Introduction

Since the sweeping reforms of 1991, there has been a concerted effort to recalibrate tax regimes, particularly concerning individual income taxes. The rationale behind this shift stems from the recognition that exorbitant tax rates can inadvertently incentivize tax evasion, undermining the efficacy of revenue collection mechanisms.

Consequently, a shift towards moderate tax reforms has gained widespread acceptance, driven by the belief that such policies not only promote savings but also encourage voluntary disclosure of income

Tax Reforms in India

- Reduction in Corporate Tax: Higher corporation tax reforms have been gradually reduced.

- Efforts have also been made to reform the indirect taxes to facilitate the establishment of a common national market for goods and commodities.

- Implementation of GST: The Indian Parliament passed a law, Goods and Services Tax Act 2016, to simplify and introduce a unified indirect tax system in India in 2016. This law came into effect in July 2017.

- This is expected to generate additional revenue for the government, reduce tax evasion and create ‘one nation, one tax and one market’.

- Simplification of Procedure: To encourage better compliance on the part of taxpayers, many procedures have been simplified and the rates also substantially lowered.

Committee and task force on Direct Tax reform recommendations

|

| Committee / Task Force |

Recommendations: |

| Kelkar Committee (2002)

Terms of Reference: To review and recommend reforms in the direct tax system in India.

Objectives: Simplify tax laws, rationalize tax rates, broaden the tax base, and enhance voluntary compliance. |

- Simplify tax laws to reduce complexity and improve compliance.

- Rationalize tax rates by reducing the number of tax slabs.

- Broaden the tax base by including more individuals and entities within the tax net.

- Phasing out tax exemptions and deductions to eliminate tax avoidance loopholes.

- Encourage voluntary compliance through taxpayer education and awareness programs.

- Gradual reduction of corporate tax reforms and rates to make Indian industry more competitive globally.

|

| Parthasarathi Shome Committee (2012):

Terms of Reference: To review the proposed General Anti-Avoidance Rules (GAAR) in the Finance Act, 2012.

Objectives: Provide recommendations to bring clarity and balance to the GAAR provisions. |

- Suggested safeguards to prevent the misuse of GAAR provisions.

- Recommended clear and objective criteria for determining tax avoidance.

- Proposed a time limit for invoking GAAR provisions to provide certainty to taxpayers.

- Advocated for a panel of experts to review GAAR cases to ensure fairness.

- Proposed that GAAR should not be invoked in cases where tax treaties exist.

- Recommended aligning GAAR provisions with international best practices to attract foreign investment.

|

| Direct Tax Code (DTC) Committee (2009):

Terms of Reference: To draft a new direct tax code for India.

Objectives: Simplify and modernize the direct tax system, revise tax reforms, deductions, exemptions, and improve tax administration. |

- Simplified tax structure with fewer tax slabs and deductions.

- Introduction of a single code governing direct taxes to reduce complexity.

- Phasing out various exemptions and deductions to broaden the tax base.

- Lowering corporate tax rates to make India more attractive for investments.

- Measures to reduce tax evasion and improve tax administration, including enhanced use of technology.

- Simplified procedures for filing tax returns and assessments.

|

Committee and task force on Indirect Tax reforms recommendations

|

| Committee / Task Force |

Recommendations: |

Raja J. Chelliah Committee (1991):

- Terms of Reference: To recommend comprehensive tax reforms in the indirect tax structure in India.

- Objectives: Introduce a Value Added Tax (VAT) system and harmonize state and central taxes to reduce tax cascading.

|

- Introduction of VAT System

- Harmonization of State and Central Taxes

- Uniform Rate Structure

- Input Tax Credit

- Exemption of Essential Goods

- Standardization of Tax Administration

- Taxpayer Education and Training

|

Kalyani Menon Sen Committee (2002):

- Terms of Reference: To examine and recommend measures to simplify customs and excise procedures.

- Objectives: Streamline customs and excise processes to facilitate trade and reduce compliance burdens.

|

- Simplification of Procedures

- Electronic Filing and Payment

- Transparency and Accountability

- Trade Facilitation

- Reduction of Litigation

- Stakeholder Consultation

- Simplification of Tariffs

- Single Window Clearance

|

T. R. Rustagi Committee (2011):

- Terms of Reference: To simplify and streamline the taxation structure of service tax reforms and administration.

- Objectives: Simplify service tax procedures and suggest measures to make compliance easier for service providers.

|

- Simplification of Tax Structure

- Rationalization of Taxable Services

- Electronic Filing and Payment

- Input Tax Credit (ITC)

- Place of Provision of Services Rules

- Regular Audits and Compliance Reviews

|

Arvind Subramanian Committee (2015)

- Terms of Reference: To recommend a revenue-neutral rate (RNR) for GST.

- Objectives: Determine an RNR to ensure that the introduction of GST does not lead to a substantial revenue loss for the government.

|

- Range for Revenue-Neutral Rate (RNR)

- Lower Rate for Precious Metals

- Additional 1% Inter-State Tax

- Compensation Mechanism for States

- Regular Review of Rates

|

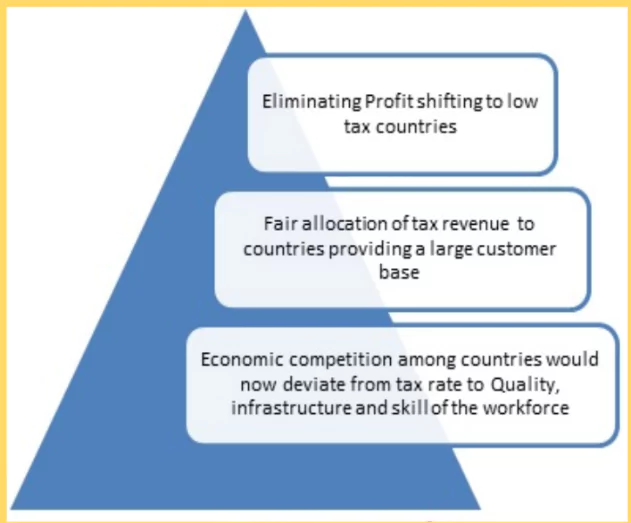

The Global Minimum Corporate Tax (GMCT) has emerged as a response to the practice of big technology companies shifting their profits to countries with lower corporate tax rates, often without relocating their actual business operations.

- Scope: GMCT applies primarily to companies that have relocated their business to tax havens with lower tax rates.

For companies based in such tax-friendly jurisdictions like Mauritius, they would continue to pay the lower tax rate of 5%. For companies based in such tax-friendly jurisdictions like Mauritius, they would continue to pay the lower tax rate of 5%.- The Global Minimum Corporate Tax Framework comprises two main pillars:

- Pillar One: Multinationals, will reallocate certain amounts of taxable income to market jurisdictions, resulting in a change in effective tax rate and cash tax obligations, as well as an impact on current transfer pricing arrangements

- Pillar Two: Income is taxed at an appropriate rate and has several complicated mechanisms to ensure this tax is paid.

- Reevaluation of Tax Measures: Once the Global Minimum Corporate Tax comes into effect, countries like India may need to reconsider measures such as the Equalization Levy, which they previously imposed on multinational technology companies like Google and Facebook.

|

Tax buoyancy

- Definition: Tax buoyancy is defined as the ratio of the percentage change in tax revenue to the percentage change in GDP.

- It indicates how tax revenues increase or decrease in response to changes in economic activity.

- Formula: Tax Buoyancy = (Percentage change in tax revenue) / (Percentage change in GDP)

| Interpretation |

| Buoyancy > 1 |

Tax revenues are growing at a faster rate than the economy. This usually occurs when the tax base expands due to either economic growth or effective tax administration and compliance. |

| Buoyancy < 1 |

Tax revenues are growing at a slower rate than the economy. This could be due to tax evasion, reductions in tax rates, or a shrinking tax base. |

| Buoyancy = 1 |

Tax revenues are growing at the same rate as the economy. |

Conclusion

- Tax reforms in India have been instrumental in driving economic growth and improving compliance.

- Various committees have played crucial roles in shaping these reforms, leading to reductions in corporate tax rates, simplification of procedures, and the implementation of the Goods and Services Tax (GST) Act.

- These tax reforms aim to enhance revenue generation, reduce tax evasion, and create a unified national market, ultimately fostering a more transparent and efficient tax system in India.