Answer:

| Approach:

Introduction

Body

- Give points about how PPP arrangements can lead to future liabilities.

- Suggest some ways to ensure that these liabilities do not hamper the future generations.

Conclusion

- PPPs are important for infrastructure development but appropriate care must be taken to ensure its sustainability.

|

Introduction:

Public-private partnerships (PPPs) are formally established agreements between public and private parties to share risks and benefits in the provision of public services and infrastructure. PPP is a model that has been widely adopted by governments around the world as a means of delivering infrastructure and public services more efficiently and effectively.

Body:

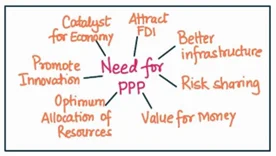

Public Private Partnerships (PPP) is required in infrastructural projects because:

- It allows access to private sector financing to build complex infrastructural projects.

- PPPs provide incentives for private sector companies to innovate and find cost-effective solutions and put to use their expertise in developing and maintaining better quality of infrastructure.

- Private sector collaboration ensures that the projects are completed on time.

But in long gestation projects, there is a greater risk from PPPs. This can be seen as follows:

- NPAs: There is a greater scope for asset-liability mismatch given the long gestation period. This leads to rise in Non-Performing Assets (NPAs) of banks which provide funds to the private players. Most of these are public sector banks (PSBs) and hence the NPAs become a liability on the people.

- Delays: PPP projects get delayed mostly due to issues in land acquisition and procedural delays. These delays add to cost overruns which makes the entire project unviable.

- Lack of regulatory framework: India lacks a comprehensive and consistent regulatory framework for PPPs, which can lead to problems such as lack of transparency and accountability. There is also an issue of prolonged litigation due to lack of clarity on various aspects of the project. This adds to cost overruns making the project unviable or defaulting on loans.

- Vijay Kelkar Committee on PPP recommended setting up independent sector-wise regulators for PPP projects.

All of these factors lead to transfer of additional liabilities to the future generation who would be obligated to pay these advances along with interest. This creates additional burden and reduces the potential to invest in their future. This makes the entire process unsustainable.

To address these issues, following steps can be taken:

- Projects must be consistent with a broad infrastructure plan and acceptable from a fiscal sustainability perspective to ensure that PPPs are not a source of unsustainable liabilities.

- Rigorous evaluation methods and cost benefit analysis must be applied during project planning.

- There should be a robust institutional framework where rights and obligation of each party is made clear. This should be accompanied by a robust dispute resolution mechanism.

Conclusion:

Although there are challenges, PPPs can help to address the challenges of financing, designing, constructing, and maintaining complex infrastructural projects.