Introduction

Microeconomics is a branch of economics that studies the behavior of individuals and firms in making decisions regarding the allocation of limited resources. Key concepts in microeconomics include supply and demand, which determine prices and quantities in markets; consumer behavior, which examines how individuals make decisions about what goods and services to purchase; producer behavior, which explores how firms decide what to produce and how much to produce; and market structures, such as perfect competition, monopoly, oligopoly, and monopolistic competition, which characterize different types of markets and their implications for efficiency and distribution of resources.

Demand Side of Economy

- Law of Demand: The Law of Demand states that all things being equal, as the price of a good or service increases, consumer demand for that good or service will decrease, and vice versa.

- Example: if the price of smartphones decreases, consumers are likely to purchase more smartphones. Conversely, if the price increases, the demand for smartphones typically drops.

- This inverse relationship between price and quantity demanded is a fundamental principle of consumer behavior in economics.

- However, this law applies only to normal goods.

- Inferior Goods: It is an economic term that describes a good whose demand drops when people’s incomes rise.

- These goods fall out of favor as incomes and the economy improves as consumers begin buying more costly substitutes instead.

- Example: Cheap cereals and food grains like rice (inferior goods) will be replaced by better quality food items like eggs , milk when income rises.

- Giffen Goods: A Giffen good is a low income, non-luxury product that defies standard economic and consumer demand theory.

- Unique Demand Behavior: Demand for Giffen goods rises when the price rises and falls when the price falls.

- This results in an upward-sloping demand curve, contrary to the fundamental laws of demand which create a downward-sloping demand curve.

- Example: Giffen goods can include bread, rice, and wheat. These goods are commonly essentials with few near-dimensional substitutes at the same price levels

- Determinants of Demand: It includes price, consumer income, tastes/preferences, prices of related goods, and future expectations.

- Substitute Goods: These are pairs of competing goods which, in the opinion of buyers, can replace each other.

- Example: If tea is costly, buyers may drink coffee.

- Complementary Goods: These are pairs of goods that are interdependent or compatible.

- Example: Bread and jam, Tea and sugar etc.

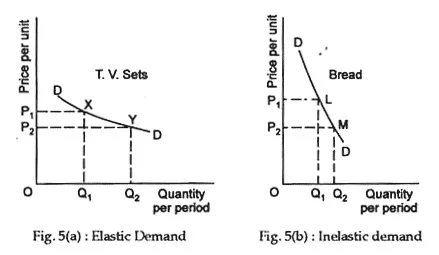

- The Elasticity of Demand: It measures how quantity demanded responds to price changes.

- Demand Curve: For any change in price, there is an inverse change in quantity demanded

- Normally, the demand slopes downwards from left to right.

- However, some unusual demand curves do not obey the law/usual demand curve.

- For them, a fall in price brings about a contraction of demand and a rise in price results in an extension of demand.

- Therefore, the demand curve slopes upwards from left to right.

- Veblen Effect: Conspicuous Consumption/Luxury Goods means spending of money on luxury goods and services to display financial power.

- Behaviour: Demand for Veblen goods increases with a rise in their price.

- Example: A Rolex watch or Rolls Royce car is desirable because of their high price and associated status symbol.

- Giffen Goods are goods with the unique characteristic that an increase in prices actually increases the quantity of the good that is demanded.

- The generally accepted explanation is that Giffen goods are a type of inferior good without a substitute.

- Example: When the price of rice increases, people cannot shift out of rice but rather eat only rice instead of other vegetables.

- Speculative Effect: It reverses the demand curve due to expectation of certain future events.

- If the price of the commodity is increasing then the consumers will buy more of it because of the expectation that it will increase still further.

- Example: Stock markets.

|

Supply Side of the Economy: Laws, Determinants, and Market Equilibrium

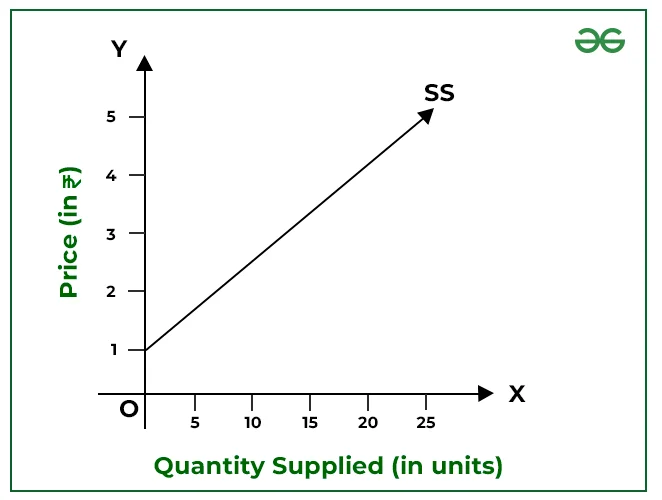

- Law of Supply: The Law of Supply states that, other things being equal as the price of a good or service increases, the quantity supplied of that good or service also increases, and vice versa.

-

- Example: If the market price of coffee beans rises, farmers are incentivized to grow more coffee beans, increasing the supply. Conversely, if prices fall, farmers may reduce their coffee production due to lower profitability. This principle illustrates the direct relationship between price and supply in economics.

- Determinants of Supply: It is influenced by factors like commodity price, production costs, taxes, and profit objectives.

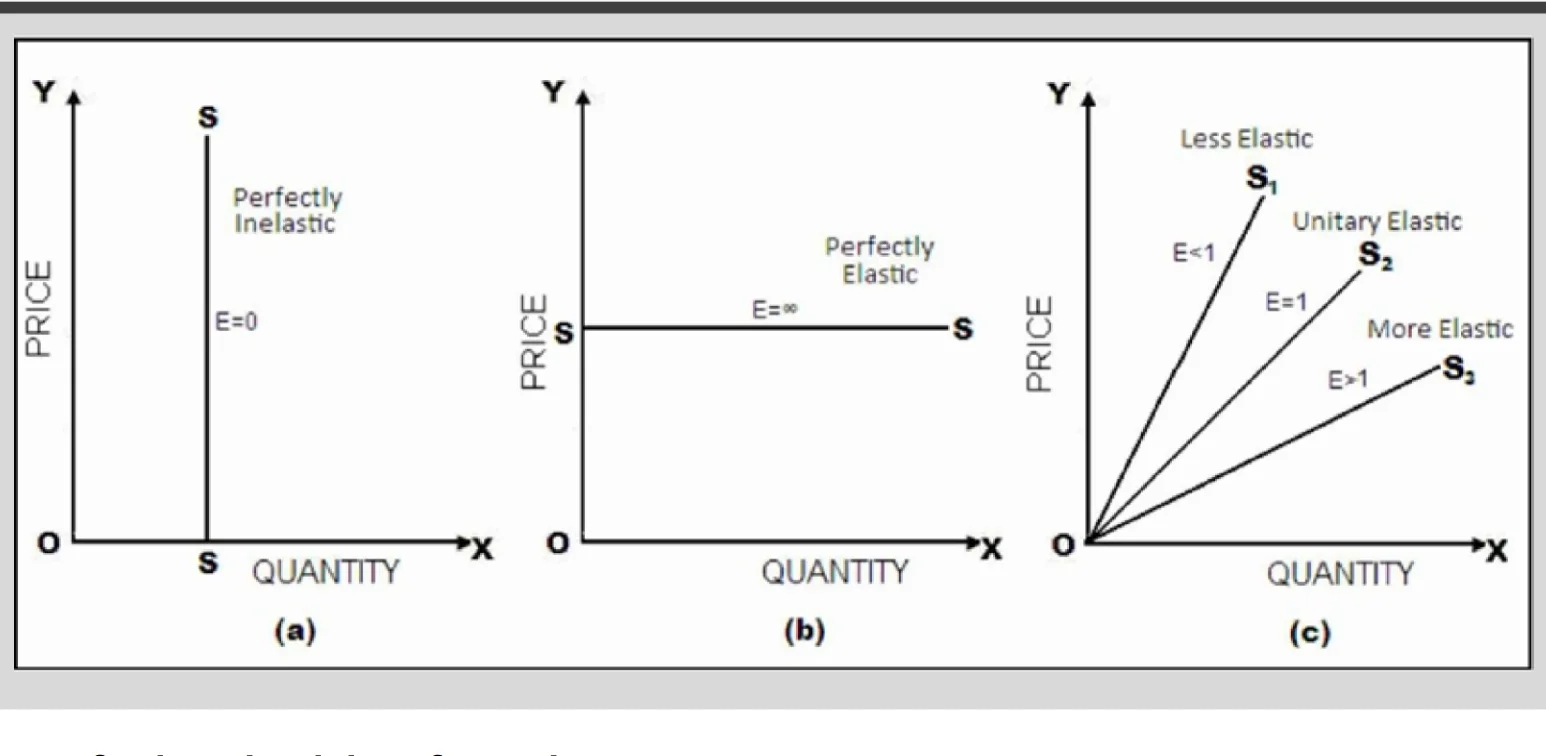

- Elasticity of Supply: It indicates the responsiveness of quantity supplied to price changes.

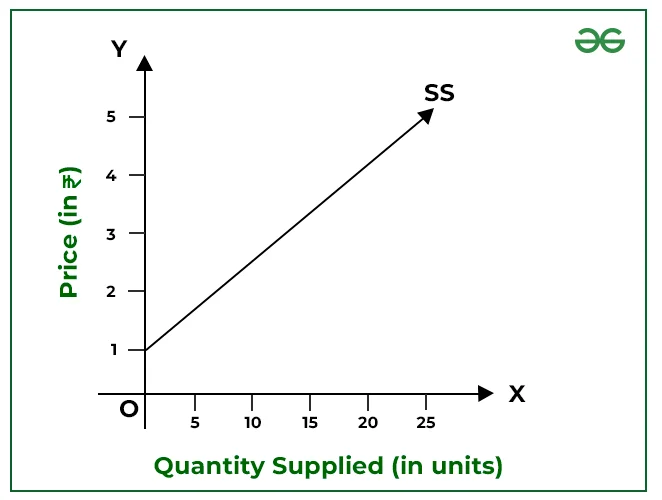

- Supply Curve : There is a direct relationship between price and quantity supplied. An increase in price, results in an increase in quantity supplied.

Market Equilibrium and Competition

- Market Equilibrium: It occurs when quantity demanded equals quantity supplied, determining the market price.

- Example: At a bakery, market equilibrium is reached when the amount of bread produced daily is sold out at closing time without leftovers or shortages.

- Price is determined at the intersection of the supply and demand curves.

- Surplus and Inventory Management: Setting the price above the equilibrium leads to a surplus, where the quantity supplied exceeds the quantity demanded. To clear inventory, the company must lower the price.

- Conversely, setting the price below equilibrium causes excess demand. The only remedy is to increase the price.

Theory of the Firm in Microeconomics: Microeconomic Perspectives on Market Structures

-

- The theory of the firm, a microeconomic branch, explores diverse organizational structures within industries and draws insights from these structures.

- Perfect Competition: In a perfectly competitive market: Numerous firms produce identical goods; No barriers impede entry or exit; Producers and consumers possess perfect market knowledge; In this scenario, prices and output levels gravitate towards equilibrium.

- The demand curve is perfectly elastic, indicating horizontal demand; Real-life instances of perfect competition are rare, but some financial markets and certain online commerce sectors align with its principles.

- Monopoly: Monopoly occurs when a single producer dominates the market. Laws often define monopoly less strictly, considering firms with a specific market share.

- Characteristics:

- Monopolies may arise due to statutory rights or government ownership.

- A monopoly can set its own prices, leading to super-normal profits.

- Government regulation is common to control monopoly power.

- Oligopoly: Oligopoly arises when a few influential producers dominate a market, with a duopoly being the minimum form.

- These producers have substantial knowledge about competitors’ actions and can predict responses to strategy changes.

- Characteristics:

- Oligopolistic markets often feature complex product differentiation, entry barriers, and significant price influence by a few large producers.

- Monopolistic Competition: Monopolistic competition involves many producers using product differentiation to distinguish themselves.

- Despite similar products, perceived differences allow short-term monopolistic behavior.

- Consumer awareness of product distinctions is essential, and barriers to entry or exit are typically lower than in oligopolistic markets.

Market Intervention in Capitalist Systems

- Advocacy for Free Market Principles: In capitalist systems, the principle of allowing markets to operate freely is generally favored.

- Role of Intervention in Provision of Public Goods and Services:

- However, there is a recognition that certain goods and services, termed ‘public goods and services,’ require intervention for adequate provision.

- This intervention, often led by governments or supra-national organizations, involves setting prices either above or below the equilibrium price.

- Maximum Price Intervention (Safeguarding Consumers): The imposition of a maximum price aims to protect consumers.

- This results in a situation where the quantity demanded surpasses the quantity supplied, provided the maximum price is set below the equilibrium price (Figure).

- Example: Historical examples, such as the UK government’s intervention during World War-II, highlight the potential consequences, including excess demand and the emergence of illegal markets.

- Minimum Price Intervention (Protecting Producers): Conversely, a minimum price is sometimes enforced to shield producers.

- Price Floors and Surplus: In this scenario, the quantity supplied exceeds the quantity demanded if the minimum price is set above the equilibrium price.

- Example: The European Union’s common agricultural policy, implementing a minimum price system, has periodically led to surpluses in the agricultural sector.

- Managing Consequences: Insights from Microeconomic Analysis

- While the impact of intervention in the price system may not always be universally undesirable, microeconomic analysis emphasizes the need to understand and manage the consequences effectively. Society must navigate the implications of such interventions to ensure a balanced and efficient economic system.

|

Elasticity in Economics: Price Sensitivity and Revenue Implications

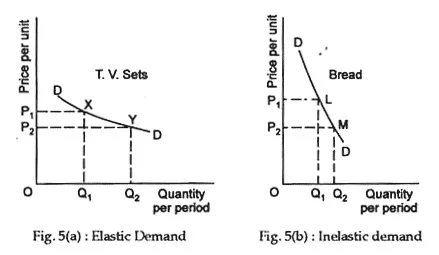

- Definition: It refers to how quantity demanded or supplied responds to changes in price.

- Price Elasticity of Demand: It is calculated by dividing the change in quantity demanded by the change in price.

- If a slight price change results in a substantial shift in quantity demanded, it indicates high elasticity.

- Conversely, if a price change has minimal impact on the quantity demanded, the demand is considered highly inelastic.

- Significance: Producers rely on this concept to predict the effects of pricing strategies, while government finance departments use it to model tax implications.

- Price Elasticity of Supply: Similarly, the price elasticity of supply is determined by dividing the change in quantity supplied by the change in price.

- Impact on Total Revenue: Elasticity of demand occurs when a price increase leads to reduced total revenue, while inelasticity results in increased total revenue.

- Unitary Elasticity: It occurs when a change in price causes no change in total revenue.

Elasticity of Demand

- Perfectly Elastic Demand: Infinite change in quantity demanded for a very small change in price.

- Perfectly Inelastic Demand: No change in quantity demanded regardless of price changes.

- Relatively Elastic Demand: Large change in quantity demanded for a small change in price.

- Unitary Elastic Demand: Proportional change in quantity demanded equals the change in price.

- Relatively Inelastic Demand: Small change in quantity demanded for a large change in price.

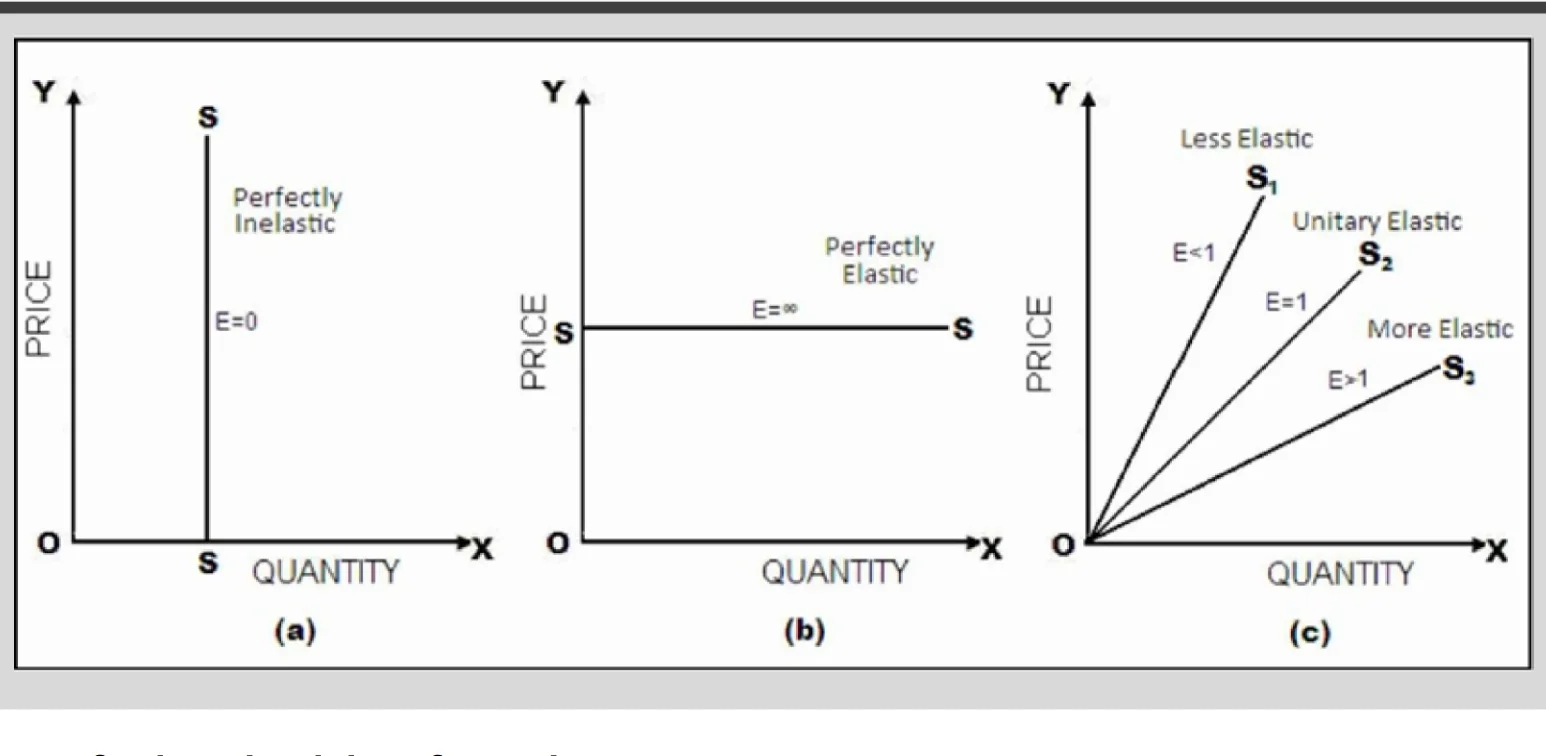

Elasticity of Supply

- Relatively Elastic Supply: More than proportional change in quantity supplied due to price change.

- Unitary Elastic Supply: Proportional change in quantity supplied equals the change in price.

- Relatively Inelastic Supply: Less than proportional change in quantity supplied due to price change.

- Perfectly Elastic Supply: Infinite change in quantity supplied for a very small change in price.

- Perfectly Inelastic Supply: No change in quantity supplied regardless of price changes.

- Example:

- During the COVID-19 pandemic, the price of masks went up because a lot of people needed them, and companies made more masks to meet the demand illustrating elastic supply.

- However, we couldn’t suddenly have more doctors, so the number of doctors didn’t increase much. This is an example of a relatively inelastic supply.

In addition to price elasticity, there are other relevant concepts:

- Income Elasticity: Measures how quantity demanded or supplied responds to changes in income.

- Cross Elasticity: Examines how the quantity demanded or supplied of one good responds to changes in the price of another good.

Some Basic Terms and Concepts

- Marginal Utility: The additional satisfaction gained from consuming an additional unit of a good or service.

- Opportunity Cost: The cost of foregone alternatives when one option is chosen over another.

- Market Equilibrium: A situation in which market supply and demand balance each other, resulting in stable prices.

- Externalities: Costs or benefits that affect a party who did not choose to incur that cost or benefit.

- Substitution Effect: The change in consumption resulting from a change in the price of a good, making consumers substitute away from higher-priced goods to lower-priced ones.

- Income Effect: The change in consumption resulting from a change in real income.

- Marginal Cost: The cost of producing one additional unit of a good.

- Diminishing Marginal Returns: A principle stating that as investment in a particular area increases, the rate of profit from that investment, after a certain point, cannot continue to increase if other variables remain constant.

- Price: The amount of money required to purchase a good or service.

- Cost: The expenses incurred in producing or acquiring a good.

- Income: Monetary or other returns, earned or unearned, accruing over a period.

- Goods and Services: Tangible products (goods) and activities performed by service providers (services).

- Final Good: A product that has completed its production and transformation process.

- Consumption Good: Goods and services consumed upon purchase.

- Capital Good: Assets used in production that do not undergo a transformation in the process.

- Fixed Asset: Business assets used for more than one accounting year.

- Depreciation: Decline in value of fixed assets over time due to use or obsolescence.