bills are issued at a discount from the par value.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 3 only

(c) 2 and 3 only

(d) 1, 2 and 3

ExplanationAns: c

Sub-Theme: Debt Instrument

Statement 1 is incorrect: The RBI is the debt manager for both the Central Government and the State Governments. RBI manages the debt of state governments on the basis of separate agreements.

Statement 2 is correct: Treasury bills are money market instruments, are short term debt instruments issued by the Government of India and are presently issued in three tenors, namely, 91 days, 182 days and 364 days.

Statement 3 is correct: Treasury bills are issued at a discount from the par value (also known as the face value) of the bill, meaning the purchase price is less than the face value of the bill. For example, a $1,000 bill might cost the investor $950 to buy the product.

Question 7

With reference to the governance of public sector banking in India, consider the following statements:

1. Capital infusion into public sector banks by the Government of India has steadily increased in the last decade.

2. To put the public sector banks in order, the merger of associate banks with the parent State Bank of India has been affected.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ExplanationAns: b

Sub-Theme: Government policies

Statement 1 is incorrect: Capital infusion into public sector banks by the Government of India has not steadily increased in the last decade.

Statement 2 is correct: Merger of associate banks with the parent State Bank of India has been affected to create improved operational efficiency and economies of scale. It will also result in improved risk management and unified treasury operations.

Question 8

India enacted the Geographical Indications of Goods (Registration and Protection) Act, 1999 in order to comply with the obligations to:

(a) ILO

(b) IMF

(c) UNCTAD

(d) WTO

ExplanationAns: d

Sub-Theme: IP Related issues/WTO

Question 9

Consider the following statements:

Human capital formation as a concept is better explained in terms of a process which enables:

1. Individuals of a country to accumulate more capital.

2. Increasing the knowledge, skill levels and capacities of the people of the country.

3. Accumulation of tangible wealth.

4. Accumulation of intangible wealth.

Which of the statements given above is/are correct?

(a) 1 and 2

(b) 2 only

(c) 2 and 4

(d) 1, 3 and 4

ExplanationAns: c

Sub-Theme: Human Capital

Statement 1 is incorrect: As per RBI, Gross capital formation refers to the aggregate of gross additions to fixed assets (that is fixed capital formation) plus change in stocks during the counting period.

Statement 2 is correct: OECD defines human capital as “the knowledge, skills, competencies and other attributes embodied in individuals or groups of individuals acquired during their life and used to produce goods, services or ideas in market circumstances”. Human capital formation is the outcome of investments in education, health, on-the job training, migration and information.

Statement 3 is incorrect: Tangible capital is also GCF as it involves largely infrastructural components.

Statement 4 is correct: Intangible wealth of a nation comprises the skilled population, human resource base, culture, arts etc.

Question 10

Despite being a high saving economy, capital formation may not result in significant increase in output due to:

(a) Weak administrative machinery

(b) Illiteracy

(c) High population density

(d) High capital-output ratio

ExplanationAns: d

Sub-Theme: Capital Formation

Question 11

If a commodity is provided free to the public by the Government, then

(a) The opportunity cost is Zero.

(b) The opportunity cost is ignored.

(c) The opportunity costs are transferred from the consumers of the product to the tax-paying

(d) The opportunity cost is transferred from the consumers of the product to the Government.

ExplanationAns: c

Sub-Theme: Opportunity Cost

Opportunity cost represents the benefits an individual, investor, or business misses out on when choosing one alternative over another. If a commodity is provided free to the public by the Government, then the opportunity cost is transferred from the consumers of the product to the tax-paying public. As per microeconomics, the opportunity cost is zero for free goods such as air and common goods such as fish/grazing land. For public goods such as street lights and defence, the opportunity cost is involved (The government could have spent that much money on street lights rather than on the military). So, the opportunity cost is not zero. Opportunity cost is also called Economic cost.

2017

Question 1

Which of the following has/have occurred in India after its liberalisation of economic policies in 1991?

Share of India’s exports in world trade increased

FDI inflows increased.

India’s foreign exchange reserves increased enormously.

Select the correct answer using the codes given below:

(a) 1 and 4 only

(b) 2, 3 and 4 only

(c) 2 and 3 only

(d) 1, 2, 3 and 4

ExplanationAns: b

Sub-Theme: Economic Reform

Statement 1 is incorrect: India’s agriculture sector has shown a gradual decline in contribution to the Indian economy post-reform. India’s traditional occupation, agriculture, currently makes up only 15% of the GDP, down from 29% in 1991.

Statement 2 is correct: India is seen as a successful exporter of IT software, auto parts, textiles, and engineering goods in the reform period. Thus, the share of India’s exports in world trade increased after its liberalisation of economic policies in 1991.

Statement 3 is correct: The Foreign investments including FDI and FII have increased from about US $ 100 million in 1990-91 to US $ 467 billion in 2012-13.

Statement 4 is correct: The opening up of the economy has led to rapid increase in foreign direct investment and foreign exchange reserves.

NOTE: This question came verbatim from Economics NCERT Class 11 Pg. 48. This highlights the importance of reading and understanding the concepts from NCERTs.

Question 2

What is/are the advantage/advantages of implementing the ‘National Agriculture Market’ scheme?

It provides the farmers access to nationwide markets, with prices commensurate with the quality of their produce.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

ExplanationAns: c

Sub-Theme: Government Policies/e-technology to aid farmers.

Statement 1 is correct: National Agriculture Market (NAM) is a pan-India electronic trading portal which networks the existing APMC mandis to create a unified national market for agricultural commodities.

Statement 2 is correct: NAM promises more options for sale. It would increase farmers’ access to nationwide markets (with prices commensurate with the quality of their produce) through warehouse based sales and thus obviate the need to transport his produce to the mandi.

National Agriculture Market (NAM):

A national market for agricultural commodities is created by connecting the current APMC mandis through the pan-Indian electronic trading portal known as the National Agriculture Market (NAM).

Advantages of e-NAM: