Introduction

- It is the gradual rise in prices of goods and services within a particular economy wherein, the purchasing power of consumers decreases, and the value of the cash holdings erode.

- Inflation measures the average price change in a basket of commodities and services over time.

- The opposite and rare fall in the price index of this basket of items is called deflation.

- In India, the Ministry of Statistics and Programme Implementation (MoSPI) measures inflation.

Understanding Inflation Indices: A Comprehensive Overview

Wholesale Price Index

- Base Year: 2011-12

- Measures the average change for bulk sale before the retail level.

- Most widely used inflation indicator. Covers only goods

- Weight: Manufactured products (64%)> Primary Articles (23%) >Fuel and Power (13%)

- Published by Office of Economic Adviser (OEA), Ministry of Commerce and Industry

Consumer Price Index

- Base Year for Consumer PRice Index: 2011-12

- Measures the change in the retail price in the prices of commodities of goods and services with reference to a base year.

- CPI Combined: RBI has adopted CPI Combined (Rural +Urban) as its key measure of inflation.

- Both goods and services

- Food and Beverage 45.86; Miscellaneous 28.32; Housing 10.07; Fuel and light 6.84; Clothing and Footwear 6.53; Pan, tobacco and intoxicants 2.38.

- By National Statistics Office (NSO),MoSPI

- CPI for Industrial Workers (IW): by the Ministry of Labor and Employment(MoLE).

- The base year for CPI (IW) was changed from 2001 to 2011.

- CPI for Agricultural Laborer (AL): by the MoLE.

- CPI for Agricultural Workers (CPI-AL) and Rural workers (CPI-RL) base year is 1986-87.

- CPI for Rural Laborer (RL): by the Ministry of Labor and Employment.

Index of Industrial Production

- Base Year: 2011-12

- Measures the growth rates in different industry groups of the economy. It is a key economic indicator of the manufacturing sector of the economy.

- 8 Core Industries: Index of 8 core industries are: Refinery Products > Electricity > Steel > Coal > Crude Oil > Natural Gas > Cement> Fertilizers.

- Weight: These 8 industries command 40.27% weight in the overall IIP weight in the overall IIP.

- Different Sectors: Manufacturing (77.63%) > Mining (14.37%) > Electricity (7.9%)

- The IIP index is computed and published by the Central Statistical Organization (CSO) every month.

Producer Price Index

- Producer Price Index (PPI) measures the average change in the price of goods and services either as they leave the place of production, called output PPI or as they enter the production process, called input PPI.

- PPI estimates the change in average prices that producers receive.

Producer Price Index (PPI) Vs Wholesale Price Index (WPI)

| Wholesale Price Index (WPI) |

Producer Price Index (PPI) |

- WPI captures the price changes at the point of bulk transactions and may include some taxes levied and distribution costs up to the stage of wholesale transactions.

|

- PPI measures the average change in prices received by the producer and excludes indirect taxes.

|

- Weight of an item in WPI is based on net traded value

|

- PPI weights are derived from Supply

|

- Multiple counting bias inherent in WPI

|

- PPI removes the multiple counting bias

|

- WPI does not cover services

|

|

- It is published by the office of Economic Advisor,

- Ministry of Commerce and Industry.

|

- PPI is measured monthly and is released in a report by the Bureau of Labor Statistics

|

Consumer Price Index (CPI) Vs Producer Price Index (PPI)

| Consumer Price Index (CPI) |

Producer Price Index (PPI) |

- CPI measures the change in average prices that a consumer pays.

|

- PPI estimates the change in average prices that a producer receives.

|

- Weights of items in CPI are derived from Consumer Expenditure Surveys.

|

- PPI is calculated on the basis of Supply.

|

GDP Deflator and Implicit Price Deflator

- The GDP deflator, also called implicit price deflator, is also another measure of inflation.

- It is the ratio of the value of goods and services an economy produces in a particular year at current prices to that of prices that prevailed during the base year.

GDP Price Deflator = ( Nominal GDP ÷ Real GDP) x 100

OR

GDP Deflator = GDP at Current Prices/GDP at Constant Prices

- Price-Driven Growth: This ratio helps to show the extent with which the increase in the GDP has happened on account of higher prices rather than an increase in output.

- Comprehensive Coverage: Since the deflator covers the entire range of goods and services produced in the economy – as against the limited commodity baskets for the wholesale or consumer price indices – it is seen as a more comprehensive measure of inflation.

- It reflects up-to-date expenditure patterns.

- The GDP deflator is available only on a quarterly basis, along with GDP estimates, whereas CPI and WPI data are released every month.

Note

- If the GDP deflator is 1, it implies no change in general price levels.

- If the GDP deflator is > 1, it implies an increase in general price levels.

- If the GDP deflator is < 1, it implies deflation or reduction of prices across the economy.

|

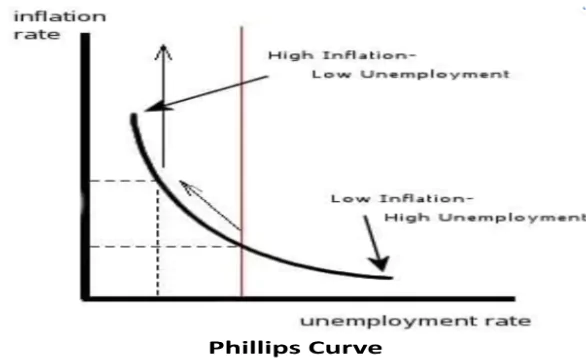

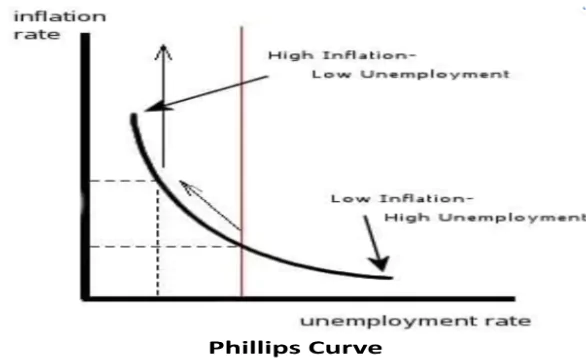

Phillips Curve

- Inverse relationship between unemployment and inflation.

- Accordingly, as levels of unemployment decrease, inflation increases.

Base Effect and Inflation

- The base effect relates to inflation in the corresponding period of the previous year, if the inflation rate was too low in the corresponding period of the previous year, even a smaller rise in the Price Index will give a high rate of inflation.

- Suppose the inflation rate in the base year is very low (e.g., 1%). In the following year, even a moderate increase in prices (e.g., 3%) would result in a relatively high percentage change. On the other hand, if the base year had a higher inflation rate (e.g., 5%), the same 3% increase in prices would represent a lower percentage change.

Inflation Targeting

- It is a monetary policy where the central bank sets a specific inflation rate as its goal and adjusts its monetary policy to achieve that rate.

- The RBI and Government of India signed a Monetary Policy Framework Agreement in 2015.

- Inflation targeting indicates the primacy of price stability as the key objective of monetary policy.

- RBI would aim to contain consumer price inflation within 6 % and within 4% with a band of (+/-) 2%.

Monetary Policy Committee (MPC)

- Establishment: Created in 2016, MPC is a statutory and institutionalized framework under the RBI Act, 1934. Urjit Patel Committee first proposed the idea for the formation of a five-member Monetary Policy Committee.

- Aim: maintaining price stability, while keeping in mind the objective of growth.

- Objective: To bring transparency and accountability in deciding monetary policy and Determines the policy interest rate required to achieve the inflation target.

- Committee Comprises: Six members where RBI Governor acts as an ex-officio chairman + 3 members are from RBI + 3 selected by government.

- Inflation Target: It is to be set once every five years by the Government of India, in consultation with the RBI.

- The MPC is required to meet at least four times in a year.

- The quorum for the meeting of the MPC is four members.

- Each member of the MPC has one vote, and in the event of an equality of votes, the Governor has a casting vote.

- Monetary Policy Report: Once every six months, the Reserve Bank is required to publish a document called the Monetary Policy Report to explain the sources of inflation and the forecasts of inflation for 6-18 months ahead.

- The current inflation target is pegged at 4% with (+/-) 2% tolerance.

- RBI Reporting Obligations for Inflation Deviations: If inflation exceeds or falls below the predetermined thresholds for three consecutive quarters, the RBI is obligated to furnish a report to the central government elucidating the reasons for the persistent price increase or decrease, outlining corrective measures, and providing an estimate of when the target will be attained.

Measures to Combat Inflation

| Monetary Policy Measures |

Fiscal Policy Measures |

Other measures |

- Increase in the Bank rate.

- Making borrowing costly by increasing interest rates.

- Increasing tendency to save.

- Controlling the credit creation.

- Conducting the open market operations.

- Increasing the Repo rate, Bank rate, CRR, SLR, and other policy rates.

|

- Reduces private spending by increasing taxes.

- Reduces government spending.

- Bringing more people under the tax coverage.

- Introducing new taxes and cesses.

|

- Price control by the government as a short-term measure.

- Import controls imposed by the government.

- Restricting wage increase by companies.

|

Correlation between Inflation, Fiscal Policy, and Monetary Policy

- Inflation is controlled by the Government through Fiscal policy and Reserve Bank of India through Monetary policy.

Monetary Policy

- The mechanism/tool used by the monetary authority of a country, generally the central/federal bank to control the money supply in the economy in order to maintain price stability and achieve high economic growth.

- In India, the central monetary authority is the RBI which maintains the price stability in the economy.

Fiscal Policy

- Fiscal policy is the use of government revenue collection (taxes or tax cuts) and expenditure (spending) to influence a country’s economy.

- Changes in the level and composition of taxation and government spending can affect macroeconomic variables, including: Aggregate demand and the level of economic activity; Saving and investment; Income distribution; Allocation of resources.

Fiscal Stimulus

- In economics, stimulus refers to attempts to use monetary or fiscal policy (or stabilisation policy in general) to stimulate the economy.

- Stimulus can also refer to monetary policies like lowering interest rates and quantitative easing.

- A stimulus is sometimes colloquially referred to as priming the pump or pump priming.

|

Important committees related to Inflation and their recommendations

|

|

|

- Developing PPI for India.

|

- Ramesh Chandra Committee (NITI Aayog)

|

- Roadmap for switching over from WPI to PPI.

|

|

|

- Monetary Policy Committee

|

- Mahendra Dev Verman Committee

|

- Linking MGNREGA to CPI-RL

|

- The committee suggested that inflation should be the nominal anchor for the monetary policy framework.

- The nominal anchor or the target for inflation should be set at 4 percent with a band of (+/-) 2 percent around it.

- Monetary Policy Decision making should be vested in a Monetary Policy Committee (MPC) that should be headed by the Governor.

|

Impacts of Inflation

- There are multi-dimensional effects of inflation on an economy both at the micro and macro levels:

- On Consumers (general people): An overall rise in prices over time reduces the purchasing power of consumers and thus reduces the aggregate demand in the economy.

- On Creditors/Lenders and Debtors: Inflation benefits the borrowers (debtors) and causes loss to the lender (creditor).

- On Investment: Investment in the economy is boosted by inflation (in the short-run).

- When prices rise, producers, traders, speculators and entrepreneurs gain on account of windfall profits because prices rise at a faster rate than the cost of production.

- Besides, there is a time-lag between the price rise and the increase in cost.

- Moreover, producers gain because the prices of their inventories (stocks) go up due to inflation. Also they generally, being borrowers of money for business purposes, stand to gain.

- On Income/Fixed Income Group

- Wage earners generally suffer during inflation, despite the fact that they obtain a wage rise to counter the rise in the cost of living.

- However, wages do not rise as much as the rise in prices of those commodities which the workers consume. Further, wages are allowed to rise much later than the rise in prices.

- If the workers are organized, they may not suffer much during inflation but if they are unorganized (like the agricultural laborers) they may suffer more as they may not find it easy to get their wages increased.

- On Saving

- Holding money does not remain an intelligent economic decision (because money loses value with every increase in inflation) which is why people visit banks more frequently and try to hold less money with themselves and put maximum with the banks in their savings accounts.

- This is also known as the shoe leather cost of inflation (as it consumes the precious time of the people visiting the bank frequently tagging their shoe).

- On Tax

- Tax-payers suffer while paying their direct and indirect taxes.

- Indirect taxes are imposed on value that increases prices of goods make tax-payers to pay increased indirect taxes.

- Similarly, due to inflation, direct tax (income tax, interest tax, etc.) burden of the tax-payers also increases as tax-payer’s gross income moves to the upward slabs of official tax brackets (but the real value of money does not increase due to inflation; in fact, it falls).

- This problem is also known as bracket creep – i.e., inflation-induced tax increases.

- On Exchange Rate: With a rise in inflation, the currency of the economy depreciates (loses its exchange value in front of a foreign currency) provided that it follows a flexible currency regime.

- On Export

- With inflation, exportable items of an economy gain competitive prices in the world market.

- Due to this, the volume of export increases (keep in mind that the value of export decreases here) and thus export income increases in the economy.

- On Import

- Inflation gives an economy the advantage of lower imports and import substitution as foreign goods become costlier.

- But in the case of compulsory imports (i.e., oil, technology, drugs, etc.) the economy does not get this benefit and loses more foreign currency instead of saving it.

- Example: India is dependent on crude oil import and thus faces huge losses during inflation.

- On Trade Balance

- In the case of a developed economy, inflation makes the trade balance favorable, while for developing economies, inflation is unfavorable for their balance of trade.

- Example: India, during inflation, exports more compared to normal times, but because of its import dependence on crude oil it pays more compared to its exports thus, leading to an adverse impact on its Current Account Deficit (CAD)

- On Employment: Inflation increases employment in the short-run, but becomes neutral or even negative in the long run.

- Public Morale: Inflation results in arbitrary redistribution of wealth favoring businessmen and debtors and hurting consumers, creditors, petty shopkeepers, small investors, and fixed income earners. This lowers the public morale.

Conclusion

- While WPI and CPI focus on price changes in specific baskets of goods and services, the GDP deflator offers a comprehensive measure of inflation by encompassing the entire range of goods and services produced in the economy. The IIP complements these indices by tracking changes in industrial output.

- Each index serves a distinct purpose, helping policymakers, businesses, and individuals understand different aspects of inflation and economic activity, thereby contributing to informed decision-making and effective policy formulation.

- Further, Inflation targeting under monetary policy plays a crucial role in fostering macroeconomic stability and guiding policy decisions to achieve long-term economic objectives.