Introduction

India initially embraced a mixed economy post-independence, integrating aspects of capitalism and socialism. In 1991, an economic crisis, marked by external debt challenges and declining foreign reserves, prompted a pivotal shift. The government initiated Liberalization, Privatisation, and Globalization (LPG) reforms, redirecting India towards a new developmental trajectory.

Overview of Indian Economy Prior 1991

- Production Across Countries

- Pre-20th century, production was mostly national, with global trade centered on raw materials, food, and finished goods, i.e colonial areas like India primarily exported raw materials and imported finished products.

- Situation Prior to the LPG Era

- Government funds were generated through taxation, public sector enterprises, and borrowing when expenditures exceed income.

- Economic Disparities and Fiscal Management

- Despite low revenues, increased government spending on unemployment, poverty, and population issues, with developmental programs failing to generate sufficient revenue,

- It was compounded by inadequate internal generation and reliance on non-immediate return areas, leading to a deficit as public sector undertakings’ income fell short of escalating expenditures.

- Foreign Exchange and International Borrowing

- Late 1980s: Widening gap between government revenue and expenditure, unsustainable borrowing, uncontrolled consumption-led use of foreign exchange, soaring essential goods prices, and a precarious depletion of foreign exchange reserves due to imbalanced imports and exports.

- Crisis Management and International Assistance

- Deepening crisis: Plummeting foreign exchange reserves prompt India to seek a $7 billion loan from the World Bank and IMF, contingent on economic liberalization, reduced government intervention, and trade restriction abolishment.

New Economic Policy (NEP) Introduction

- Complying with the international agencies’ conditions, India announced the New Economic Policy (NEP).

- The NEP encompassed two primary strategies:

- Stabilisation Measures: Short-term measures to rectify balance of payments discrepancies and control inflation by maintaining adequate foreign exchange reserves

- Structural Reform Measures: Long-term measures to augment the economy’s efficiency and international competitiveness by eliminating rigidities in various segments of the Indian economy.

- The core themes of the reforms were

- Liberalization: It is the direction of reforms.

- Privatisation: It is path to the reforms.

- Globalisation: It is the ultimate aim of reforms.

Liberalization

- Liberalization in 1991: Launched to remove governmental restrictions, granting businesses freedom in import-export decisions.

- Comprehensive Impact: Policies extended to industrial, financial, taxation, foreign exchange, trade, and investment sectors.

- Deregulation of the Industrial Sector

- Pre-1991 Regulatory Mechanisms: Stringent regulations included industrial licensing, limited private sector involvement, small-scale industries reservations, and controls on price and distribution.

- Post-1991 Reforms: Industrial licensing was abolished for most categories (exceptions for alcohol, hazardous chemicals).

- De-reservation of goods previously restricted to small-scale industries.

- Introduction of market-determined prices in most industries.

- Financial Sector Reforms

- Pre-1991 Financial Sector Regulation: Under stringent regulation by the Reserve Bank of India (RBI), covering commercial banks, investment banks, stock exchanges, and the foreign exchange market.

- Post-1991 Reforms:

- Transitioned RBI’s role from regulator to facilitator, allowing the financial sector autonomy in decision-making.

- Facilitated establishment of private sector banks (Indian and foreign) with increased foreign investment limits (around 74%).

- Banks meeting certain conditions could establish branches and rationalize networks without RBI approval, while retaining some managerial aspects with RBI for stakeholder safeguarding.

- Foreign Institutional Investors (FIIs) like merchant bankers, mutual funds, and pension funds permitted to invest in Indian financial markets.

Tax Reforms

- Tax Reforms Post-1991: Focused on modifying government taxation and public expenditure policies as part of fiscal policy.

- Reduction in Income and Corporation Taxes:

- Witnessed a continuous reduction in individual income taxes and corporation tax rates post-1991.

- Aimed At: promoting savings, voluntary income disclosure, and compliance.

- Indirect Tax Reforms:

- Efforts made to reform indirect taxes on commodities.

- The goal was to establish a common national market for goods and commodities.

- Goods and Services Tax (GST) Act 2016:

- In 2016, efforts culminated in the establishment of a unified indirect tax system through the Goods and Services Tax Act 2016.

- Effective from July 2017, aimed at simplifying tax procedures and reducing evasion.

- Foreign Exchange Reforms

- 1991 Balance of Payments Crisis Response: Immediate devaluation of the rupee to address the crisis, boosting foreign exchange inflow.

- Exchange Rate Reforms:

- Initiated market-determined exchange rates post-1991.

- Based on foreign exchange demand and supply, reducing government control over the rupee’s value.

- Trade and Investment Policy Reforms

- Aimed at enhancing international competitiveness and attracting foreign investments and technology infusion.

- Dismantling Pre-Reform Policies: Abolished high tariffs and tight control over imports that hindered manufacturing sector growth and efficiency.

- Reform Measures (Effective from April 2001):

- Abolished import licensing (excluding hazardous and environmentally sensitive industries).

- Removed quantitative restrictions on imports and exports.

- Reduced tariff rates.

- Objectives:

-

- Boost competitive stance of Indian goods in international markets.

- Foster efficiency and modern technology adoption in local industries.

Privatisation

- Meaning: Privatisation denotes the transition from government ownership or management to private sector control of enterprises.

- This transition manifests in two primary ways:

- By the government relinquishing ownership and management of public sector companies.

- By the outright sale of such companies.

- Disinvestment is the strategic process through which the government reduces its ownership stake in public sector enterprises by selling shares to either strategic or financial buyers.

- This can be achieved through the sale of shares on stock exchanges or by directly selling shares to interested buyers.

- Approaches to Disinvestment:

- Minority Disinvestment: The government maintains a majority stake in the company, typically greater than 51%, ensuring that it retains management control.

- Majority Divestment: Control of the company is transferred to the acquiring entity, but the government retains some stake, allowing for continued involvement.

- Complete Privatisation: The entire 100% control of the company is transferred to the buyer, resulting in complete privatization.

- Disinvestment Process in India: In India, the Department of Investment and Public Asset Management (DIPAM), under the Ministry of Finance, oversees the disinvestment process.

- National Investment Fund (NIF): To channelize the proceeds from the disinvestment of Central Public Sector Enterprises, the government established the National Investment Fund (NIF) in 2005.

- Benefits of Privatisation

- Facilitating Foreign Direct Investment (FDI): Privatisation was envisaged as a catalyst for increasing the inflow of Foreign Direct Investment (FDI), thereby contributing to economic growth and modernisation.

- Enhancing PSU Efficiency through Managerial Autonomy: The government aimed to boost the efficiency of PSUs by granting them managerial autonomy.

- This autonomy was manifested through the conferment of special statuses like Maharatnas, Navratnas, and Miniratnas on certain PSUs, empowering them with greater managerial discretion.

Navratnas and Public Enterprise Policies

- The government, drawing inspiration from the eminent ‘Navratnas’ or Nine Jewels of King Vikramaditya’s court, identified and designated Public Sector Enterprises (PSEs) as Maharatnas, Navratnas, and Miniratnas.

- Operational Autonomy and Performance Enhancement:The designated PSEs were endowed with increased managerial and operational autonomy.

- This enhanced autonomy extended to operational, financial, and managerial realms.

- Examples of Designated Public Sector Enterprises:

- Maharatnas: Indian Oil Corporation Limited, Steel Authority of India Limited

- Navratnas: Hindustan Aeronautics Limited, Mahanagar Telephone Nigam Limited

- Miniratnas: Bharat Sanchar Nigam Limited, Airport Authority of India, Indian Railway Catering and Tourism Corporation Limited

Historical Context and Original Objectives of PSEs

- Self Reliance: The inception of many profitable PSEs dates back to the 1950s and 1960s, aligning with the public policy emphasis on self-reliance.

- Objectives: These enterprises were established with the dual aim of infrastructure provision and direct employment generations.

- Outcomes and Future Endeavours

-

- The conferred statuses contributed to the improved performance of these companies.

- Despite accusations of partial privatisation through disinvestment, the government, of late, has resolved to retain these enterprises in the public sector.

- The objective now is to facilitate their expansion into global markets and empower them to independently raise resources from financial markets.

|

- Trade Barriers: A tax on imports exemplifies a trade barrier, impacting the cost and quantity of goods imported.

- Trade barriers were employed by governments to regulate foreign trade, deciding the type and quantity of goods imported.

|

Globalization

- Globalization is broadly perceived as the integration of a nation’s economy with the global economy, fostering greater interdependence and integration.

- It is the ultimate aim of LPG reforms.

- The Siricilla Tragedy

- In line with liberalization, privatization, and globalization (LPG), the government introduced reforms in the power sector.

- Consequences of the Reforms

- Tariff Hikes: The most notable outcome was a significant increase in power tariffs.

- Effect on the Power Loom Industry: Power looms, a crucial part of the cottage and small-scale sector, rely heavily on power.

- High tariffs severely impacted these industries, especially since power producers failed to provide consistent and quality power.

- With wages tied to production, power cuts directly affected the earnings of power loom workers.

- The Tragedy

- The combination of increased tariffs and inconsistent power supply led to a financial crisis for the weavers.

- In Siricilla, a town in Andhra Pradesh, the situation became so dire that fifty power loom workers took their own lives.

|

Indian Economy During Reforms: An Assessment

- As the reform process in India completes three decades, an assessment of the Indian economy reveals a mixed scenario.

- Growth is primarily gauged by the Gross Domestic Product (GDP).

- GDP Growth and Sectoral Performance

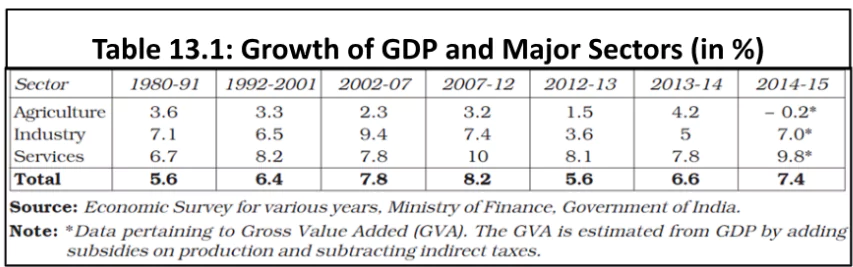

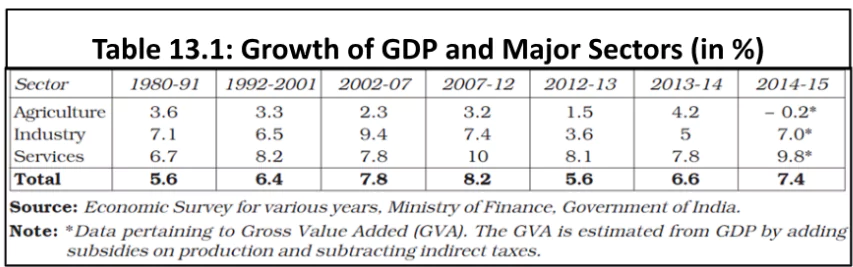

Post-1991: India saw a substantial rise in GDP growth, from 5.6% during 1980-91 to 8.2% during 2007-12, mainly driven by the service sector. Refer to table 13.1

Post-1991: India saw a substantial rise in GDP growth, from 5.6% during 1980-91 to 8.2% during 2007-12, mainly driven by the service sector. Refer to table 13.1- However, the agriculture sector saw a decline in growth, while the industrial sector showed fluctuations.

- Despite a setback in growth rates across sectors during 2012-15, the service sector continued to thrive, notably with a 9.8% growth rate in 2014-15.

- Foreign Investments and Reserves

- The reform era ushered in a significant increase in foreign direct investment (FDI) and foreign exchange reserves, with FDI and foreign institutional investment (FII) rising from about US $100 million in 1990-91 to US $30 billion in 2017-18.

- Foreign exchange reserves surged from about US $6 billion in 1990-91 to about US $413 billion in 2018-19 (In October 2021 and , making India one of the largest foreign exchange reserve holders globally.

- Export Dynamics

- India emerged as a successful exporter of auto parts, pharmaceutical goods, engineering goods, IT software, and textiles post-1991.

Conclusion

- India’s shift from a mixed economy to embracing globalization post-1991 has brought both opportunities and challenges.

- Key reforms aimed at attracting foreign investment and integrating India with the global economy yielded mixed outcomes.

- While urban consumers and certain sectors like IT benefited, the agrarian sector and small producers faced hurdles. The chapter underlines the need for a balanced approach to ensure ‘fair globalization’, safeguarding the interests of the less privileged while fostering inclusive growth.

Post-1991: India saw a substantial rise in GDP growth, from 5.6% during 1980-91 to 8.2% during 2007-12, mainly driven by the service sector. Refer to table 13.1

Post-1991: India saw a substantial rise in GDP growth, from 5.6% during 1980-91 to 8.2% during 2007-12, mainly driven by the service sector. Refer to table 13.1