Introduction

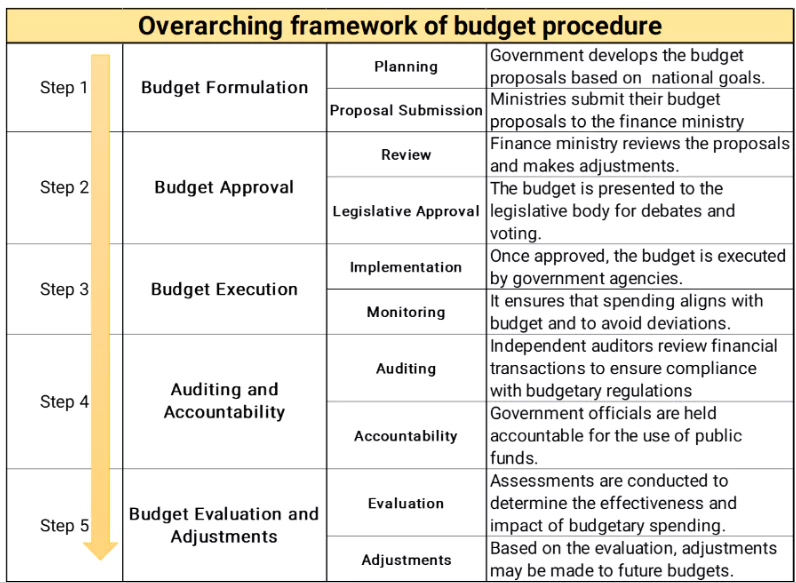

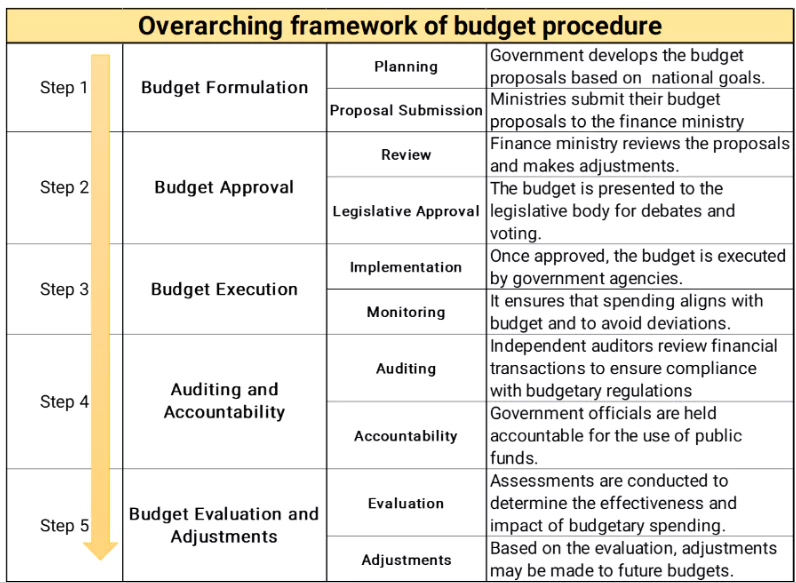

- It is an Annual Financial Statement as mandated by Article 112 of the Indian Constitution.

- It is presented before the Parliament, an estimated receipts and expenditures of the government for a particular financial year, running from 1 April to 31 March.

- The Department of Economic Affairs is responsible for the preparation of the Union Budget that is presented to the Parliament. (UPSC 2015)

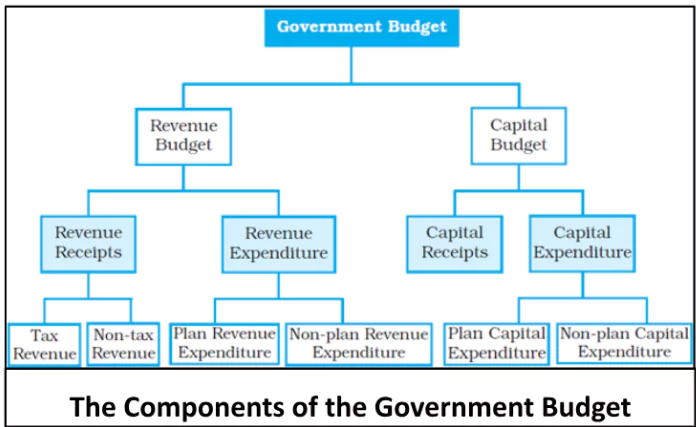

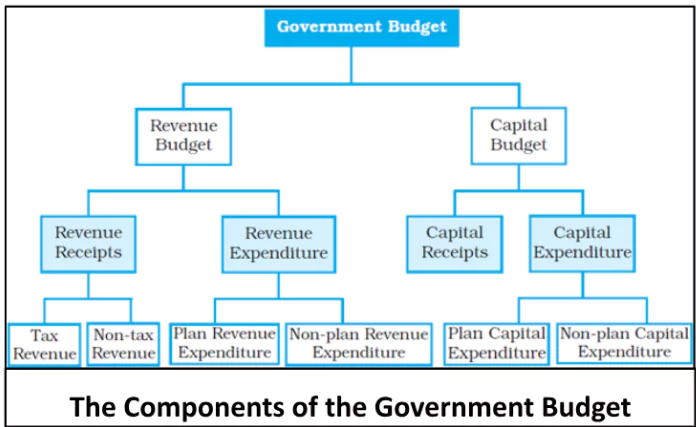

Classification of Budget Accounts

The budget is bifurcated into two main accounts:

- Revenue Account (or Revenue Budget): It includes items related only to the current financial year.

- Capital Account (or Capital Budget): It encompasses concerns regarding the assets and liabilities of the government.

Objectives of Government Budget

The government increases the welfare of the people by intervening in the economy in the following ways.

A. Allocation Function

- Government provides certain goods and services that are beyond the scope of market mechanisms i.e. by individual exchange. Such goods are:

Classification of Goods: Goods are categorized into Public Goods and Private Goods based on their nature and the extent to which individuals can be excluded from their consumption.

Classification of Goods: Goods are categorized into Public Goods and Private Goods based on their nature and the extent to which individuals can be excluded from their consumption.-

- Examples of Public Goods: National defense, roads, government administration etc.

- Examples of Private Goods: Clothes, cars, food items etc.

- Distinctive Features: Public Goods and Private Goods exhibit two major differences:

- Non-Rivalry: Public goods exhibit non-rivalry, i.e. one person’s consumption does not reduce the availability for others such as public parks, unlike private goods, where consumption is rivalrous.

- Non-excludability: Public goods are non-excludable, allowing individuals to enjoy benefits without payment, while private goods can exclude non-payers from consumption.

- Challenges and Government Intervention

- Public goods’ consumption creates ‘free-riders’,where some users enjoy the benefits without paying, prompting government intervention to bridge the payment gap and ensure provision.

Other than “estimated receipts and expenditure of the Government” the Budget also contains the following pieces of information:

- Estimates of revenue and capital receipts,

- Ways and means to raise the revenue,

- Estimates of expenditure,

- Details of the actual receipts and expenditure of the closing financial year and the reasons for any deficit or surplus in that year, and

- The economic and financial policy of the coming year, i.e., taxation proposals, prospects of revenue, spending program and introduction of new schemes/projects

|

B. Redistribution Function

- It aims to achieve a ‘fair’ income distribution through interventions such as transfers and taxes.

- Flow of National Income

- It is the total monetary value of all goods and services produced by a country during a financial year.

- The total national income of a country is distributed between:

- Private Sector: Consisting of firms and households, known as private income.

- Government Sector: Known as public income.

- Government’s Impact on Income Distribution

- The government influences personal disposable income by Making Transfers (such as subsidies or social benefits) and Collecting Taxes (from households and firms).

Understanding Government Receipts: Revenue and Capital Classification

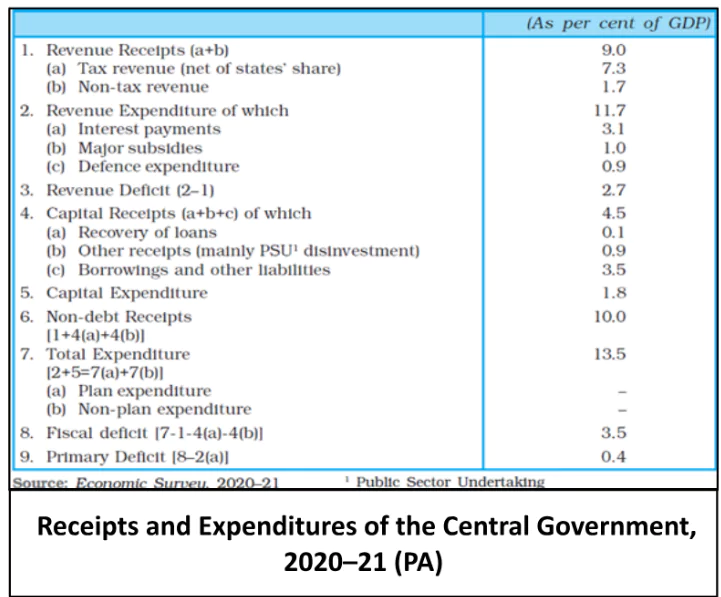

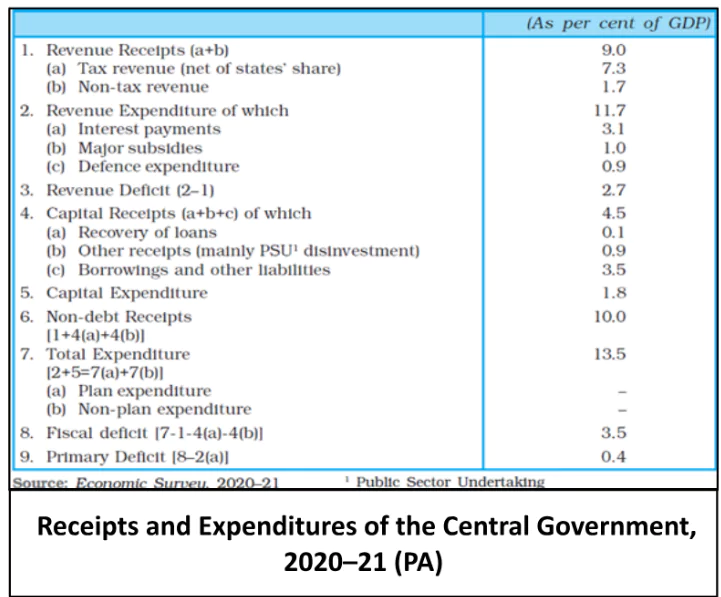

Revenue Receipts

- These receipts are non-redeemable government receipts that do not create a claim and primarily fund current expenses.

- Revenue Receipts, comprising Tax Revenues and Non-Tax Revenues.

Tax Revenues

- Tax revenue, the main income for governments, is derived from taxation and is categorized into various sources.

- Direct Taxes: It is a tax that a person or organization pays directly to the government or an entity that imposed it. Following are some examples:

- Personal Income Tax: Levied on individuals’ income.

- Corporation Tax: Levied on firms’ profits.

- Other direct taxes like wealth tax, gift tax, and estate duty (now abolished) are termed ‘paper taxes’ due to their minimal contribution to revenue.

- Indirect Taxes: It is the tax levied on the consumption of goods and services. Following are some examples:

- Excise Taxes: Duties on goods produced domestically.

- Customs Duties: Taxes on imported and exported goods.

- Service Tax: Levied on the provision of services.

- Taxation System: The taxation system is primarily categorised into two types:

- Progressive Taxation System: In this system, higher income attracts a higher tax rate.

- Proportional Taxation System: In this system, the tax rate is a fixed proportion of profits.

Non-Tax Revenues

- It is the recurring income earned by the government from sources other than taxes. Following are some examples:

- Interest Receipts: From loans provided by the central government.

- Dividends and Profits: From government investments.

- Fees and Other Receipts: For services rendered by the government.

- Cash Grants-in-aid: From foreign countries and international organizations.

- The estimation of revenue receipts is influenced by the tax proposals outlined in the Finance Bill.

Capital Receipts

- Capital Receipts for the government involve monetary gains from loans or asset sales, impacting liabilities or reducing financial assets. Following are the capital receipts:

- Loans: It is a sum of money that an individual, company, or government borrows from a bank or other financial institution.

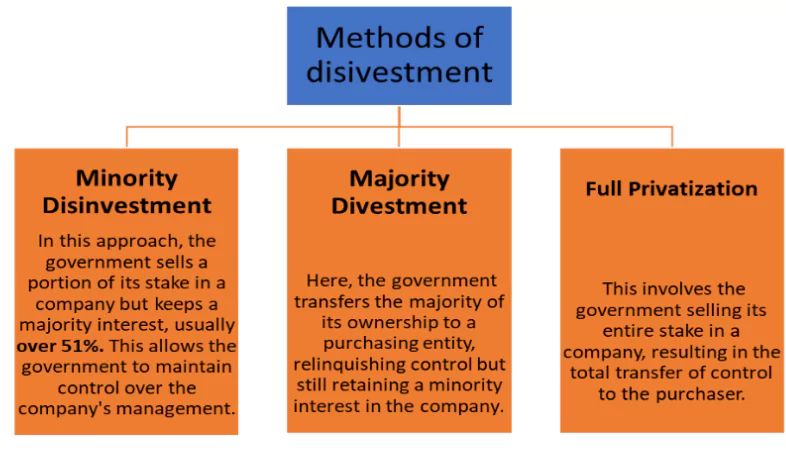

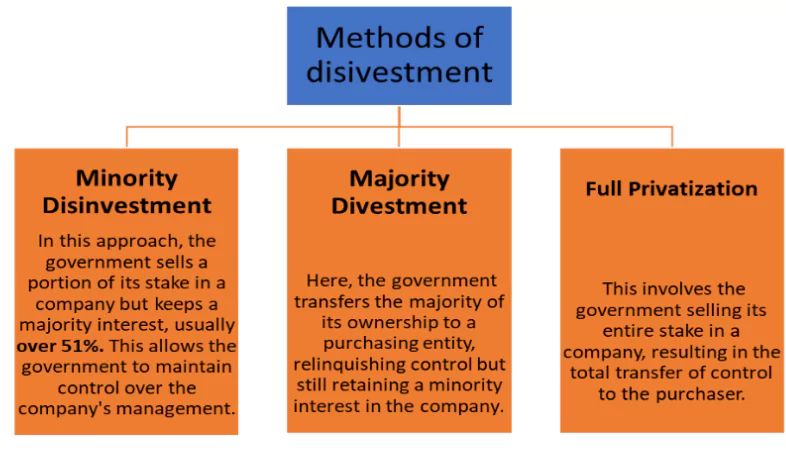

- Sale of Government Assets: Assets sales, such as the disinvestment of Public Sector Undertakings (PSUs), result in a reduction of the government’s total financial assets.

- This disinvestment refers to the sale of government shares in PSUs.

- Debt-Creating and Non-Debt Creating Receipts

- Debt Receipts: These are the receipts that create financial liabilities for the government. Example: Loans.

- Non-debt Receipts: These are the receipts that don’t create any financial liabilities for the government.

- Implications of Capital Receipts

-

- While loans enhance liabilities due to repayment and interest obligations, asset sales diminish the government’s financial asset base along with future earning potential from those assets.

Government Expenditure: Revenue and Capital Classification

Revenue Expenditure

- It refers to the spending incurred for purposes other than the creation of physical or financial assets of the central government.

- Revenue expenditure is one that neither creates assets nor reduces any liability of the government.

It comprises expenses necessary for the normal functioning of government departments and services, interest payments on government debt, and grants distributed to state governments and other parties.

It comprises expenses necessary for the normal functioning of government departments and services, interest payments on government debt, and grants distributed to state governments and other parties.

Classification of Revenue Expenditure

It is classified into plan and Non-Plan Expenditure as per budget documents:

- Plan Revenue Expenditure: It relates to central Plans (the Five-Year plans) and central assistance for State and Union Territory plans.

- Non-Plan Revenue Expenditure: It covers a vast range of general, economic and social services of the government.

- The main elements of non-plan expenditure are interest payments, defense services, subsidies, salaries and pensions.

-

- Interest Payments: On-market loans, external loans, and various reserve funds, represent the largest component of non-plan revenue expenditure.

- Defense Services: Regarded as committed expenditure due to national security concerns, there is little scope for a significant reduction.

- Subsidies: These are an important policy tool aimed at enhancing welfare. These can be implicit, through under-pricing of public goods and services like education and health, or explicit, on items such as exports, interest on loans, food, and fertilizers.

- Salaries and Pensions: For government employees.

Capital Expenditure

- It refers to government spending that results in the creation of physical or financial assets or a reduction in financial liabilities. It includes:

- Acquisition of land, buildings, machinery, and equipment.

- Investment in shares.

- Loans and advances by the central government to state and union territory governments, Public Sector Undertakings (PSUs), and other parties.

- Upgrading/Repairing an existing asset.

- Repayment of loan.

- Classification of Capital Expenditure

- Plan Capital Expenditure: This pertains to the central plan and central assistance for state and union territory plans.

- Non-Plan Capital Expenditure: It covers various general, social, and economic services provided by the government.

- Accompanying the budget, three policy statements mandated by the Fiscal Responsibility and Budget Management Act, 2003 (FRBMA) are:

- Medium-term Fiscal Policy Statement: It sets a three-year rolling target for specific fiscal indicators, It Includess,

- Examining the sustainability of financing revenue expenditure through revenue receipts and

- The productive utilization of capital receipts, including market borrowings.

- Fiscal Policy Strategy Statement: It sets the government’s fiscal priorities, examines current policies, and justifies any deviations in significant fiscal measures.

- Macroeconomic Framework Statement: It assesses the economy’s prospects concerning the GDP growth rate, the fiscal balance of the central government, and the external balance.

| Feature |

Revenue Budget |

Capital Budget(UPSC 2016) |

| Focus |

Day-to-day expenses and receipts |

Long-term investments and asset creation |

| Income |

Taxes, fees, fines, etc. |

Borrowing, surplus, specific levies |

| Expenditure |

Salaries, administration, subsidies, social programs |

Infrastructure, capital projects |

| Objective |

Fiscal stability |

Economic growth |

| Impact |

Short-term economic activity |

Long-term economic development |

Sources of Non-Tax Revenue for Governments

- Non-tax revenue is the recurring income earned by the government from sources other than taxes. E.g:

- Fees and Charges: Revenue earned from providing services or issuing licenses and permits.

- This includes fees for government services like passport issuance, driving licenses, court services, and administrative services.

- Fines and Penalties: Money collected from penalties imposed for violations of laws and regulations.

- Examples: Include traffic fines, environmental violation penalties, and other legal penalties.

- Profits from Public Enterprises: Earnings from businesses owned or operated by the government.

- These can include profits from public utilities, transport companies, and other state-owned enterprises.

- Interest and Dividends: Income generated from investments held by the government, such as interest from bank deposits or dividends from shares in companies.

- Royalties and Licenses: Payments received for the use of government resources or property.

- This often includes royalties from natural resource extraction (like oil, gas, and minerals) and fees for broadcasting and telecommunication licenses.

- Grants and Donations: Funds received from other governments, international organizations, or private entities, as well as donations from individuals and organizations.

- Sales of Goods and Services: Income from the sale of various goods and services by government agencies.

- Property Income: Revenue from the rent, lease, or sale of government-owned property and assets.

Government Disinvestment in Public Sector Enterprises: Process and Management

The disinvestment process involves the sale of government stake in public sector enterprises to strategic or financial buyers, either through the sale of shares on stock exchanges or through the sale of shares directly to buyers.

Procedure of disinvestment

- The disinvestment process in India is managed by the Department of Investment and Public Asset Management (DIPAM), a department within the Ministry of Finance.

- DIPAM’s main goal is to oversee and handle the government’s investments in public sector enterprises, including the process of disinvesting government shares in these entities.

- In 2005, the Indian Government established the National Investment Fund (NIF). The funds obtained from the disinvestment of Central Public Sector Enterprises are directed into this fund.

Conclusion

- Budget provides a structured framework for organizing budgetary data, and facilitating analysis, planning, and decision-making by policymakers and managers.

- By grouping transactions into distinct categories such as revenue, expenditure, assets, and liabilities, it offers transparency, accountability, and comparability in budgetary processes.

- Overall, the classification of budget accounts serves as a cornerstone for effective fiscal management and oversight within governmental and organizational contexts.

Classification of Goods: Goods are categorized into Public Goods and Private Goods based on their nature and the extent to which individuals can be excluded from their consumption.

Classification of Goods: Goods are categorized into Public Goods and Private Goods based on their nature and the extent to which individuals can be excluded from their consumption. It comprises expenses necessary for the normal functioning of government departments and services, interest payments on government debt, and grants distributed to state governments and other parties.

It comprises expenses necessary for the normal functioning of government departments and services, interest payments on government debt, and grants distributed to state governments and other parties.